January 2025

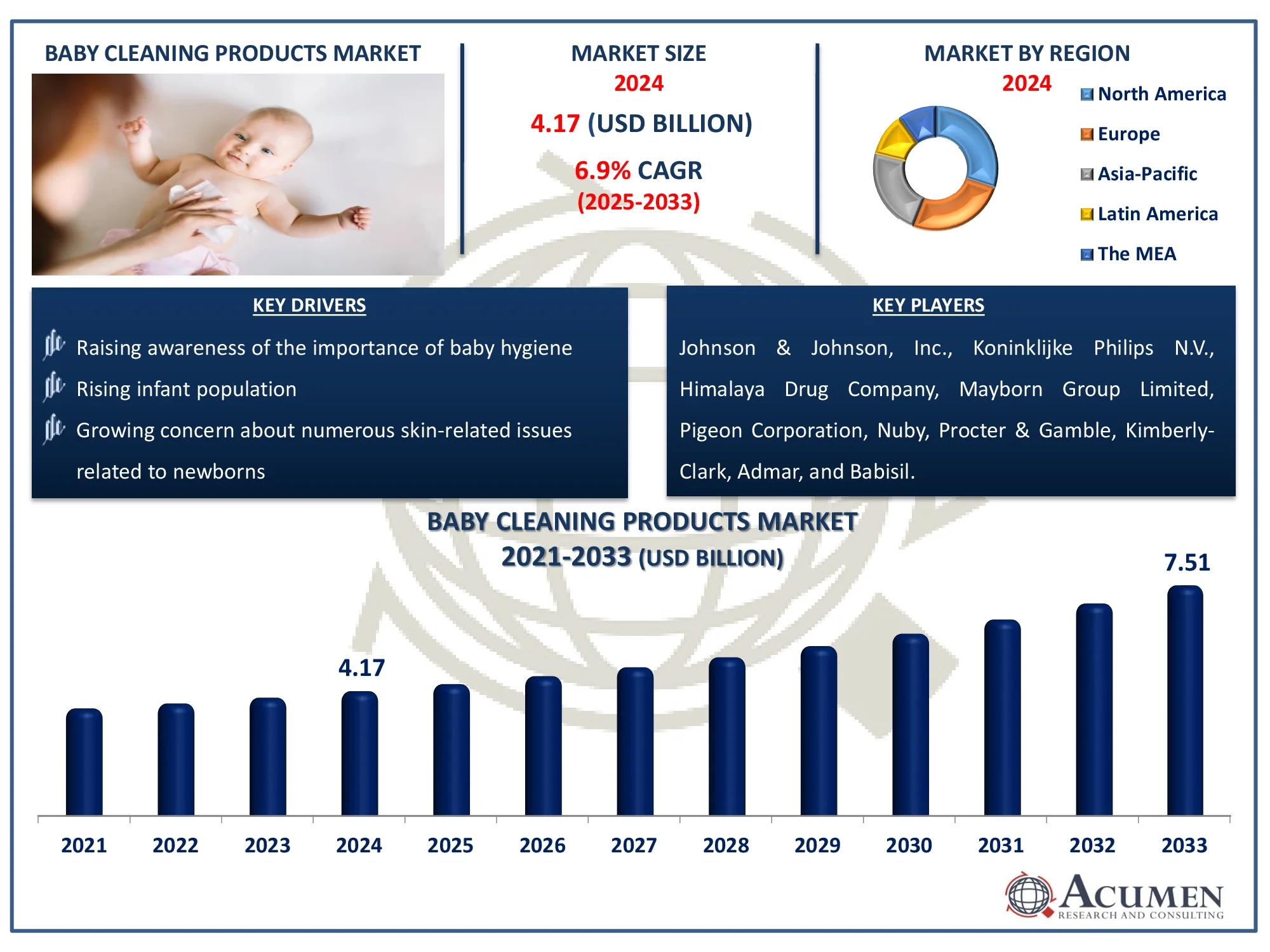

The Global Baby Cleaning Products Market Size accounted for USD 4.17 Billion in 2024 and is estimated to achieve a market size of USD 7.51 Billion by 2033 growing at a CAGR of 6.9% from 2025 to 2033.

The Global Baby Cleaning Products Market Size accounted for USD 4.17 Billion in 2024 and is estimated to achieve a market size of USD 7.51 Billion by 2033 growing at a CAGR of 6.9% from 2025 to 2033.

