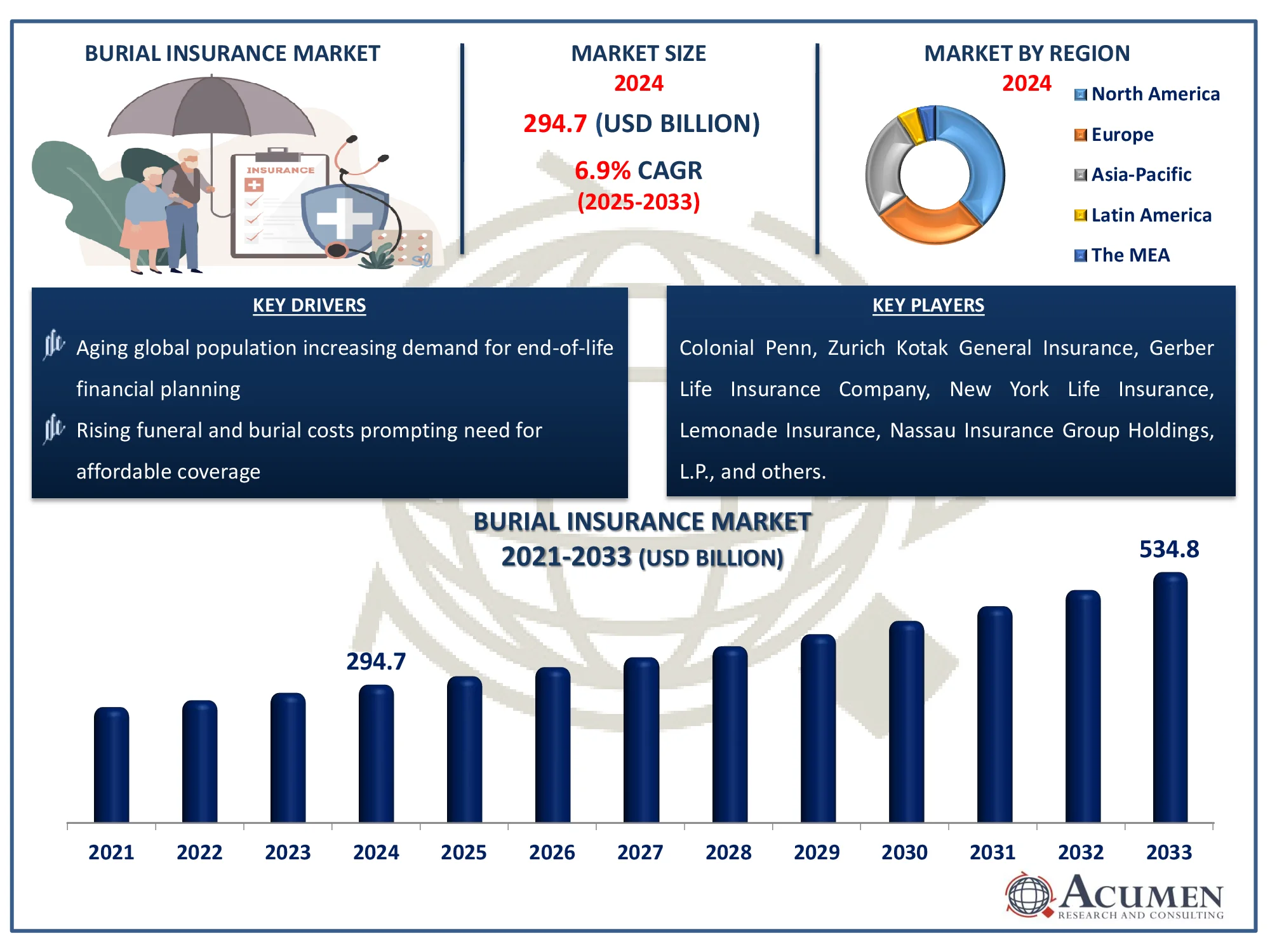

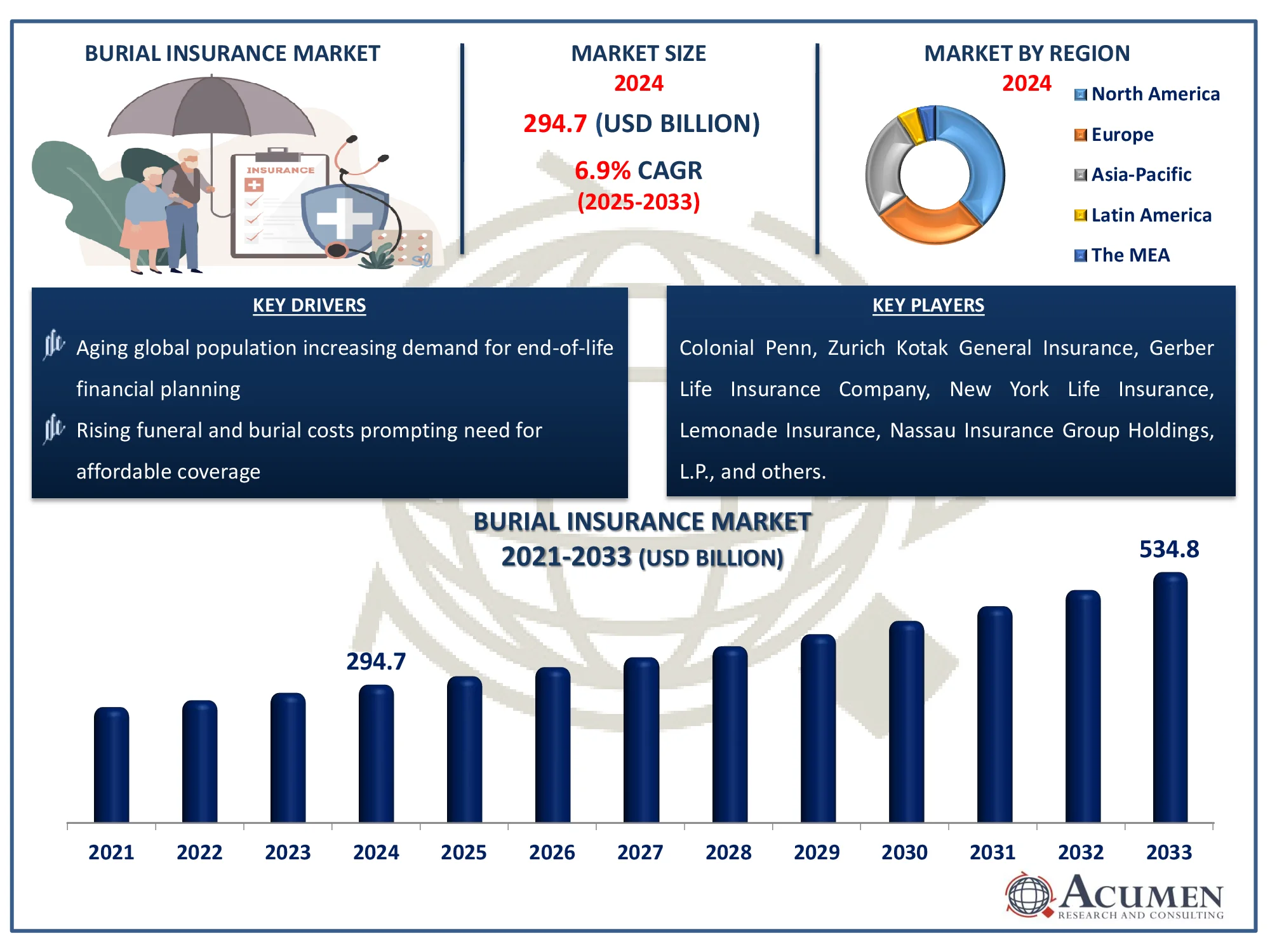

The Global Burial Insurance Market Size accounted for USD 294.7 Billion in 2024 and is estimated to achieve a market size of USD 534.8 Billion by 2033 growing at a CAGR of 6.9% from 2025 to 2033.

