October 2018

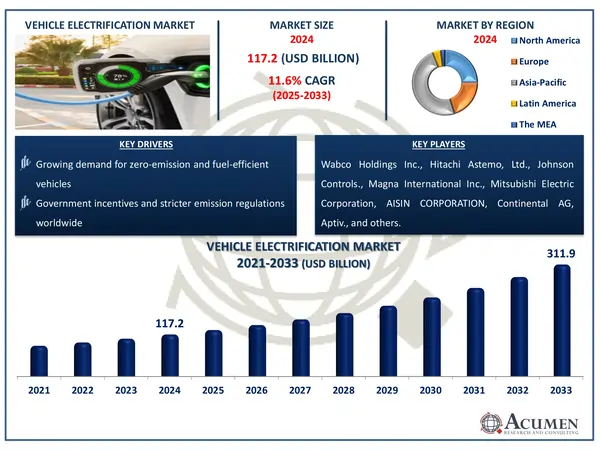

The Global Vehicle Electrification Market Size accounted for USD 117.2 Billion in 2024 and is estimated to achieve a market size of USD 311.9 Billion by 2033 growing at a CAGR of 11.6% from 2025 to 2033.

The Global Vehicle Electrification Market Size accounted for USD 117.2 Billion in 2024 and is estimated to achieve a market size of USD 311.9 Billion by 2033 growing at a CAGR of 11.6% from 2025 to 2033.

Vehicle electrification is the process of powering automobiles with electricity instead of traditional fossil fuels. It covers technologies such as hybrid, plug-in hybrid, battery electric, and fuel cell vehicles that aim to reduce emissions and increase energy efficiency. The term "electric" refers to vehicles that run purely on electricity, with batteries and electric motors replacing internal combustion engines. In contrast, electrified refers to any vehicle that uses electricity in any manner, such as hybrids, plug-in hybrids, and fuel cell automobiles. All electric vehicles are electrified, however not all of them are totally electric.

Companies like as Robert Bosch GmbH, Continental AG, and DENSO CORPORATION are leading the way with sophisticated electrification technology. Others, including Aptiv and Johnson Electric Holdings Limited, make substantial contributions to electric powertrain components. Mitsubishi Electric Corporation and BorgWarner Inc. are known for their advances in electric drive systems. Collectively, these companies are critical to accelerating the automotive industry's shift to sustainable and electric mobility.

Market Drivers

Market Restraints

Market Opportunities

|

Market |

Vehicle Electrification Market |

|

Vehicle Electrification Market Size 2024 |

USD 117.2 Billion |

|

Vehicle Electrification Market Forecast 2033 |

USD 311.9 Billion |

|

Vehicle Electrification Market CAGR During 2025 - 2033 |

11.6% |

|

Vehicle Electrification Market Analysis Period |

2021 - 2033 |

|

Vehicle Electrification Market Base Year |

2024 |

|

Vehicle Electrification Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Vehicle Type, By Product, By Hybridization, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Wabco Holdings Inc., Hitachi Astemo, Ltd., Johnson Controls., Magna International Inc., Mitsubishi Electric Corporation, Continental AG, AISIN CORPORATION, Aptiv., Johnson Electric Holdings Limited., JTEKT Corporation., ZF Friedrichshafen AG, BorgWarner Inc., DENSO CORPORATION., Valeo SA, and Robert Bosch GmbH. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Consumers and governments are increasingly emphasizing environmentally friendly transportation, which is driving up demand for electric cars (EVs). Our data shows that the global EV market, which was valued at USD 560.9 billion in 2023, is expected to expand to USD 2,342.3 billion by 2032, with a CAGR of 17.6% between 2024 and 2032. Global EV sales are also predicted to hit 20 million units by 2025, accounting for more than 25% of all car sales worldwide, according to the International Energy Agency's 2017 Global EV Outlook. The growing awareness of climate change is pushing the shift toward more sustainable transportation alternatives.

Supportive government policies, including tax breaks, purchase subsidies, and rigorous pollution laws, are helping to accelerate EV adoption worldwide. These measures reduce the cost of EVs while also driving automakers to innovate more. However, high upfront prices and a scarcity of home or public charging options remain significant obstacles, especially in price-sensitive markets. These obstacles continue to dissuade potential purchasers, despite the long-term cost reductions associated with EV ownership.

