January 2024

Global Automotive Lightweight Materials Market is expected to grow at a CAGR of 8.0% from 2019 to 2026 and to attain valuation of over US$ 155,985 Mn by 2026.

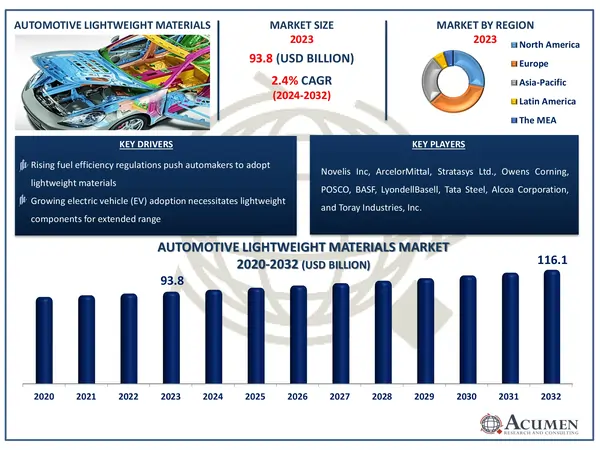

The Global Automotive Lightweight Materials Market Size accounted for USD 93.8 Billion in 2023 and is estimated to achieve a market size of USD 116.1 Billion by 2032 growing at a CAGR of 2.4% from 2024 to 2032.

In order to reduce their weight and increase their speed and fuel consumption, automotive lightweight materials are used. These lightweight materials are an appropriate replacement for heavy conventional materials that were previously used to build the vehicle frame due to advantages such as lower material usage, increased strength, better handling and low corrosion rate. Carbon fiber is one of those materials that are commonly used by global manufacturers as it provides a reduction in vehicle weight while retaining strength.

|

Market |

Automotive Lightweight Materials Market |

|

Automotive Lightweight Materials Market Size 2023 |

USD 93.8 Billion |

|

Automotive Lightweight Materials Market Forecast 2032 |

USD 116.1 Billion |

|

Automotive Lightweight Materials Market CAGR During 2024 - 2032 |

2.4% |

|

Automotive Lightweight Materials Market Analysis Period |

2020 - 2032 |

|

Automotive Lightweight Materials Market Base Year |

2023 |

|

Automotive Lightweight Materials Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Component, By Material Type, By Electric & Hybrid Vehicle Type, By End-Use, By End Use, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Novelis Inc, ArcelorMittal, Stratasys Ltd., Owens Corning, POSCO, BASF, LyondellBasell, Tata Steel, Alcoa Corporation, and Toray Industries, Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Higher fuel efficiency, increased vehicle durability and shelf life, and reduced CO2 emissions from vehicles are the main factors driving growth of automotive lightweight materials market. The transportation industry accounts for 23% of total global CO2 emissions; automotive manufacturers have developed lightweight pollution-reducing materials that have further boosted market growth. Higher prices of lightweight materials such as few composite materials and carbon fibers compared to standard materials increase the vehicle overall cost, which in turn constraints the market growth. However, the effect of this restriction is expected to be further reduced with different research facilities working on low-cost replacements. Depleting iron and other common material stocks in the world creates new opportunities for market growth.

Automotive manufacturers are increasingly using multi-material architectures that combine metals, composites, and polymers to optimise strength, weight, and cost. Advanced joining techniques, including as friction stir welding and adhesive bonding, enable the seamless integration of varied materials, hence increasing crash safety and fuel efficiency. Concerns about sustainability are driving up demand for recyclable lightweight materials such as bio-composites and recycled aluminum. Automakers are focused on closed-loop recycling technologies to improve material utilization, which aligns with circular economy ambitions. This approach decreases reliance on virgin raw materials while maintaining performance standards, supporting more environmentally responsible vehicle production.

The worldwide market for automotive lightweight materials is split based on component, material type, electric & hybrid vehicle type, application, end use, and geography.

According to automotive lightweight materials industry analysis, the body and frame sector is predicted to dominate the market. This supremacy stems from the growing use of high-strength steel, aluminum, and carbon fiber composites to reduce vehicle weight while retaining structural integrity. Automotive manufacturers are focusing on lightweight frames to enhance fuel efficiency, emissions, and overall vehicle performance. Furthermore, stringent government regulations requiring emissions reductions encourage manufacturers to adopt lightweight materials for body construction. Electric vehicles (EVs) increase demand because their lightweight frames improve battery efficiency and range. With advances in novel manufacturing techniques such as hot stamping and extrusion, the body and frame category remains the industry leader, ensuring both safety and sustainability.

