November 2023

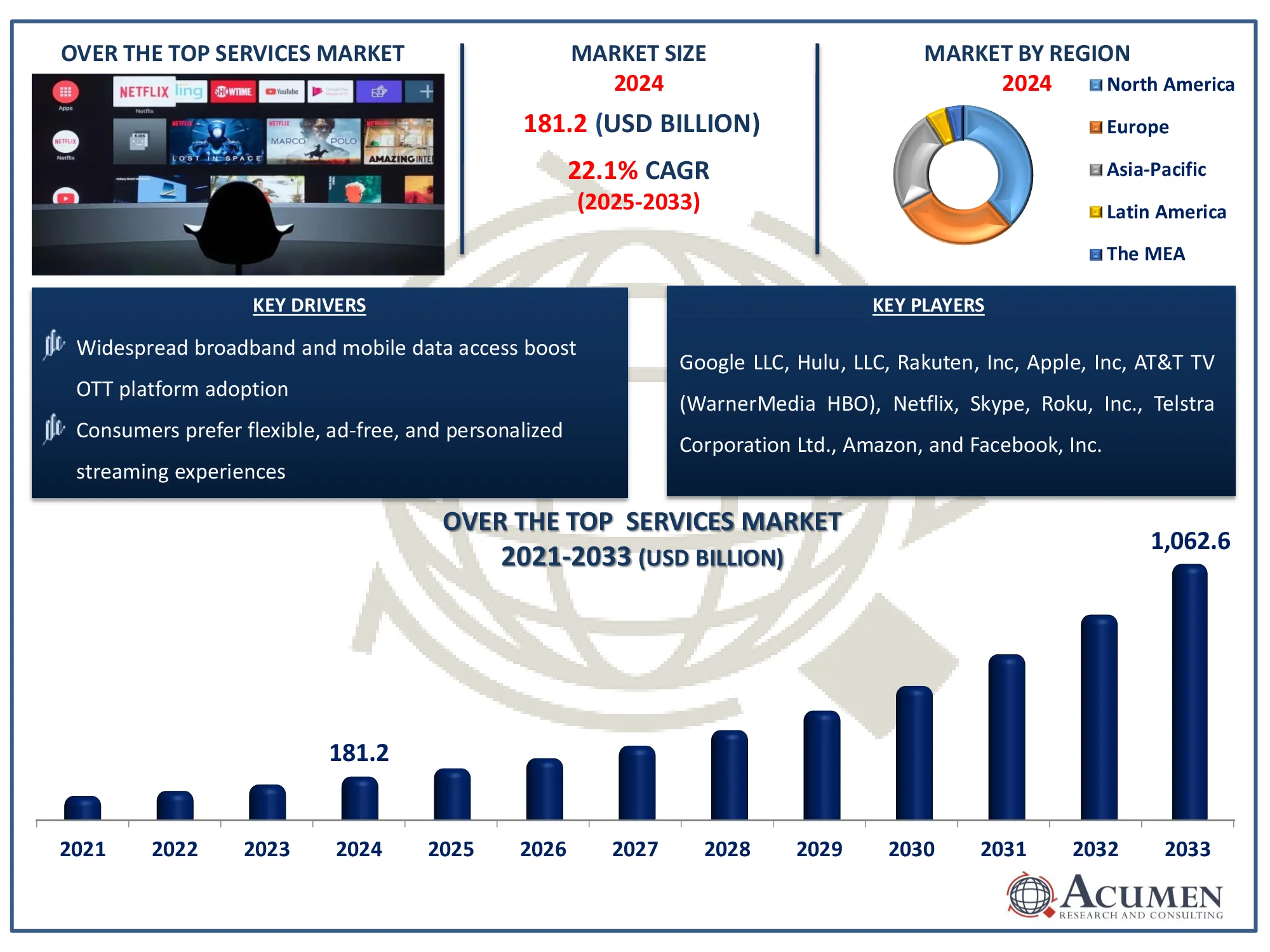

The Global Over the Top (OTT) Services Market Size accounted for USD 181.2 Billion in 2024 and is estimated to achieve a market size of USD 1,062.6 Billion by 2033 growing at a CAGR of 22.1% from 2025 to 2033.

The Global Over the Top (OTT) Services Market Size accounted for USD 181.2 Billion in 2024 and is estimated to achieve a market size of USD 1,062.6 Billion by 2033 growing at a CAGR of 22.1% from 2025 to 2033.

Over-the-top (OTT) services are digital media platforms that transmit video, audio, and messaging over the internet, bypassing traditional cable or satellite providers. These services include streaming behemoths like Netflix, Amazon Prime, and Disney+, which provide on-demand entertainment with no territorial limits. With increased internet penetration and the proliferation of smart devices, OTT services are transforming the media sector by offering tailored content, ad-free experiences, and low-cost subscription models. Future developments in AI-driven suggestions, 5G connectivity, and interactive content will enhance user engagement, making OTT the dominant mode of digital entertainment.

