September 2018

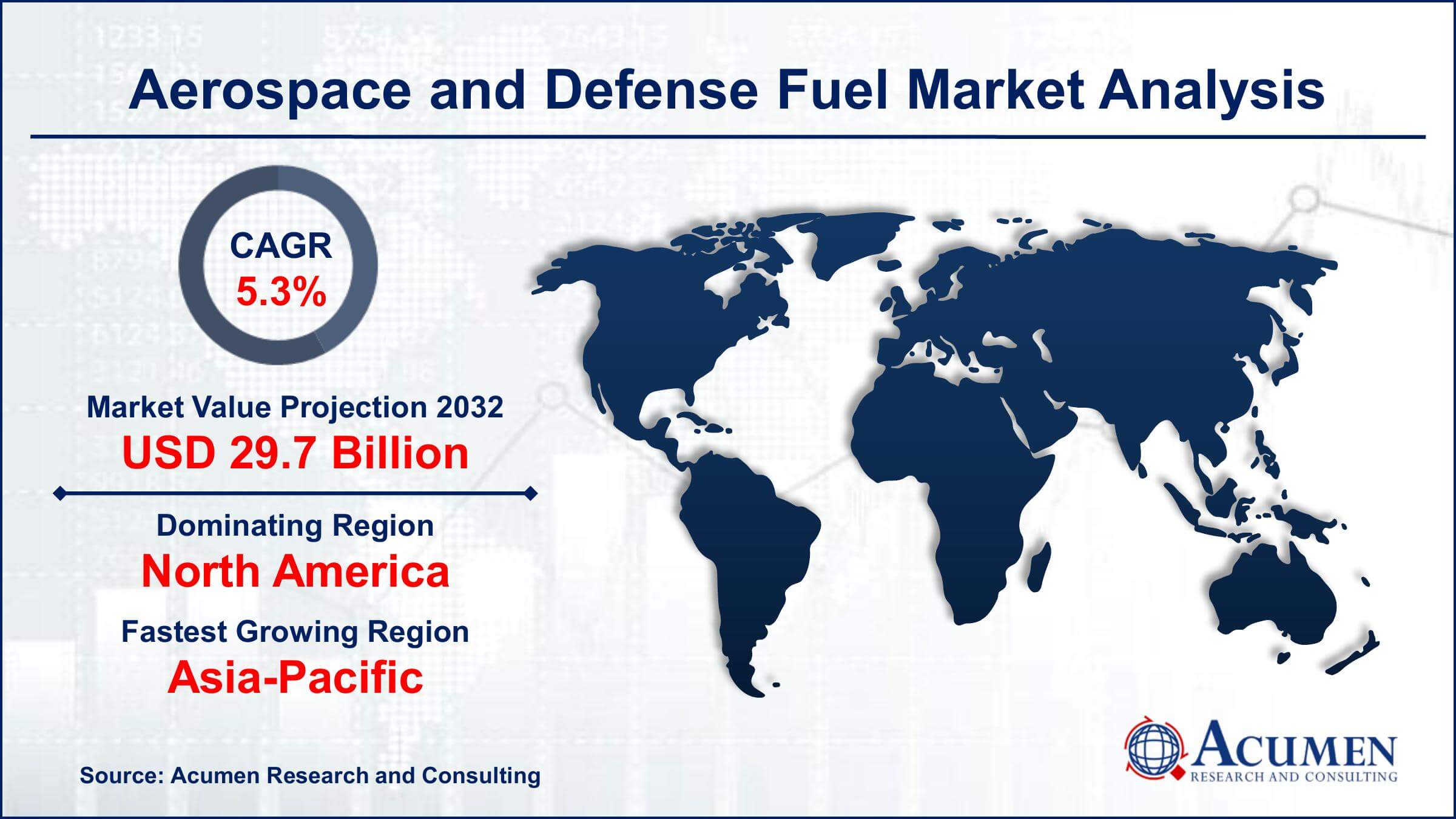

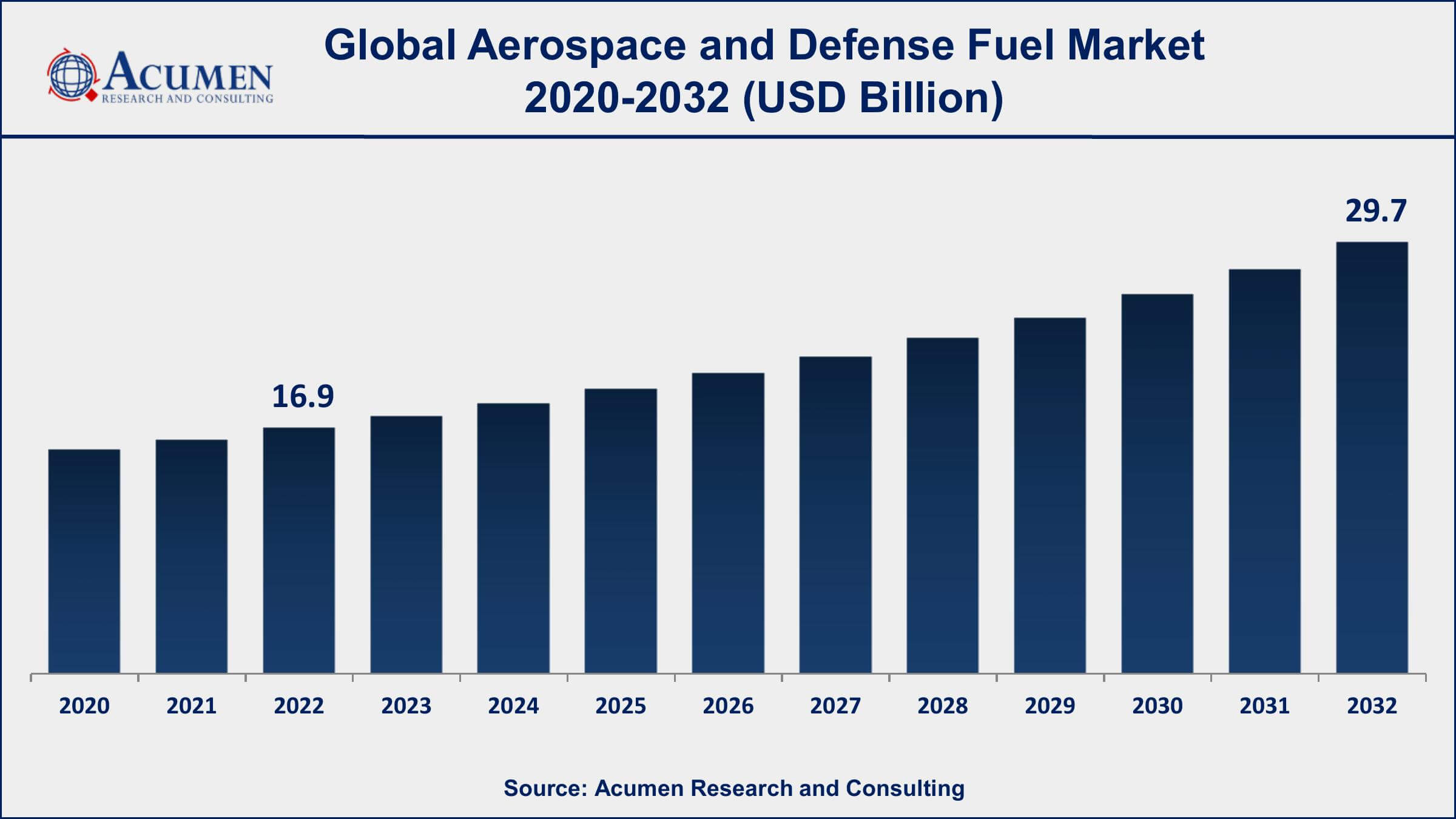

Aerospace and Defense Fuel Market Size accounted for USD 16.9 Billion in 2022 and is projected to achieve a market size of USD 29.7 Billion by 2032 growing at a CAGR of 5.3% from 2023 to 2032.

