April 2024

Leisure Boats Market (By Boat: Sailing Boats, Motorboats, Jet Skis, Wave Runners, Inflatable Boats; By Type: Motorized Boats, Non-motorized Boats; By Propulsion System: Diesel, Gasoline, Electric/hybrid, Sail drive; By Application: Recreational boating, Fishing, Tourism & rentals, Sports & racing; By End-Use: Individual Consumers, Commercial Rental Companies, Charter Operators, Tourism & Hospitality Sector) - Global Industry, Share, Analysis, Trends and Forecast 2026 - 2035

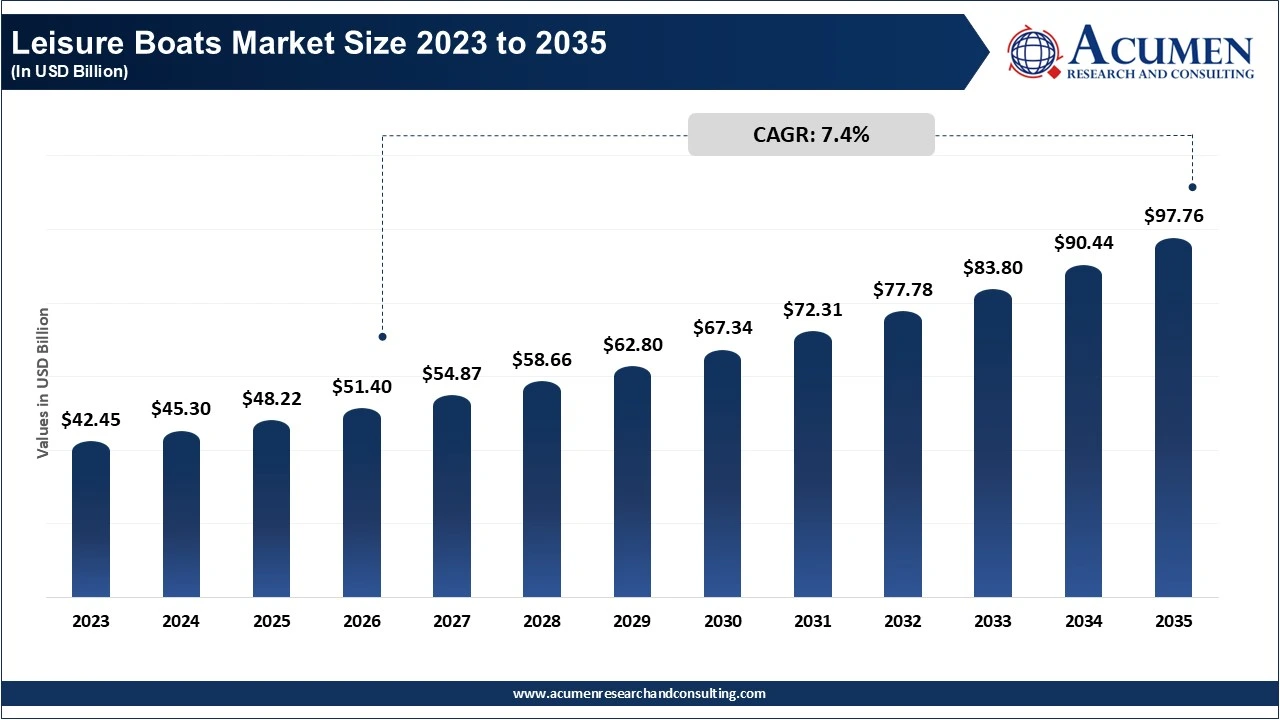

The global leisure boats market size was valued at USD 48.22 billion in 2025 and is anticipated to reach around USD 97.76 billion by 2035 growing at a CAGR of 7.4% from 2026 to 2035.

The significant growth of the leisure boats market is driven by the increased consumer disposable income, increasing coastal and Inland tourism, as well as the growing trend towards spending time on recreation and lifestyle-related activities. As urban residents want leisure outdoor time, boating has become the preferred activity for relaxation, interacting with friends, and engaging in sports and recreation. The establishment of new marinas, more availability of rental boats and charters, and alternative ownership models have created accessibility for first-time boaters. While replacement demand for old decorative fleets continues to be a part of ongoing growth, water tourism and fishing tourism demand is growing and helping to sustain continued sales growth in top regions.