Burial Insurance Market Highlights

- The global burial insurance market is projected to reach USD 534.8 billion by 2033, growing at a CAGR of 6.9% from 2025 to 2033

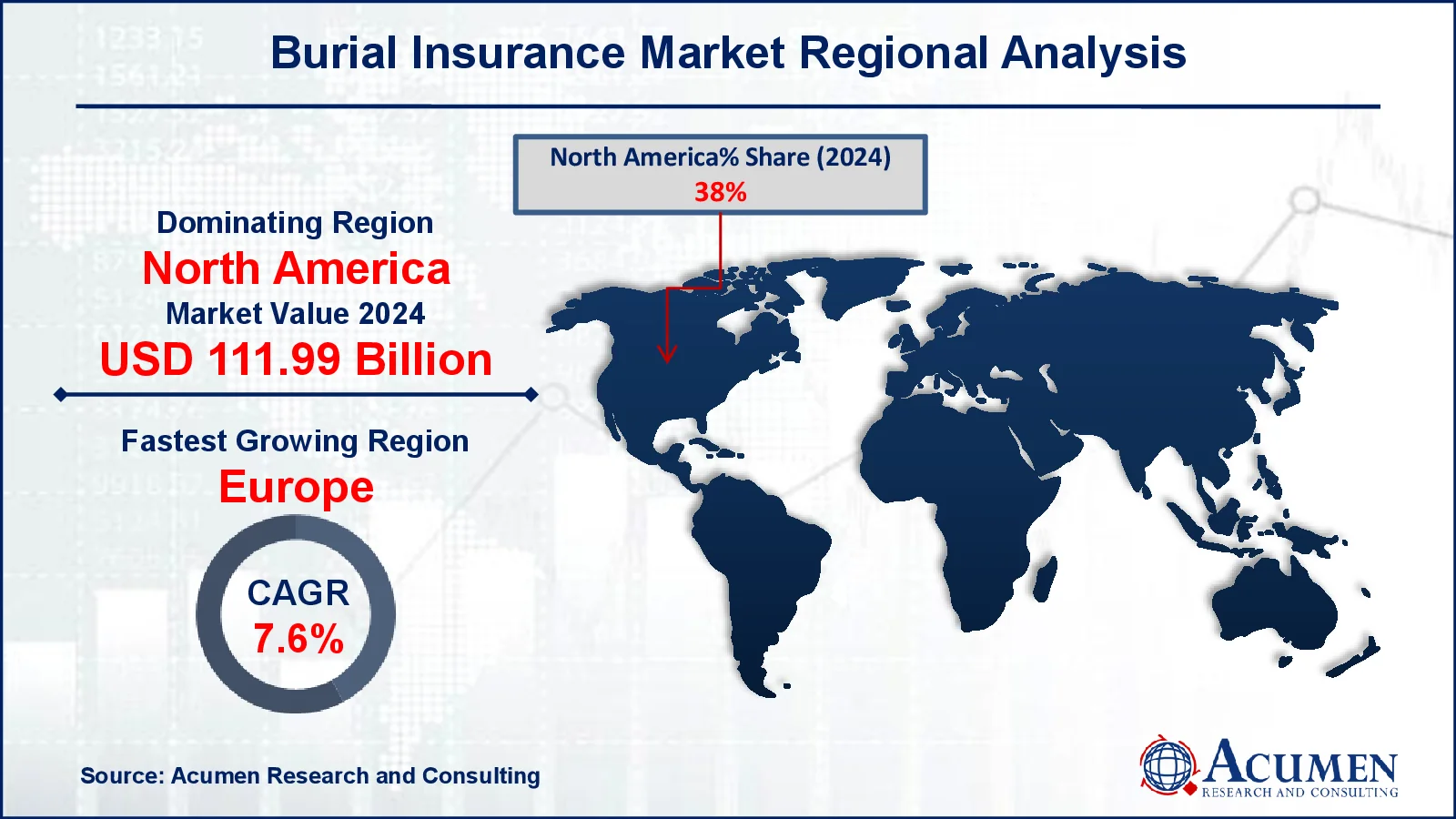

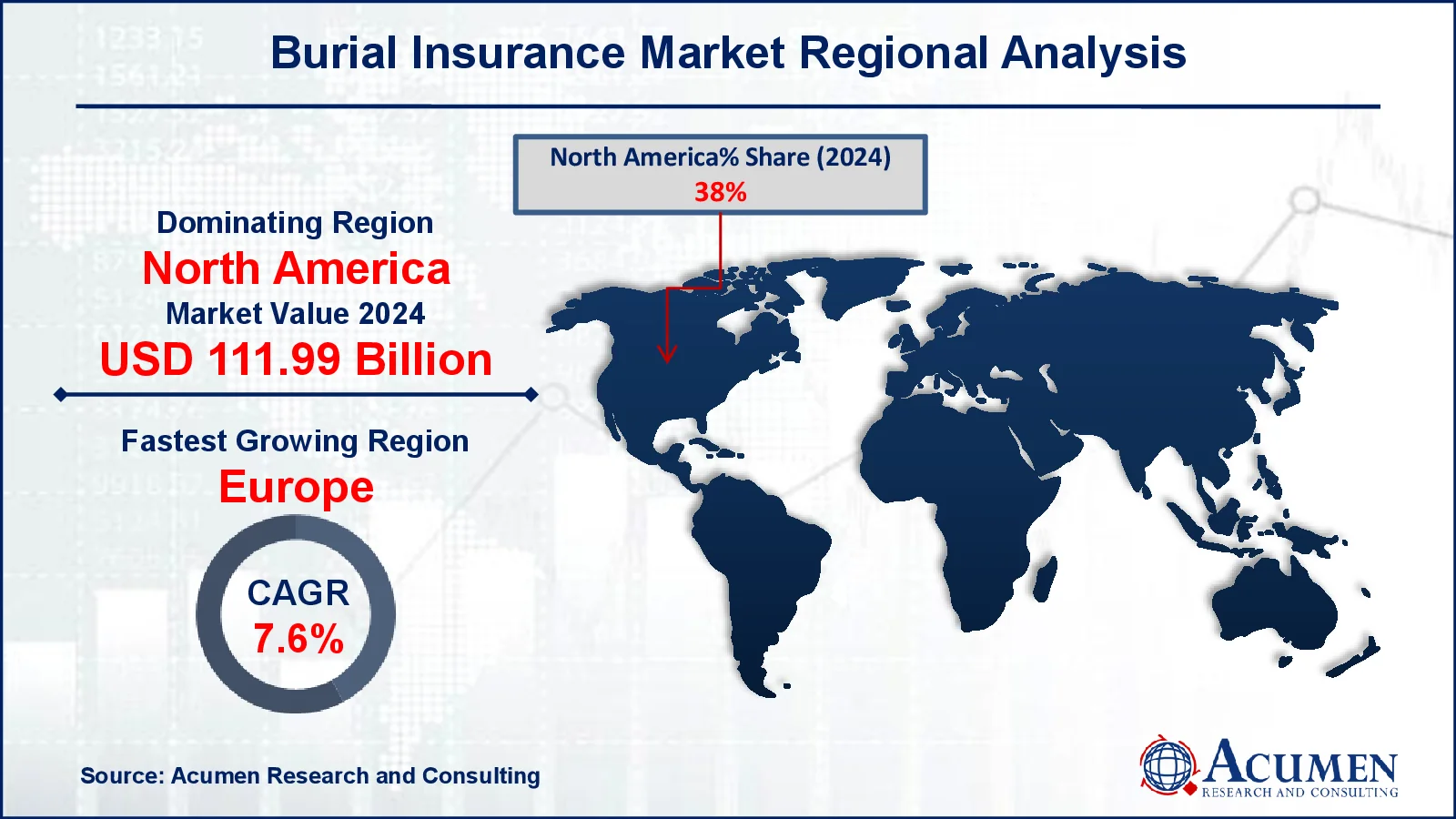

- In 2024, the North American burial insurance market was valued at approximately USD 111.99 billion

- The European burial insurance market is expected to grow at a CAGR of over 7.6% from 2025 to 2033

- Modified or graded death benefit coverage represented 46% of the total market share in 2024

- The age group over 70 accounts for 33% of the burial insurance market share

- Digital transformation and AI integration to streamline policy management and enhance customer experience is a popular burial insurance market trend

Burial insurance, often known as final expense insurance, is a type of life insurance that explicitly pays for funeral, burial, and other end-of-life expenses. It normally provides modest coverage amounts ranging from $5,000 to $25,000, making it more inexpensive and accessible, particularly to seniors. Most burial insurance policies do not require medical exams and have simple application procedures, making them excellent for the elderly or people with health difficulties.

