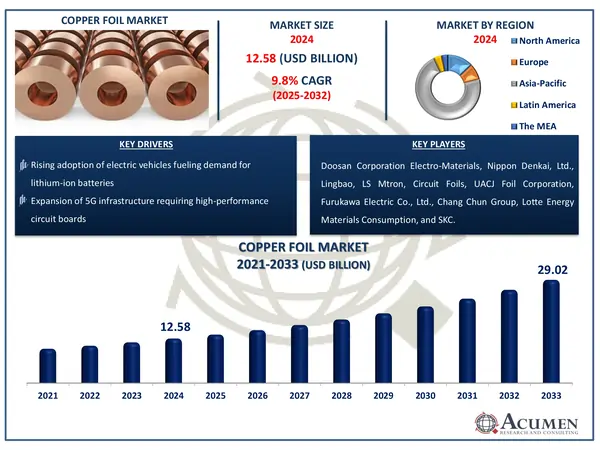

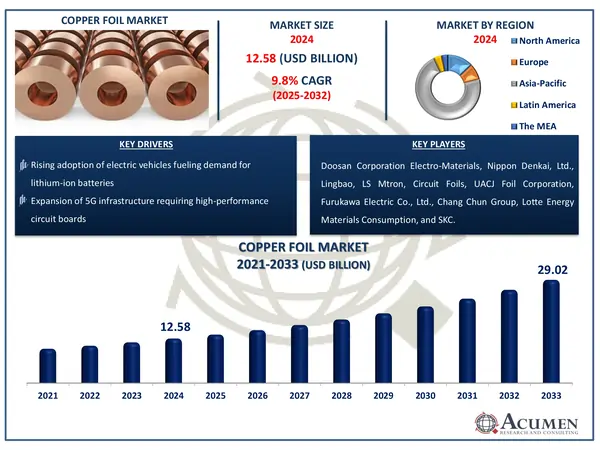

The Global Copper Foil Market Size accounted for USD 12.58 Billion in 2024 and is estimated to achieve a market size of USD 29.02 Billion by 2033 growing at a CAGR of 9.8% from 2025 to 2033.

Copper Foil Market Highlights

- The global copper foil market is expected to reach USD 29.02 billion by 2033, with a CAGR of 9.8% from 2025 to 2033

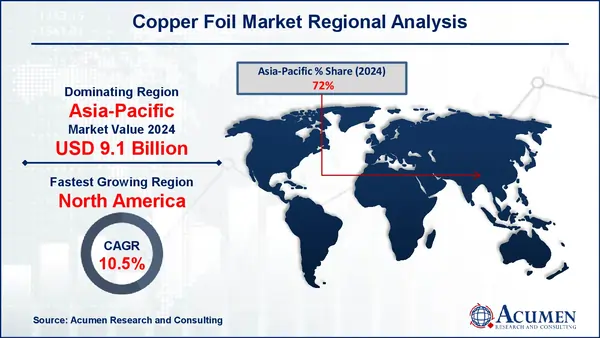

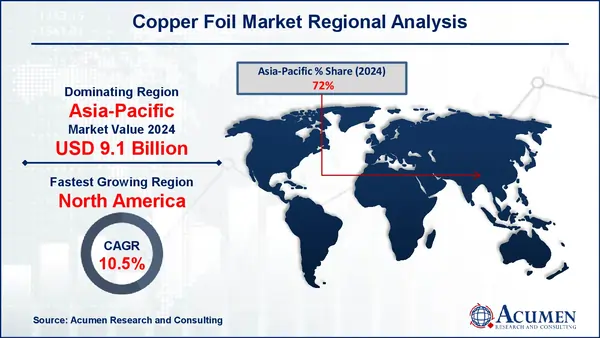

- The Asia-Pacific copper foil market was valued at approximately USD 9.1 billion in 2024

- The North America market is projected to grow at a CAGR of over 10.5% from 2025 to 2033

- The rolled product sub-segment accounted for 57% of the copper foil market share in 2024

- Based on the application, the circuit boards sub-segment generated around USD 7.7 billion revenue

