November 2023

Advanced Air Mobility Market (By Component: Hardware, Software; By Product: Fixed Wing, Rotary Blade, Hybrid; By Propulsion Type: Gasoline, Electric, Hybrid; By Application: Cargo Transport, Passenger Transport, Mapping & Surveying, Special Mission, Surveillance & Monitoring, Others; By End-Use: Commercial, Government & Military) - Global Industry Analysis, Size, Share, Trends and Forecast 2026 to 2035

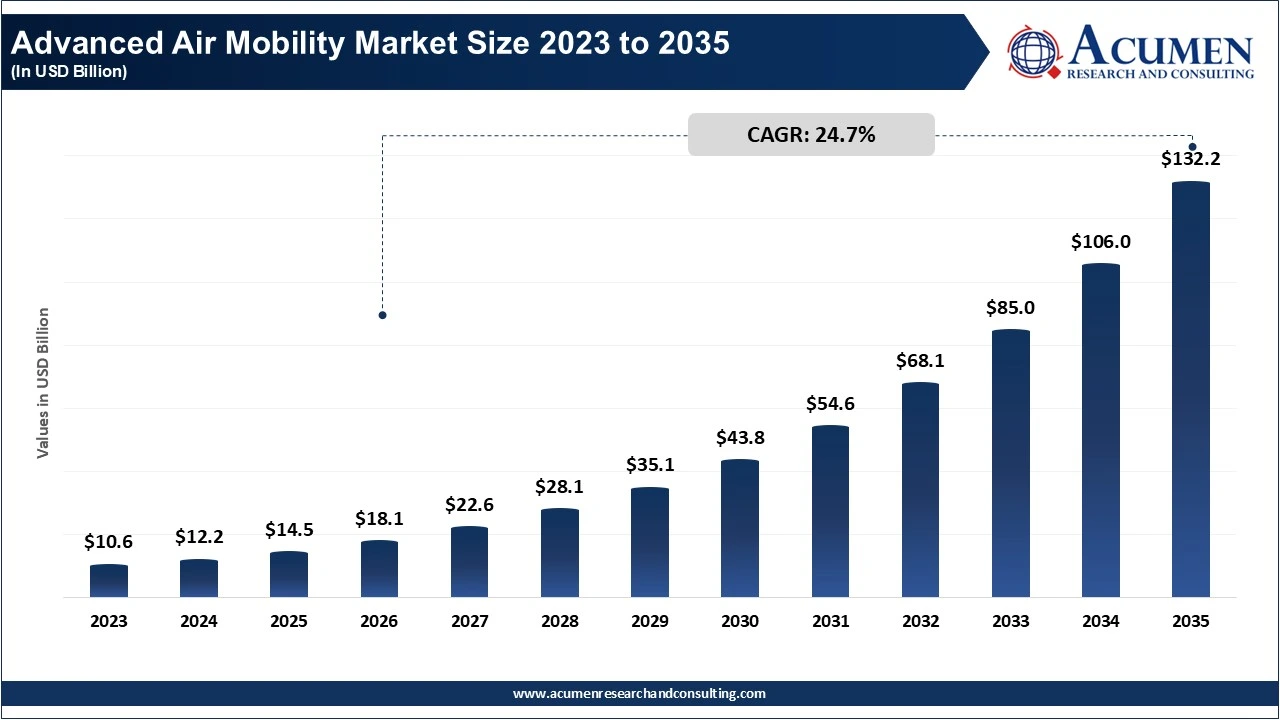

The global advanced air mobility market size was accounted for USD 14.50 billion in 2025 and is estimated to reach around USD 132.20 billion by 2035 growing at a CAGR of 24.7% from 2026 to 2035.

The significant growth of the advanced air mobility (AAM) market is due to the rapid advancement of technology-related areas that include electric propulsion systems, lightweight composite materials, autonomous navigation systems and battery technology. As urban area congestion continues to increase, there is also a growing desire for an alternative mode of transportation that is faster and safer and is also environmentally sustainable. Governments worldwide are beginning to develop support for AAM through the establishment of regulatory frameworks, development of pilot programs and development of infrastructure for vertiports, UTM (Unmanned Traffic Management) systems, and integrated airspace management systems. The increasing use of drone-based logistics, last-mile delivery and emergency response services also assist the growth of this market.