Insurance Information Institute (III.org) states that, burial insurance can be customized to cover an individual or a complete family. A related option to burial life insurance, known as burial or "pre-need" insurance, entails prepaying for funeral costs. This plan allows you to select your funeral home, kind of service, casket or cremation, flowers, headstone, burial plot, and even the cost of grave digging and filling. By paying in advance, you may secure the current prices for these services.

Global Burial Insurance Market Dynamics

Market Drivers

- Aging global population increasing demand for end-of-life financial planning

- Rising funeral and burial costs prompting need for affordable coverage

- Growing awareness and marketing of final expense insurance to seniors

Market Restraints

- Limited coverage amounts compared to traditional life insurance

- High premiums for older individuals or those with health issues

- Low awareness in developing regions about burial insurance products

Market Opportunities

- Expansion into emerging markets with aging demographics

- Digital platforms enabling easier policy access and purchase

- Product innovation like bundled plans with health or annuity benefits

Burial Insurance Market Report Coverage

|

Market

|

Burial Insurance Market

|

|

Burial Insurance Market Size 2024

|

USD 294.7 Billion

|

|

Burial Insurance Market Forecast 2033

|

USD 534.8 Billion

|

|

Burial Insurance Market CAGR During 2025 - 2033

|

6.9%

|

|

Burial Insurance Market Analysis Period

|

2021 - 2033

|

|

Burial Insurance Market Base Year

|

2024

|

|

Burial Insurance Market Forecast Data

|

2025 - 2033

|

|

Segments Covered

|

By Coverage, By Age Group, By Distribution Channel, and By Geography

|

|

Regional Scope

|

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

|

|

Key Companies Profiled

|

Colonial Penn, Zurich Kotak General Insurance, Gerber Life Insurance Company, New York Life Insurance, Lemonade Insurance, Nassau Insurance Group Holdings, L.P., Fidelity Life Association, Allianz Life Insurance Company, Globe Life Insurance, Royal Neighbors of America, Mutual of Omaha, Ethos Life, Generali Group, State Farm, and The Baltimore Life Insurance Company.

|

|

Report Coverage

|

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis

|

Burial Insurance Market Insights

The aging global population is dramatically increasing demand for end-of-life financial planning, resulting in rise in the burial insurance market. According to the United Nations (UN), the global population of persons aged 65 and older is expected to increase by almost 370 million between 2015 and 2030, a growth rate of more than 60%. Furthermore, the United Nations predicts that the rate of population aging in the twenty-first century will outpace that of the twentieth century, with elderly soon outnumbering infants under the age of five.

Furthermore, the American Planning Association reports that older folks require twice as much hospital care as younger people, but less than half of those over 65 have any type of health insurance (Aged and Aging in the United States, 1959). This gap in coverage, combined with increased medical expenditures, has made improved insurance benefits for the elderly a significant issue. As a result, burial insurance has arisen as a low-cost way for seniors to manage final expenses while avoiding financial hardship on their relatives.

However, expensive premiums for older persons and those with pre-existing health conditions continue to be a major barrier, making burial insurance less accessible to those in greatest need. This affordability barrier may limit greater market use. On the plus side, the proliferation of digital platforms has made it easier for seniors to research, compare, and acquire burial insurance coverage. For example, in December 2020, Chubb collaborated with Brazilian neobank Nubank to introduce a digital life insurance product in Brazil. Such technologies assist in reaching tech-savvy senior consumers by providing convenient, user-friendly policy access, hence opening up new growth potential in the market.

Burial Insurance Market Segmentation

The worldwide market for burial insurance is split based on coverage, age group, distribution channel, and geography.

Burial Insurance Market By Coverage

- Level Death Benefit

- Guaranteed Acceptance

- Modified or Graded Death Benefit

According to burial insurance industry analysis, modified or graded death benefit coverage is popular because it is accessible to high-risk persons, such as elderly with health difficulties. These insurance provide partial or limited benefits in the early years, gradually increasing to full coverage after a specified term. This system enables insurers to manage risk while also giving coverage to those who would otherwise be denied. As a result, they are a popular choice for elderly persons looking for guaranteed admittance without medical tests.

