October 2018

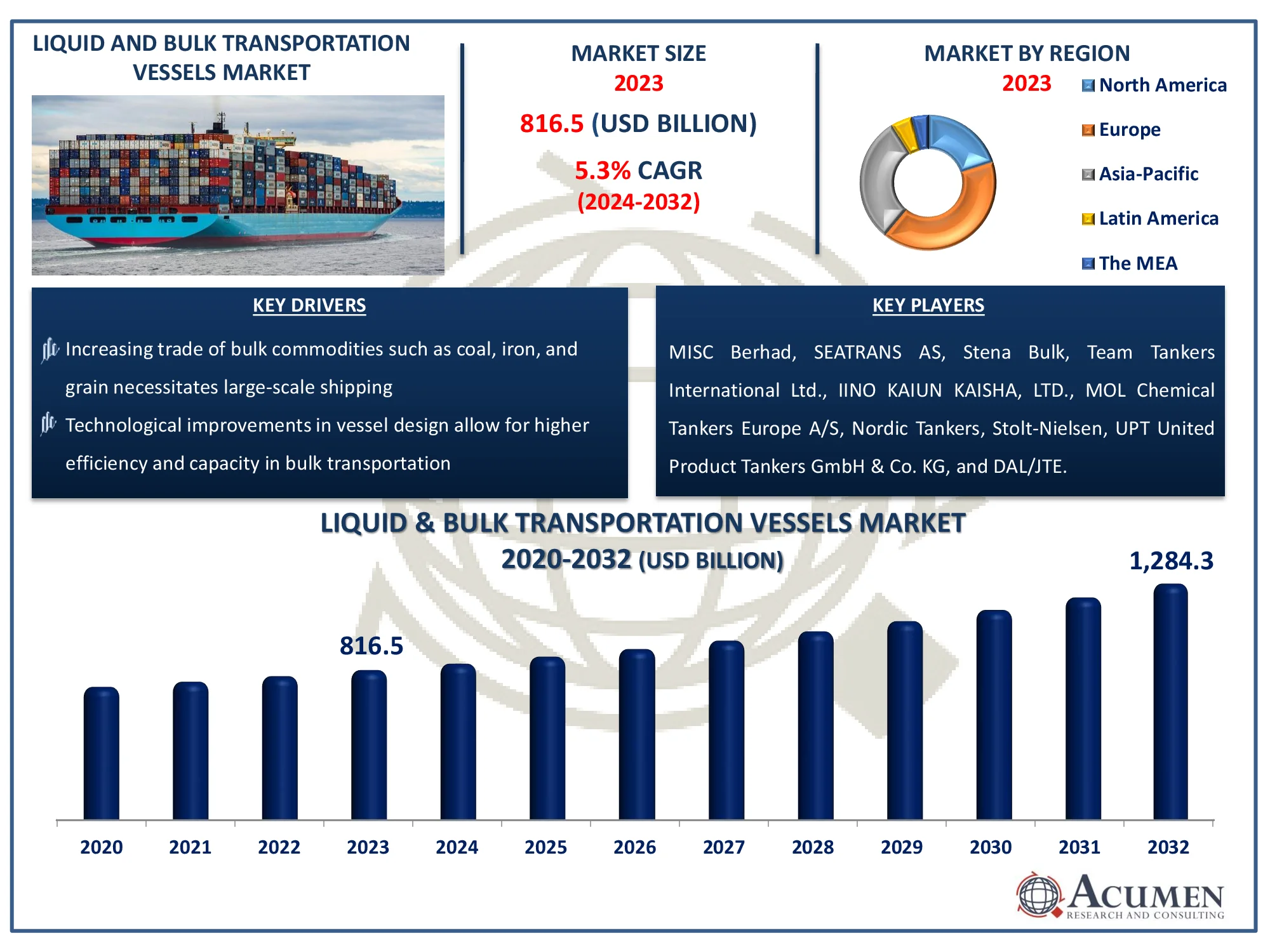

The Global Liquid And Bulk Transportation Vessels Market Size accounted for USD 816.5 Billion in 2023 and is estimated to achieve a market size of USD 1,284.3 Billion by 2032 growing at a CAGR of 5.3% from 2024 to 2032.

The Global Liquid And Bulk Transportation Vessels Market Size accounted for USD 816.5 Billion in 2023 and is estimated to achieve a market size of USD 1,284.3 Billion by 2032 growing at a CAGR of 5.3% from 2024 to 2032.

A bulk commodity is generally referred to a substance such as coal, iron, and grain, which is generally traded in large quantities. It has an unusual character which makes it easy for transportation. A transport system is generally planned to ensure that all its parts work together efficiently and in a minimum possible time. Water transport is one of the most important transportation chains which helps to move bulk commodities from one place to another place between producers and consumers. Cargo moves through the entire system as a series of distinct shipments. Storage areas in different locations act as a buffer to allow for time differences in the arrival and departure of a particular commodity.

