July 2020

The Global Air Traffic Control Equipment Market Size accounted for USD 6.58 Billion in 2024 and is estimated to achieve a market size of USD 11.26 Billion by 2033 growing at a CAGR of 6.2% from 2025 to 2033.

The Global Air Traffic Control Equipment Market Size accounted for USD 6.58 Billion in 2024 and is estimated to achieve a market size of USD 11.26 Billion by 2033 growing at a CAGR of 6.2% from 2025 to 2033.

Air traffic control (ATC) equipment consists of specialized systems together with technologies which air traffic controllers utilize to guarantee aircraft safety while maintaining orderly and efficient flight operations above and on the ground. The equipment base in ATC consists of radar systems for aircraft position tracking and communication systems for controller-pilot interactions and navigation aids for aircraft guidance plus surveillance systems that include Automatic Dependent Surveillance–Broadcast (ADS–B). These tools enable controllers to maintain aircraft distances between each other while avoiding accidents and handle flight departure procedures and destination guidance.

Advanced software and digital systems operate within modern ATC equipment to handle data processing and weather monitoring and traffic prediction tasks. Technology advancements in global air traffic management have prompted ATC operations to integrate more automation features and artificial intelligence systems to assist in quick decisions and minimize human mistakes. Technological progress remains essential for enhancing real-time flight monitoring along with airspace traffic control and developing advanced air traffic systems which handle manned and unmanned aircraft.

|

Market |

Air Traffic Control Equipment Market |

|

Air Traffic Control Equipment Market Size 2024 |

USD 6.58 Billion |

|

Air Traffic Control Equipment Market Forecast 2033 |

USD 11.26 Billion |

|

Air Traffic Control Equipment Market CAGR During 2025 - 2033 |

6.2% |

|

Air Traffic Control Equipment Market Analysis Period |

2021 - 2033 |

|

Air Traffic Control Equipment Market Base Year |

2024 |

|

Air Traffic Control Equipment Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Equipment Type, By Application, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

BAE Systems plc, Thales SA, Raytheon Company, Northrop Grumman Corporation, Indra Sistemas, S.A, Saab Ab, Aeronav Group, Aquila, Searidge Technologies, and Intelcan Technosystems. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The increasing global air traffic volume is a primary driver of the air traffic control equipment market. The International Air Transport Association (IATA) predicts that global air travelers will surpass 4.7 billion people by 2025 as they continue to increase from their 2019 total of 4.5 billion. The growing number of air travel operations requires contemporary ATC equipment because it needs advanced airspace management systems with real-time surveillance capabilities and communication platforms. ATC equipment market growth is accelerated by increasing satellite-based technology deployments including ADS-B (Automatic Dependent Surveillance–Broadcast) and multilateration systems which provide enhanced surveillance and safety for busy air traffic paths.

The market keeps expanding because of quick technological advancements. National governments spend capital to modernize their obsolete air traffic infrastructure through the implementation of digital and AI-powered systems. The U.S. Federal Aviation Administration (FAA) implements NextGen air transportation system to modernize air traffic control and enhance safety and improve fuel efficiency and capacity. The Single European Sky ATM Research (SESAR) project across Europe enables the harmonization of air traffic management between neighboring countries. Radar systems together with digital towers and advanced communication tools and weather monitoring systems receive increased demand from these programs leading to substantial market growth in ATC equipment.

Multiple barriers prevent the ATC equipment market from reaching its complete growth potential. The main difficulty for ATC system implementation and upkeep stems from their expensive deployment requirements which affect emerging markets. The transition from outdated legacy systems to digital platforms necessitates large investments for infrastructure development alongside employee training and cybersecurity protection. The ATC systems face rising concerns due to escalating cybersecurity threats. Digital ATC infrastructure interconnectivity has created a dangerous vulnerability to cyberattacks which produces adoption delays because it compromises aviation safety.