Burial Insurance Market By Age Group

- Over 50

- Over 60

- Over 70

- Over 80

The over-70 age group dominates the burial insurance sector due to their greater emphasis on end-of-life preparation and financial security for their families. Individuals in this age group frequently confront failing health and limited standard insurance options, so burial insurance provides a straightforward and accessible solution. This demographic prefers speedy approval and guaranteed coverage without medical tests. Their high demand makes them the major target market, resulting in significant growth in the sector.

Burial Insurance Market By Distribution Channel

- Direct Sales

- Agents and Brokers

- Online Aggregators

- Others

According to burial insurance market forecast, among these, agents and brokers are projected to dominate the industry due to their personalized service and ability to help customers through complex insurance options. Direct sales give ease by allowing users to purchase insurance directly from insurers, whilst internet aggregators enable easy comparison and access to many plans.

Burial Insurance Market Regional Outlook

North America

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Burial Insurance Market Regional Analysis

In terms of regional segments, North America dominates the burial insurance market, owing to an aging population, widespread awareness of end-of-life planning, and a well-established insurance industry. For example, in April 2024, New York Life Insurance acquired a minority investment in Fairview Capital, a well-known private equity and venture capital firm. This effort aims to increase prospects for Fairview by investing USD 1 billion to assist reduce the wealth gap in undercapitalized and neglected communities. Rising funeral costs and limited healthcare coverage for seniors in the United States are driving demand in the North American burial insurance industry.

Europe is expected to see significant growth in the burial insurance sector, owing to its increasingly aging population and increased collaboration among key industry participants to expand insurance offers across many countries. In April 2022, iptiQ teamed with November to launch a new insurance policy in Germany called 'Whole of Life', which will cover funeral fees for November subscribers. This effort helps the company's regional expansion.

Burial Insurance Market Players

Some of the top burial insurance companies offered in our report include Colonial Penn, Zurich Kotak General Insurance, Gerber Life Insurance Company, New York Life Insurance, Lemonade Insurance, Nassau Insurance Group Holdings, L.P., Fidelity Life Association, Allianz Life Insurance Company, Globe Life Insurance, Royal Neighbors of America, Mutual of Omaha, Ethos Life, Generali Group, State Farm, and The Baltimore Life Insurance Company.