Building a dependable and extensive fast-charging infrastructure is crucial for reducing range anxiety and growing EV acceptability. For example, according to International Energy Agency (IEA), Brazil's charging infrastructure expanded rapidly, reaching over 12,000 public charging sites by the end of 2024. Other emerging markets are rapidly expanding their networks to meet burgeoning EV demand.

Countries across Europe have made significant strides in the development of public charging networks. By the end of 2024, the Netherlands had over 180,000 public charging stations, followed by Germany (160,000) and France (155,000). Austria also added 8,000 new charging outlets, mostly funded by government subsidies. This rapid growth in fast-charging infrastructure creates a significant opportunity for the future expansion of the car electrification business.

The worldwide market for vehicle electrification is split based on vehicle type, product, hybridization, and geography.

According to vehicle electrification industry analysis, passenger vehicles dominate the vehicle electrification sector due to their large manufacturing volume and consumer demand. For example, passenger vehicle (PV) sales in India reached a new high of 4.3 million units in FY25, representing a 2% increase over FY24, according to data from the Society of Indian Automobile Manufacturers. Government subsidies and higher pollution standards also primarily target personal transportation, accelerating its expansion.

As per products, electric vacuum pumps lead the car electrification sector by replacing traditional engine-driven pumps in electric and hybrid vehicles. These pumps are critical for braking systems, particularly in EVs, which lack engine-generated vacuum. Their efficiency, small design, and ability to function independently of the engine make them ideal for use in modern electric drivetrains. As more people choose electric vehicles, the demand for electric vacuum pumps grows rapidly.

According to vehicle electrification market forecast, internal combustion engine (ICE) and micro-hybrid vehicle hybridization play important roles in merging traditional engines with basic electric systems. Micro-hybrids employ start-stop technology and light electric assistance to enhance fuel efficiency and cut pollutants without fully electrifying the vehicle. This technique allows manufacturers to meet tighter emission regulations while gradually introducing consumers to electrified technology. As a result, micro-hybrid vehicles represent a critical step toward fully electric transportation.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

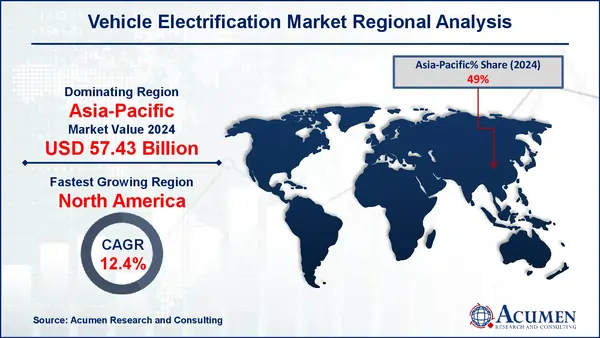

In terms of regional segments, Asia-Pacific dominates the vehicle electrification industry, owing to significant government incentives, a well-established manufacturing environment, and high consumer demand in nations such as China, Japan, and South Korea. China remains the world's largest electric vehicle (EV) market, with the presence of significant industry players fueling market expansion. For example, in 2024, BorgWarner announced a joint venture with Shaanxi Fast Auto Drive Group, a major Chinese producer of commercial vehicle drivetrain systems, to broaden its offering of electric and hybrid commercial vehicles. Furthermore, growing urbanization and rising environmental consciousness are driving the region's shift toward electrified mobility.

Meanwhile, in Europe, vehicle electrification is gaining traction due to rigorous emissions requirements and the European Union's tough climate goals. Nations including as Germany, Norway, and the United Kingdom are actively investing in EV infrastructure and providing incentives to encourage adoption. In a significant move, Ford Motor Company said in February 2021 that it would phase out fossil fuel-powered vehicles in Europe, with the goal of selling entirely plug-in hybrid and electric models by 2026. Key industry participants' strategic activities are critical to improving the European car electrification market.

some of the top vehicle electrification companies offered in our report include Wabco Holdings Inc., Hitachi Astemo, Ltd., Johnson Controls., Magna International Inc., Mitsubishi Electric Corporation, Continental AG, AISIN CORPORATION, Aptiv., Johnson Electric Holdings Limited., JTEKT Corporation., ZF Friedrichshafen AG, BorgWarner Inc., DENSO CORPORATION., Valeo SA, and Robert Bosch GmbH.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

October 2018

January 2024

September 2020

January 2021