According to the Internet Governance Project, the Ministry of Information and Broadcasting (MIB) is aiming to regulate OTT platforms using the same framework as traditional broadcasters, which may have an impact on market dynamics, compliance costs, and content strategies. Reopening consultations on the November 2023 draft gives industry parties the opportunity to establish a balanced regulatory framework that promotes market expansion while maintaining compliance. A clear and balanced regulatory framework would assist the over the top services market to grow.

|

Market |

Over the Top (OTT) Services Market |

|

Over the Top (OTT) Services Market Size 2024 |

USD 181.2 Billion |

|

Over the Top (OTT) Services Market Forecast 2033 |

USD 1,062.6 Billion |

|

Over the Top (OTT) Services Market CAGR During 2025 - 2033 |

22.1% |

|

Over the Top (OTT) Services Market Analysis Period |

2021 - 2033 |

|

Over the Top (OTT) Services Market Base Year |

2024 |

|

Over the Top (OTT) Services Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Service Type, By Device Type, By Content, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled Aviation |

Google LLC, Hulu, LLC, Rakuten, Inc, Apple, Inc, AT&T TV (WarnerMedia HBO), Netflix, Skype, Roku, Inc., Telstra Corporation Ltd., Amazon, and Facebook, Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The ubiquitous availability of high-speed internet and low-cost mobile data has greatly accelerated the rise of OTT platforms. The government's Digital India Initiative has expanded internet coverage beyond metro cities to tier 2 and tier 3 cities, as well as rural areas. In March 2024, 398.35 million of India's 954.40 million internet subscribers lived in rural areas. Additionally, 95.15% of villages (612,952 out of 644,131) currently have 3G/4G mobile connectivity, contributing to a 14.26% increase in internet subscribers from 251.59 million in 2014 to 954.40 million in 2024. Users can now access OTT content at any time and from any location, boosting over the top services over the top (OTT) services market expansion.

The increasing proliferation of smart TVs, streaming devices, and 5G networks has improved the OTT viewing experience by allowing for high-quality, buffer-free streaming. According to 5G Americas, global wireless growth is accelerating, with more than 170 million additional 5G connections expected in Q3 2024 alone. North America leads in 5G adoption, with 264 million connections accounting for 70% of the population, and is predicted to overtake 4G by 2025, reaching 391 million connections. As 5G spreads, it attracts a wider audience and enhances subscriber retention, accelerating the expansion of the over-the-top services sector.

Government-imposed regulatory uncertainties and content limitations can pose issues for OTT platforms, limiting content availability and increasing compliance costs. Such limitations may limit creative freedom and impede growth in the over-the-top services market.

However, artificial intelligence enables OTT platforms to personalize content recommendations based on user preferences, hence increasing viewer engagement and watch duration. AI-driven insights also allow for better content curation and targeted advertising, leading to higher subscription and revenue development.

The worldwide market for over the top (OTT) services is split based on service type, device type, content, end-user, and geography.

According to over the top (OTT) services industry analysis, managed services play an important role in industry by supporting content distribution, security, analytics, and cloud-based infrastructures. These services enable OTT platforms improve user experience, manage operations, and assure flawless streaming across several devices. Online services such as video streaming, live broadcasting, and interactive content are quickly expanding in the OTT sector. With rising demand for on-demand and real-time information, internet services are anticipated to grow even more, fueled by technical improvements and shifting customer preferences.

Based on device type, the smartphone segment dominates the industry due to broad use of mobile devices and low-cost internet connection. According to International Data Corporation's (IDC) Worldwide Quarterly Mobile Phone Tracker, India's smartphone market expanded by 4% year on year (YoY), with shipments totaling 151 million units. With the convenience of on-the-go streaming, users are increasingly turning to smartphones to watch videos, live content, and interactive media.

According to over the top services market analysis, video market is likely to expand rapidly, driven by increased consumer demand for streaming movies, TV series, live sports, and original content. Leading platforms such as Netflix, Disney+, and YouTube dominate the industry, making video streaming the most profitable and entertaining segment of the OTT business. For example, in December 2022, Netflix teamed with Nike Training Club to bring health and workout programs on its platform, broadening its content offerings beyond entertainment.

Other segments are gaining traction. Games and audio/VOIP are on the upswing, with cloud gaming and music streaming services gaining popularity. Meanwhile, communication services, such as messaging and video calling apps, continue to rise.