The ATC equipment market demonstrates rapid growth opportunities mainly through Asia-Pacific and the Middle Eastern regions. By 2035 Asia-Pacific will produce more than 35% of worldwide air traffic growth with China and India leading investments to transform their airports and airspace systems. The market presents new possibilities for ATC equipment vendors because of increasing demand for unmanned aerial vehicles (UAVs) and drone integration into commercial airspace. The potential for profitable growth in the future will emerge from AI-based traffic prediction models together with cloud-based control systems and UAM platform integration.

Air Traffic Control Equipment Market Segmentation

Air Traffic Control Equipment Market SegmentationThe worldwide market for air traffic control equipment is split based on equipment type, application, and geography.

According to air traffic control equipment industry analysis, communications equipment is the market's largest sector, owing to its critical role in ensuring seamless communication between pilots and air traffic controllers. This category includes VHF/UHF radios, data link systems, intercoms, and voice communication control systems, all of which enable the real-time, reliable exchange of flight safety-critical information. As global air traffic and airspace management complexity increase, so does the demand for continuous, high-fidelity communication systems. The combination of digital voice systems and IP-based communication platforms boosts market growth by enabling faster, more secure transmissions. Furthermore, the modernization of current ATC infrastructure, as well as the push for remote and digital towers, are propelling the development and implementation of new communication technologies, reaffirming this segment's market supremacy.

According to ATC equipment industry analysis, the commercial aircraft end-use segment has historically gathered the largest share. This is due to the fact that commercial airlines and cargo carriers are the most frequent users of air traffic control services and equipment. With rising air traffic volumes and rising demand for air travel, the need for efficient and safe air traffic management systems has never been greater. Aside from commercial and cargo aircraft, the defense aircraft sector makes extensive use of air traffic control equipment, especially for military air traffic management and flight operations. Private aircraft, while not as important in terms of market size as commercial and military aircraft, use air traffic control services and equipment, especially at larger airports and in congested airspace. In general, the market for air traffic control equipment is expected to expand across all end-use segments, owing to rising demand for more efficient and safe air traffic management systems, especially in emerging markets with expanding aviation industries.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