Another major factor for advanced air mobility market growth is governmental support, there is also an increasing amount of private and public sector investment in eVTOL (electric Vertical Take-Off and Landing) manufacturers, Urban Air Mobility (UAM) startups, and ecosystem technology providers. Major aerospace companies and automobile original equipment manufacturers (OEMs) have started to enter into AAM and this is helping to build a large amount of momentum for the commercialization of AAM. In addition, increasing interest in the environmental sustainability of aviation through the transition to zero-emission, electric aircraft has helped support the AAM expansion. Increasingly using AAM technology for the transportation of both passengers and cargo, surveillance, and medical deliveries are all helping to drive global adoption and growth of advanced air mobility market over the long term through the continued collaboration of manufacturers (OEMs), telecommunications, and smart cities.

Rapid Advancements in Electric Propulsion & eVTOL Technologies

Increasing Government Support & Urban Mobility Initiatives

Airspace Integration & Safety Regulatory Barriers

High Infrastructure Costs & Limitations in Battery Technology

Expansion into Cargo Logistics, Emergency Response & Rural Connectivity

Growing Investment from Aerospace, Automotive & Tech Ecosystems

| Area of Focus | Details |

| Advanced Air Mobility Market Size 2025 | USD 14.5 Billion |

| Advanced Air Mobility Market Forecast 2035 | USD 132.2 Billion |

| Advanced Air Mobility Market CAGR During 2026 - 2035 | 24.7% |

| Segments Covered | By Component, By Product, By Propulsion Type, By Application, By End-Use, and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Airbus S.A.S., Aurora Flight Sciences, Bell Textron Inc., Guangzhou EHang Intelligent Technology Co. Ltd., Embraer S.A., Joby Aviation, Lilium GmbH, Neva Aerospace, Opener, Inc., PIPISTREL (Textron Inc.), Vertical Aerospace Group Ltd., and Workhorse Group, Inc. |

| Report Coverage | Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The worldwide market for advanced air mobility is split based on component, product, propulsion type, application, end-use, and geography.

Hardware is currently the dominant component segment in the advanced air mobility market because it is an integral part of developing aircrafts, such as propulsion, rotors, avionics, battery and structural systems. Because of the physical aspect of the aircraft, hardware occupies the highest proportion of the total cost to produce and is needed for the flight performance and safety of the aircraft. The hardware's dominance will continue to as the leading segment for commercial and pre-commercial aircraft deployments. Rapid prototype building, fleet production and ongoing hardware upgrades are all factors that add to the increased hardware demand.

| Component | Market Share (%) | Key Highlights |

| Hardware | 82% | Dominant due to high-cost components such as propulsion systems, rotors, batteries, sensors, and avionics, which form the core of eVTOL and drone manufacturing. |

| Software | 18% | Fastest-growing driven by autonomy, AI-based flight control, digital traffic management, fleet optimization, and predictive maintenance solutions. |

Software is the fastest-growing component, due to its increasing integration into autonomous navigation, real-time air traffic management, fleet optimization and predictive maintenance systems. With the growth of AAM ecosystems, there will be a need for more Software Driven Intelligence in order to coordinate dense urban air traffic, reduce operating expenses, and enable completely autonomous commercial operations; in addition, the transition to Digital Airspace Management and Artificial Intelligence (AI) enabled Decision Support Systems has continued to drive software adoption for both commercial and governmental missions.

