January 2021

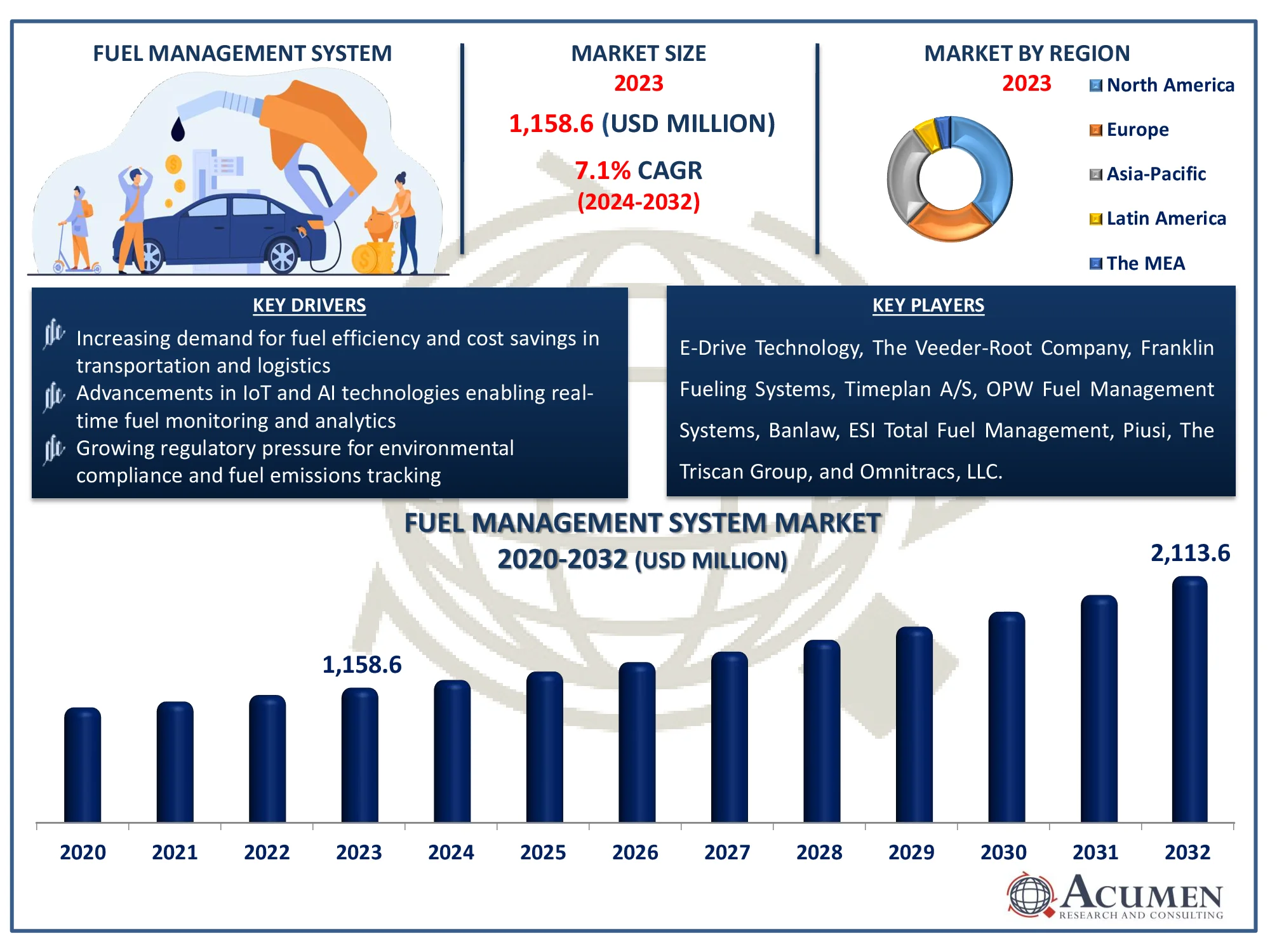

The Global Fuel Management System Market Size accounted for USD 1,158.6 Million in 2023 and is estimated to achieve a market size of USD 2,113.6 Million by 2032 growing at a CAGR of 7.1% from 2024 to 2032.