Composites account for a considerable portion of the automotive lightweight materials market. Composites, which combine a reinforcing element (such as carbon or glass fiber) with a matrix material (such as resin), have a high strength-to-weight ratio, which is essential for lightweighting. This feature enables for the production of lighter components while maintaining structural integrity. In addition, composites provide design freedom, allowing for complicated shapes and the integration of many functions. This adaptability is useful for designing aerodynamic and visually appealing vehicles. While metals and plastics aid in lightweighting, composites' superior strength-to-weight ratio and design flexibility account for a significant market share, particularly in high-performance and electric cars where weight reduction is critical.

Battery electric vehicles (BEVs) are predicted to account for the majority of the automotive lightweight materials sector as the globe transitions to entirely electric mobility. Because BEVs rely only on battery power, reducing vehicle weight is crucial for increasing driving range, energy efficiency, and performance. Aluminum, carbon fiber, and sophisticated composites are increasingly used by automakers to reduce battery weight and improve aerodynamics. Furthermore, government incentives, stringent environmental rules, and expanded charging infrastructure are all promoting BEV adoption worldwide. The increased demand for long-range EVs has sparked research into lightweight structural components, bringing BEVs to the top of the market. As electrification improves, lightweight materials in BEVs are projected to become more prevalent.

The body in white (BIW) segment leads the automotive lightweight materials market, accounting for over 26% of total market share. This dominance is fueled by the growing need for lightweight car structures that improve fuel efficiency and minimize emissions. The roof, side panels, doors, and pillars are all part of the car's structural structure, known as BIW. To minimize weight while maintaining safety, automakers are increasingly employing aluminum, carbon fiber composites, and high-strength steel. Government regulations on vehicle emissions and fuel economy encourage the use of lightweight materials in BIW. Furthermore, the growing popularity of electric vehicles (EVs), which require lightweight structures and extended battery range, is boosting market expansion.

Passenger vehicles dominated the automotive lightweight materials sector due to their emphasis on fuel efficiency and regulatory compliance. As consumer preferences evolve toward more fuel-efficient and environmentally friendly automobiles, automakers are increasingly using lightweight materials including aluminum alloys, carbon fiber composites, and high-strength steel. These materials help to reduce overall vehicle weight, which improves fuel economy and performance while maintaining structural integrity. Lightweight materials are encouraged by global emission standards because they reduce vehicle bulk and thus COâ‚‚ emissions. Furthermore, the growing number of electric and hybrid passenger vehicles has expedited this trend, with automakers prioritizing weight reduction to improve battery efficiency and driving range. As a result, the use of lightweight materials has become a significant concern in modern passenger vehicle design.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

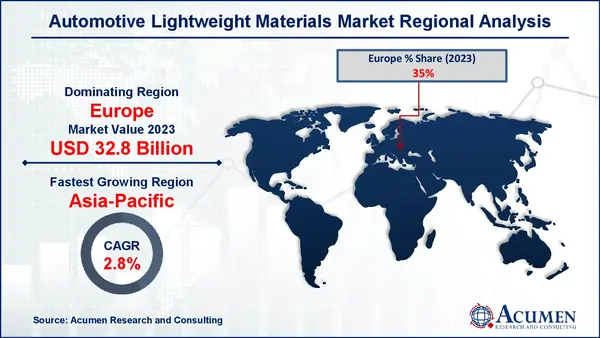

The automotive lightweight materials market analysis is provided for major regional markets including North America, Europe, Asia-Pacific, Latin America, Middle East & Africa followed by major countries.

The Europe projected to lead the global industry in the automotive lightweight materials market forecast period due to implementation of Euro 6 norms in Europe region which gives knock-on consequence of decreasing air pollution, such as nitrogen oxide and carbon monoxide. Furthermore, increasing demand for vehicles is one of the major factors driving the growth of the market in this region and will show significant growth during forecast period.

However North America is second leading region for the automotive lightweight materials market followed by Asia-Pacific. During the forecast period, the Asia-Pacific region is projected to be the fastest growing in the automotive lightweight materials market. This region growth is attributed to factors such as thriving automotive industry and the growing awareness of the people about reducing car emissions using heavyweight materials. Latin America and Middle East & Africa are emerging markets due to rise in demand of lightweight vehicles in this region.

Some of the top automotive lightweight materials companies offered in our report include Novelis Inc, ArcelorMittal, Stratasys Ltd., Owens Corning, POSCO, BASF, LyondellBasell, Tata Steel, Alcoa Corporation, and Toray Industries, Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

January 2024

June 2024

July 2023

January 2021