December 2023

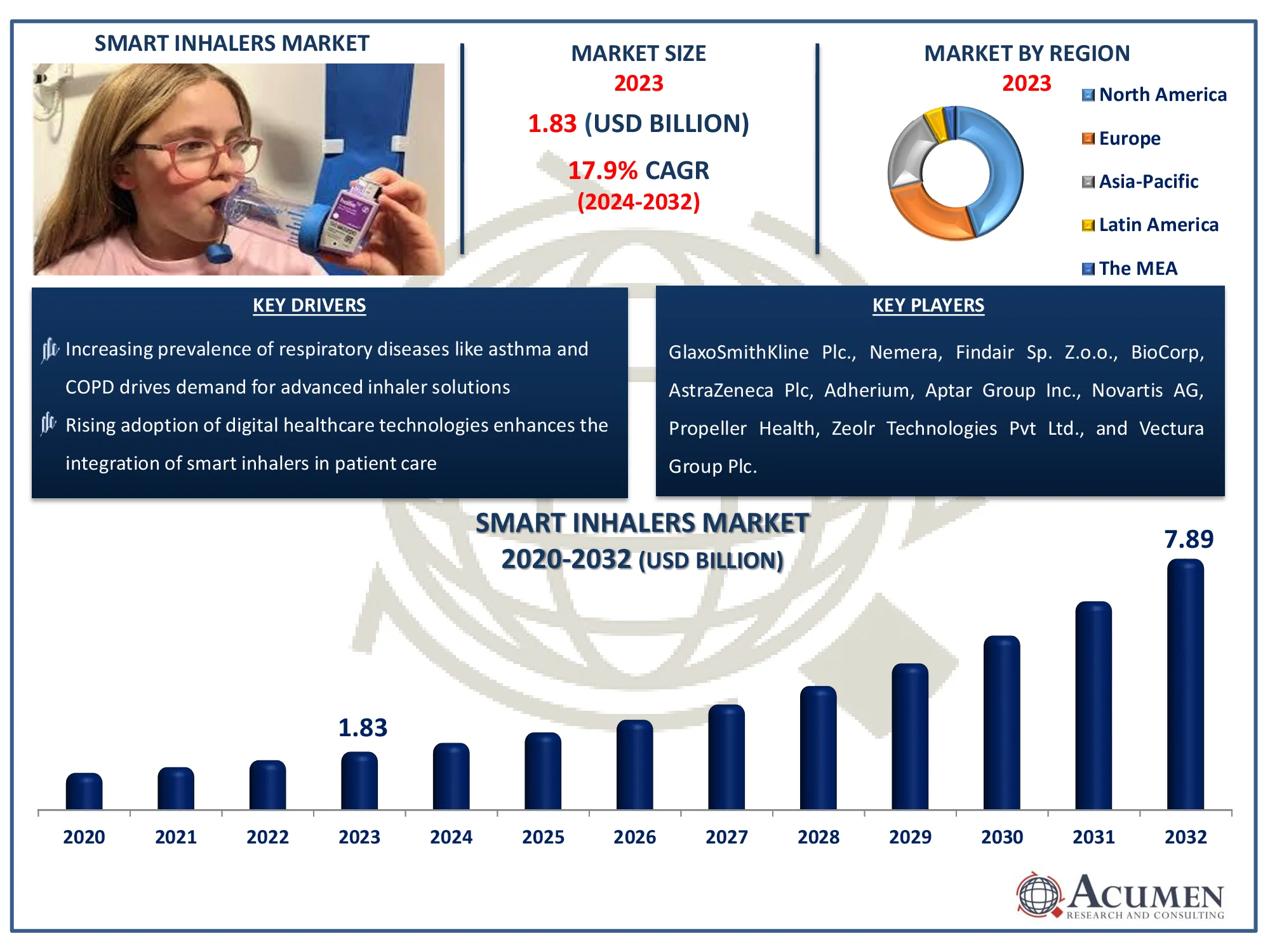

The Global Smart Inhalers Market Size accounted for USD 1.83 Billion in 2023 and is estimated to achieve a market size of USD 7.89 Billion by 2032 growing at a CAGR of 17.9% from 2024 to 2032.

The Global Smart Inhalers Market Size accounted for USD 1.83 Billion in 2023 and is estimated to achieve a market size of USD 7.89 Billion by 2032 growing at a CAGR of 17.9% from 2024 to 2032.