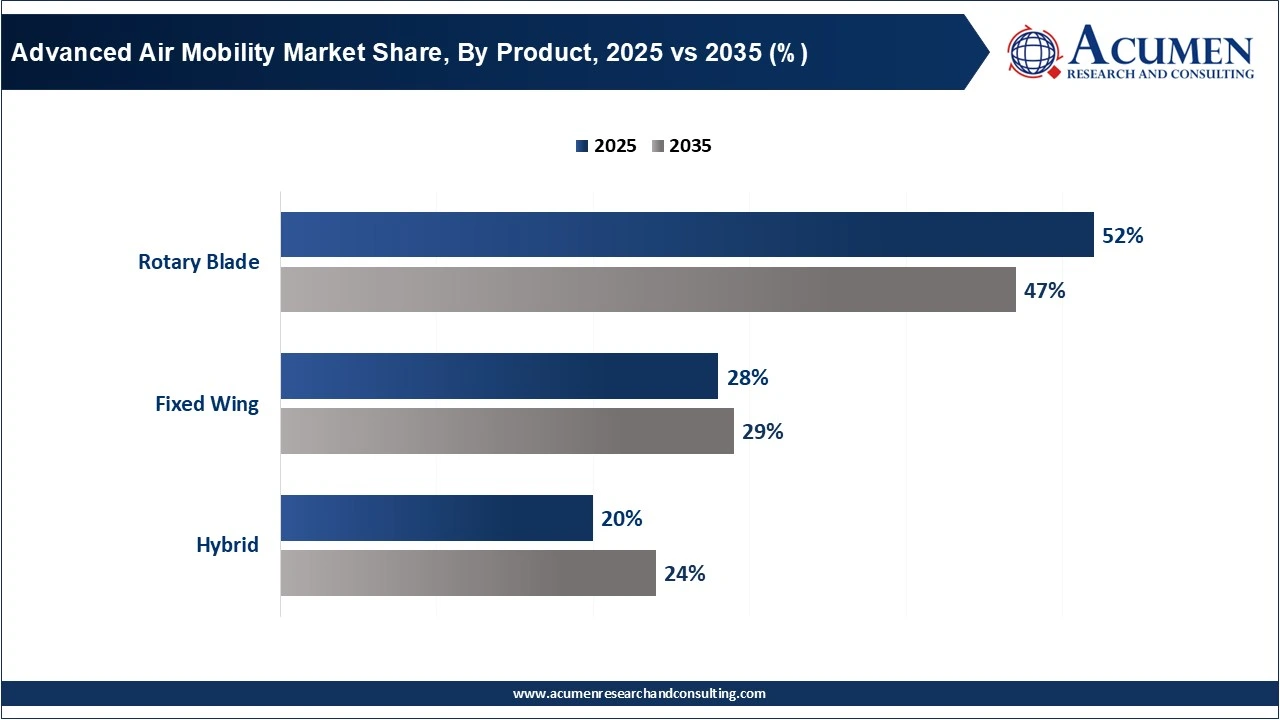

Rotary blade aircraft dominate the segment due to their ability to support short-range urban mobility, vertical takeoff and landing, and small operational footprints. Most of the first eVTOL prototypes being built today use multirotor or tilt-rotor configurations as they provide excellent stability, excellent maneuverability, and an easier certification path. These advantages contribute significantly to rotary aircraft being the preferred option for air taxi services, medical emergency services, and short-haul logistics; thus maintaining their position as the industry leader in the current marketplace.

| Product | Market Share (%) | Key Highlights |

| Rotary Blade | 52% | Leads the market because most early commercial AAM aircraft use multirotor or tilt-rotor designs suited for vertical takeoff and urban mobility. |

| Fixed Wing | 28% | Preferred for longer-range missions and regional air mobility with better aerodynamic efficiency and lower energy consumption. |

| Hybrid | 20% | Leads the market because most early commercial AAM aircraft use multirotor or tilt-rotor designs suited for vertical takeoff and urban mobility. |

Hybrid aircraft represent the fastest-growing segment, due to ability to provide both vertical takeoff capabilities and the advantages of fixed-wing platforms, such as longer ranges and greater aerodynamic efficiencies. Therefore, hybrid systems are an excellent fit for regional air mobility (RAM), intercity routes and extended cargo missions, which current multirotor aircraft face a number of range and endurance limitations. Hybrid aircraft will continue to evolve and gain momentum within the investment marketplace as more and more operations will require longer distance travel capabilities.

