April 2023

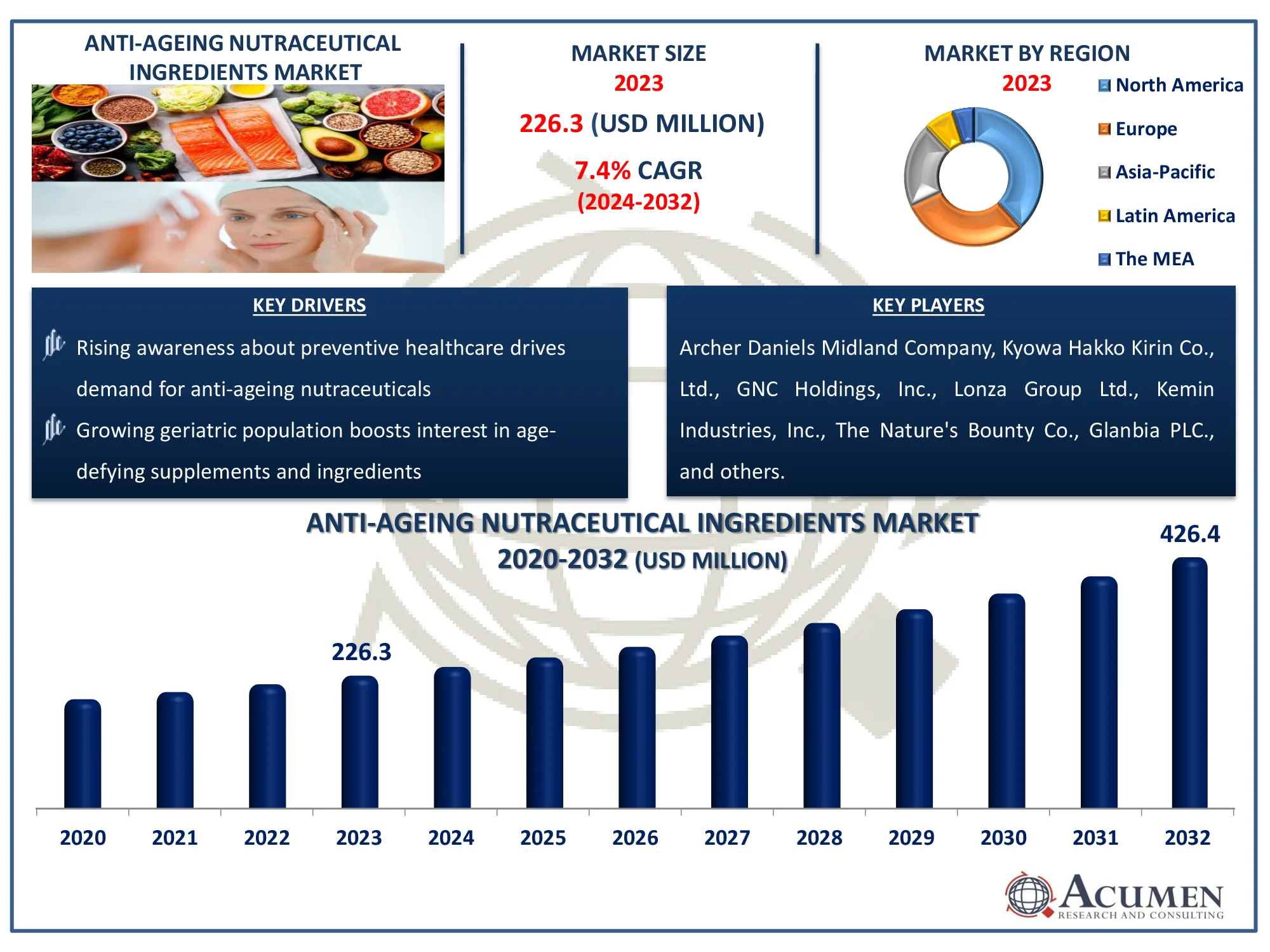

The Global Anti-Ageing Nutraceutical Ingredients Market Size accounted for USD 226.3 Million in 2023 and is estimated to achieve a market size of USD 426.4 Million by 2032 growing at a CAGR of 7.4% from 2024 to 2032.