According to over the top services market forecast, media and entertainment industry leads the market, as streaming platforms promote huge user interaction with movies, TV episodes, live events, and original content. This sector is expanding, with rising subscriptions and advertising revenues. Health and fitness, as well as education and training, are expanding as more people use online workout programs and e-learning platforms. E-commerce, IT, and telecom businesses use OTT services for live shopping, consumer engagement, and digital communication. The government and other sectors use OTT for public communication, remote work, and virtual events, which contributes to the market's overall expansion.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

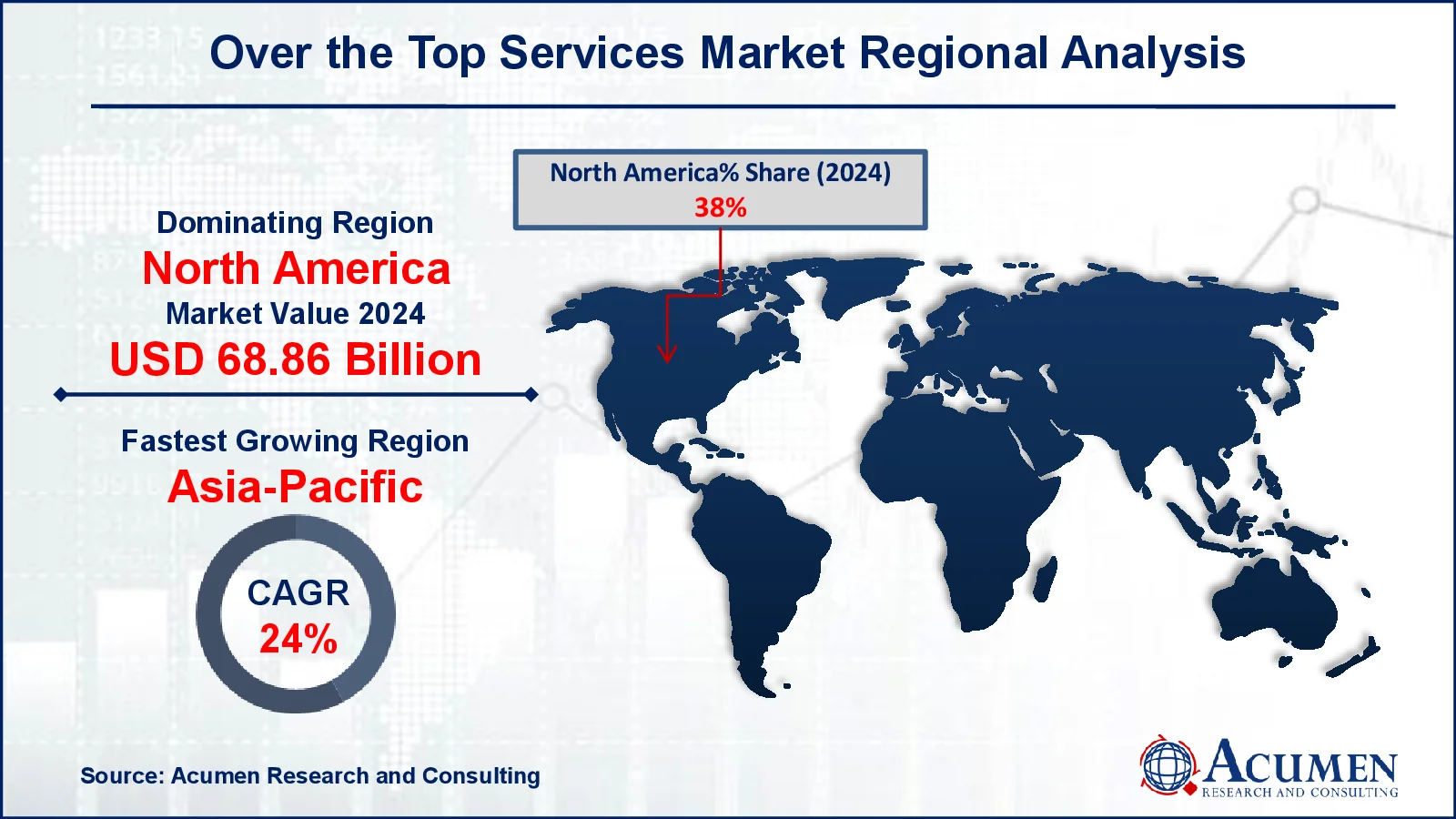

In terms of regional segments, North America currently owns the highest share of the global OTT services market and is predicted to continue to grow over the forecast period. Technological developments, the existence of large service providers, and a high per capita income all support market growth. For example, in May 2021, Amazon, Inc. debuted miniTV, a free movie streaming app, as part of a drive to expand its user base while integrating services such as e-commerce, payments, and food delivery. Furthermore, rising internet penetration in the United States and Canada is projected to drive market growth in the near term.

Meanwhile, Asia-Pacific is fastest-growing to witness significant growth in OTT services market, driven by the increasing presence of global OTT players like Amazon and Netflix and the expansion of local platforms like Zee5 in India. In October 2023, Prasar Bharati increased its efforts to establish an OTT platform in conjunction with key industry participants, hence strengthening the market. Additionally, rising mobile internet penetration and affordable high-speed data in China, Japan, and India are key factors contributing to the rapid expansion of the OTT industry in the region. Europe holds the notable over the top services market share and is projected to grow at a steady pace throughout the forecast period.

Some of the top over the top services companies offered in our report includes Google LLC, Hulu, LLC, Rakuten, Inc, Apple, Inc, AT&T TV (WarnerMedia HBO), Netflix, Skype, Roku, Inc., Telstra Corporation Ltd., Amazon, and Facebook, Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

November 2023

July 2022

March 2023

January 2023