The growing public awareness of the importance of infant cleaning products is propelling the market forward. Furthermore, the increasing usage of organic materials such as cotton in the manufacture of cleaning wipes, sprays, and fabric stabilizers is likely to drive market growth in the coming years. Baby cleaning products are specifically made for babies and children under the age of three, using gentle ingredients to protect infants' health. A baby's skin is still in the formative stage, making it more sensitive to infections. These products serve to reduce microbial exposure, lowering the incidence of skin rashes, itching, and other conditions in newborns and young children. Prolonged exposure to these germs can impair the immune system.

|

Market |

Baby Cleaning Products Market |

|

Baby Cleaning Products Market Size 2024 |

USD 4.17 Billion |

|

Baby Cleaning Products Market Forecast 2033 |

USD 7.51 Billion |

|

Baby Cleaning Products Market CAGR During 2025 - 2033 |

6.9% |

|

Baby Cleaning Products Market Analysis Period |

2021 - 2033 |

|

Baby Cleaning Products Market Base Year |

2024 |

|

Baby Cleaning Products Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Product, By Sales Channel, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Johnson & Johnson, Inc., Koninklijke Philips N.V., Himalaya Drug Company, Mayborn Group Limited, Pigeon Corporation, Nuby, Procter & Gamble, Kimberly-Clark, Admar, and Babisil International Ltd. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The increased awareness of infant hygiene, as well as numerous promotional measures, are significant drivers of the baby cleaning products industry. The Time to Care and Love campaign, a collaboration between the Pan American Health Organization (PAHO) and its Latin American Centre for Perinatology (CLAP), aims to promote awareness about the importance of infant care and give evidence-based information on the issue.

Several factors, including increasing awareness of baby hygiene, the rising development of innovative cleaning products, and the growing disposable income of populations in emerging economies, are contributing to the market's growth. The demand for baby cleaning products is expected to rise due to these factors. For instance, in October 2021, Godrej Consumer Products Ltd, an India-based company, introduced Goodnessme, a premium range of baby care kits made with organic ingredients designed for sensitive infant skin.

Furthermore, the growing emphasis on baby hygiene, advances in cleaning product innovation, and rising disposable incomes in developed countries are all driving market growth. Poor hygiene and sanitation in children can result in a variety of issues, including rashes, blisters, and itching. Businesses are always innovating, releasing new and improved products, which is expected to help the overall market's growth. For example, in February 2024, MamyPoko Pants introduced Extra Absorb Pants with over 30 patented technology. The diapers are said to be up to 60% absorbent. As a result, parents' increasing willingness to invest in their children's hygiene is likely to drive growth in the infant cleaning products market.

Baby Cleaning Products Market Segmentation

Baby Cleaning Products Market SegmentationThe worldwide market for baby cleaning products is split based on product, sales channel, and geography.

According to a baby cleaning products industry analysis, the laundry detergent category will dominate the global market in 2024. ARM & HAMMER plans to launch ARM & HAMMER Baby Hypoallergenic Liquid Laundry Detergent in April 2022. The liquid detergent designed for infants and newborns contains no dyes, preservatives, or harsh chemicals. Conventional laundry detergents contain hazardous chemicals that, while effective at cleaning clothes, are detrimental to babies' fragile skin. Baby laundry cleansers are made of confidential materials that provide good cleaning while also maintaining the babies' skin health. The increasing burden of diseases caused by germs or infections has increased global acceptance of baby washing powders, resulting in the expansion of this industry in the past.

Retail generates the highest revenue within the sales channel segment, owing to an increasing diversity of options in the retail industry as well as rising discount offers for consumers, which will be a major driving force for this segment. Furthermore, during the projection period for the infant cleaning products market, the e-commerce segment is expected to be the fastest-growing area. This can be attributed to growing internet penetration, smartphone use, the popularity of e-commerce platforms, and huge discounts offered by online retailers. These factors are expected to drive the segment's expansion in the next years.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Baby Cleaning Products Market Regional Analysis

Baby Cleaning Products Market Regional AnalysisNorth America led the baby cleaning products market in 2024, owing to increased birth rates and prominent market players' ongoing launch of new baby care product portfolios. For example, in July 2022, Johnson & Johnson, a brand located in the United States, launched a new skin and hair care line for babies named "Vivvi & Bloom". The brand launched shampoo, body lotion, and body massage oil to meet the increased need for high-quality baby care products among millennial parents. These products are also accessible on big e-commerce websites such as Amazon and Flipkart. Additionally, the adoption of innovative marketing strategies by major companies to promote baby cleaning and care products is anticipated to encourage consumers to embrace these products, further propelling the growth of the regional market.

Numerous activities related to baby hygiene are being conducted by major corporations, which are expected to drive the U.S. baby cleaning product market. The rising prevalence of diseases linked to inadequate hygiene and sanitation is expected to bode well for the nation's baby cleaning products sector. According to World Vision International, every year, about 159 million children under the age of five confront the problem of stunted growth, 45.6% of child deaths are caused by undernutrition, and 50.4% of underweight status is caused by a lack of hygiene and sanitation.

Some of the top baby cleaning products companies offered in our report includes Johnson & Johnson, Inc., Koninklijke Philips N.V., Himalaya Drug Company, Mayborn Group Limited, Pigeon Corporation, Nuby, Procter & Gamble, Kimberly-Clark, Admar, and Babisil International Ltd.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

January 2025

October 2018

September 2021

November 2021