Another major growth factor is technological advancement and industry investments in new hulls, lightweight materials, and engines for increasing fuel-efficiency safe, and better performance. The increasing popularity of electric and hybrid boats throughout the industry is being driven by increasing environmental awareness towards reducing emissions. Therefore, manufacturers are looking for ways to develop cleaner and quieter boats. Moreover, significant investments from manufacturers, engine suppliers, and marine technology companies, in conjunction with financing availability, are creating an environment that promotes rapid development of new leisure products and accelerates market penetration. Digital sales platforms and smart technologies will also provide long-term benefits to the leisure boat market.

| Attribute | Details |

| Leisure Boats Market Size 2025 | USD 48.22 Billion |

| Leisure Boats Market Forecast 2035 | USD 97.76 Billion |

| Leisure Boats Market CAGR During 2026 - 2035 | 7.4% |

| Analysis Period | 2023 - 2035 |

| Base Year | 2025 |

| Forecast Data | 2026 - 2035 |

| Segments Covered | By Boat, By Type, By Propulsion System, By Application, By End-Use, and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Azimut Benetti Group, Boston Whaler, Brunswick Corporation, Ferretti Group, Groupe Beneteau, MasterCraft, Princess Yachts, Sea Ray, Sunseeker, Viking Yachts, Avon Marine, and Baja Marine. |

North America currently dominates the leisure boats market due to a well-established boating culture, high levels of disposable income, and superior marine infrastructure throughout the United States and Canada. There are many extensive coastlines, lakes, and inland water bodies, as well as numerous leading boat manufacturers and dealers also high levels of boat ownership in the leisure boat industry support continued replacement demand and sustained market growth. Additionally, the high participation rates in recreational boating, fishing, and water sports, and also through the availability of favourable terms of financing, and the existence of sophisticated marina facilities, lead to the development of a well-supported replacement market.

Asia Pacific is the fastest-growing region because of increasing disposable incomes, urbanization, and developing marine tourism. Marina and associated waterfront tourism projects, along with rental-based boating services, are being heavily promoted by China, Australia, Japan, and Southeast Asian countries. In addition, the growth of the middle-class population and interest in experiential tourism are leading to increased domestic and international investment in marine and coastal tourism, which is creating an environment for sustainable growth in this sector throughout the Asia Pacific region and beyond.

The worldwide market for leisure boats is split based on boat type, propulsion system, application, end-use, and geography.

Motorboats is currently the dominant boat in the leisure boats market because it being used in recreational cruising, fishing, and tourism. Motorboats have many advantages over other types of leisure boats, including greater speed, better comfort, greater distances they can travel, and the availability of amenities onboard. The use of motorboats also lends itself to personal ownership as well as commercial applications such as chartering and rentals. Due to their higher selling price, motorboats represent a larger portion of the overall market value, and the regular upgrades to the design, safety, and performance features also allow for them to remain the dominant segment in the long term.

| Boat | Market Share (%) | Key Highlights |

| Motorboats | 30% | Dominates the market due to extensive use in recreational cruising, fishing, and tourism, supported by high comfort and versatility. |

| Sailing Boats | 25% | Preferred for leisure cruising and eco-friendly boating, especially in coastal and inland waters. |

| Jet Skis | 22% | Fastest-growing segment driven by adventure tourism, rentals, and demand from younger consumers. |

| Wave Runners | 14% | Growing popularity in water sports and resort-based activities due to high speed, maneuverability, and ease of use. |

| Inflatable Boats | 9% | Used widely in rentals and short-distance recreation because of affordability, portability, and low maintenance. |

Jet skis is the fastest-growing segment, because of the increasing need for adventure sports and high-energy recreation. Jet skis are smaller than most other types of boats, are affordable, and are easy to operate. This makes them attractive to younger consumers and first-time boaters. The growth of the coastal tourism industry, along with the growth of water sports resort businesses and rental models for watercrafts, will continue to support the growth of jet ski sales, especially in new tourist destination locations and recreational areas.

Motorized boats dominate the leisure boats market due to revenue generated primarily through the sale of yachts, motorboats, and powered recreational vessels. Due to their advanced propulsion systems and onboard technologies, motorized boats provide an essential means for long-distance cruising, tourism operations, and premium leisure activities. The continued dominance of motorized boats is reinforced by the increasing prices of these vessels, the growing demand for replacement vessels, and the growth of marina infrastructure around the world.

| Product | Market Share (%) | Key Highlights |

| Motorized Boats | 85% | Dominates due to high demand for yachts, motorboats, and PWCs used in recreation, tourism, and rentals. |

| Non-Motorized Boats | 15% | Growing steadily with eco-tourism, kayaking, sailing, and low-cost recreational activities. |

Non-motorized boats are the fastest-growing segment due to the high sustainability and low ecological impacts of recreation activities is driving an increase in the number of people registering. Kayaks, paddleboats, and sailboats are becoming more popular in eco-tourism as well as in either the inland waterways or protected marine areas. Low acquisition and maintenance costs, combined with rising environmental awareness, are driving adoption, especially among recreational users and tourism operators focused on sustainability.

