The Global Cobalt Based Amorphous Alloy Market Size accounted for USD 1.38 Billion in 2024 and is estimated to achieve a market size of USD 2.27 Billion by 2033 growing at a CAGR of 5.8% from 2025 to 2033.

Cobalt Based Amorphous Alloy Market Highlights

- The global cobalt-based amorphous alloy market is projected to reach USD 2.27 billion by 2033, growing at a CAGR of 5.8% from 2025 to 2033

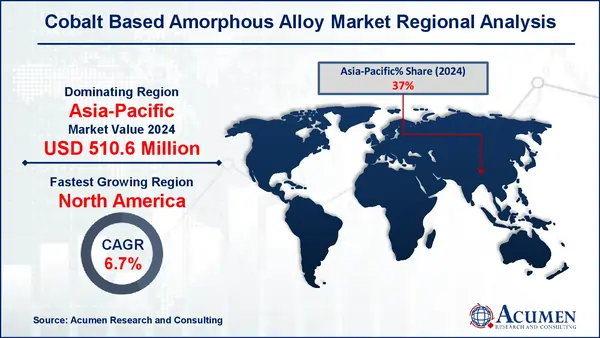

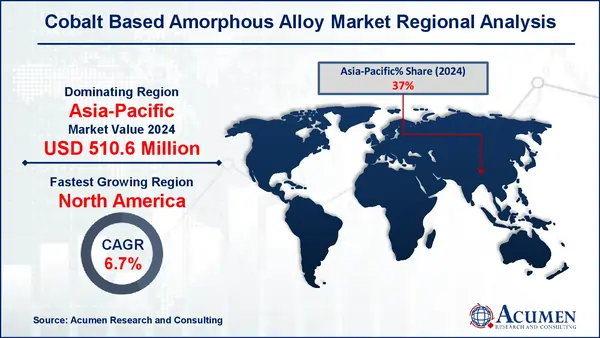

- In 2024, the Asia-Pacific cobalt-based amorphous alloy market was valued at approximately USD 510.6 million

- The North America region is expected to grow at a CAGR exceeding 6.7% between 2025 and 2033

- Thin film amorphous alloys held a significant market share in 2024

- Rising demand from the medical and aerospace sectors for high-strength, corrosion-resistant materials in critical applications is a popular cobalt based amorphous alloy market trend

Cobalt-based amorphous alloys are non-crystalline metallic materials made mostly of cobalt but also include elements such as boron, iron, and silicon. Unlike ordinary metals, they do not have a regular atomic structure, giving them higher magnetic, mechanical, and corrosion resistance.

These alloys are commonly employed in applications that need great strength, low energy loss, and endurance, such as magnetic sensors, transformers, and aerospace components. Their unusual atomic arrangement allows for improved performance in harsh environments, making them a useful material for sophisticated engineering applications.

Global Cobalt Based Amorphous Alloy Market Dynamics

Market Drivers

- Growing demand for high-performance magnetic materials in electronics and automotive industries

- Superior corrosion resistance and mechanical strength compared to crystalline alloys

- Increasing investments in renewable energy and transformer core applications

Market Restraints

- High production costs due to complex manufacturing processes

- Limited availability and fluctuating prices of raw materials like cobalt

- Competition from alternative advanced materials such as nanocrystalline alloys

Market Opportunities

- Expanding use in medical devices and aerospace components

- Emerging markets adopting smart grid technologies and energy-efficient solutions

- Technological advancements enabling cost-effective large-scale production

Cobalt Based Amorphous Alloy Market Report Coverage

|

Market

|

Cobalt Based Amorphous Alloy Market

|

|

Cobalt Based Amorphous Alloy Market Size 2024

|

USD 1.38 Billion

|

|

Cobalt Based Amorphous Alloy Market Forecast 2033

|

USD 2.27Billion

|

|

Cobalt Based Amorphous Alloy Market CAGR During 2025 - 2033

|

5.8%

|

|

Cobalt Based Amorphous Alloy Market Analysis Period

|

2021 - 2033

|

|

Cobalt Based Amorphous Alloy Market Base Year

|

2024

|

|

Cobalt Based Amorphous Alloy Market Forecast Data

|

2025 - 2033

|

|

Segments Covered

|

By Type, By Application, By End Use, By Distribution Channel, and By Geography

|

|

Regional Scope

|

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

|

|

Key Companies Profiled

|

Zhejiang Zhongjing Electric, CATECH, Hitachi Metal, Toshiba Materials, Vacuumschmelze, Metglas Inc., and Dyou Scientific & Technology.

|

|

Report Coverage

|

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis

|

Cobalt Based Amorphous Alloy Market Insights

As businesses prioritize energy efficiency and device downsizing, cobalt-based amorphous alloys are gaining popularity due to their outstanding soft magnetic characteristics. These alloys improve the performance of electric motors, transformers, and EV powertrains while providing superior durability, wear resistance, and corrosion resistance, making them ideal for tough settings. Their unique atomic structure increases component lifespan and decreases maintenance requirements.