Electric propulsion is the dominant the AAM market due to its quieter operation, lower emissions levels, and significantly lower cost to operate when compared with traditional combustion engine type aircraft. The establishment of the Distributed Electric Propulsion (DEP) system has enabled the safe and efficient flight of eVTOL vehicles in an environmentally friendly manner. There will be strong regulatory support for the advancement of clean aviation and improvements in battery technologies will further reinforce electric propulsion systems as the best option for near-term commercial deployment of AAM services.

| Propulsion Type | Market Share (%) | Key Highlights |

| Electric | 50% | Dominates because of low emissions, quiet operation, strong government support, and advances in battery-electric eVTOL systems. |

| Hybrid | 30% | Fastest-growing as it overcomes battery limitations, enabling longer range, heavier payloads, and reliable operations. |

| Gasoline | 20% | Used mainly in early-stage or specialized platforms but declining as the industry shifts to electric and hybrid solutions. |

Hybrid propulsion is the fastest-growing segment, because hybrid systems can provide greater operating distances and endurance than electric motors can currently achieve with batteries. Initially, hybrids use electric propulsion systems in conjunction with combustion and turbine engines as a power source, which offers the user longer operation times, higher cargo capacity and greater overall reliability. These benefits are leading to a rapid increase in hybrid aircraft, particularly in the areas of cargo logistics, regional air mobility and delivery of longer distances.

Cargo transport is currently dominant the market in the advanced air mobility, supported by strong adoption of eVTOL cargo drones and autonomous aircraft for delivery (last mile), medical transport, and speed of logistics. Logistics providers, healthcare systems and ecommerce businesses are rapidly increasing their reliance on aerial cargo solutions in order to manage traffic congestion on the ground and improve delivery times. The combination of lower cost, access to remote locations, and fast deployment capabilities have allowed cargo drone technology to capture the largest portion of early commercial AAM deployments.

| Application | Market Share (%) | Key Highlights |

| Cargo Transport | 28% | Dominant segment due to rising demand for aerial logistics, medical delivery, last-mile transport, and automated supply chain operations. |

| Passenger Transport | 22% | Growing demand for urban air taxis and intercity eVTOL services, supported by smart-city initiatives and airport shuttle trials. |

| Surveillance & Monitoring | 20% | Fastest-growing driven by government, defense, infrastructure, and industrial use cases requiring real-time aerial intelligence. |

| Mapping & Surveying | 12% | Widely used for construction, agriculture, mining, and infrastructure inspection. |

| Special Mission | 10% | Covers firefighting, disaster relief, search and rescue, and emergency response operations. |

| Others | 8% | Includes tourism, recreational flights, and experimental R&D activities. |

Surveillance and monitoring is the fastest-growing segment, due to increasing demand for real-time aerial intelligence by Government, Infrastructure, and Industry. The use of AAM Vehicles has rapidly increased in the use of border monitoring, environmental assessment, inspection of utility lines, Public Safety Operations, and Critical Infrastructure Monitoring. Their ability to operate autonomously over large areas, respond quickly to changing conditions, and gather precise data makes them indispensable Tools of Choice for mission-critical tasks where manned aircraft at a significantly higher cost required.

The commercial sector dominates the AAM market due to the widespread deployment of aircraft for logistics, inspections, urban air mobility, infrastructure surveying and growing interest in corporate use. Operators in the private sector, logistics companies, and mobility providers continue to make large investments into fleet expansion as there is a continuing and increasing demand for aerial services that are faster, safer, and more efficient. The broad applicability within all industries reinforces the concept of a commercial end-user as the largest revenue contributor.

| End-Use | Market Share (%) | Key Highlights |

| Commercial | 61% | Leading segment due to broad adoption in logistics, surveying, inspection, and urban mobility services. Strong private-sector investment drives growth. |

| Government & Military | 39% | Fastest-growing due to increasing use in defense intelligence, tactical resupply, border security, and emergency operations. Supported by rising government funding. |

Government and military are the fastest-growing segment, fueled by increased use for reconnaissance, disaster response, border security, tactical resupply, and emergency response. AAM platforms provide defense agencies with the capability to operate in difficult environments at lower costs and with greater flexibility than traditional aerospace platforms. Increased budgets for unmanned aviation and hybrid aviation systems allow for rapid adoption of AAM technologies in military and public safety applications.