The Global Anti-Ageing Nutraceutical Ingredients Market Size accounted for USD 226.3 Million in 2023 and is estimated to achieve a market size of USD 426.4 Million by 2032 growing at a CAGR of 7.4% from 2024 to 2032.

Ageing is a natural process that occurs as cells, organisms, and tissues in the body gradually lose their functional capacity. While it is impossible to stop aging, it is now possible to slow it down. Nutraceuticals include therapeutic characteristics that can help prevent or cure diseases. These can be present in foods as nutrients. Nutraceutical-enriched food has excellent antioxidative qualities and is beneficial in combating the causes of anti-aging. Free radicals are formed by the body when cells use up oxygen, which can cause oxidative harm to the body. As a result, consuming such nutraceuticals would reduce free radical-related negative effects.

|

Market |

Anti-Ageing Nutraceutical Ingredients Market |

|

Anti-Ageing Nutraceutical Ingredients Market Size 2023 |

USD 226.3 Million |

|

Anti-Ageing Nutraceutical Ingredients Market Forecast 2032 |

USD 426.4 Million |

|

Anti-Ageing Nutraceutical Ingredients Market CAGR During 2024 - 2032 |

7.4% |

|

Anti-Ageing Nutraceutical Ingredients Market Analysis Period |

2020 - 2032 |

|

Anti-Ageing Nutraceutical Ingredients Market Base Year |

2023 |

|

Anti-Ageing Nutraceutical Ingredients Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product Type, By Form, By Application, By Distribution Channel, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company, Kyowa Hakko Kirin Co., Ltd., GNC Holdings, Inc., Lonza Group Ltd., Kemin Industries, Inc., The Nature's Bounty Co., Glanbia PLC., Herbalife Nutrition Ltd., Blackmores Limited, and Pfizer Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The increasing genetic population drives the expansion of the anti-aging nutraceutical ingredients market. For example, the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP) forecasts that by 2023, Asia and the Pacific would be home to 697 Billion older people (60 and older), accounting for over 60% of all elderly people worldwide. Currently, approximately one in every seven people in the region is 60 years or older, and by 2050, one in every four people will be of this age. This increasing number of elderly individuals requires solutions for their age-related health problems or skin disorders, which inevitably shows expansion of this market in the anticipated year.

Among the several anti-aging options, nutraceutical ingredients are one of the most suitable. Furthermore, because these agents are herbal, they may have fewer negative effects than other options on the market today. The desire to remain young is the primary element driving the growth of the anti-aging nutraceutical ingredients market. For instance, as per Michigan Medicine Organization, Overall, 59% of adults aged 50 to 80 believe they appear younger than others their age. The percentage was slightly greater among women, those with better incomes, more years of schooling, and present employment. Only 6% of older persons believe they look older than their counterparts, with the majority believing they look similar. Adults aged 50 to 64 were slightly more likely to believe they seemed older than those aged 65 to 80. This reflects a common aspiration to preserve a youthful appearance as people age. This is supported by the intense marketing and promotional efforts used by the manufacturers of such products, as well as the increasing spending power of customers. Furthermore, as consumers become more aware, the demand for such items grows.

However, high price of these products is currently refraining a majority of consumers falling in the middle to low income group from buying these products, which is greatly hindering the growth of anti-aging nutraceutical ingredients market at present. However, increasing market penetration by the major manufacturers operating in this industry would ensure smooth growth of this market in the future. This market is still untapped in the under developed countries.

Further, strengthening economic condition of the underdeveloped countries would also ensure the growth of this anti-aging nutraceutical ingredients market in coming years. Increased market penetration from premium brands in the under developed economies would ensure uninterrupted growth of anti-aging nutraceutical ingredients market in future. Currently, North African countries and some countries in the Middle East are devoid of the availability of such products. Availability of the same would ensure the growth of this market.

