January 2019

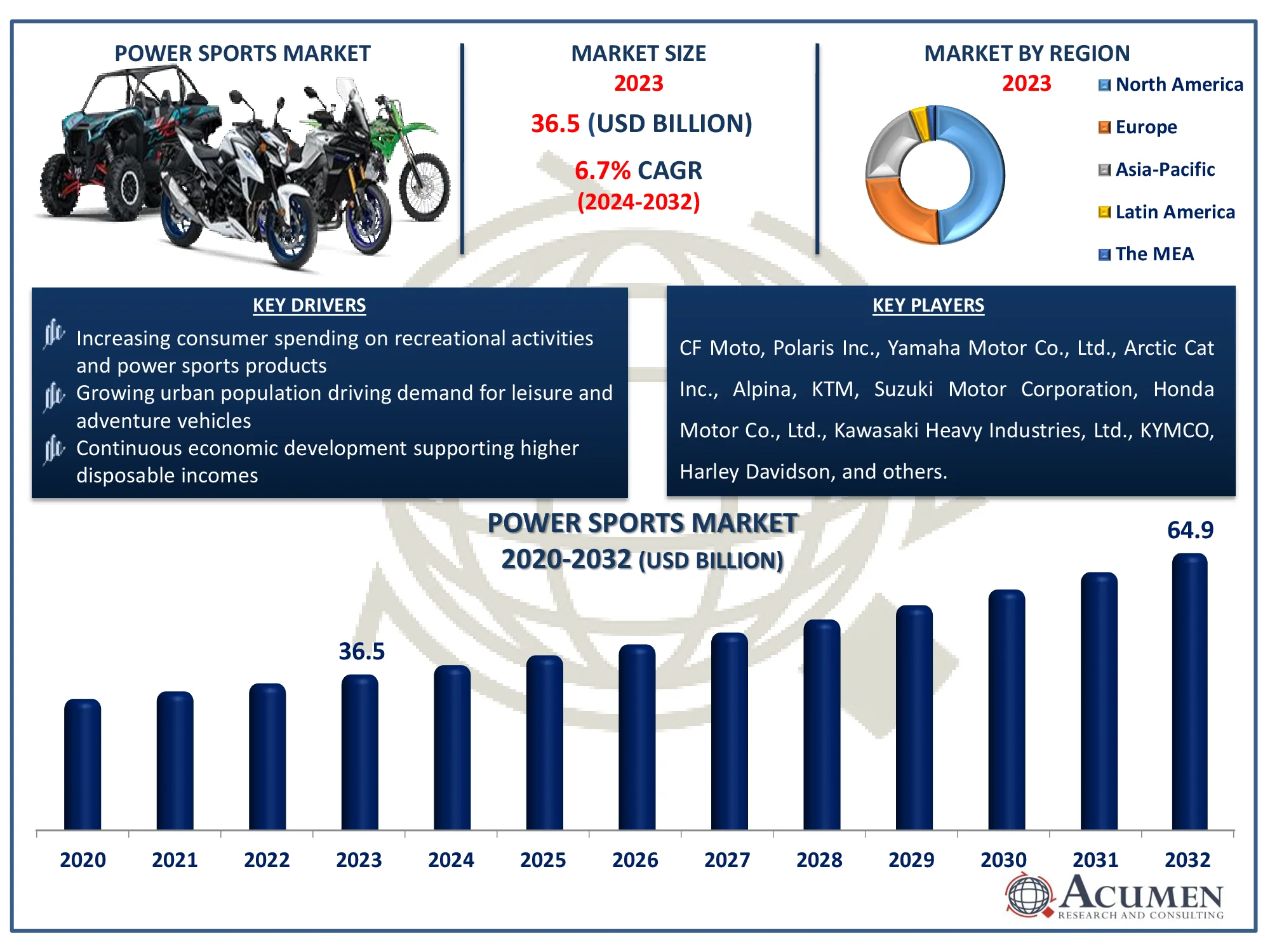

The Global Power Sports Market Size accounted for USD 36.5 Billion in 2023 and is estimated to achieve a market size of USD 64.9 Billion by 2032 growing at a CAGR of 6.7% from 2024 to 2032.

The Global Power Sports Market Size accounted for USD 36.5 Billion in 2023 and is estimated to achieve a market size of USD 64.9 Billion by 2032 growing at a CAGR of 6.7% from 2024 to 2032.

