January 2018

The Global Biosimilars Market Size accounted for USD 26.7 Billion in 2023 and is estimated to achieve a market size of USD 113.2 Billion by 2032 growing at a CAGR of 17.5% from 2024 to 2032.

The Global Biosimilars Market Size accounted for USD 26.7 Billion in 2023 and is estimated to achieve a market size of USD 113.2 Billion by 2032 growing at a CAGR of 17.5% from 2024 to 2032.

A biosimilar, also known as subsequent entry biologic or follow-on biologic, is a medical product (drug) that is almost a similar or identical copy of the original product which is manufactured by some other company. These products are legitimately permitted versions of the original innovator products. They are generally manufactured when the patent of original product of the parent company expires.

The key factors propelling the growth of biosimilars market include the continuous increase in pressure to reduce healthcare expenditure, growing incidences of several diseases, increasing demand for biosimilars owing to their cost-effectiveness, helpful effects in the current clinical trials, growing number of off-patented drugs, and growing biosimilars demand in various therapeutic applications including blood disorders and rheumatoid arthritis. However, factors restricting the global biosimilars demand are strict regulatory requirements in different countries, high manufacturing costs and complexities and innovative strategies applied by various biosimilar drug manufacturers to limit the entry of new players.

|

Market |

Biosimilars Market |

|

Biosimilars Market Size 2023 |

USD 26.7 Billion |

|

Biosimilars Market Forecast 2032 |

USD 113.2 Billion |

|

Biosimilars Market CAGR During 2024 - 2032 |

17.5% |

|

Biosimilars Market Analysis Period |

2020 - 2032 |

|

Biosimilars Market Base Year |

2023 |

|

Biosimilars Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Drug Class, By Application, By End User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Reliance Life Sciences, Fresenius Kabi, Teva Pharmaceuticals, Bio-Thera Solutions, Amgen, Sandoz, Viatris, Coherus Biosciences, Biocon Ltd, Apobiologix, Pfizer, and Biocad. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The rising cost of biologic drugs has put a significant pressure on healthcare systems globally. As a result, there is an increasing need for less expensive alternatives, which has resulted in the growth of the biosimilars industry. Biosimilars are an economical answer since they offer high-quality, lower-cost equivalents to the original biologics. This reduces the cost burden on both patients and healthcare providers, making biologics more accessible to a wider population. The increased knowledge of biosimilars' cost-saving potential has hastened their use in a variety of therapeutic areas, including oncology, immunology, and rheumatology.

Many blockbuster biologic medication patents will expire, creating a great potential for biosimilars. When the patents on these biologics expire, other businesses can produce cheaper biosimilar copies. This tendency is particularly visible in the oncology and autoimmune disease treatment industries, where costly biologics have dominated. Patent expiration not only opens up the market for biosimilars, but it also encourages competition, which lowers prices and improves patient access to these critical treatments.

Emerging markets provide considerable opportunities for the biosimilars business. As these regions' healthcare systems grow, there is a greater demand for inexpensive biologics. Biosimilars can address this demand by offering high-quality medicines at a lower cost, making them a viable choice for countries with restricted healthcare resources. This growth may also help to improve general healthcare access and outcomes in these markets.

Biosimilars Market Segmentation

Biosimilars Market SegmentationThe worldwide market for biosimilars is split based on product, drug class, application, end user, and geography.

According to biosimilars industry analysis, recombinant non-glycosylated proteins provide the most revenue for the market due to their multiple production and application benefits. These proteins are created by genetic engineering techniques that do not require glycosylation, a difficult post-translational modification. This increases production efficiency, reduces costs, and broadens scalability. Furthermore, recombinant non-glycosylated proteins are more stable and easier to create on a large scale, making them ideal for commercial biosimilar manufacturing. Their wide range of uses, notably in therapeutic fields such as oncology and autoimmune illnesses, contributes to their supremacy. Their increased popularity and utilization in the biosimilars industry can be attributed to the simplicity of their manufacturing process.

