December 2023

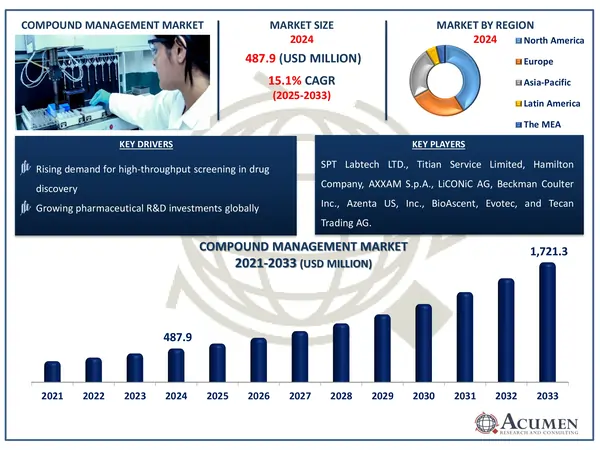

The Global Compound Management Market Size accounted for USD 487.9 Million in 2024 and is estimated to achieve a market size of USD 1,721.3 Million by 2033 growing at a CAGR of 15.1% from 2025 to 2033.

The Global Compound Management Market Size accounted for USD 487.9 Million in 2024 and is estimated to achieve a market size of USD 1,721.3 Million by 2033 growing at a CAGR of 15.1% from 2025 to 2033.

Compound management is the process of storing, handling, and tracking chemical compounds used primarily in drug development and research. It entails precisely organizing and retrieving chemicals in order to assure sample integrity and experimental reproducibility. Advanced systems frequently incorporate automation, robots, and software to efficiently manage massive compound libraries. This approach is crucial for pharmaceutical corporations, biotech firms, and research institutes that want to speed R&D.

The Society for Laboratory Automation and Screening (SLAS) Discovery emphasizes the importance of compound management in virtual research settings. It underlines the significance of a strong pipeline of compounds and a dependable discovery engine in supporting research programs from screening to candidate nomination. The article demonstrates how good compound management ensures sample integrity, streamlines workflows, and accelerates the drug development process, particularly in a decentralized or collaborative research context.

|

Market |

Compound Management Market |

|

Compound Management Market Size 2024 |

USD 487.9 Million |

|

Compound Management Market Forecast 2033 |

USD 1,721.3 Million |

|

Compound Management Market CAGR During 2025 - 2033 |

15.1% |

|

Compound Management Market Analysis Period |

2021 - 2033 |

|

Compound Management Market Base Year |

2024 |

|

Compound Management Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Type, By Sample Type, By Application, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

SPT Labtech LTD., Titian Service Limited, Hamilton Company, AXXAM S.p.A., LiCONiC AG, Beckman Coulter Inc., Azenta US, Inc., BioAscent, Evotec, and Tecan Trading AG. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The increasing demand for high-throughput screening in drug discovery is driving the development of more efficient compound management systems. For example, the National Institute of Health (NIH) states that the growing use of high-throughput screening (HTS), fuelled by advances such as assay downsizing, automation, and integration with analytical technologies, necessitates robust compound storage, monitoring, and handling. With HTS now capable of processing up to 100,000 compounds per day, there is an increasing demand for improved compound management systems, which is directly contributing to the growth of the compound management market.

Pharmaceutical businesses are also boosting their R&D investments, which raises the demand for sophisticated compound storage and retrieval solutions. According to the India Brand Equity Foundation, Indian pharmaceutical companies are predicted to expand revenue by 9-11% in FY25, boosted by excellent performances in major markets such as the United States, Europe, and emerging areas. India's pharmaceutical sector, famed for its cost-effective R&D, which is believed to be approximately 87% less expensive than in developed countries, is well-positioned to grow research efforts. This growing pattern shows an increasing demand for dependable and scalable compound management infrastructure.

However, the substantial initial investment required to implement automated compound management systems continues to be a significant obstacle, particularly for smaller laboratories and biotech enterprises.

On the plus side, using artificial intelligence and robotics into compound management opens up new options to improve efficiency and accuracy. For example, in January 2022, AstraZeneca expanded its AI-powered drug research collaboration with BenevolentAI to include disorders such as systemic lupus erythematosus and heart failure. Such collaborations highlight the growing need for better compound management systems, as AI-generated drug candidates require fast and dependable storage and retrieval to support expedited research pipelines.

The worldwide market for compound management is split based on type, sample type, application, end-user, and geography.

According to compound management industry analysis, products dominate the business, and automated compound/sample storage systems can manage vast amounts of samples with precision and minimal human interaction. These systems provide appropriate storage conditions, reduce the danger of contamination, and increase retrieval speed. Automated liquid handling systems simplify operations by precisely dispensing and controlling liquid samples, increasing efficiency in high-throughput settings. Other storage systems contribute by providing adaptable and scalable options for varied research needs.

Based on the sample type, chemical compounds play an important function since they are at the heart of drug research and development. Efficient management of these substances is critical for accurate inventory control, optimal storage conditions, and high-throughput screening. As research has become more sophisticated, there has been a huge increase in need for advanced systems to track, store, and retrieve chemicals.

As per application, drug discovery sub-segment leads the compound management business due to its crucial role in the development of novel therapies. Efficient compound storage, tracking, and retrieval are critical for high-throughput screening and other research activities in drug discovery. As pharmaceutical businesses engage extensively in R&D, there is an increasing demand for sophisticated compound management systems capable of handling large chemical libraries. These technologies enable correct data management, increase research efficiency, and speed up the drug discovery process.

According to compound management market forecast, pharmaceutical end-users take the lead due to their high demand for efficient systems to assist drug discovery and development procedures. Pharmaceutical firms, which invest extensively in R&D, require advanced compound management solutions to handle enormous amounts of chemical compounds with precision and speed. These technologies are critical for improving processes, assuring compliance, and expediting the discovery of new medicines in the pharmaceutical sector.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

In terms of regional segments, North America dominates the compound management market, owing to its strong pharmaceutical and biotech infrastructure, particularly in the United States. The U.S. Department of State emphasizes the country's robust biotech ecosystem, which is supported by large R&D investments, university research centers, and private sector labs that drive innovation and international leadership. The region benefits from significant R&D investment, innovative automation technology, and a concentration of key industry players. For example, in May 2023, Hamilton and Biosero signed a co-marketing agreement to improve automated liquid handling workflows, leveraging Hamilton's advanced automation technologies and Biosero's Green Button Go Software Suite to increase lab efficiency. Regulatory support and notable research institutes are also driving the implementation of compound management technologies.

Meanwhile, the Asia-Pacific region's compound management market is rapidly rising, fueled by increased pharmaceutical research and government-backed biotech programs. According to the China National Intellectual Property Administration (CNIPA), the Chinese government intends to increase investments in new drug development while also encouraging innovation in local pharmaceutical enterprises. Countries such as China, India, and South Korea are also improving their R&D skills and investing in sophisticated laboratory facilities.

Some of the top compound management companies offered in our report include SPT Labtech LTD., Titian Service Limited, Hamilton Company, AXXAM S.p.A., LiCONiC AG, Beckman Coulter Inc., Azenta US, Inc., BioAscent, Evotec, and Tecan Trading AG.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

December 2023

April 2021

January 2020

February 2025