CHAPTER 1. Executive Summary

1.1. Global Burial Insurance Market Snapshot

1.2. Global Burial Insurance Market

CHAPTER 2. Market Variables and Scope

2.1. Introduction to Burial Insurance

2.2. Classification and Scope

CHAPTER 3. Market Dynamics and Trends

3.1. Global Burial Insurance Market Dynamic

3.2. Drivers

3.3. Restraints

3.4. Growth Opportunities

CHAPTER 4. Premium Insights

4.1. Global Burial Insurance Market Dynamics, Impact Analysis

4.2. Porter’s Five Forces Analysis

4.2.1. Bargaining Power of Suppliers

4.2.2. Bargaining Power of Buyers

4.2.3. Threat of Substitute Products

4.2.4. Rivalry among Existing Firms

4.2.5. Threat of New Entrants

4.3. PESTEL Analysis

4.4. Value Chain Analysis

4.5. Market Attractiveness

4.6. Product Lifecycle Analysis

4.7. Product Pricing Analysis

4.8. Demand-Supply Analysis

4.9. Patent Analysis

4.10. Regulatory Framework

4.11. Vendor Landscape

4.11.1. List of Buyers

4.11.2. List of Suppliers

CHAPTER 5. Burial Insurance Market By Coverage

5.1. Global Burial Insurance Market Snapshot, By Coverage

5.2. Global Burial Insurance Market, By Coverage, 2024 VS 2033

5.2.1. Market Size and Forecast

5.2.2. Level Death Benefit

5.2.2.1. Overview

5.2.2.2. Key Growth Factors and Opportunities

5.2.2.3. Market Size and Forecast

5.2.3. Guaranteed Acceptance

5.2.3.1. Overview

5.2.3.2. Key Growth Factors and Opportunities

5.2.3.3. Market Size and Forecast

5.2.4. Modified or Graded Death Benefit

5.2.4.1. Overview

5.2.4.2. Key Growth Factors and Opportunities

5.2.4.3. Market Size and Forecast

CHAPTER 6. Burial Insurance Market By Age Group

6.1. Global Burial Insurance Market Snapshot, By Age Group

6.2. Global Burial Insurance Market, By Age Group, 2024 VS 2033

6.2.1. Market Size and Forecast

6.2.2. Over 50

6.2.2.1. Overview

6.2.2.2. Key Growth Factors and Opportunities

6.2.2.3. Market Size and Forecast

6.2.3. Over 60

6.2.3.1. Overview

6.2.3.2. Key Growth Factors and Opportunities

6.2.3.3. Market Size and Forecast

6.2.4. Over 70

6.2.4.1. Overview

6.2.4.2. Key Growth Factors and Opportunities

6.2.4.3. Market Size and Forecast

6.2.5. Over 80

6.2.5.1. Overview

6.2.5.2. Key Growth Factors and Opportunities

6.2.5.3. Market Size and Forecast

CHAPTER 7. Burial Insurance Market By Distribution Channel

7.1. Global Burial Insurance Market Snapshot, By Distribution Channel

7.2. Global Burial Insurance Market, By Distribution Channel, 2024 VS 2033

7.2.1. Market Size and Forecast

7.2.2. Direct Sales

7.2.2.1. Overview

7.2.2.2. Key Growth Factors and Opportunities

7.2.2.3. Market Size and Forecast

7.2.3. Agents and Brokers

7.2.3.1. Overview

7.2.3.2. Key Growth Factors and Opportunities

7.2.3.3. Market Size and Forecast

7.2.4. Online Aggregators

7.2.4.1. Overview

7.2.4.2. Key Growth Factors and Opportunities

7.2.4.3. Market Size and Forecast

7.2.5. Others

7.2.5.1. Overview

7.2.5.2. Key Growth Factors and Opportunities

7.2.5.3. Market Size and Forecast

CHAPTER 8. Burial Insurance Market, by Region

8.1. Overview

8.2. Global Burial Insurance Market, By Region

8.2.1. Market Size and Forecast

8.3. North America

8.3.1. Market Size and Forecast

8.3.2. North America Burial Insurance Market, By Country

8.3.3. North America Burial Insurance Market, By Coverage

8.3.4. North America Burial Insurance Market, By Age Group

8.3.5. North America Burial Insurance Market, By Distribution Channel

8.3.6. U.S.

8.3.6.1. U.S. Burial Insurance Market, By Coverage

8.3.6.2. U.S. Burial Insurance Market, By Age Group

8.3.6.3. U.S. Burial Insurance Market, By Distribution Channel

8.3.7. Canada

8.3.7.1. Canada Burial Insurance Market, By Coverage

8.3.7.2. Canada Burial Insurance Market, By Age Group

8.3.7.3. Canada Burial Insurance Market, By Distribution Channel

8.4. Europe

8.5. Asia Pacific

8.6. LAMEA

CHAPTER 9. Competitive Landscape

9.1. Strategic Move Analysis

9.1.1. Top Player Positioning/Market Share Analysis

9.2. Recent Developments by the Market Participants (2024)

CHAPTER 10. Company Profile

10.1. Colonial Penn

10.1.1. Company Overview

10.1.2. Company Snapshot

10.1.3. Financial Performance

10.1.4. Business Overview

10.1.5. Product Portfolio

10.1.6. Strategic Growth

10.1.7. SWOT Analysis

10.2. Zurich Kotak General Insurance

10.3. Gerber Life Insurance Company

10.4. New York Life Insurance

10.5. Lemonade Insurance

10.6. Nassau Insurance Group Holdings, L.P.

10.7. Fidelity Life Association

10.8. Allianz Life Insurance Company

10.9. Globe Life Insurance

10.10. Royal Neighbors of America

10.11. Mutual of Omaha

10.12. Ethos Life

10.13. Generali Group

10.14. State Farm

10.15. The Baltimore Life Insurance Company