November 2024

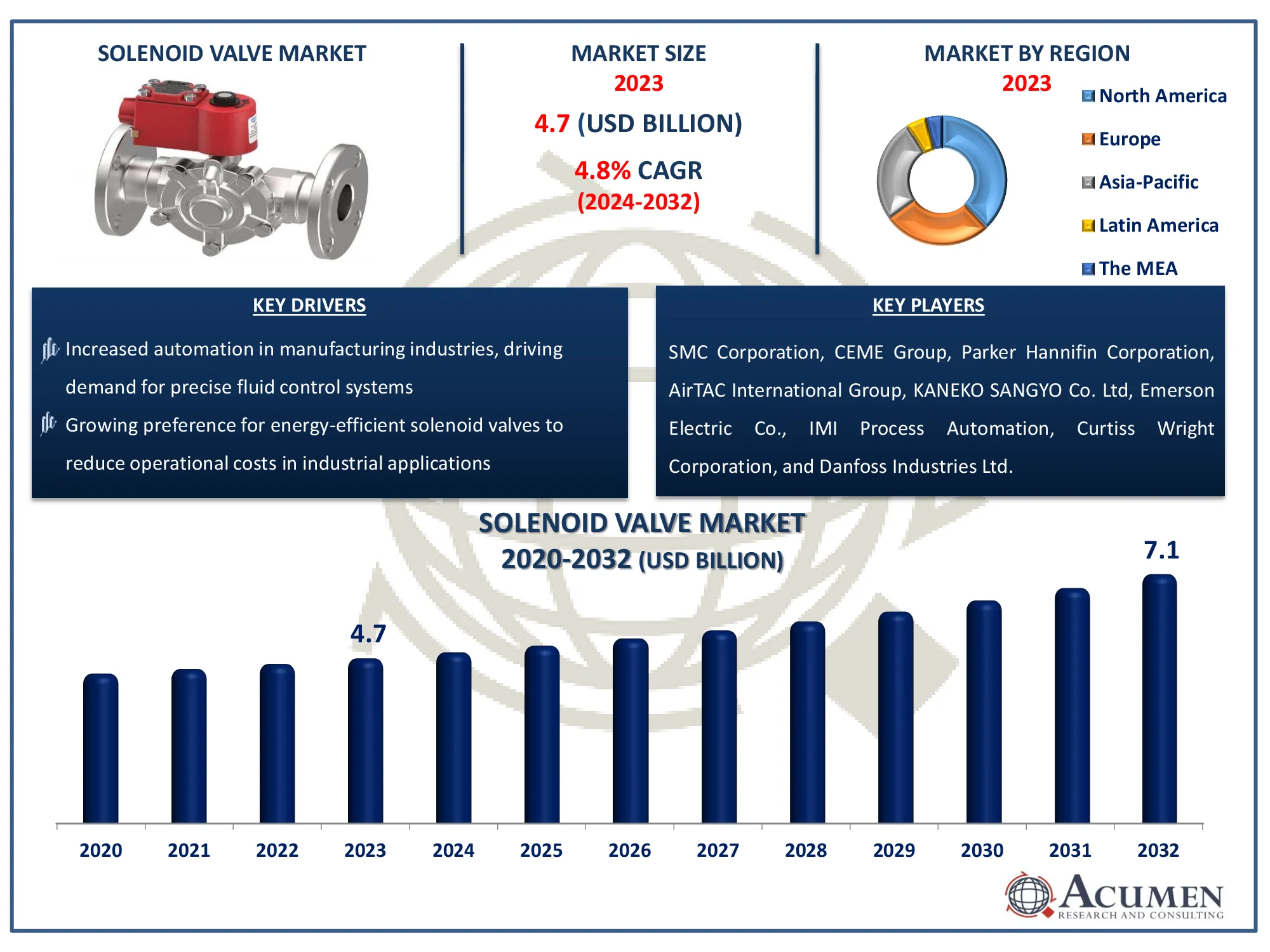

The Global Solenoid Valve Market Size accounted for USD 4.7 Billion in 2023 and is estimated to achieve a market size of USD 7.1 Billion by 2032 growing at a CAGR of 4.8% from 2024 to 2032.

The Global Solenoid Valve Market Size accounted for USD 4.7 Billion in 2023 and is estimated to achieve a market size of USD 7.1 Billion by 2032 growing at a CAGR of 4.8% from 2024 to 2032.