According to the National Institutes of Health (NIH), high-performance magnetic materials are essential for developing technologies such as electric vehicles and renewable energy systems. Recent discoveries seek to create materials with improved magnetic characteristics while reducing reliance on finite rare-earth metals. Researchers have created a novel SmFe-based compound, SmFeâ.âNâ.â, which has more magnetic anisotropy and saturation magnetization than typical NdFeB magnets, potentially enhancing performance under high-temperature settings. These innovations not only improve device efficiency, but also reduce supply chain risks associated with crucial commodities.

However, the fabrication of cobalt-based amorphous alloys necessitates quick cooling and rigorous process control, increasing manufacturing costs and limiting their use in cost-sensitive applications. Despite this, industries with stringent performance and safety criteria, such as aerospace and medicine, are increasingly using these alloys due to their strength and dependability. For example, National Institutes of Health (NIH) states that cobalt-based alloys, in particular, are commonly utilized in orthopedic implants because to their high wear, corrosion, and biocompatibility levels. Originally employed in dental operations, their applications have spread to hip, knee, and shoulder prostheses, fueling market expansion as demand rises for reliable, long-lasting joint replacements in the medical field.

Cobalt Based Amorphous Alloy Market Segmentation

The worldwide market for cobalt based amorphous alloy is split based on type, application, end use, distribution channel, and geography.

Cobalt Based Amorphous Alloy Market By Type

- Bulk Amorphous Alloys

- Thin Film Amorphous Alloys

- Powder Form Amorphous Alloys

According to cobalt based amorphous alloy industry analysis, thin film amorphous alloys are dominating the cobalt-based amorphous alloy sector due to their better magnetic characteristics and downsizing possibilities. These films are commonly employed in modern electronics, sensors, and micro-electromechanical systems (MEMS). Their superior strength, corrosion resistance, and temperature stability make them excellent for precision applications. As demand for small, high-efficiency components rises, thin film variations drive innovation and industry growth.

Cobalt Based Amorphous Alloy Market By Application

- Energy Storage Systems

- Magnetic Components

- Structural Applications

- Electrical and Electronic Components

According to application segment, magnetic components dominate the cobalt-based amorphous alloy sector because they have excellent soft magnetic properties such as low coercivity and high permeability. This makes them excellent for use in transformers, inductors, and magnetic sensors in electronics and power applications. Their effectiveness in lowering energy losses improves gadget performance and reliability. As industries prioritize energy-saving solutions, demand for cobalt-based amorphous magnetic components continues to rise, propelling market expansion.

Cobalt Based Amorphous Alloy Market By End Use

- Automotive

- Energy and Power

- Industrial Machinery

- Aerospace and Defense

- Medical and Healthcare

- Electronics and Electrical

- Others

Based on end-users, the electronics and electrical sectors dominate the cobalt-based amorphous alloy market due to the alloys' superior magnetic and electrical properties. These materials are essential for producing transformers, inductors, and magnetic sensors, which improve energy efficiency and device performance. Their ability to work stably at high frequencies makes them excellent for use in current electronic devices. The growing need for small, high-performance electrical components is propelling market growth in this end-use segment.

Cobalt Based Amorphous Alloy Market By Distribution Channel

- Distributors

- Direct Sales

- Online Platforms

According to cobalt based amorphous alloy market forecast, direct sales as a distribution method is helping to expand the market. Direct sales allow manufacturers to build stronger ties with their consumers, providing specialized solutions and technical assistance that improves customer satisfaction. This strategy is especially useful in industries that require specialist materials, such as aerospace, automotive, and electronics, where precise specifications and performance criteria are essential. Direct sales can lead to more efficient distribution and potentially reduced costs, propelling market expansion further.

