December 2023

The Global Abrasive Blasting Nozzle Market Size accounted for USD 216.8 Million in 2024 and is estimated to achieve a market size of USD 332.8 Million by 2033 growing at a CAGR of 4.9% from 2025 to 2033.

The Global Abrasive Blasting Nozzle Market Size accounted for USD 216.8 Million in 2024 and is estimated to achieve a market size of USD 332.8 Million by 2033 growing at a CAGR of 4.9% from 2025 to 2033.

Abrasive blasting nozzle is a device used in abrasive blasting to accelerate air and an abrasive blasting mixture over a surface that needs repair and subsequent protection from corrosion. The abrasive and air mixture is discharged from the end of the hose through the blast nozzle. Moreover, the length and tapered design of the nozzle determines the pattern and velocity of the mixture exiting the nozzle. These nozzles are made up of materials like tungsten carbide, aluminum, boron carbide, and silicon nitride. These materials are especially used to withstand the force and pressure at the outlet tip's nozzle while spraying pressurized air and abrasive at high velocity and pressure on an area with defects or corrosion.

|

Market |

Abrasive Blasting Nozzle Market |

|

Abrasive Blasting Nozzle Market Size 2024 |

USD 216.8 Million |

|

Abrasive Blasting Nozzle Market Forecast 2033 |

USD 332.8 Million |

|

Abrasive Blasting Nozzle Market CAGR During 2025 - 2033 |

4.9% |

|

Abrasive Blasting Nozzle Market Analysis Period |

2021 - 2033 |

|

Abrasive Blasting Nozzle Market Base Year |

2024 |

|

Abrasive Blasting Nozzle Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Nozzle Type, By Type, By Bore Size, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Everblast, Sponge-Jet Inc., AGSCO Corporation, BlastOne International, Graco Inc., Airblast B.V., Contracor, Elcometer Limited, Burwell Technologies, Kennametal Inc., Manus Abrasive Systems Inc., Marco International Group LLC, KEIR Manufacturing, Inc., and CLEMCO. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The rising demand for abrasive blasting machines for performing various tasks including surface preparation, restoration, and graffiti removal are supporting the market growth. These nozzles help in reducing the overall prices and benefit the end-users in terms of optimizing the utilization of abrasives, achieving appropriate blasting patterns, and using the compressed air efficiently. The continued adoption of blasting machines that can be operated using a remote control to comply with the guidelines drafted by the Occupational Safety and Health Administration (OSHA) is further bolstering the market growth. The demand is expected to increase in near future owing to the increased usage across commercial and defense applications. Furthermore, the untapped market is further projected to create potential opportunities over the forecast period.

Moreover, growing demand for surface finishing in automotive and aerospace industries is fueling the need for efficient abrasive blasting nozzles. These sectors require high-precision surface treatment for better coating adhesion and component durability, boosting market growth.

Health and safety concerns related to abrasive dust exposure hinder market expansion. Prolonged exposure to dust particles can lead to respiratory issues, increasing the need for strict regulations and protective measures. However, rising demand for eco-friendly and dustless blasting solutions open new avenues for innovation. As environmental regulations tighten, manufacturers are investing in sustainable technologies to meet customer and regulatory expectations.

The worldwide market for abrasive blasting nozzle is split based on nozzle type, material, bore size, end-user, and geography.

According to abrasive blasting nozzle industry analysis, the venturi nozzle dominates industry due to its high efficiency and performance. Its unusual design accelerates the abrasive combination by constricting the throat and extending the exit, resulting in a high-velocity stream. This leads to faster cleaning rates, improved surface coverage, and lower abrasive use. Industries favor Venturi nozzles because they produce consistent results in large-scale and high-precision blasting applications.

According to material, the carbide tips segment dominates the abrasive blasting nozzle market due to its remarkable durability and wear resistance. Among its subtypes, tungsten carbide, boron carbide, and silicon carbide are well-known for their ability to tolerate high-pressure and abrasive conditions. These materials improve nozzle life and provide constant performance, making them excellent for demanding applications. Their supremacy stems from increased industry demand for long-lasting and efficient blasting solutions.

Abrasive Blasting Nozzle Market Bore Size

Based on bore size, 3/8 inch bore size is the industry leader in abrasive blasting nozzles due to its ideal mix of pressure and abrasive flow. It provides efficient cleaning performance while preserving abrasive material, making it cost-effective for a wide range of applications. This bore size is extremely versatile, allowing for both light-duty and heavy-duty blasting applications. Its widespread acceptance across sectors is attributed to its interoperability with common blasting equipment and dependable results.

According to abrasive blasting nozzle market forecast, maritime (shipyard) end-user sector dominates the market, owing to the strong demand for surface preparation in shipbuilding and maintenance. To remove rust, old paint, and marine vegetation from big vessel surfaces, powerful and long-lasting nozzles are required. Abrasive blasting is essential for maintaining corrosion resistance and coating adherence in tough marine environments. The ongoing need for repair and refurbishment in global shipyards fuels continued demand in this category.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

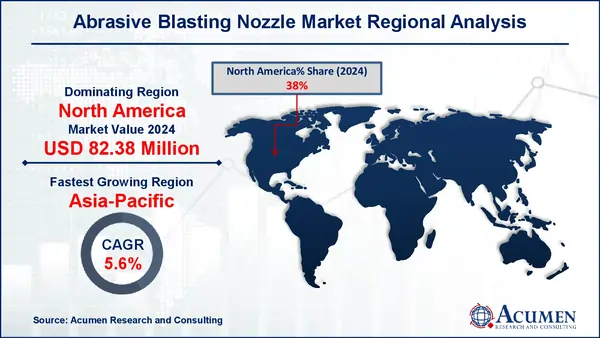

In terms of regional segments, Asia-Pacific accounted for the maximum share in terms of revenue in 2024. The region is accounted for a significant share owing to its major economies including Japan, China, and India. The rapidly developing automotive and construction sector of the developing economies of the region is supporting the demand for abrasive blasting nozzles in the respective sector. The increasing investment by major players in the region in order to take advantage of available opportunities is further bolstering the market value.

The Middle East and Africa area is experiencing considerable expansion in the abrasive blasting nozzle market as the construction, oil and gas, and maritime sectors expand. Major infrastructural projects and industrial development are driving up demand for surface preparation tools. Furthermore, growing investments in shipyards and energy plants are fueling the demand for efficient blasting equipment. The region's emphasis on modernization and industrialization encourages the increased use of advanced nozzle technology.

Some of the top abrasive blasting nozzle companies offered in our report include Everblast, Sponge-Jet Inc., AGSCO Corporation, BlastOne International, Graco Inc., Airblast B.V., Contracor, Elcometer Limited, Burwell Technologies, Kennametal Inc., Manus Abrasive Systems Inc., Marco International Group LLC, KEIR Manufacturing, Inc., and CLEMCO.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

December 2023

April 2021

September 2023

October 2024