Gasoline currently dominates the leisure boats market due to its widespread availability and lower initial cost, and compatibility across a wide range of small to mid-sized leisure boats. Furthermore, gasoline propulsion is further supported through a developed fuel distribution system and a comprehensive service network that supports the many uses of gasoline engines compared to other fuel types. As a result, gasoline propulsion continues to be the preferred choice for private and rental boat operators in geographic areas with limited access to electric charging stations.

| Propulsion System | Market Share (%) | Key Highlights |

| Gasoline | 51% | Leads due to widespread availability, lower upfront cost, and suitability for small to mid-size leisure boats. |

| Diesel | 29% | Preferred for larger yachts and long-distance cruising due to higher torque and fuel efficiency. |

| Electric / Hybrid | 12% | Fastest-growing segment driven by emission regulations and sustainability trends. |

| Sail Drive | 8% | Used mainly in sailing boats for auxiliary propulsion and fuel efficiency. |

Electric and hybrid propulsion systems represent the fastest-growing segment because of increased environmental concern and stringent environmental regulations. Advances in battery technology, charging systems, and energy efficiency have improved the performance and range of electric and hybrid-powered vessels. The quiet operation of electric and hybrid-powered vessels, combined with their significantly lower emissions, makes these systems very appealing for eco-sensitive waterways and for use by the tourism industry and the public, leading to their worldwide adoption.

Recreational boating is the dominant application segment as leisure boats are primarily used for personal use, social interaction, and lifestyle, which are overwhelmingly used for leisure boating. Demand in this segment continues to increase as disposable income, more people engage in outdoor leisure activities, and marinas are adding more capacity and improving infrastructure. Additionally, other significant demand generated from the recreational boating segment produces the highest market revenue. Therefore as individuals continue to purchase more and upgrade their leisure boats, the recreational boating segment continues to create significant revenue streams.

| Application | Market Share (%) | Key Highlights |

| Recreational Boating | 60% | Dominates as most boats are used for personal leisure, cruising, and lifestyle activities. |

| Fishing | 16% | Supported by strong participation in recreational fishing across coastal and inland waters. |

| Tourism & Rentals | 14% | Fastest-growing application due to marine tourism and rental-based business models. |

| Sports & Racing | 10% | Niche segment driven by competitive boating and water sports events. |

Tourism and rental applications are the fastest-growing segment due to an increase in consumer demand for boating experiences in exchange for access to vessels, as opposed to ownership. Increases in marine tourism, the development of coastal resort-type areas, and the emergence of digital reservation platforms are fueling growth within this marketplace. High usage rates and repeat use of charters by tourists increase business volume for rental and charter companies, further assisting their rapid growth in the marketplace.

Individual consumers dominate the leisure boats market because people primarily use boats for recreation and fishing through private ownership. A continuing increase in household income, a desire for a lifestyle based on leisure activities, and the availability of financing options are sustaining continued high demand from individual purchasers. Individual purchasers are also a major source of secondary service work, upgrades, and repairs to the boats they purchase. Thus, individual consumers account for a substantial proportion of the overall market value of leisure boats.

| End-Use | Market Share (%) | Key Highlights |

| Individual Consumers | 68% | Largest segment driven by private ownership and lifestyle-oriented leisure boating. |

| Commercial Rental Companies | 14% | Growing with tourism demand and short-term access models. |

| Charter Operators | 8% | Supported by luxury tourism and customized boating experiences. |

| Tourism & Hospitality Sector | 10% | Driven by resort-based boating and integrated marine tourism offerings. |

Commercial rentals are the fastest-growing end-use segment, supported by shared-use, subscription, and tourism models being utilized. Partnerships with travel agencies, resorts, and hospitality service providers create an increase in demand for fleets. The growing number of international tourists and increased consumer demand for short-term flexible boating experiences without the responsibility of owning a boat are key drivers for this segment's growth.

By Boat

By Type

By Propulsion System

By Application

By End-Use

By Region

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2024

September 2024

March 2023

January 2019