In general, a bulk transport system consists of a sea voyage and two land journeys which might be done through train, conveyor, lorry, and pipeline. There are four storage areas mainly - loading port, discharging port, destination, and handling operations as the cargo moves through the entire system. Ships are considered to be a part of bulk transport systems and are used by cargo shippers. For instance, the transport system places restraint on the size of the ship. Depth of water and the berth length at both ports, i.e., loading and unloading port, determines the maximum size of the ship which can be used to transport a particular commodity from one place to another.

The key aim is to move the cargo as efficiently and cheaply in a minimum possible time whether the transport system is for a coal mine and a power station or a chemical plant and fertilizer industry. Every commodity and a particular industry have definite specific transport requirements, and no single system is best suitable for each and every situation.

Delivery frequency of commodities from one place to another is very important from the shipper’s point of view, and larger ships require fewer trips to deliver the same volume. Cargo handling does not change with changes in voyage distance, and so it becomes less important in the unit cost. There are numerous participants in the bulk transport system. Cargo owners stood in the first position in the businesses of bulk cargo transportation on a periodic basis. Their business varies very much from one customer to another customer. In industries such as paper, steel, pulp, and oil refineries, cost-effective transportation of raw materials is very essential. They require the cheapest possible transport, whose most important objective is to reduce the transportation cost.

|

Market |

Liquid And Bulk Transportation Vessels Market |

|

Liquid And Bulk Transportation Vessels Market Size 2023 |

USD 816.5 Billion |

|

Liquid And Bulk Transportation Vessels Market Forecast 2032 |

USD 1,284.3 Billion |

|

Liquid And Bulk Transportation Vessels Market CAGR During 2024 - 2032 |

5.3% |

|

Liquid And Bulk Transportation Vessels Market Analysis Period |

2020 - 2032 |

|

Liquid And Bulk Transportation Vessels Market Base Year |

2023 |

|

Liquid And Bulk Transportation Vessels Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Vessel Type, By Transport Type, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

MISC Berhad, SEATRANS AS, Stena Bulk, Team Tankers International Ltd., IINO KAIUN KAISHA, LTD., MOL Chemical Tankers Europe A/S, Nordic Tankers, Stolt-Nielsen, UPT United Product Tankers GmbH & Co. KG, and DAL/JTE. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Some of the factors driving the growth of the liquid and bulk transportation vessels market include the high requirement of commodities such as crude oil and natural gas in emerging economies of Asia-Pacific such as India and China and the Middle East. Thus, in order to bridge the demand and supply gap, liquid and bulk transportation vessels are highly required. High operational costs and maintenance of transportation vessels can obstruct the growth of the liquid and bulk transportation vessels market.

The vital principle of bulk transport is that unit costs can be decreased with the increasing size of cargo. In heavier and bigger ships, unit costs are low, in addition to cargo handling and storage charges being cheaper for high volumes. Thus, the bulk trades are continually under economic pressure to increase the cargo consignment size.

Large numbers of opportunities are present for liquid and bulk transportation vessel manufacturers as new avenues for business are coming up with the increase in the number of imports and exports.

Liquid and Bulk Transportation Vessels Market Segmentation

Liquid and Bulk Transportation Vessels Market SegmentationThe worldwide market for liquid and bulk transportation vessels is split based on vessel type, transport type, application, and geography.

According to liquid & bulk transportation vessels industry analysis, the market includes a diverse range of boats designed to transport a variety of cargoes, including liquids and bulk commodities. This market is fueled by rising worldwide demand for goods and resources, particularly in emerging economies. In this industry, dry cargo vessels have emerged as the dominant sector. Several causes contribute to this rise, including increased global demand for consumer goods, raw minerals, and agricultural products. The increase of worldwide trade, as well as the growing reliance on foreign supply chains, have all contributed considerably to the segment's rise.

The short sea sector of the liquid & bulk transportation vessels market is likely to be the largest. This expansion is principally driven by a renewed emphasis on regional trade and coastal infrastructure development. Short sea shipping has various advantages over long-haul routes, including decreased fuel usage, pollution, and faster delivery times. Furthermore, the rising emphasis on sustainable transportation alternatives, as well as the passage of stricter environmental regulations, are expected to boost demand for short-distance marine transportation.

The liquid & bulk transportation vessels market serves a diverse range of industries, with natural gas and crude oil expected to be the largest segment. This segment's relevance stems from worldwide energy consumption, which needs the efficient and consistent delivery of these important commodities. The increased reliance on fossil fuels, combined with the expansion of global trade routes, is driving the industry's growth. Furthermore, technological advances such as liquefied natural gas (LNG) carriers have bolstered the natural gas transportation business.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

