May 2020

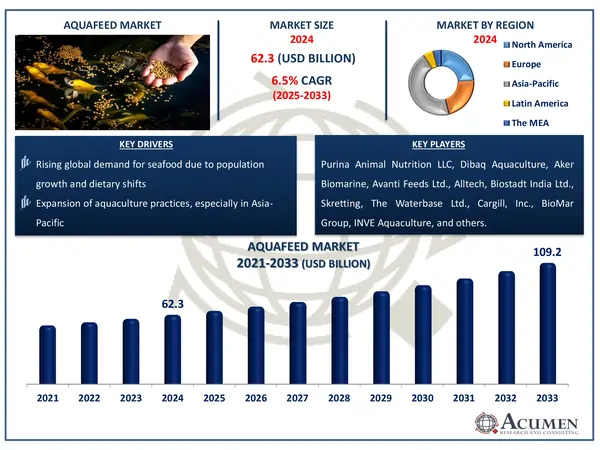

The Global Aquafeed Market Size accounted for USD 62.3 Billion in 2024 and is estimated to achieve a market size of USD 109.2 Billion by 2033 growing at a CAGR of 6.5% from 2025 to 2033.

The Global Aquafeed Market Size accounted for USD 62.3 Billion in 2024 and is estimated to achieve a market size of USD 109.2 Billion by 2033 growing at a CAGR of 6.5% from 2025 to 2033.

Aquafeed is a specially manufactured diet intended to suit the nutritional needs of aquatic animals such as fish, shrimp, and crabs. It is critical for aquaculture, as it promotes healthy growth, disease resistance, and high productivity in farmed aquatic species. Aquafeed often includes fish meal, plant proteins, vitamins, and minerals. The composition varies according to the species being fed and their developmental stage, so promoting a balanced and sustainable aquatic farming system.

Aquafeed is a formulated feed intended to suit the nutritional requirements of aquatic species such as fish, shrimp, and crabs. It is essential for aquaculture because it promotes growth, boosts immunity, and increases production. Typical ingredients include fish meal, plant-based proteins, vital vitamins, and minerals. Formulations vary according to species and life stage, ensuring balanced nutrition and sustainable farming.

|

Market |

Aquafeed Market |

|

Aquafeed Market Size 2024 |

USD 62.3 Billion |

|

Aquafeed Market Forecast 2033 |

USD 109.2 Billion |

|

Aquafeed Market CAGR During 2025 - 2033 |

6.5% |

|

Aquafeed Market Analysis Period |

2021 - 2033 |

|

Aquafeed Market Base Year |

2024 |

|

Aquafeed Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Feed, By Form, By Ingredient, By Species, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Purina Animal Nutrition LLC, Dibaq Aquaculture, Aker Biomarine, Avanti Feeds Ltd., Alltech, Biostadt India Ltd., Skretting, The Waterbase Ltd., Cargill, Inc., BioMar Group, INVE Aquaculture, Charoen Pokphand Foods PCL, Ridley Corp. Ltd., Aller Aqua, and BENEO. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Growing public awareness of the health of people and increased prevalence of diseases such as diabetes, blood pressure, heart attacks and obesity in the population drives consumers to eat a protein-rich diet that encourages demand growth. Knowledge of the value of omega-3 in everyday diets will foster developments in the industry. Increased appetite for raw fish foods like sushi would boost the demand for goods further.

The market share would possibly be strengthened with improved nutritional benefits such as increased feed palatability, food intakes and increased digestion and absorption by incorporating fish meal to animal feeding. Aquafeeds are predicted to have extraordinary properties, such as improving the protein quality, consistent distribution of components and balanced development of aquatic cultural animals.

In addition, aquafeed decreases the risk of pathogens in different species and stimulates the edible growth in food dishes on the aquafeed market. One of the key reasons for the high adoption rate between fishery owners of aquafeed is the growing distribution of foodborne diseases induced by the ingestion of infected seafood. However, anchovy capture variations due to the El-Nino phenomena and other environmental changes may have a detrimental effect on the aquaculture industry.

