April 2025

The Global Microelectronics Material Market Size accounted for USD 57.5 Billion in 2024 and is estimated to achieve a market size of USD 99.5 Billion by 2033 growing at a CAGR of 6.3% from 2025 to 2033.

The Global Microelectronics Material Market Size accounted for USD 57.5 Billion in 2024 and is estimated to achieve a market size of USD 99.5 Billion by 2033 growing at a CAGR of 6.3% from 2025 to 2033.

Microelectronic materials are specialized substances used to design, manufacture, and package microelectronic devices such as semiconductors, integrated circuits (ICs), and sensors. These materials are essential for the performance, durability, and shrinkage of electronic components used in computers, cellphones, automotive electronics, and medical equipment. They include elemental materials like silicon, compound semiconductors like gallium arsenide (GaAs) and silicon carbide (SiC), as well as support materials such as photoresists, deposition solvents, bonding wires, and encapsulants. These materials facilitate fabrication operations such as doping, etching, and lithography, as well as temperature control, electrical interconnects, and mechanical protection in packaging. As technology advances to smaller and faster devices, there is a growing demand for high-purity, novel microelectronics materials across many industries.

|

Market |

Microelectronics Material Market |

|

Microelectronics Material Market Size 2024 |

USD 57.5 Billion |

|

Microelectronics Material Market Forecast 2033 |

USD 99.5 Billion |

|

Microelectronics Material Market CAGR During 2025 - 2033 |

6.3% |

|

Microelectronics Material Market Analysis Period |

2021 - 2033 |

|

Microelectronics Material Market Base Year |

2024 |

|

Microelectronics Material Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Material Type, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

DuPont, Shin-Etsu MicroSi, Inc, BASF, W.L. Gore, LORD Corp., Honeywell Electronic Materials, PiBond, Dow Corning, KYOCERA, and Entegris. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The microelectronics material market is expanding rapidly, fueled by rising demand for advanced consumer electronics, 5G infrastructure, and broad usage of IoT devices. As semiconductors continue to reduce in size while increasing in complexity and performance, the demand for high-performance materials such photoresists, dielectric materials, silicon wafers, and CMP slurries has grown. The advent of artificial intelligence (AI) and machine learning (ML) technologies, which necessitate faster and more efficient circuitry, has increased demand for precisely tailored materials.

The growing popularity of electric vehicles (EVs) and self-driving cars, both of which rely significantly on high-density semiconductor components, has propelled market growth. This has led in greater global investment in semiconductor fabrication facilities, particularly in Asia-Pacific and North America, where governments and business are collaborating to strengthen local chip manufacturing and solve supply chain risks. Furthermore, the shift to EUV (Extreme Ultraviolet) lithography for chip production is increasing demand for next-generation lithography materials with ultrapure compositions.

However, the market faces a number of challenges, including the significant capital expenditure required for R&D and manufacturing, as well as supply chain disruptions and geopolitical tensions that impact raw material availability. Despite this, opportunities are emerging as a result of material innovation, such as low-k dielectrics and better packaging materials, which enhance chip performance and reliability.

Sustainability is also beginning to influence market dynamics, as manufacturers shift toward environmentally friendly formulas and recycling practices. Overall, with the convergence of technological improvement, growing semiconductor content in end-user devices, and government support, the microelectronics material market is positioned for continuous growth, driven by innovation and changing application landscapes.

The worldwide market for microelectronics material is split based on material type, application, and geography.

According to microelectronics material industry analysis, the elementary material sector is expected to hold the largest market share among the market's three material type categories (elementary material, compound material, and other materials). This dominance is primarily due to silicon, which is still the fundamental building block of semiconductor devices. Silicon's abundance, low cost, and well-established manufacturing processes provide basic materials with a substantial competitive edge.

While compound materials such as gallium arsenide and silicon carbide are gaining popularity for specific applications in power electronics and high-frequency devices, silicon remains the dominant material. Despite growing interest in compound alternatives for next-generation applications, the maturity of silicon-based manufacturing infrastructure, combined with continuous innovation in silicon processing technologies, keeps basic materials at the forefront of the market.

During the microelectronics material market forecast period, fabrication materials are expected to grow the fastest in the sector. This growth is mostly due to rising demand for high-performance semiconductors for advanced computing, 5G, automotive electronics, and AI-driven applications. Silicon wafers, photoresists, dielectric layers, and chemical mechanical planarization (CMP) slurries are all important fabrication materials throughout the early stages of semiconductor manufacture. As chip layouts get more advanced, with smaller nodes and 3D structures, the demand for ultrapure and precisely manufactured materials increases. Furthermore, the global expansion of semiconductor manufacturing facilities, notably in Asia-Pacific and North America, has increased demand for fabrication materials, making this the fastest-growing application segment.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

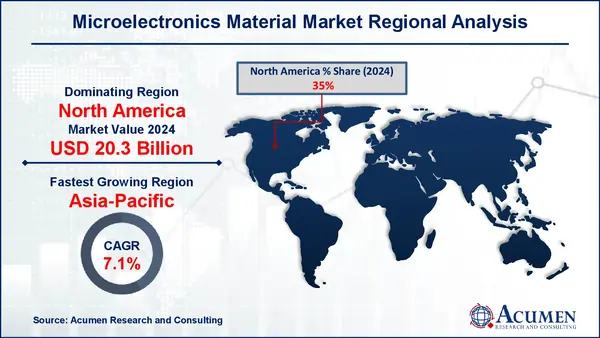

North America also plays an important role, owing to considerable investments in semiconductor R&D, design innovation, and manufacturing rebirth. The United States, in particular, is experiencing a surge in local production initiatives sponsored by legislation such as the CHIPS and Science Act, which aims to improve supply chains and reduce reliance on Asian imports. This movement is likely to increase demand for advanced microelectronics materials, especially those employed in fabrication and advanced packaging technologies.

The microelectronics material market demonstrates varied growth trends across key regions, with Asia-Pacific emerging as the fastest-growing region. Countries like China, South Korea, Japan, and Taiwan hold a substantial share due to their well-established semiconductor manufacturing infrastructure. These countries are home to many major foundries and integrated device makers (IDMs), including as TSMC, Samsung, and SMIC, which account for a significant share of fabrication and packaging material consumption. Government-sponsored projects in China and South Korea to improve semiconductor self-sufficiency are increasing material demand in the region.

Europe holds a moderate market share during the microelectronics material market forecast period, focusing on automotive electronics and industrial IoT applications. Germany, the Netherlands, and France are major contributors, with governments and semiconductor companies collaborating to build advanced production facilities. Meanwhile, Latin America, the Middle East, and Africa have smaller market shares due to weak infrastructure and slow technological adoption, but these are expected to grow gradually as a result of foreign investment and increased electronics consumption.

Some of the top microelectronics material companies offered in our report include DuPont, Shin-Etsu MicroSi, Inc, BASF, W.L. Gore, LORD Corp., Honeywell Electronic Materials, PiBond, Dow Corning, KYOCERA, and Entegris.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2025

March 2023

June 2024

April 2021