Monoclonal antibodies are expected to dominate the biosimilars market due to their broad use in the treatment of chronic diseases such as cancer, autoimmune disorders, and inflammation. These biologics are well-known for their ability to precisely target specific cells, resulting in improved therapeutic outcomes. With several blockbuster biologic treatments losing patent protection, demand for monoclonal antibody biosimilars has risen, driven by regulatory approvals and lower costs than the original biologic. Furthermore, developments in bioprocessing technology have made it simpler to manufacture high-quality biosimilar monoclonal antibodies that are both safe and effective. This segment's rapid expansion is being fueled by increased acceptance in emerging markets, where price and accessibility are critical considerations in healthcare decisions.

Long-term conditions such as rheumatoid arthritis, psoriasis, and Crohn's disease are becoming more common, as the chronic and autoimmune disorders category accounts for the great majority in the biosimilar market forecast period. These illnesses may necessitate lengthy treatment regimens, making cost-effective alternatives like biosimilars quite enticing. Patients gain considerably from biosimilars' price and accessibility, particularly in places with limited healthcare budgets. Furthermore, the growing array of biosimilars addressing chronic and autoimmune diseases has expanded therapy options for both patients and physicians. Favorable regulatory settings, as well as growing physician confidence in biosimilars' safety and efficacy, contribute to the segment's significance. As the demand for long-term therapeutic solutions grows, this market expands rapidly.

Hospital pharmacies are projected to dominate the biosimilars industry due to their critical role in dispensing sophisticated biologic medicines. These pharmacies frequently serve patients who require specialist care, such as those receiving chemotherapy treatments or treating autoimmune disorders. The regulated environment of hospitals ensures the proper handling and administration of biosimilars, which are sensitive to storage and handling circumstances. Furthermore, hospitals are typically the primary point of entry for newly approved biosimilars, facilitating widespread use. As healthcare providers promote biosimilars for their cost-effectiveness, hospital pharmacies have emerged as the primary procurement and distribution channel. Their incorporation with healthcare systems enhances dependability and increases patient adherence to prescribed pharmaceuticals, so solidifying their market dominance.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