Smart inhalers are similar to conventional inhalers; however, they pose the facility of sending timely notifications to the users or patients. These notifications aim to remind the patient to complete their inhaler dose at given time. Therefore, smart inhalers have emerged as a novel product in terms of design approach for applications such as asthma and COPD management. It is expected that the market for smart inhalers will be following the trend from the conventional market. These products are the extension of conventional inhaler products due to the trend of connected medical devices and increasing use of smart phone connected health fitness devices.

|

Market |

Smart Inhalers Market |

|

Smart Inhalers Market Size 2023 |

USD 1.83 Billion |

|

Smart Inhalers Market Forecast 2032 |

USD 7.89 Billion |

|

Smart Inhalers Market CAGR During 2024 - 2032 |

17.9% |

|

Smart Inhalers Market Analysis Period |

2020 - 2032 |

|

Smart Inhalers Market Base Year |

2023 |

|

Smart Inhalers Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Indication, By End Use, By Distribution Channel, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

GlaxoSmithKline Plc., Nemera, Findair Sp. Z.o.o., BioCorp, AstraZeneca Plc, Adherium, Aptar Group Inc., Novartis AG, Propeller Health, Zeolr Technologies Pvt Ltd., and Vectura Group Plc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Few of the major factors driving the demand for smart inhalers include growing worldwide population which is vulnerable to air pollutants and allergies. Further inclination of young population towards smart and digitalized daily monitoring medical devices spurs the adoption of smart inhalers over conventional ones. Also, growing frequency of daily medication doses along with the escalation in prevalence of COPD and asthma fuels the demand for smart inhalers.

In terms of technology, smart inhalers pose improved features and properties that enhances user experience. However, manufacturing techniques are expensive and are likely to pose a restraint to the market growth. It is expected that, enhancement in the manufacturing technologies for electronic goods can reduce the manufacturing cost which will enable availability of low cost smart inhaler products. Therefore, it is clear that technological advancements can ultimately upkeep the market growth.

One of the greatest advantages of these devices is that it stores the medical data of patient in mobile application and transfers it to the cloud server connected via Internet. Therefore, it helps doctors to exam the exact medicine dosage taken by the patient, thus providing extra room for medical treatment. Factors such as limited product availability and issues with data privacy can limit the market for smart inhalers across the globe. Smart inhalers come with the facility to attach traditional nebulizers and inhalers and nebulizers.

The worldwide market for smart inhalers is split based on type, indication, end use, distribution channel, and geography.

According to smart inhalers industry analysis, the dry powdered inhalers (DPIs) segment has the highest market revenue share due to better features and greater usage. DPIs are popular due to their simplicity, which eliminates the need for manual coordination between inhalation and actuation. As a result, they are appropriate for those with persistent respiratory illnesses such as asthma or COPD. DPIs are also environmentally friendly because they do not require propellant. Their ability to administer proper pharmacological dosages improves therapeutic efficacy, which benefits both physicians and patients. The incorporation of smart technologies into DPIs, such as mobile tracking and monitoring applications, increases demand while retaining market leadership.

Chronic obstructive pulmonary disease (COPD) segment is largest during the smart inhalers market forecast period, owing to the disease's increasing incidence, particularly among the elderly and smokers. COPD patients require ongoing monitoring and management, therefore smart inhalers are a crucial tool for maintaining optimal drug adherence and improving results. These gadgets allow patients and clinicians to improve treatment plans by monitoring inhalation patterns in real time. Furthermore, growing awareness of the need of early intervention and personalized treatment in COPD therapy has expedited the use of smart inhalers. The ability to connect to digital platforms for remote patient monitoring makes smart inhalers more appealing for satisfying the complex needs of COPD sufferers.

The hospital segment has emerged as the key category in the smart inhalers market, owing to the rising emphasis on precise diagnosis and thorough treatment in regulated healthcare environments. Hospitals frequently treat patients with severe or poorly managed respiratory conditions, necessitating the use of modern technologies such as smart inhalers to ensure exact medicine delivery. These gadgets assist hospital staff in monitoring patient adherence and treatment efficacy, resulting in optimal care. Furthermore, hospitals routinely implement cutting-edge medical technologies to improve patient outcomes, making them early adopters of smart inhalers. The incorporation of these devices into hospital systems for tracking and analytics emphasizes their significance, cementing hospitals as the dominant end-user segment in this market.

The hospital pharmacy segment dominates the smart inhalers market because it plays an important role in ensuring the availability of innovative medical equipment for both inpatient and outpatient care. Hospital pharmacies are a reliable source for specialty drugs and gadgets like smart inhalers, which help patients with complex respiratory ailments. These settings benefit from direct access to healthcare specialists, resulting in more precise instruction and faster device assistance. Furthermore, limited inventory and high quality standards in hospital pharmacies increase patient trust. As digital health solutions become more integrated into hospital ecosystems, demand for smart inhalers through this channel increases, bolstering the company's market position.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

