April 2023

Aerospace and Defense C-Class Parts Market Size accounted for USD 16.9 Billion in 2021 and is projected to achieve a market size of USD 25.6 Billion by 2030 rising at a CAGR of 4.8% from 2022 to 2030.

The Global Aerospace and Defense C-Class Parts Market Size accounted for USD 16.9 Billion in 2021 and is projected to achieve a market size of USD 25.6 Billion by 2030 rising at a CAGR of 4.8% from 2022 to 2030. Increasing aircraft fleet across the world is a primary factor that is driving the aerospace and defense c-class parts industry growth. In addition, the rising demand for robust and durable products in the aerospace and defense sector is another factor boosting the market revenue.

Aerospace and Defense C-Class Parts Market Report Statistics

Factors such as fluctuating raw material prices and availability of alternatives such as adhesives replacing mechanical parts are factors expected to hamper the growth of global aerospace & defense c-class parts market. In addition, high competitive rivalry among players and operation on low profit ratio is expected to challenge the growth of target market. However, increasing air travel from consumers, rising demand for fuel efficient airplanes, and focus on development of low cost raw material for mechanical products are factors expected to create new opportunities for players operating in the global aerospace & defense c-class parts market over the forecast period. In addition, increasing partnership between regional and international players is expected to support the revenue transaction of the target market.

Global Aerospace and Defense C-Class Parts Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Aerospace and Defense C-Class Parts Market Report Coverage

| Market | Aerospace and Defense C-Class Parts Market |

| Aerospace and Defense C-Class Parts Market Size 2021 | USD 16.9 Billion |

| Aerospace and Defense C-Class Parts Market Forecast 2030 | USD 25.6 Billion |

| Aerospace and Defense C-Class Parts Market CAGR During 2022 - 2030 | 4.8% |

| Aerospace and Defense C-Class Parts Market Analysis Period | 2018 - 2030 |

| Aerospace and Defense C-Class Parts Market Base Year | 2021 |

| Aerospace and Defense C-Class Parts Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amphenol Corp., LMI Aerospace, Inc., RCB Bearings, Inc., Trimas Corp., LiSi Aerospace, Precision Castparts Corp., Safran SA, Arconic, Inc., Triumph Group, and Eaton Corp. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Aerospace and Defense C-Class Parts Market Growth Factors

Flourishing airline sector across the globe, rising defense spending by countries and demand for reliable parts from airplane manufacturer are major factors expected to drive the growth of global aerospace & defense c-class parts market. Government of developed and developing countries is spending high in the development of enhanced and effective aircrafts in order to enhance the customer experience. Aerospace & defense sale is witnessing high rise among different states in the US. Statewide the A&D industry sale was US$ 137 Bn in 2019. The state’s contribution towards the sale is increasing as compared to previous year such as Wyoming (21%), Vermont (15%), South Carolina (12%), Missouri (11%), and Nevada (11%). Government is providing various contracts to help states gain high momentum. In 2018, According to Department of Defense, more than US$358 billion in contract payments were made across all fifty states and the District of Columbia.

According to our aerospace and defense c-class parts industry analysis, these factors are expected to impact the growth of target market. As one of the highest revenue generation industry for the government the sector is witnessing rapid advancements and high investments. In 2019, aerospace & defense sector contributed US$ 17.6 Bn revenue to the state and local tax departments also US$ 46 Bn to the federal tax department. Presence of large number of players operating in the country and introduction of new products is positively impacting the market. Favorable business policies by the government and increasing spending on airline sector are expected to support the market growth. According to Department for Promotion of Industry and Internal Trade (DPIIT), FDI inflow in India’s air transport sector (including air freight) reached US$ 2.95 billion between April 2000 and March 2021.