National Institute of Health (NIH) estimates that increasing research has confirmed that carotenoids have various biological activities, such as antioxidant, anti-tumor, anti-diabetic, anti-aging, and anti-inflammatory activities. These carotenoids are used for skin health such as anti-ageing and photo protection of skin. The probiotics and carotenoids are reported for decreasing the skin damage due to UV-exposure and also in modulating early skin biomarkers of UV effects. These biological innovations also boost the demand for the anti-aging nutraceutical ingredients market.

Anti-Ageing Nutraceutical Ingredients Market Segmentation

Anti-Ageing Nutraceutical Ingredients Market SegmentationThe worldwide market for anti-ageing nutraceutical ingredients is split based on product type, form, application, distribution channel, and geography.

According to the anti-ageing nutraceutical ingredients industry analysis, vitamins are rapidly expanding product type due to their demonstrated effectiveness in enhancing skin health and general vigor. Vitamins C and E are strong antioxidants that counteract free radical damage and promote collagen formation for youthful skin. Vitamin D and A also help with skin repair and regeneration, making them popular in anti-aging products. Their diverse applications in nutritional supplements, functional meals, and drinks contribute to their anti-aging nutraceutical ingredients market demand.

According to the anti-ageing nutraceutical ingredients industry analysis, tablets and capsules are rapidly expanding because of their convenience, accurate dosing, and extended shelf life. Consumers choose these formats because they are convenient and portable, making them suited for daily use. They provide effective delivery of important elements such as vitamins, antioxidants, and peptides, resulting in optimal absorption and effectiveness. The expanding health-conscious population, combined with developments in encapsulation technology, bolsters their anti-aging nutraceutical ingredients market demand.

According to the anti-ageing nutraceutical ingredients market forecast, dietary supplements are the fastest-growing segment in market, driven by rising consumer awareness of preventative healthcare and holistic wellbeing. These supplements are particularly appealing because they provide focused benefits for skin health, energy, and age-related issues. Their flexibility, which includes tablets, capsules, powders, and gummies, appeals to a wide range of consumer tastes. Rising demand for natural and science-backed ingredients in supplements fuels their expansion as a critical application in the anti-aging nutraceutical ingredients market.

According to the anti-ageing nutraceutical ingredients market forecast, online stores are expected to exhibit notable growth due to the convenience of doorstep delivery, wider product availability, and increasing consumer preference for digital shopping platforms. Specialty stores continue to attract consumers seeking expert guidance and premium products, while supermarkets/hypermarkets benefit from high foot traffic and impulse buying in anti-aging nutraceutical ingredients market.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