Cobalt Based Amorphous Alloy Market Regional Outlook

North America

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cobalt Based Amorphous Alloy Market Regional Analysis

In terms of regional segments, the Asia-Pacific region dominates the cobalt-based amorphous alloy market, owing to its robust manufacturing base and increased demand from the electronics, automotive, and renewable energy industries. Government actions to promote energy-efficient technologies accelerate industry growth. According to the Press Information Bureau (PIB), in 2024, the Union Cabinet approved a Rs. 7,453 crore Viability Gap Funding (VGF) scheme to develop India's first offshore wind energy projects, with Rs. 6,853 crores allocated for 1 GW capacity (500 MW each off the coasts of Gujarat and Tamil Nadu) and Rs. 600 crores for port infrastructure upgrades. This represents a clear governmental push toward sustainable energy, increasing demand for sophisticated materials such as cobalt-based amorphous alloys in high-efficiency wind turbine systems.

The cobalt-based amorphous alloy market in North America is expanding rapidly, driven by advances in aerospace, defense, and renewable energy industries. The region is also experiencing a growth in the use of electric vehicles, as well as a strategic focus on resilient material supply networks. According to the International Council on Clean Transportation, over 1.5 million new electric vehicles were sold in the United States in 2024, accounting for almost 10% of total new light-duty vehicle sales. This rise, combined with a strong focus on high-performance materials and innovation, is accelerating the use of cobalt-based amorphous alloys in North America.

Cobalt Based Amorphous Alloy Market Players

Some of the top cobalt based amorphous alloy companies offered in our report includes Zhejiang Zhongjing Electric, CATECH, Hitachi Metal, Toshiba Materials, Vacuumschmelze, Metglas Inc., and Dyou Scientific & Technology.