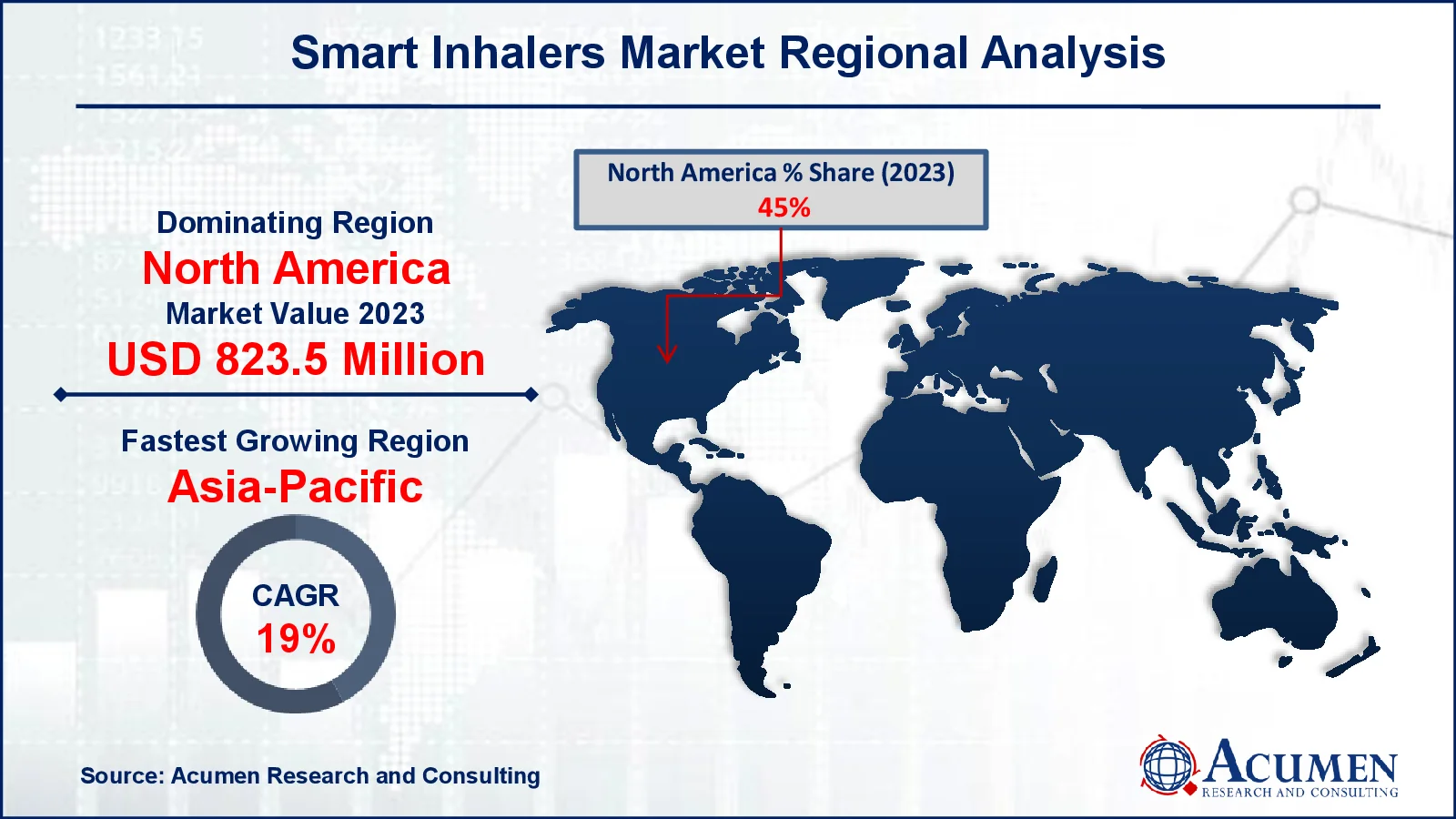

The North American region, in terms of geography, holds the largest market revenue shares as adoption of smart inhalers is more in this region along with the awareness towards COPD treatment and asthma. Asia-Pacific is likely to be the fastest-growing region throughout the forecast period coupled with major revenue contribution from China. It can be seen that countries like India and China are spending more on healthcare infrastructure to fulfill the medical requirements.

As a result, the industry is expected to grow drastically in Asia-Pacific during the smart inhalers market forecast period. Continuous growth in per capita disposable income in countries such as India, China, Brazil and Philippines can lead to the growth in adoption of smart inhaler products. Majority of smart inhaler products are been used by research and development centers in Europe and China, thus making these regions together account for half of the market share.

Some of the top smart inhalers companies offered in our report include GlaxoSmithKline Plc., Nemera, Findair Sp. Z.o.o., BioCorp, AstraZeneca Plc, Adherium, Aptar Group Inc., Novartis AG, Propeller Health, Zeolr Technologies Pvt Ltd., and Vectura Group Plc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

December 2023

July 2023

September 2023

December 2024