The Global Fuel Management System Market Size accounted for USD 1,158.6 Million in 2023 and is estimated to achieve a market size of USD 2,113.6 Million by 2032 growing at a CAGR of 7.1% from 2024 to 2032.

The increasing demand for energy, combined with rising fuel prices, has highlighted the importance of controlling and monitoring fuel consumption. This has resulted to an increase in the global demand for fuel management systems. These systems are critical in monitoring fuel usage across many transportation sectors, including trains, roadways, aviation, and maritime. Fuel management systems are designed to measure and regulate fuel consumption, allowing you to limit your usage and save money. These systems, which are mostly utilized in vehicle fleets such as aircraft and trains, provide a highly effective technique of tracking gasoline usage by collecting data that optimizes fuel dispensing, inventory management, and fuel purchasing. In addition, the system tracks the amount of fuel injected for onsite storage management.

|

Market |

Fuel Management System Market |

|

Fuel Management System Market Size 2023 |

USD 1,158.6 Million |

|

Fuel Management System Market Forecast 2032 |

USD 2,113.6 Million |

|

Fuel Management System Market CAGR During 2024 - 2032 |

7.1% |

|

Fuel Management System Market Analysis Period |

2020 - 2032 |

|

Fuel Management System Market Base Year |

2023 |

|

Fuel Management System Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Process, By Type, By Generation, By Application, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

E-Drive Technology, The Veeder-Root Company, Franklin Fueling Systems, Timeplan A/S, OPW Fuel Management Systems, Banlaw, ESI Total Fuel Management, Piusi, The Triscan Group, and Omnitracs, LLC. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The fuel management system (FMS) industry is being pushed primarily by factors such as reduced gas and oil waste, rising fuel prices, an increasing number of fuel stations and cars, and an increased requirement for inventory management. For example, the International Energy Agency forecasts that following Russia's invasion of Ukraine, the IEA's March Oil Market Report reduced its forecast for world oil demand in 2022 by 950 thousand barrels per day (kb/d) due to the anticipated effects of higher prices and slower GDP growth. The IEA predicts that rising oil prices, triggered in part by geopolitical events such as Russia's invasion of Ukraine, will result in slower economic growth (GDP) and lower demand for oil. As gasoline prices rise and economic development slows, companies and organizations will increasingly focus on managing and optimizing fuel usage to effectively manage expenses. Fuel management systems aid in measuring fuel consumption, optimizing fuel economy, and decreasing waste, which is especially crucial in an environment of rising prices. As a result, such circsumstances can accelerate the adoption of FMS technology, resulting in market development.

However, the high installation costs of FMS remain a significant barrier to industry expansion. On the other hand, increased awareness of the benefits given by FMS, particularly in key oil-consuming countries in the APAC region, provides considerable prospects for market competitors.

Furthermore, the development of sustainable and environmentally friendly fuel management technologies propels the fuel management system (FMS) Market. For example, the International Air Transport Association (IATA) estimates that Sustainable Aviation Fuel (SAF) could contribute around 65% of the emissions reductions required by aviation to achieve net zero CO2 emissions by 2050. To meet demand, output will need to be increased dramatically. The greatest acceleration is projected in the 2030s, as regulatory support expands globally, SAF competes with fossil fuels, and reliable offsets become scarce. This will boost the expansion of the FMS sector by emphasizing the growing need for advanced systems to optimize, track, and control the usage of sustainable aviation fuel (SAF) as it becomes more extensively implemented in the industry.

Fuel Management System Market Segmentation

Fuel Management System Market SegmentationThe worldwide market for fuel management system is split based on process, type, application, end-user, and geography.