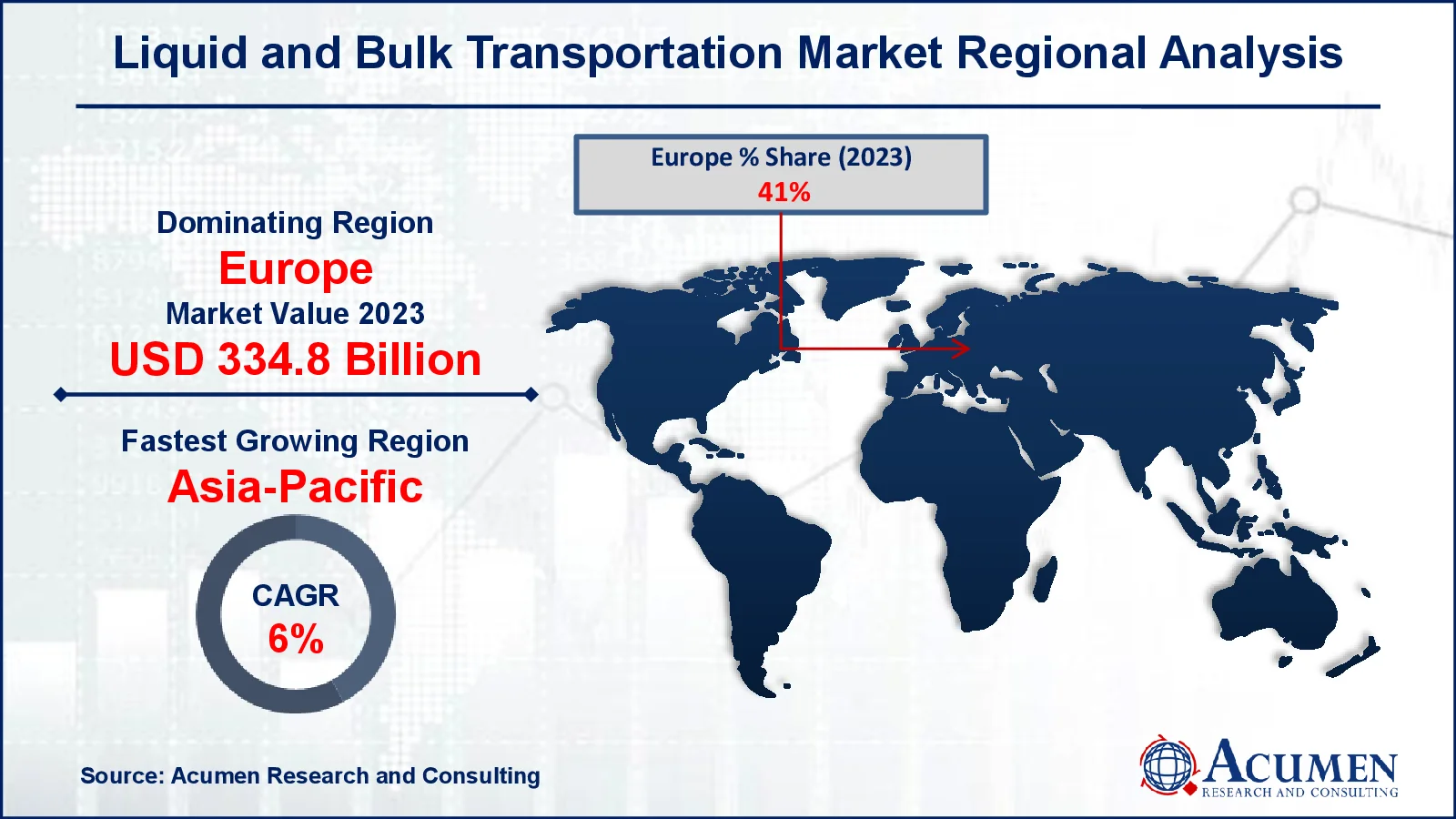

Liquid And Bulk Transportation Vessels Market Regional Analysis

Liquid And Bulk Transportation Vessels Market Regional AnalysisThe European region has the biggest market share because of well-established trade routes, a flourishing maritime industry, and high demand for a wide range of commodities. Europe's strategic location as a worldwide trading hub, paired with its strong industrial foundation and massive infrastructure, contributes to its industry leadership.

However, the Asia-Pacific area will probably to grow significantly and become a prominent role in the liquid and bulk transportation vessels market forecast period. A variety of reasons contribute to its rapid development. the region has a growing middle class, which drives up consumer demand and increases imports of consumer products, raw resources, and industrial components. Second, the rise of Asia-Pacific economies, such as China and India, has resulted in major industrial growth and infrastructure development, increasing need for efficient commodity transportation.

Furthermore, government efforts to improve marine infrastructure, such as port construction and modernization projects, are making the regional maritime commerce environment more favorable. The growing emphasis on regional trade in Asia-Pacific, combined with the rising demand for energy resources, is driving demand for specialized vessels such as LNG carriers and crude oil tankers.

Some of the top liquid and bulk transportation vessels companies offered in our report includes MISC Berhad, SEATRANS AS, Stena Bulk, Team Tankers International Ltd., IINO KAIUN KAISHA, LTD., MOL Chemical Tankers Europe A/S, Nordic Tankers, Stolt-Nielsen, UPT United Product Tankers GmbH & Co. KG, and DAL/JTE.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

October 2018

March 2023

May 2020

July 2022