Solenoid valve refers to a mechanical device which involves the use of solenoid to achieve control on activation of the valve. In solenoid valve, the electric current is passed through a solenoid channel. Solenoid valves are globally considered as electromechanically operated valves and are widely used for controlling the flow of gas or liquid. Solenoid valves are most popularly used in fluidic applications as control elements. Solenoid valves perform several important tasks such as shut-off, release, distribute or mix fluids and gases. Solenoid valves involves the use of solenoid which offers various advantages such as safe and fast switching, high reliability, compact design, extended service life and low control power.

|

Market |

Solenoid Valve Market |

|

Solenoid Valve Market Size 2023 |

USD 4.7 Billion |

|

Solenoid Valve Market Forecast 2032 |

USD 7.1 Billion |

|

Solenoid Valve Market CAGR During 2024 - 2032 |

4.8% |

|

Solenoid Valve Market Analysis Period |

2020 - 2032 |

|

Solenoid Valve Market Base Year |

2023 |

|

Solenoid Valve Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Material, By Function, By Industry Vertical, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

SMC Corporation, Anshan Solenoid Valve Co. Ltd, CEME Group, Parker Hannifin Corporation, AirTAC International Group, KANEKO SANGYO Co. Ltd, Emerson Electric Co., IMI Process Automation, Curtiss Wright Corporation, and Danfoss Industries Ltd. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The global solenoid valves market is growing at a rapid pace and is anticipated to witness a significant amount of growth over the forecast period. In addition, constant evolution in the global market, in terms of new product development and product innovations, is leading to the overall development of new and advanced technologies. Solenoid valves are most commonly used in hydraulic and fluid power pneumatic systems in order to achieve control on large industrial valves or fluid power motors. Furthermore, solenoid valves are also being used in automatic irrigation water sprinkler systems. Also, dishwashers and washing machines also employ the use of solenoid valves in order to gain control on the flow of water into the machine.

Various factors which are involved in driving the growth of global solenoid valves market include increasing number of end-use applications of solenoid valves in several industrial sectors coupled with lower price of a solenoid valve as compared to other traditional valves. Moreover, low power consumption of solenoid valves is another major factor anticipated to accelerate the growth of global solenoid valve market over the forecast period. Furthermore, increasing developments in the solenoid valves as well as introduction of new solenoid valves such as pinch valves, customized valves, and micro-miniature valves escalates the overall growth of global market.

The worldwide market for solenoid valve is split based on material, function, industry vertical, and geography.

According to solenoid valve industry analysis, the stainless steel sector lead the market and earns the most revenue because to its exceptional features, which include excellent corrosion resistance, durability, and strength. Stainless steel solenoid valves are commonly used in industries such as oil and gas, chemicals, and pharmaceuticals because they can withstand corrosive fluids, high pressures, and extreme temperatures. Their ability to perform in severe settings makes them the ideal choice for crucial applications. Furthermore, developments in stainless steel alloys have increased their efficiency and compatibility with a variety of media, accelerating their usage. The growing demand for dependable and long-lasting materials in industrial and commercial applications assures that stainless steel solenoid valves continue to dominate the market.

The 2 way solenoid valve segment drives the market owing to its versatility and wide application across industries. These valves have an entrance and an exit, making it easy to turn on and off fluid or gas flow. Water treatment, agriculture, and manufacturing industries rely heavily on two-way solenoid valves for efficient and dependable liquid and gaseous media control. Their compact design and ease of integration with automated systems increase their desirability. Additionally, the growing emphasis on water conservation and efficient irrigation systems has increased their demand. The segment's dominance is driven by its capacity to withstand a wide range of pressures and temperatures, making it an essential component in a variety of industrial processes.

The oil and gas industry is expected to dominate the market, owing to the vital need for accurate fluid and gas management in exploration, extraction, and refining activities. Solenoid valves are essential for managing flow in pipelines, safety systems, and offshore platforms, where dependability and quick reaction are critical. The industry benefits from the growing complexity of oil and gas operations, which necessitates modern flow control technologies to ensure operational efficiency and safety compliance. Furthermore, the growth of liquefied natural gas (LNG) facilities and the implementation of improved recovery techniques will increase the use of solenoid valves. This sector's reliance on tough and durable equipment demonstrates its major contribution to market growth.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