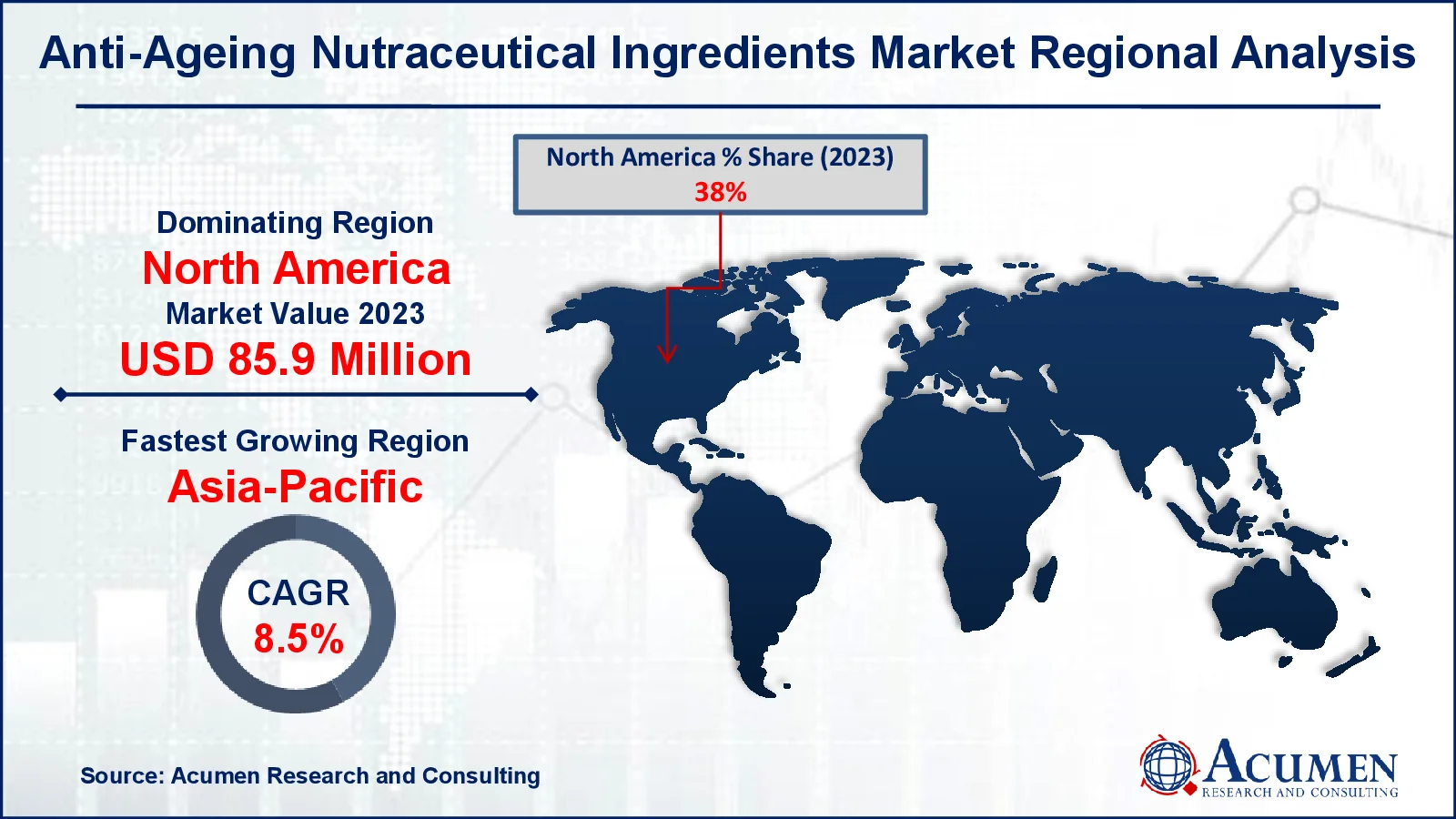

Anti-Ageing Nutraceutical Ingredients Market Regional Analysis

Anti-Ageing Nutraceutical Ingredients Market Regional AnalysisFor several reasons, North America is the largest contributor to the global anti-aging nutraceutical ingredients market. According to the Population Reference Bureau, the number of Americans aged 65 and older is expected to rise from 58 million in 2022 to 82 million by 2050 (a 47% increase), with the 65-and-over age group accounting for 17% to 23% of the total population. The aging population in the United States is driving North American anti-aging nutraceutical ingredients market dominance.

Asia-Pacific is likely to expand the fastest during the forecast period, owing to rising disposable incomes, increased knowledge of preventative healthcare, and an aging population. Additionally, the region's thriving e-commerce sector and cultural emphasis on holistic wellbeing contribute to anti-aging nutraceutical ingredients market growth. According to Invest India, internet penetration in India has hit new highs, with more than 918 million customers as of September 2023. Notably, the rural internet subscriber base is quickly expanding, currently totaling 375.66 million subscribers, suggesting the democratization of online access. Nearly all pin codes in India have seen e-commerce penetration. China, India, and South Korea are major contributors to the Asia-Pacific anti-ageing nutraceutical market. Other countries such as Mexico, Brazil, Poland, and Russia are expected to increase in anti-aging nutraceutical ingredients market.

Some of the top anti-ageing nutraceutical ingredients companies offered in our report include Archer Daniels Midland Company, Kyowa Hakko Kirin Co., Ltd., GNC Holdings, Inc., Lonza Group Ltd., Kemin Industries, Inc., The Nature's Bounty Co., Glanbia PLC., Herbalife Nutrition Ltd., Blackmores Limited, and Pfizer Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2023

October 2024

January 2020

March 2025