- Innovation in ultra-thin and high-temperature copper foils for specialized use cases is a popular copper foil market trend that fuels the industry demand

Copper foil is a thin, malleable sheet of copper metal, often ranging in thickness from 0.0005 to 0.1 inches. It has good electrical conductivity and thermal characteristics, making it essential in electronics manufacturing, particularly for printed circuit boards. In addition to electronics, copper foil can be used for electrical shielding against electromagnetic interference, decorative arts and crafts (particularly stained glass), roofing and architectural details, thermal management systems, RFID antennas, and flexible circuit components. Its natural antibacterial properties make it valuable in therapeutic applications, while its corrosion resistance provides life in harsh environments. Copper foil's distinctive reddish-orange metallic luster makes it both practical and visually appealing in a variety of applications.

Global Copper Foil Market Dynamics

Market Drivers

- Rising adoption of electric vehicles fueling demand for lithium-ion batteries

- Growing consumption of consumer electronics and smart devices

- Expansion of 5G infrastructure requiring high-performance circuit boards

- Increasing need for energy storage solutions in renewable energy systems

Market Restraints

- Volatile copper prices impacting overall production costs

- Environmental concerns and regulations regarding copper mining

- Technological complexity in producing ultra-thin and high-performance copper foils

Market Opportunities

- Emerging applications in flexible and wearable electronics

- Development of high-capacity EV batteries driving advanced foil requirements

- Government incentives promoting green technologies and EV adoption

Copper Foil Market Report Coverage

|

Market

|

Copper Foil Market

|

|

Copper Foil Market Size 2024

|

USD 12.58 Billion

|

|

Copper Foil Market Forecast 2033

|

USD 29.02 Billion

|

|

Copper Foil Market CAGR During 2025 - 2033

|

9.8%

|

|

Copper Foil Market Analysis Period

|

2021 - 2033

|

|

Copper Foil Market Base Year

|

2024

|

|

Copper Foil Market Forecast Data

|

2025 - 2033

|

|

Segments Covered

|

By Product, By Application, By Care Provider, and By Geography

|

|

Regional Scope

|

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

|

|

Key Companies Profiled

|

Doosan Corporation Electro-Materials, Nippon Denkai, Ltd., Lingbao, LS Mtron, Circuit Foils, UACJ Foil Corporation, Furukawa Electric Co., Ltd., Chang Chun Group, Lotte Energy Materials Consumption, and SKC.

|

|

Report Coverage

|

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis

|

Copper Foil Market Insights

The global copper foil market is quickly developing, driven primarily by rising usage of electric vehicles (EVs), the rise of renewable energy sources, and rapid technological innovation across industries. The increasing usage of lithium-ion batteries in EVs, which use copper foil as a current collector in battery anodes, is a primary driver of this need. China alone produced over 8 million EVs in 2023, significantly increasing demand for high-performance copper foil. Furthermore, the growing global number of renewable energy installations, such as solar and wind farms, has raised demand for energy storage systems, many of which incorporate copper foil components.

The electronics sector adds to the market's growth. The expansion of consumer electronics, such as smartphones, tablets, and wearable gadgets, is driving up demand for printed circuit boards (PCBs). Copper foil, being an intrinsic component of PCBs, is critical to their functionality. Technological advancements have also enabled the creation of ultra-thin and highly conductive copper foils, which are now used in flexible electronics and medical devices, increasing the market's application scope.

However, various constraints limit the market's full potential. The volatility of raw copper pricing is still a major concern, affecting production costs and supply chain stability. Environmental restrictions governing copper mining and processing pose extra obstacles, especially in areas with strict emissions and waste management laws. Furthermore, the worldwide supply chain is vulnerable to interruptions due to the concentration of copper production in specific regions, resulting in possible bottlenecks.

On the potential side, emerging markets in Asia-Pacific and Latin America are heavily investing in industrialization and renewable infrastructure, creating new opportunities for copper foil use. Government initiatives that promote green technology, advances in solid-state batteries, and recycling and sustainability breakthroughs all contribute to increased growth. These improvements position the copper foil market for further global growth.