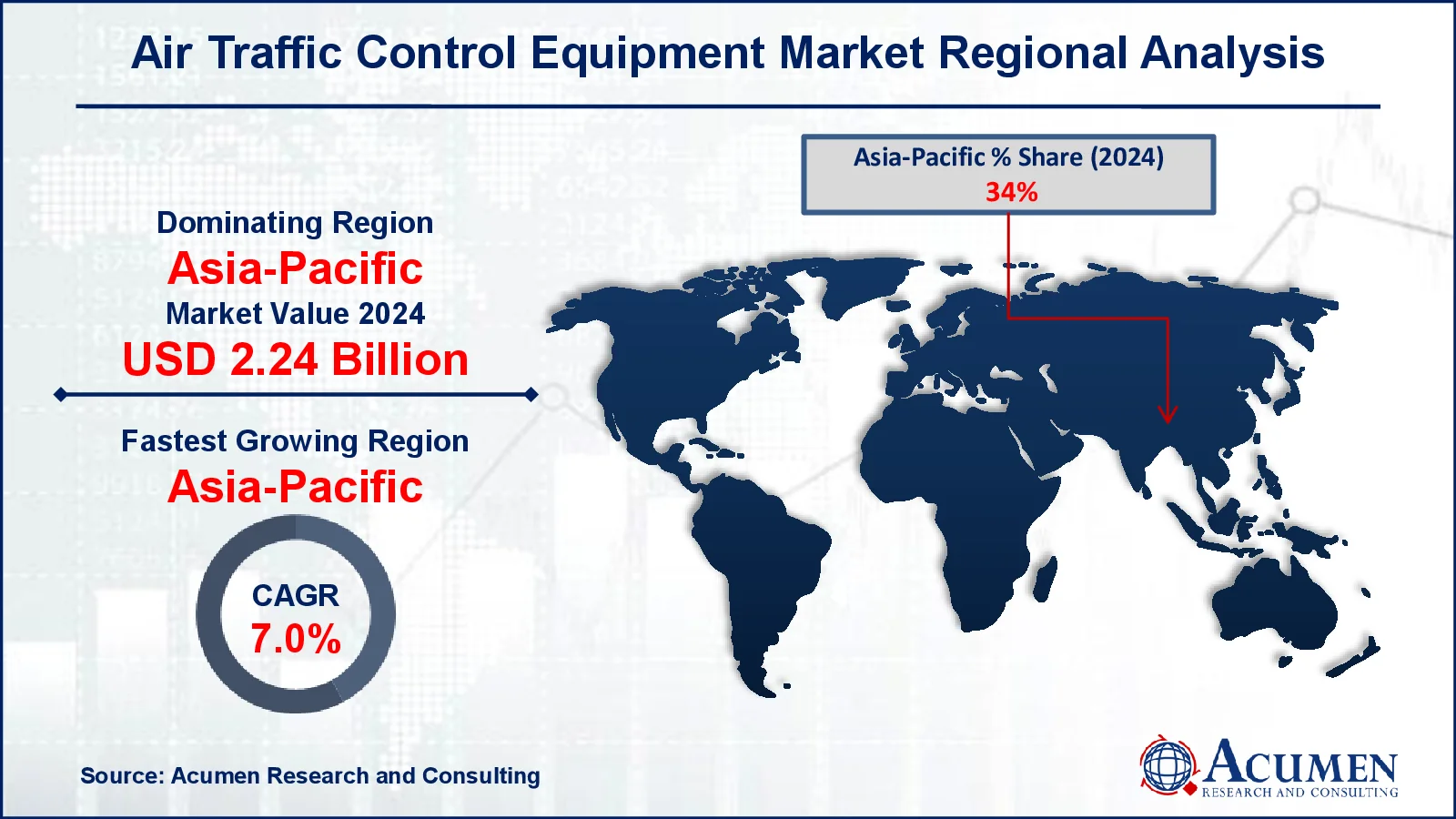

Air Traffic Control Equipment Market Regional Analysis

Air Traffic Control Equipment Market Regional AnalysisThe ATC equipment market is expected to witness the highest growth in the Asia-Pacific. Currently, Asia-Pacific lead the commercial air traffic control equipment market owing to a high number of air travelers and the presence of large and technologically advanced airports in these regions. However, North America and APAC countries have been investing significantly in the modernization of existing airports and the construction of new airports, on account of the rising passenger traffic. This growth can be attributed to the liberalization of regulations related to air transport, an increase in government spending for infrastructure development, an increase in demand for air travel, and the growing GDP of these regions. Thus, the global air traffic control equipment market in Asia-Pacific and the Middle East is analyzed significantly and is expected to reach its peak over the forecast period.

Countries such as Japan, China, India, UAE, and Brazil are analyzed to register significant growth levels in the market during the forecast period. The ATC equipment market in Asia-Pacific is estimated to register high growth, as the Revenue Passenger Kilometers (RPK) and aircraft movements are analyzed to be twice as compared to other regions. China is expected to be the swiftest growing market during the forecast period, due to significant investments in the modernization of existing airports as well as the construction of new airports.

North America second largest in the global ATC equipment market and is expected to maintain its share in the coming years. With the U.S. national aviation authority collaborating with various industry partners and aiming at initiatives to transform ATC facilities to the standard automation replacement system from the traditional automated radar terminal system, the North American market is expected to thus have a positive outlook in the near future. The ATC equipment market ecosystem comprises airports, air navigation service providers, airlines, regulatory authorities, and equipment suppliers, among others.

Some of the top air traffic control equipment companies offered in our report include BAE Systems plc, Thales SA, Raytheon Company, Northrop Grumman Corporation, Indra Sistemas, S.A, Saab Ab, Aeronav Group, Aquila, Searidge Technologies, and Intelcan Technosystems.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

July 2020

October 2018

March 2023

May 2023