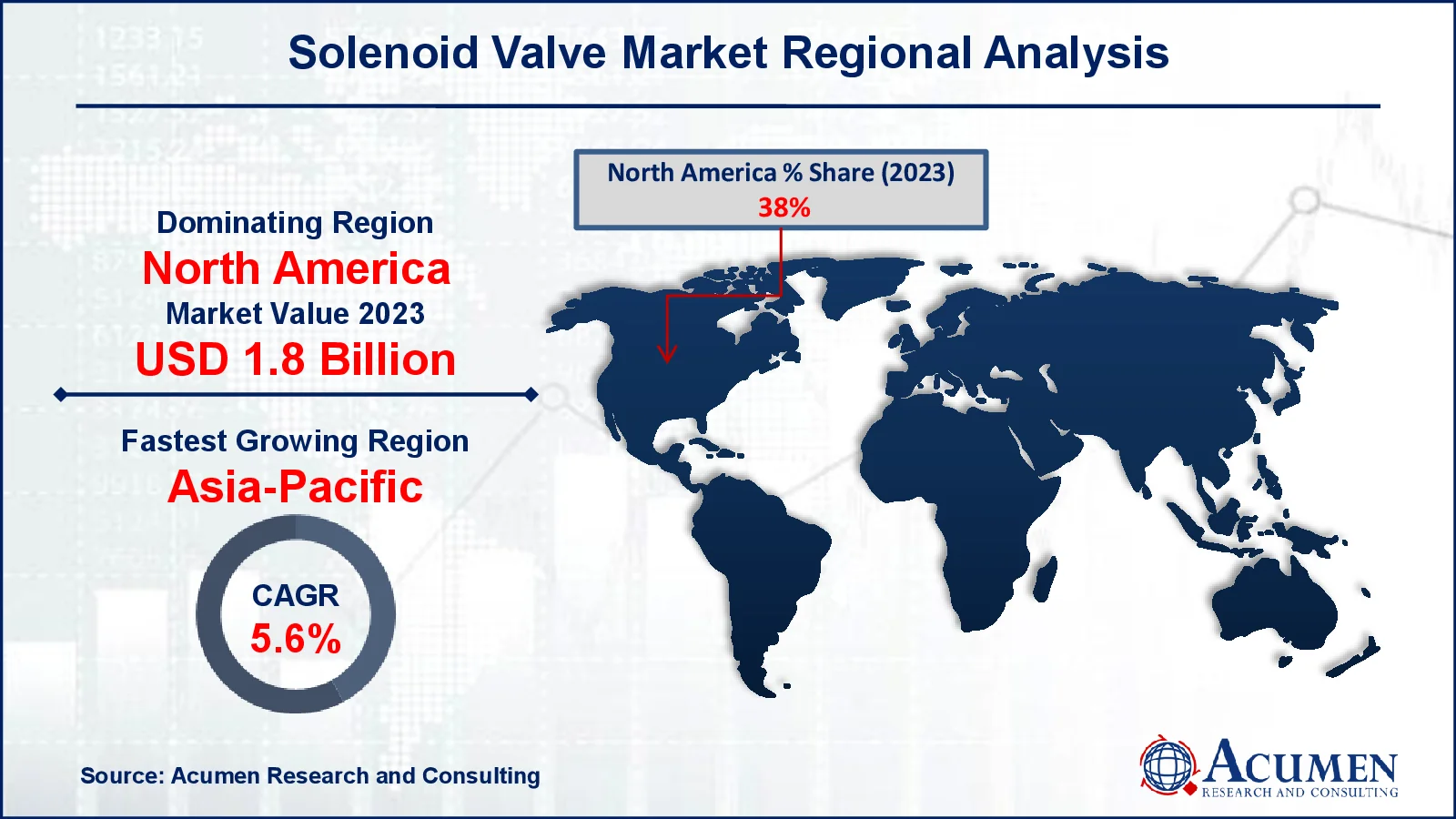

The market varies significantly by area, owing to variances in industrial activity, infrastructure development, and technical improvement. North America is in a dominant position, because to strong demand from the oil and gas, automobile, and pharmaceutical industries. The region's emphasis on automation and energy-saving solutions hastens the use of solenoid valves. Its dominance is supported by the existence of important market competitors as well as continued investments in modern production technology.

Europe follows closely, supported by strong growth in the chemical, food & beverages, and water treatment industries. Stringent environmental regulations in the region have encouraged the use of solenoid valves in eco-friendly and sustainable operations. Additionally, innovations in smart valves with IoT integration have gained traction across the industrial landscape.

Asia-Pacific emerges as the fastest-growing area in the solenoid valve market forecast period, because of rising industrialization and urbanization in nations like China, India, and Japan. Key drivers include the rising automotive and manufacturing sectors, as well as major investment in water and wastewater infrastructure. The region also benefits from low production costs and the availability of skilled workers, which encourages the formation of manufacturing clusters. The solenoid valve market varies significantly by area, owing to variances in industrial activity, infrastructure development, and technical improvement.

Some of the top solenoid valve companies offered in our report includes SMC Corporation, Anshan Solenoid Valve Co. Ltd, CEME Group, Parker Hannifin Corporation, AirTAC International Group, KANEKO SANGYO Co. Ltd, Emerson Electric Co., IMI Process Automation, Curtiss Wright Corporation, and Danfoss Industries Ltd.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

November 2024

December 2022

May 2021

January 2018