Copper Foil Market Segmentation

The worldwide market for copper foil is split based on product, application, and geography.

Copper Foil Market By Product

Rolled copper foil has the biggest market share due to its outstanding mechanical properties and flexibility. The hot rolling process yields copper foil with good ductility, uniform thickness, and smooth surface properties. These characteristics make it suitable for flexible printed circuit boards (FPCBs), which are widely utilized in smartphones, tablets, wearable devices, and automotive electronics. Its tremendous tensile strength and ability to bend without shattering make it ideal for future uses such as folding screens and flexible batteries. Furthermore, the trend of downsizing in consumer electronics is driving demand for rolled copper foil, ensuring its market dominance. Its low surface roughness makes it attractive with manufacturers for high-frequency and precision circuit applications.

Copper Foil Market By Application

- Circuit Boards

- Electrical Appliances

- Batteries

- Medical

- Solar & Alternative Energy

- Others

According to copper foil industry analysis, the circuit boards sector dominates the copper foil market, owing to the critical function of copper in printed circuit boards (PCBs), which are the foundation of practically all electronic devices. Copper foil is used as a conductive layer in PCBs, providing superior electrical conductivity and heat resistance, which are critical for assuring reliable performance in complicated electronic systems. With the rapid growth of consumer electronics, such as smartphones, tablets, laptops, and smart home devices, the demand for high-performance PCBs has surged.

Furthermore, the growth of automotive electronics and industrial automation is driving the demand for improved circuit boards, resulting in increased copper foil use. The move to 5G technology and increased downsizing of electrical components necessitate increasingly sophisticated multilayer PCBs, increasing the demand on high-quality copper foil. Circuit boards are the dominating application sector in the worldwide copper foil market, owing to their combined rise across several industries.

Copper Foil Market Regional Outlook

North America

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Copper Foil Market Regional Analysis

In 2024, Asia-Pacific dominated the global copper foil market, contributing for more than 72% of total sales, or almost USD 9.1 billion. This dominance is the result of the region's rapid industrialization, a robust manufacturing sector, and significant investments in battery manufacturing and energy projects. China, as the world's largest producer and consumer of copper, is critical, particularly in the manufacture of electric vehicles (EVs), which is predicted to reach 8 million by 2023.

India's copper foil market generated considerable revenue in 2024 and is expected to rise at a high CAGR through 2033. The rise of the electronics and automotive sectors is driving the boom, with a particular emphasis on electric vehicles and renewable energy efforts. Rolled copper foil was the most profitable product segment in 2024, but electrodeposited copper foil is expected to grow the fastest throughout the projected period.

In North America, the United States was the fastest growing copper foil market in 2024. The region's growth is supported by government initiatives and investments in renewable energy, particularly solar power. According to the U.S. Energy Information Administration (EIA), solar electricity capacity additions in the U.S. increased from 45% in 2022 to 56% in 2023, with estimates of 62% in 2024. The growth in solar energy projects is likely to increase demand for copper foil in the region.

In 2024, Europe had the notable share of the global copper foil market, accounting for USD 1.0 billion in revenues. The market is predicted to grow at a significant CAGR. Germany is expected to have the highest CAGR in the region over this time. The rise is being driven by increased demand for electric vehicles, energy storage systems, and the European Union's ambitions to achieve a circular economy by 2033.

Copper Foil Market Players

Some of the top copper foil companies offered in our report include Doosan Corporation Electro-Materials, Nippon Denkai, Ltd., Lingbao, LS Mtron, Circuit Foils, UACJ Foil Corporation, Furukawa Electric Co., Ltd., Chang Chun Group, Lotte Energy Materials Consumption, and SKC.