CHAPTER 1. Executive Summary

1.1. Global Cobalt Based Amorphous Alloy Market Snapshot

1.2. Global Cobalt Based Amorphous Alloy Market

CHAPTER 2. Market Variables and Scope

2.1. Introduction to Cobalt Based Amorphous Alloy

2.2. Classification and Scope

CHAPTER 3. Market Dynamics and Trends

3.1. Global Cobalt Based Amorphous Alloy Market Dynamic

3.2. Drivers

3.3. Restraints

3.4. Growth Opportunities

CHAPTER 4. Premium Insights

4.1. Global Cobalt Based Amorphous Alloy Market Dynamics, Impact Analysis

4.2. Porter’s Five Forces Analysis

4.2.1. Bargaining Power of Suppliers

4.2.2. Bargaining Power of Buyers

4.2.3. Threat of Substitute Products

4.2.4. Rivalry among Existing Firms

4.2.5. Threat of New Entrants

4.3. PESTEL Analysis

4.4. Value Chain Analysis

4.5. Market Attractiveness

4.6. Product Lifecycle Analysis

4.7. Product Pricing Analysis

4.8. Demand-Supply Analysis

4.9. Patent Analysis

4.10. Regulatory Framework

4.11. Vendor Landscape

4.11.1. List of Buyers

4.12. List of Suppliers

CHAPTER 5. Cobalt Based Amorphous Alloy Market By Type

5.1. Global Cobalt Based Amorphous Alloy Market Snapshot, By Type

5.2. Global Cobalt Based Amorphous Alloy Market, By Type, 2024 VS 2033

5.2.1. Market Size and Forecast

5.2.2. Bulk Amorphous Alloys

5.2.2.1. Overview

5.2.2.2. Key Growth Factors and Opportunities

5.2.2.3. Market Size and Forecast

5.2.3. Thin Film Amorphous Alloys

5.2.3.1. Overview

5.2.3.2. Key Growth Factors and Opportunities

5.2.3.3. Market Size and Forecast

5.2.4. Powder Form Amorphous Alloys

5.2.4.1. Overview

5.2.4.2. Key Growth Factors and Opportunities

5.2.4.3. Market Size and Forecast

CHAPTER 6. Cobalt Based Amorphous Alloy Market By Application

6.1. Global Cobalt Based Amorphous Alloy Market Snapshot, By Application

6.2. Global Cobalt Based Amorphous Alloy Market, By Application, 2024 VS 2033

6.2.1. Market Size and Forecast

6.2.2. Energy Storage Systems

6.2.2.1. Overview

6.2.2.2. Key Growth Factors and Opportunities

6.2.2.3. Market Size and Forecast

6.2.3. Magnetic Components

6.2.3.1. Overview

6.2.3.2. Key Growth Factors and Opportunities

6.2.3.3. Market Size and Forecast

6.2.4. Structural Applications

6.2.4.1. Overview

6.2.4.2. Key Growth Factors and Opportunities

6.2.4.3. Market Size and Forecast

6.2.5. Electrical and Electronic Components

6.2.5.1. Overview

6.2.5.2. Key Growth Factors and Opportunities

6.2.5.3. Market Size and Forecast

CHAPTER 7. Cobalt Based Amorphous Alloy Market By End Use

7.1. Global Cobalt Based Amorphous Alloy Market Snapshot, By End Use

7.2. Global Cobalt Based Amorphous Alloy Market, By End Use, 2024 VS 2033

7.2.1. Market Size and Forecast

7.2.2. Automotive

7.2.2.1. Overview

7.2.2.2. Key Growth Factors and Opportunities

7.2.2.3. Market Size and Forecast

7.2.3. Energy and Power

7.2.3.1. Overview

7.2.3.2. Key Growth Factors and Opportunities

7.2.3.3. Market Size and Forecast

7.2.4. Industrial Machinery

7.2.4.1. Overview

7.2.4.2. Key Growth Factors and Opportunities

7.2.4.3. Market Size and Forecast

7.2.5. Aerospace and Defense

7.2.5.1. Overview

7.2.5.2. Key Growth Factors and Opportunities

7.2.5.3. Market Size and Forecast

7.2.6. Medical and Healthcare

7.2.6.1. Overview

7.2.6.2. Key Growth Factors and Opportunities

7.2.6.3. Market Size and Forecast

7.2.7. Electronics and Electrical

7.2.7.1. Overview

7.2.7.2. Key Growth Factors and Opportunities

7.2.7.3. Market Size and Forecast

7.2.8. Others

7.2.8.1. Overview

7.2.8.2. Key Growth Factors and Opportunities

7.2.8.3. Market Size and Forecast

CHAPTER 8. Cobalt Based Amorphous Alloy Market By Distribution Channel

8.1. Global Cobalt Based Amorphous Alloy Market Snapshot, By Distribution Channel

8.2. Global Cobalt Based Amorphous Alloy Market, By Distribution Channel, 2024 VS 2033

8.2.1. Market Size and Forecast

8.2.2. Distributors

8.2.2.1. Overview

8.2.2.2. Key Growth Factors and Opportunities

8.2.2.3. Market Size and Forecast

8.2.3. Direct Sales

8.2.3.1. Overview

8.2.3.2. Key Growth Factors and Opportunities

8.2.3.3. Market Size and Forecast

8.2.4. Online Platforms

8.2.4.1. Overview

8.2.4.2. Key Growth Factors and Opportunities

8.2.4.3. Market Size and Forecast

CHAPTER 9. Cobalt Based Amorphous Alloy Market, by Region

9.1. Overview

9.2. Global Cobalt Based Amorphous Alloy Market, By Region

9.2.1. Market Size and Forecast

9.3. North America

9.3.1. Market Size and Forecast

9.3.2. North America Cobalt Based Amorphous Alloy Market, By Country

9.3.3. North America Cobalt Based Amorphous Alloy Market, By Type

9.3.4. North America Cobalt Based Amorphous Alloy Market, By Application

9.3.5. North America Cobalt Based Amorphous Alloy Market, By End Use

9.3.6. North America Cobalt Based Amorphous Alloy Market, By Distribution Channel

9.3.7. U.S.

9.3.7.1. U.S. Cobalt Based Amorphous Alloy Market, By Type

9.3.7.2. U.S. Cobalt Based Amorphous Alloy Market, By Application

9.3.7.3. U.S. Cobalt Based Amorphous Alloy Market, By End Use

9.3.7.4. U.S. Cobalt Based Amorphous Alloy Market, By Distribution Channel

9.3.8. Canada

9.3.8.1. Canada Cobalt Based Amorphous Alloy Market, By Type

9.3.8.2. Canada Cobalt Based Amorphous Alloy Market, By Application

9.3.8.3. Canada Cobalt Based Amorphous Alloy Market, By End Use

9.3.8.4. Canada Cobalt Based Amorphous Alloy Market, By Distribution Channel

9.4. Europe

9.5. Asia Pacific

9.6. LAMEA

CHAPTER 10. Competitive Landscape

10.1. Strategic Move Analysis

10.1.1. Top Player Positioning/Market Share Analysis

10.2. Recent Developments by the Market Participants (2024)

CHAPTER 11. Company Profile

11.1. Zhejiang Zhongjing Electric

11.1.1. Company Overview

11.1.2. Company Snapshot

11.1.3. Financial Performance

11.1.4. Business Overview

11.1.5. Product Portfolio

11.1.6. Strategic Growth

11.1.7. SWOT Analysis

11.2. CATECH

11.3. Hitachi Metal

11.4. Toshiba Materials

11.5. Vacuumschmelze

11.6. Metglas Inc.

11.7. Dyou Scientific & Technology