June 2022

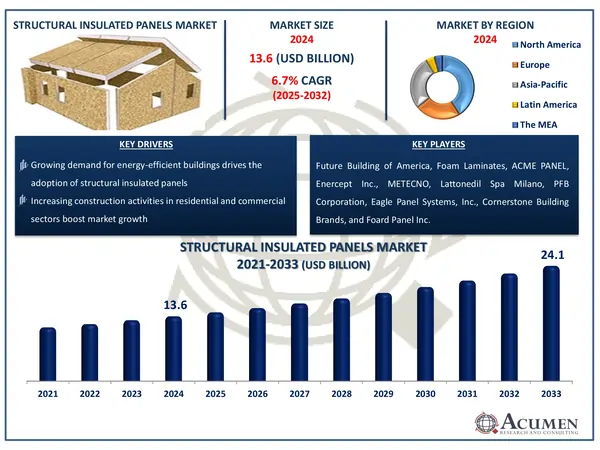

The Global Structural Insulated Panels Market Size accounted for USD 13.6 Billion in 2024 and is estimated to achieve a market size of USD 24.1 Billion by 2033 growing at a CAGR of 6.7% from 2025 to 2033.

The Global Structural Insulated Panels Market Size accounted for USD 13.6 Billion in 2024 and is estimated to achieve a market size of USD 24.1 Billion by 2033 growing at a CAGR of 6.7% from 2025 to 2033.

The requirement for strong-performance and green building systems with eco-friendly materials is expected to further boost consumer demand on the market. Structural panels are prefabricated construction materials that facilitate and speed up the process of installation without affecting the quality of construction. In addition, cold-storage systems are projected to grow in the food and drink sector to have a positive impact on market growth. During the forecast period, residential and commercial pipeline projects would probably support consumer demand. The demand for structural insulated panels is also anticipated to grow in isolating patterns for energy efficient and sustainable building. Hence, uplifting the demand for SIP over the coming years. Structural-insulated panels are very heat and cold tolerant and therefore help to maintain an optimum level of the space climate, leading to low electricity costs. But the biggest obstacle for the industry is projected to be high commodity prices and transport costs for rigid insulated boards. The review of the SIP application assessment and its disadvantages clearly indicate the need for further studies to be improved beyond the existing SIP.

|

Market |

Structural Insulated Panels Market |

|

Structural Insulated Panels Market Size 2024 |

USD 13.6 Billion |

|

Structural Insulated Panels Market Forecast 2033 |

USD 24.1 Billion |

|

Structural Insulated Panels Market CAGR During 2025 - 2033 |

6.7% |

|

Structural Insulated Panels Market Analysis Period |

2021 - 2033 |

|

Structural Insulated Panels Market Base Year |

2024 |

|

Structural Insulated Panels Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Product Type, By Sheathing Type, By Application, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled Aviation |

Future Building of America, Owens Corning, Foam Laminates, ACME PANEL, Enercept Inc., METECNO, Lattonedil Spa Milano, PFB Corporation, Kingspan Group, Eagle Panel Systems, Inc., Cornerstone Building Brands, and Foard Panel Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The buildings that are built with these insulated boards, though, offer greater insulation and long-term cost-effectiveness. The constant separation provided by these panel's helps keep the wall temperature steady, which gives the occupant high comfort. It also decreases humidity accumulation on the wall and improves building surface longevity. The demand for structurally insulated panels is expected to increase through energy efficiency legislation and the initiatives taken by EU countries to reduce overall emissions from carbon in the region.

The construction and durability of isolation systems are key players in the sector panels. However, rising prices of plastics and wood materials are expected to hinder growth during the structural insulated panels market forecast period. Insulated polyurethane panels offer better temperature resistance and lightweight properties. The development of inexpensive and environmentally sensitive houses in rapid pace has put dream home into scope since the advent of building technologies. Since SIPs are already engineered panels, the facility of installation and speed are increased without affecting building quality. Wall assemblies installed in factories such as SIPs could minimize building time and operating cost by 40 to 48%.

The worldwide market for structural insulated panels is split based on product type, sheathing type, application, end-user, and geography.

Polystyrene, namely expanded polystyrene (EPS), dominates the structural insulated panel (SIP) market. EPS is widely utilized because to its lightweight design, low cost, and excellent thermal insulation. It boasts high energy efficiency and moisture resistance, making it a popular choice for both residential and commercial structures. Furthermore, EPS SIPs are easier to handle, which reduces construction time and labor costs.