CHAPTER 1. Executive Summary

1.1. Global Copper Foil Market Snapshot

1.2. Global Copper Foil Market

CHAPTER 2. Market Variables and Scope

2.1. Introduction to Copper Foil

2.2. Classification and Scope

CHAPTER 3. Market Dynamics and Trends

3.1. Global Copper Foil Market Dynamic

3.2. Drivers

3.3. Restraints

3.4. Growth Opportunities

CHAPTER 4. Premium Insights

4.1. Global Copper Foil Market Dynamics, Impact Analysis

4.2. Porter’s Five Forces Analysis

4.2.1. Bargaining Power of Suppliers

4.2.2. Bargaining Power of Buyers

4.2.3. Threat of Substitute Products

4.2.4. Rivalry among Existing Firms

4.2.5. Threat of New Entrants

4.3. PESTEL Analysis

4.4. Value Chain Analysis

4.5. Market Attractiveness

4.6. Product Lifecycle Analysis

4.7. Product Pricing Analysis

4.8. Demand-Supply Analysis

4.9. Patent Analysis

4.10. Regulatory Framework

4.11. Vendor Landscape

4.11.1. List of Buyers

4.11.2. List of Suppliers

CHAPTER 5. Copper Foil Market By Product

5.1. Global Copper Foil Market Snapshot, By Product

5.2. Global Copper Foil Market, By Product, 2024 VS 2033

5.2.1. Market Size and Forecast

5.2.2. Rolled

5.2.2.1. Overview

5.2.2.2. Key Growth Factors and Opportunities

5.2.2.3. Market Size and Forecast

5.2.3. Electrodeposited

5.2.3.1. Overview

5.2.3.2. Key Growth Factors and Opportunities

5.2.3.3. Market Size and Forecast

CHAPTER 6. Copper Foil Market By Application

6.1. Global Copper Foil Market Snapshot, By Application

6.2. Global Copper Foil Market, By Application, 2024 VS 2033

6.2.1. Market Size and Forecast

6.2.2. Circuit Boards

6.2.2.1. Overview

6.2.2.2. Key Growth Factors and Opportunities

6.2.2.3. Market Size and Forecast

6.2.3. Electrical Appliances

6.2.3.1. Overview

6.2.3.2. Key Growth Factors and Opportunities

6.2.3.3. Market Size and Forecast

6.2.4. Batteries

6.2.4.1. Overview

6.2.4.2. Key Growth Factors and Opportunities

6.2.4.3. Market Size and Forecast

6.2.5. Medical

6.2.5.1. Overview

6.2.5.2. Key Growth Factors and Opportunities

6.2.5.3. Market Size and Forecast

6.2.6. Solar & Alternative Energy

6.2.6.1. Overview

6.2.6.2. Key Growth Factors and Opportunities

6.2.6.3. Market Size and Forecast

6.2.7. Others

6.2.7.1. Overview

6.2.7.2. Key Growth Factors and Opportunities

6.2.7.3. Market Size and Forecast

CHAPTER 7. Copper Foil Market, by Region

7.1. Overview

7.2. Global Copper Foil Market, By Region

7.2.1. Market Size and Forecast

7.3. North America

7.3.1. Market Size and Forecast

7.3.2. North America Copper Foil Market, By Country

7.3.3. North America Copper Foil Market, By Product

7.3.4. North America Copper Foil Market, By Application

7.3.5. U.S.

7.3.5.1. U.S. Copper Foil Market, By Product

7.3.5.2. U.S. Copper Foil Market, By Application

7.3.6. Canada

7.3.6.1. Canada Copper Foil Market, By Product

7.3.6.2. Canada Copper Foil Market, By Application

7.4. Europe

7.5. Asia Pacific

7.6. LAMEA

CHAPTER 8. Competitive Landscape

8.1. Strategic Move Analysis

8.1.1. Top Player Positioning/Market Share Analysis

8.2. Recent Developments by the Market Participants (2024)

CHAPTER 9. Company Profile

9.1. Doosan Corporation Electro-Materials

9.1.1. Company Overview

9.1.2. Company Snapshot

9.1.3. Financial Performance

9.1.4. Business Overview

9.1.5. Product Portfolio

9.1.6. Strategic Growth

9.1.7. SWOT Analysis

9.2. Nippon Denkai, Ltd.

9.3. Lingbao

9.4. LS Mtron

9.5. Circuit Foils

9.6. UACJ Foil Corporation

9.7. Furukawa Electric Co., Ltd.

9.8. Chang Chun Group

9.9. Lotte Energy Materials Consumption

9.10. SKC