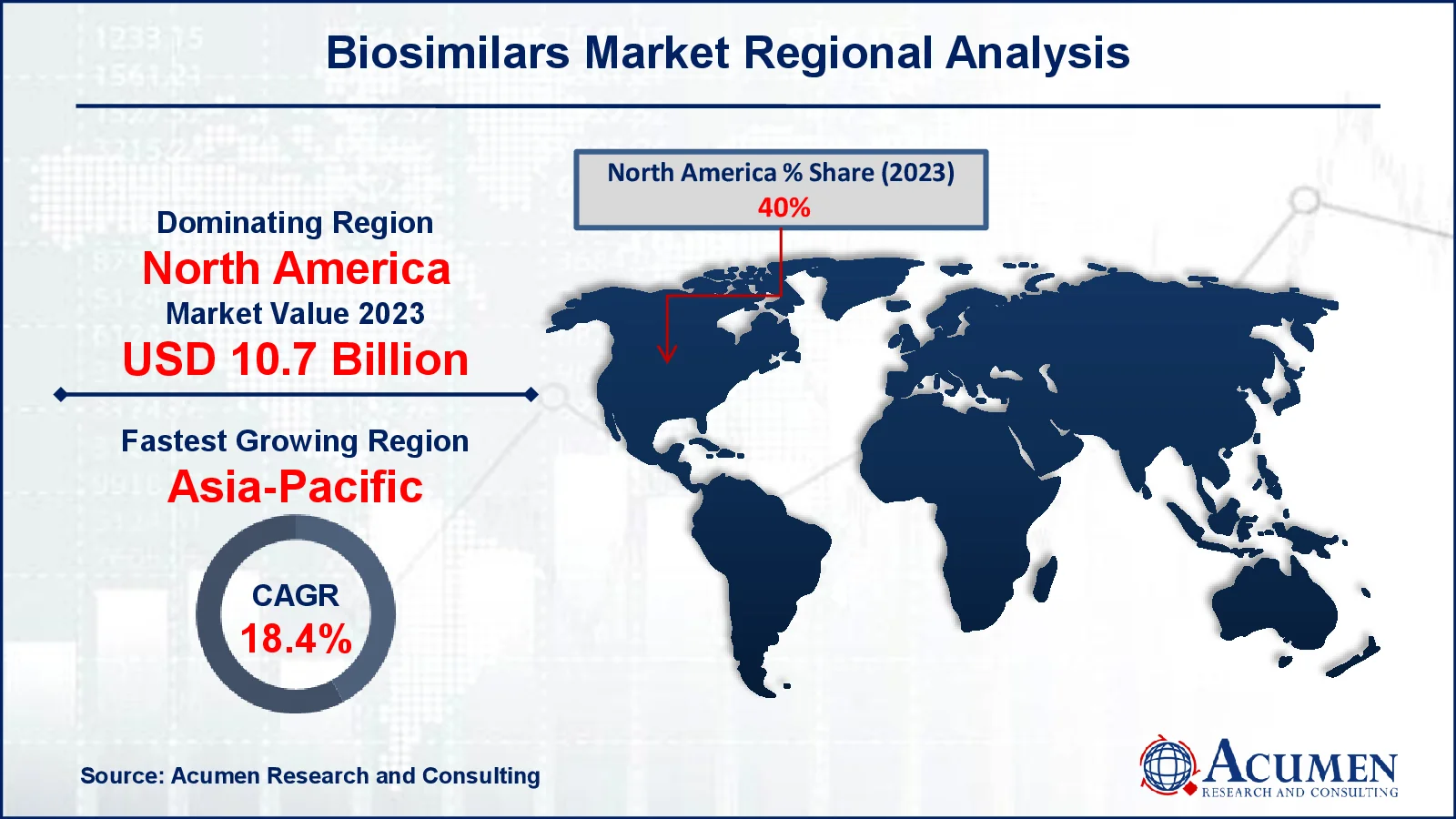

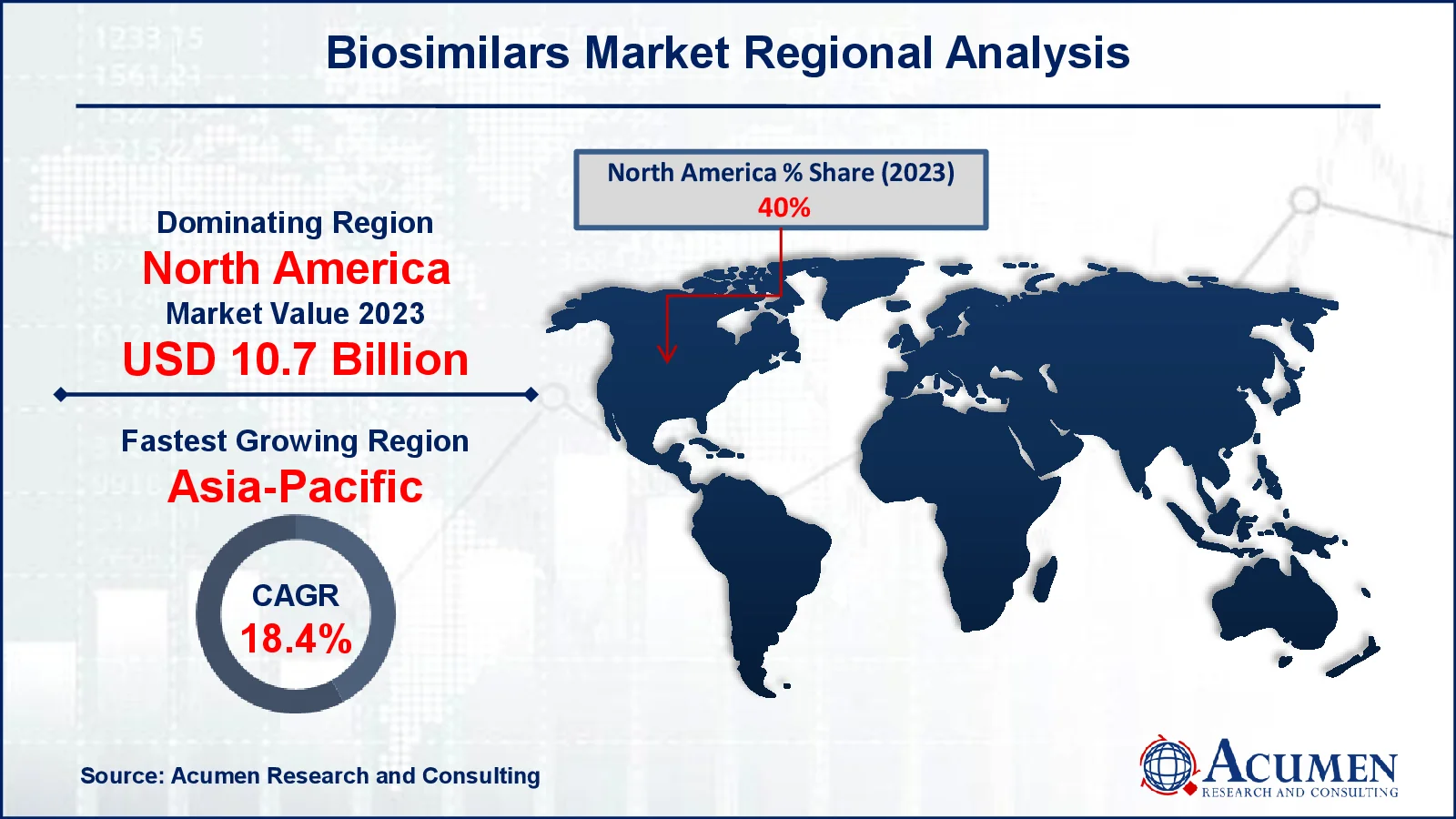

Biosimilars Market Regional Analysis

Biosimilars Market Regional AnalysisIn terms of biosimilars market analysis, North America leads the industry, owing to a well-established healthcare infrastructure, significant expenditure in biopharmaceutical research, and the presence of prominent industry competitors. The establishment of regulatory frameworks such as the Biologics Price Competition and Innovation Act (BPCIA) has resulted in quicker biosimilar approvals in the area, particularly in the US. Chronic illnesses such as cancer, diabetes, and autoimmune disorders all contribute to increased demand. Furthermore, the increased emphasis on reducing healthcare costs has resulted in the usage of less expensive biosimilar alternatives. In Canada, supportive policies and increasing physician awareness have aided industry expansion.

Meanwhile, Asia-Pacific is the fastest-growing area in the biosimilars market, because of greater healthcare access, rising chronic illness rates, and a growing need for low-cost treatment options. China, India, and South Korea are emerging as important players, leveraging their superior biopharmaceutical manufacturing skills and competitive pricing strategies. Government measures to increase domestic manufacturing and shorten regulatory processes have encouraged industry expansion. Furthermore, rising investments in R&D, together with increased awareness of biosimilars among healthcare professionals and patients, are driving the region's rapid growth. The combination of cost and accessibility positions Asia-Pacific as a growth hotspot.

Some of the top Biosimilars companies offered in our report includes Reliance Life Sciences, Fresenius Kabi, Teva Pharmaceuticals, Bio-Thera Solutions, Amgen, Sandoz, Viatris, Coherus Biosciences, Biocon Ltd, Apobiologix, Pfizer, and Biocad.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

January 2018

January 2018

May 2021

April 2023