The power sports sector includes both utilitarian and recreational vehicles, emphasizing a lifestyle-oriented consumer. This industry encompasses side-by-side vehicles (SxS), all-terrain vehicles (ATVs), snowmobiles, powerboats, motorcycles, and personal watercraft (PWCs). It is heavily influenced by macroeconomic factors such as increased consumer confidence, higher living standards, unemployment rates, housing market health, and easy access to finance. Globally, the power sports market is largely concentrated in North America and Europe, particularly the United States, Canada, and Germany. Power sports are a subcategory of motor sports, with popular examples being ATVs, motorbikes, PWCs, and snowmobiles. One distinguishing feature of power sports vehicles is their reliance on gasoline engines, with handlebars usually utilized for navigating. Their popularity has skyrocketed thanks to events like the X-Games.

|

Market |

Power Sports Market |

|

Power Sports Market Size 2023 |

USD 36.5 Billion |

|

Power Sports Market Forecast 2032 |

USD 64.9 Billion |

|

Power Sports Market CAGR During 2024 - 2032 |

6.7% |

|

Power Sports Market Analysis Period |

2020 - 2032 |

|

Power Sports Market Base Year |

2023 |

|

Power Sports Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Vehicle Type, By Fuel Type, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

CF Moto, Polaris Inc., Yamaha Motor Co., Ltd., Arctic Cat Inc., Alpina, KTM, Suzuki Motor Corporation, Honda Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., KYMCO, Harley Davidson, Taiga Motors, BRP, and Argo Vehicles Ltd. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The global power sports market is being driven by increased spending on power sports items, rising replacement demand for boats, a growing urban population, higher consumer expenditures, and continued global economic development. For instance, Polaris have engaged in learing the unique ways customers use their products, from mudding to property care, to create purpose-built vehicles with increased features that let customers to maximize their experiences. This emphasis on customized solutions is expected to increase consumer expenditure on these specialized powersports equipment in 2023. Polaris surpassed Honda in the ATV industry, a growing interest in recreational boating among younger demographics, the change from ATVs to side-by-side vehicles, the adoption of innovative technology like Shopatron, and a variety of recovery rates in the powerboat sector.

However, the market confronts several hurdles, including environmental concerns, an aging baby boomer demographic, and harsh weather conditions. Urbanization, foreign market expansion, and accelerated global economic growth are all additional growth drivers. Despite this, the quick market growth is hampered by variable product and component pricing, as well as the negative environmental implications of power sports activities.

Growing interest in recreational activities contributes to market growth. According to the Outdoor Recreation Roundtable, the number of outdoor recreation participants increased by 2.3 percent in 2022 to a record 168.1 million, accounting for 55 percent of the U.S. population aged six and above. Although 2022 outdoor recreation saw record numbers of participants and participation rates (particularly among families and adolescents). Furthermore, 80% of outdoor activity categories saw increased participation in 2022, including broad categories like camping and fishing as well as smaller categories like sport climbing and skateboarding.

Power Sports Market Segmentation

Power Sports Market SegmentationThe worldwide market for power sports is split based on vehicle type, fuel type, application, and geography.

According to the power sports industry analysis, side-by-side vehicles (SxS) reign supreme due to their adaptability, performance, and growing appeal for recreational and utility use. These vehicles have great off-road capability, carrying numerous people and including advanced safety measures such as roll cages and seat belts. Their flexibility to a variety of terrains and activities, from trail riding to heavy-duty work, makes them very desirable. Furthermore, manufacturers are constantly innovating with new technology, comfort, and designs, which fuel their market supremacy.

Gasoline dominates the powersports industry by fuel type due to its broad availability and high energy density, providing dependable performance for vehicles such as ATVs, UTVs, and motorbikes. Gasoline engines have demonstrated longevity, high power production, and the ability to operate in a variety of terrains and situations. Their well-developed infrastructure, which includes fueling stations and maintenance support, adds to their domination. Furthermore, manufacturers are always improving gasoline engines to improve fuel efficiency and reduce emissions, keeping them competitive in an ever-changing market.

According to the power sports market forecast, off-road application segment leads due to the rising demand for adventure and outdoor recreational activities. Vehicles like ATVs, UTVs, and dirt bikes are specifically designed for rugged terrains, offering versatility and superior performance across forests, mountains, and deserts. This segment also benefits from expanding off-road trails, parks, and events that attract enthusiasts globally. Moreover, the integration of advanced technologies and improved safety features further drives the popularity and dominance of off-road applications in the market.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