According to fuel management system industry analysis, onsite fuel management system category dominates, with widespread application in industries such as transportation, construction, and mining. These systems provide real-time fuel monitoring, which reduces pilferage and improves operational efficiency, making them crucial for organizations with high fuel usage. The increased requirement for cost optimization pushes up demand for onsite fuel management solutions. Meanwhile, fleet operators choose card-based fuel management systems to measure gasoline expenses, but total fuel management systems offer an all-in-one solution that combines fuel procurement, storage, and consumption tracking for end-to-end efficiency.

The monitoring segment is critical to the FMS process because real-time fuel tracking and analytics are required to prevent fuel theft, optimize usage, and ensure operational efficiency. The growing demand for automated monitoring systems in industries such as transportation, aviation, and logistics accelerates market adoption. Meanwhile, measurement assures proper gasoline distribution and inventory tracking, while reporting enables firms to comply with rules and evaluate fuel data.

In the fuel management system market, the third generation involves advanced automation, real-time fuel monitoring and connection with GPS and telematics. The increased need for cloud-based solutions and data analytics fuels the development of third-generation FMS. Meanwhile, first and second generation systems rely on basic manual and semi-automated processes, fourth generation introduces AI-driven analytics and IoT connectivity, and fifth generation features blockchain integration and predictive analytics for next-level fuel optimization.

Historically, fleet management segment is predicted to grow rapidly in the FMS market, since controlling fuel usage in big vehicle fleets is critical for cost savings and operational efficiency. These systems provide real-time tracking, route optimization, and fuel theft prevention, making them critical for the transportation, logistics, and aviation industries. The growing usage of telematics and IoT-based fleet solutions fuels the demand for FMS in fleet administration. Meanwhile, fuel consumption focuses on tracking and reducing fuel use, while efficiency provides optimal fuel performance, and viscosity control is crucial in industries such as maritime and aviation.

In the fuel management system market, road transportation segment has a sizable market share due to the high fuel consumption and operational costs associated with commercial fleets, logistics, and public transit. The growing use of telematics, GPS tracking, and government fuel-efficiency rules all contribute to increased demand in this market. Meanwhile, FMS is used in rail transportation to optimize fuel in locomotives, marine transportation focuses on fuel efficiency and pollution compliance, and airplanes rely on advanced fuel monitoring to improve safety and save operating costs.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Fuel Management System Market Regional Analysis

Fuel Management System Market Regional AnalysisNorth America has long dominated the fuel management system (FMS) market due to the large number of significant fuel management solution suppliers, well-established transportation infrastructure, and stringent fuel economy and emissions regulations. Veeder-Root, for example, launched The PLUS VIEW in 2023, a mobile application for Android and iOS smartphones. This tool connects to automatic tank gauges, offering users rapid access to inventory, compliance, and alarm data, hence improving real-time monitoring and fuel management efficiency. The region's widespread use of modern telematics, IoT-enabled fuel monitoring, and fleet management automation solidifies its market leadership. Furthermore, an increasing emphasis on sustainability and fuel efficiency is driving innovation and adoption throughout North America.

Asia-Pacific is experiencing substantial expansion in the fuel management system (FMS) market, owing to fast industrialization, expanding transportation networks, and the presence of large companies in China, India, and Japan. For example, in December 2023, Cummins India and Repos Energy collaborated to debut the DATUM fuel management system at CII EXCON. DATUM (Data Automated Teller Ultimate Machine) is an intelligent fuel management system aimed particularly at diesel applications. Its major purpose is to help clients overcome the challenges they experience in appropriately managing fuel operations. The increasing use of IoT, cloud-based FMS, and smart fleet solutions is driving market expansion in Asia-Pacific.

Some of the top fuel management system companies offered in our report include E-Drive Technology, The Veeder-Root Company, Franklin Fueling Systems, Timeplan A/S, OPW Fuel Management Systems, Banlaw, ESI Total Fuel Management, Piusi, The Triscan Group, and Omnitracs, LLC

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

January 2021

November 2022

October 2025

March 2023