In addition, the introduction of strict rules which limit fisheries activity is to some extent expected to decrease market demand. fish meal price fluctuations can further influence the size of the market.

The worldwide market for aquafeed is split based on feed, form, ingredient, species, and geography.

According to aquafeed industry analysis, grower feed is important in the aquafeed industry since it is required for aquatic species throughout their intermediate growth phase. It promotes adequate nutrition, healthy weight gain, and efficient feed conversion. This makes it an important product sector for increasing output and profitability in aquaculture. Grower feed is becoming increasingly important in the fish business as demand rises.

Accordingform of aquafeed industry, dry form segment dominates the business due to its extended shelf life, simplicity of storage, and cost-effectiveness during transportation. Dry aquafeed, such as pellets and crumbles, is frequently utilized due to its convenience and ability to provide balanced nutrition economically. It is less likely to deteriorate than wet feed, making it excellent for large-scale aquaculture operations. It also provides better control over feeding and reduces water contamination. These benefits make dry feed the favored choice for many aquaculture operations.

Based on ingredient, soybean is the most popular ingredient in the aquafeed business due to its high protein content, low cost, and widespread availability. It is an effective plant-based alternative to fishmeal, promoting sustainable aquaculture techniques. Soybean meal improves feed efficiency and encourages healthy growth in a wide range of aquatic species. Its nutritional value and cost-effectiveness make it a standard ingredient in current aquafeed compositions.

According to aquafeed market forecast, carp species dominate due to their enormous global production, particularly in Asia, where they are used extensively in aquaculture. These freshwater fish develop quickly and adapt well to a variety of farming conditions, resulting in increased demand for specialized feed. Carp farming is inexpensive and widely used, resulting in regular feed requirements. The species' herbivorous and omnivorous diet makes them suitable for plant-based feed formulations such as soybean meal. As a result, carp continue to be a key driver of growth in the worldwide aquafeed sector.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

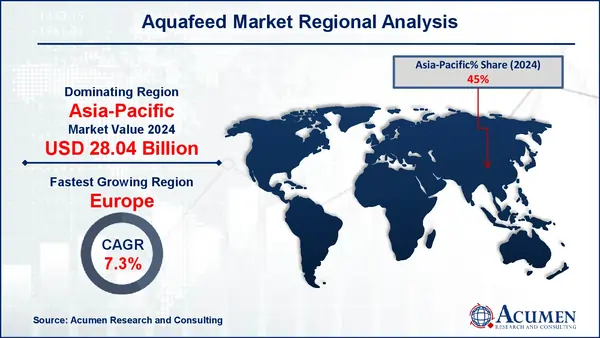

In terms of regional segments, Asia-Pacific was the industry leader in 2024, with the projected future lead. Aquaculture production is anticipated to stimulate demand for the commodity over the forecast period in the region, primarily in China, as well as factors such as ease of fish farming, species longevity and better water quality within closed agricultural systems.

As one of the biggest saumon manufacturers, Europe has emerged as the second-largest buyer. In nearly all European countries, salmon are rising, particularly in moderate-climate coastal areas, which are projected to have a positive effect on market growth over the forecast period. In the interior, growing demand for salmon has induced anaesthetic and sedation materials to rise during shipping, thus driving demand for additional. Aquaculture is based in Chile, Brazil, Mexico, and Ecuador in Central and South America. The region's aquaculture industry contributes to job growth, food security and production of foreign currency. Including salmonids, shrimps, tilapia, carpox and seaweed are the key aquatic species produced in the area.

Some of the top aquafeed companies offered in our report include Purina Animal Nutrition LLC, Dibaq Aquaculture, Aker Biomarine, Avanti Feeds Ltd., Alltech, Biostadt India Ltd., Skretting, The Waterbase Ltd., Cargill, Inc., BioMar Group, INVE Aquaculture, Charoen Pokphand Foods PCL, Ridley Corp. Ltd., Aller Aqua, and BENEO.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

May 2020

April 2024

February 2024

September 2020