Aerospace and Defense C-Class Parts Market Segmentation

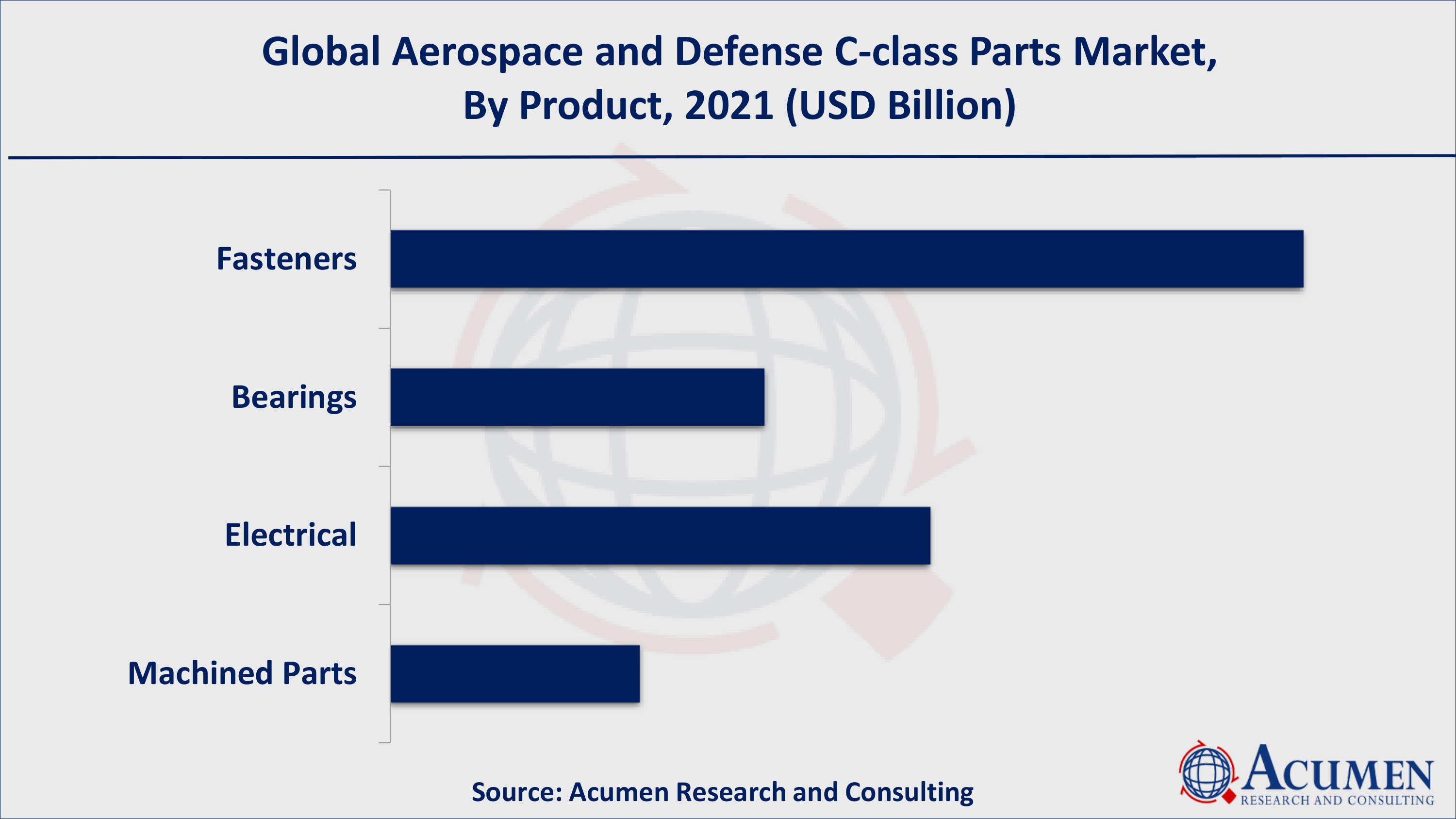

The global aerospace & defense c-class parts market is segmented into product, application, and end-use. The product segment is divided into fasteners, bearings, electrical, and machined parts. Among products, the fasteners segment is expected to account for major revenue share in the global aerospace & defense c-class parts market. Airframe, interiors, engine, and system are covered in the application segment. Furthermore, the end-use segment is bifurcated into commercial, military, and business & general aviation.

Aerospace and Defense C-Class Parts Market By Product

Aerospace and Defense C-Class Parts Market By Application

Aerospace and Defense C-Class Parts Market By End-Use

Aerospace and Defense C-Class Parts Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Aerospace and Defense C-Class Parts Market Regional Analysis

The market in Asia-Pacific is expected to witness faster growth in the target market due to rising demand for enhanced aircraft. Increasing consumer preference for air travel and evolving airline business is expected to augment the growth of target market. Enterprises inclination towards enhancing the business in developing countries through partnership is expected to support the growth of target market in this region.

Aerospace and Defense C-Class Parts Market Players

Players operating in the global aerospace & defense c-class parts market are Amphenol Corp., LMI Aerospace, Inc., RCB Bearings, Inc., Trimas Corp., LiSi Aerospace, Precision Castparts Corp., Safran SA, Arconic, Inc., Triumph Group, and Eaton Corp. The global aerospace & defense c-class parts market is highly competitive due to presence of large number of players and innovative product offerings. In addition, business expansion activities through partnerships and agreements are factors expected to further increase the competition.

Enterprise focus towards business acquisition and securing contracts are factors expected to boost the regional market growth.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2023

February 2023

May 2023

December 2024