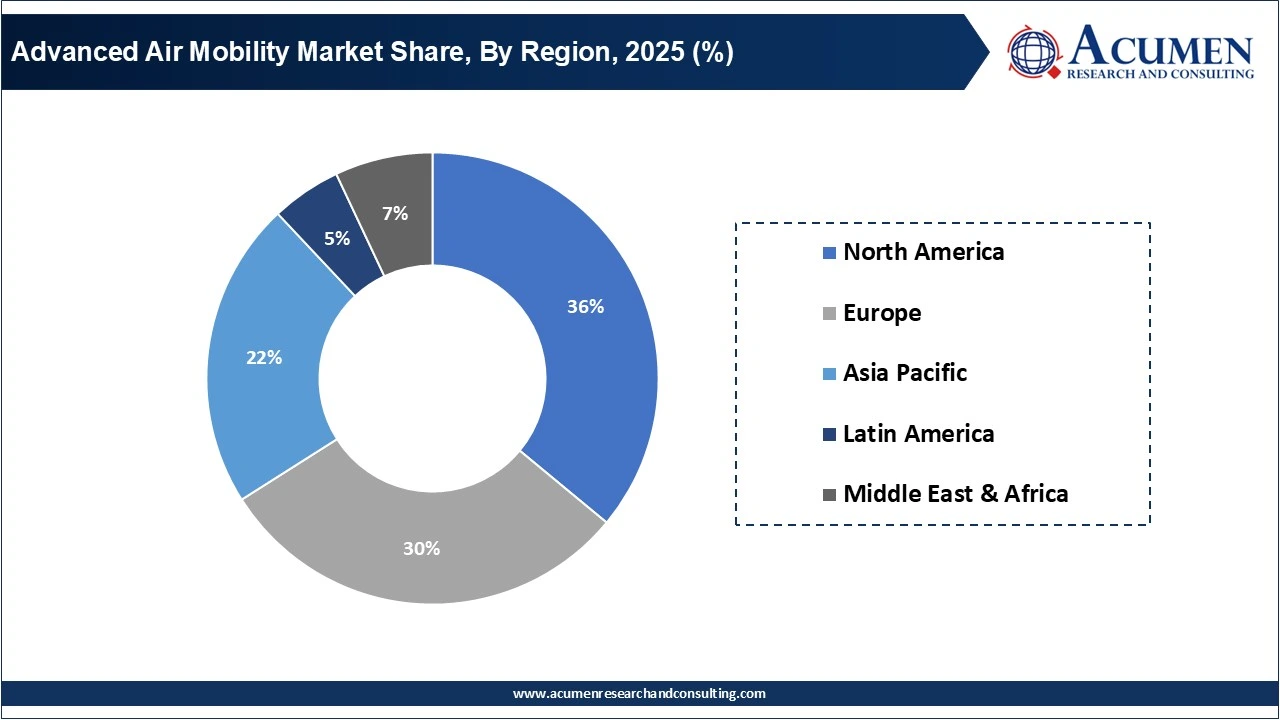

North America currently dominates the global AAM market due in large part to the number of commercial eVTOL manufacturing, superior aerospace infrastructure, and strong support from aviation regulatory agencies such as the FAA. As such, early pilot projects exist for urban air taxi services, cargo drone corridor development, and public-private partnerships to develop vertiports and integrate airspaces in the North American region. The commercialization of AAM technology has been accelerated in the U.S. and Canada by large technology/aviation companies that have access to both extensive venture capital and governmental support. Furthermore, a high demand for logistics, medical deliveries, and smart-city mobility has placed North America as a market leader in adoption.

Asia Pacific is the fastest-growing region, due to increasing urbanization, congested cities throughout Asia, and increasing support from governments for the future growth of commercial air vehicles (AAM). Major markets in this area, including China, Japan, South Korea, and Singapore are currently making substantial investments in establishing AAM routes, creating large-scale drone delivery systems, and investing heavily in developing certification programs for eVTOL aircraft. In addition, the Asia Pacific region's existing manufacturing strengths and significant early adoption of smart mobility technology will continue to attract both international and domestic aerospace investment. At the same time, the demand for increased efficiency in intercity transportation, emergency response services, and automation in logistics will make the Asia Pacific region the fastest growing AAM market globally.

By Component

By Product

By Propulsion Type

By Application

By End-Use

By Region

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

November 2023

February 2023

May 2023

February 2024