While polyurethane (PU) SIPs offer improved insulation and strength, their expensive cost prevents broad usage. Glass wool is utilized for fire resistance, although is less frequent in SIPs than polystyrene. Others, such as mineral wool and phenolic foam, have specialized purposes. Overall, EPS remains popular due to its cost, durability, and insulating performance.

In the structural insulated panels (SIP) market, the most popular sheathing type is oriented strand board (OSB). Its dominance arises from its low cost, structural strength, and widespread availability. OSB is engineered to be both load-bearing and long-lasting, making it a great choice for residential and commercial construction. OSB is less expensive than plywood while providing comparable performance, which increases its popularity among builders. While sheet metal is durable and fire resistant, its use is limited due to high costs and specific industrial applications. The "Others" category, which includes fiber cement board and gypsum board, is for specific applications. OSB is still the preferred material for SIP sheathing due to its versatility and cost savings.

According to structural insulated panels industry analysis, in 2024, the application for walls and floors represented the largest market share. An increasing need to renovate housing facilities due to better living standards and higher spending efficiency is likely to further stimulate the market growth of structural insulated panels. The increase in cold chain operations in major economies such as Asia-Pacific and North America due to the increasing consumption of processed and packaged food supply has driven the market for structural insulated panels. The reliability of well-built SIP houses has been shown to be similar to traditional buildings. Though, the failure of the structural insulated panel housing units can lead to poor installation procedures. Material and transport costs are the biggest challenges for SIP buildings. SIPs can be made more costly than conventional wood-framed buildings through extra material costs. In contrast, transport costs can be multiple times higher in comparison to traditional building goods for panelized products. These incremental costs can, however, be fully compensated by saving the cost on-site.

Due to the similarities in materials and construction practices, the life expectancy of a well-designed and well-kept SIP house is equivalent to a conventionally constructed home. These panels are produced according to application and thermal / structural requirements in different dimensions and thicknesses. Non-residential sector dominated the global SIP market and is projected to show similar trend over the forecast period. Residential sector is also anticipated to show significant growth over the structural insulated panels (SIP) market forecast period owing to green building initiatives by various regulatory bodies across Asia, Americas, and Europe.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

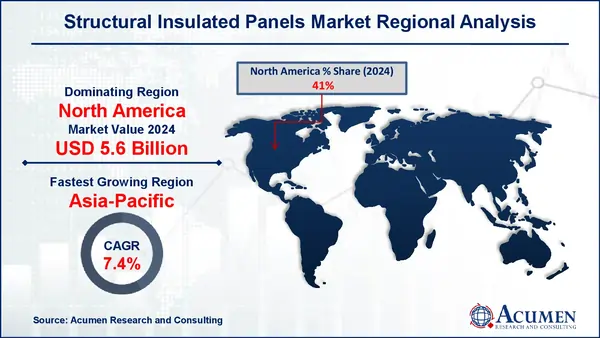

North America is the largest market for structural insulated panels, owing to high demand in residential and commercial construction, strict energy-efficiency standards, and a strong presence of significant producers. The Asia-Pacific region is the fastest-growing market, driven by urbanization, growing awareness of green buildings, and government measures to promote energy-efficient construction. Countries such as China, India, and Japan are increasingly using SIPs as a long-term replacement to traditional materials.

There are four major SIP companies in Canada and a number of small businesses. Local building authorities consider technologies differently, but it was generally good when more information was provided. In Canada, an SIP building can be built and building code clearance can still be received. Also, as an alternative construction material for residential and light-commercial buildings in the UK, structural insulated panels (SIPs) slowly gain in popularity. People believe that in contrast with standard timber frame construction, they show significant power, thermal efficiency, and deployment speed advantages. During the design of many kinds of panel construction systems, panels consisting of a thick layer of foam sandwiched between the two layers of the guided strand board (OSB) or plated surface are generally referred to as SIP. To Britain, the idea was relatively unknown, but its popularity in other nations, especially in the United States and Canada, inspired British designers and suppliers to join.

Some of the top structural insulated panels market companies offered in our report include Future Building of America, Owens Corning, Foam Laminates, ACME PANEL, Enercept Inc., METECNO, Lattonedil Spa Milano, PFB Corporation, Kingspan Group, Eagle Panel Systems, Inc., Cornerstone Building Brands, and Foard Panel Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

June 2022

April 2020

April 2023

April 2020