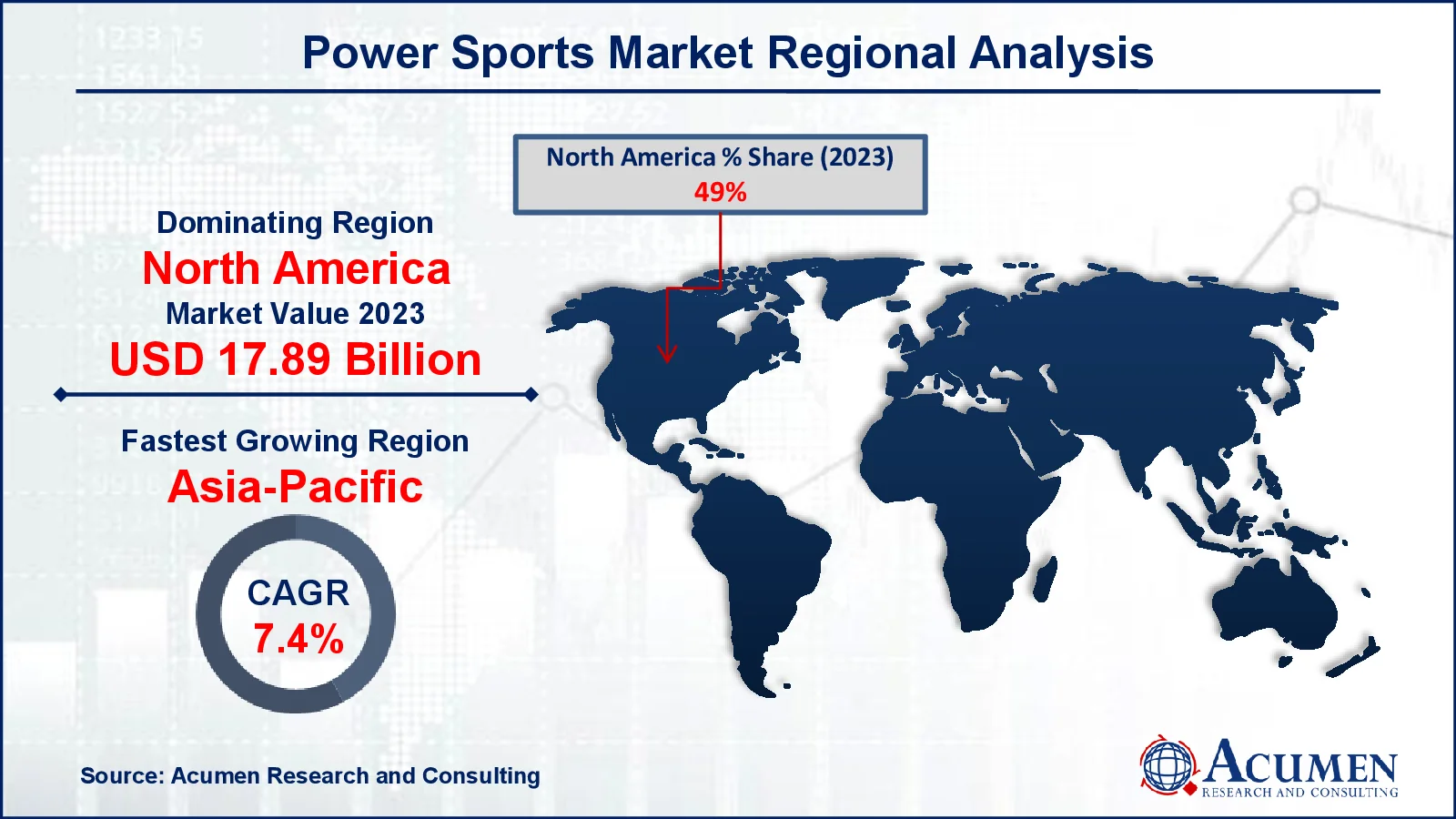

Power Sports Market Regional Analysis

Power Sports Market Regional AnalysisFor several reasons, North America dominates the powersports market, owing to its strong culture of outdoor recreation and adventure sports. For example, the Bureau of Economic Analysis (BEA) reports that inflation-adjusted ("real") GDP for the outdoor recreation economy increased 3.6 percent in 2023, compared to a 2.9 percent increase for the overall U.S. economy, indicating a slowing from the 10.2 percent increase in outdoor recreation in 2022. The region has well-established infrastructure, including huge off-road routes and racing events, as well as a high spending income among consumers. A strong network of manufacturers and dealerships assures accessibility and innovation in vehicles such as ATVs, UTVs, and snowmobiles.

Asia-Pacific's powersports market is expanding rapidly, mainly to increased urbanization, rising disposable incomes, and a growing interest in recreational activities. Expanding off-road parks and tourism in China, India, and Japan are opening up new markets for producers. For example, in October 2023, Kayo Electric debuted its latest range of electric ATV models, the EA70 and EA110. The vehicles have been specifically built to provide ATV aficionados with a safer and more exhilarating off-road driving experience. Furthermore, a young populace and government backing for adventure tourism help to drive the region's growing adoption of powersports vehicles.

Some of the top power sports companies offered in our report include CF Moto, Polaris Inc., Yamaha Motor Co., Ltd., Arctic Cat Inc., Alpina, KTM, Suzuki Motor Corporation, Honda Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., KYMCO, Harley Davidson, Taiga Motors, BRP, and Argo Vehicles Ltd.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

January 2019

April 2023

February 2025

March 2025