The Global Aerospace and Defense Fuel Market Size accounted for USD 16.9 Billion in 2022 and is projected to achieve a market size of USD 29.7 Billion by 2032 growing at a CAGR of 5.3% from 2023 to 2032. Increasing defense spending by various governments, coupled with the rising demand for air travel and the expansion of the global aviation industry, are the major factors driving the aerospace and defense fuel market growth. In addition, the adoption of new and advanced technologies for fuel-efficient engines is also expected to boost the aerospace and defense fuel market value in the coming years.

Aerospace and Defense Fuel Market Report Key Highlights

Aerospace and defense fuel is a specialized petroleum-based fuel used to drive an aircraft. Aerospace and defense fuel is maintained at a relatively higher quality than other fuels used in moderately critical applications including road transport or heating. This fuel often contains fuel additives to enhance its overall efficiency and reduce the risk of explosion or icing owing to high temperatures. Most aerospace and defense fuels are the types of petroleum fuels that are generally used in jet turbine engines or automotive/generator engines with spark plugs. It is also used widely in aircraft with diesel engines. Aerospace and defense fuel is generally of four types namely avgas, jet fuel, CNG, and others. Avgas also known as aviation gasoline is largely used in internal combustion engines with spark plugs.

Global Aerospace and Defense Fuel Market Trends

Market Drivers

Market Restraints

Market Opportunities

Aerospace and Defense Fuel Market Report Coverage

| Market | Aerospace and Defense Fuel Market |

| Aerospace and Defense Fuel Market Size 2022 | USD 16.9 Billion |

| Aerospace and Defense Fuel Market Forecast 2032 | USD 29.7 Billion |

| Aerospace and Defense Fuel Market CAGR During 2023 - 2032 | 5.3% |

| Aerospace and Defense Fuel Market Analysis Period | 2020 - 2032 |

| Aerospace and Defense Fuel Market Base Year | 2022 |

| Aerospace and Defense Fuel Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Naseba, Royal Dutch Shell Plc., Chevron Corporation, Reliance Industries Limited, Essar, HPCL, BP p.l.c., Eaton, Exxon Mobil Corporation, Total, Indian Oil Corporation Ltd., Bharat Oman Refineries Limited, and China Petrochemical Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The formulation of avgas is different as compared to mogas, also known as motor gasoline, which is used in military vehicles and cars. Avgas is formulated for its safety, stability, and predictable and changeable performance across a wide scope of environments. Avgas is ordinarily used in aircraft which use Wankel or reciprocating engines. While jet fuel is a clean fuel that is based on either a naphtha-kerosene blend or unleaded kerosene, it is like diesel fuel and is typically used in either turbine engines or compression ignition engines. Jet fuel powers commercial aircraft and is a mixture of kerosene that burns at 49°C. Kerosene-based aircraft fuel possesses a relatively higher flash point as compared to gasoline-based aircraft fuel. This, in turn, requires a relatively higher temperature for its ignition. Jet fuel is a highly efficient fuel and in case it fails any quality test to be used in a jet aircraft, it can be used in less demanding applications such as railroad engines. Moreover, liquefied natural gas or compressed natural gas is some other fuel used in an aircraft. Turbofans can be operated by different types of fuels such as natural gas. The main advantage of using natural gas over jet fuel is its lower cost.

An increase in the world economy, increasing prominence of cheaper airlines, and rising demand for aircraft, especially from emerging countries like India and China are some key factors that are expected to boost the global aerospace and defense fuel market. Moreover, increasing passenger traffic by around 10% to 12% per annum is complementing the demand for aerospace fuel. Also, expansion in production plans in aircraft manufacturing is another major factor anticipated to drive the global aerospace and defense fuel market growth during the forecast period. In addition, the focus on expansion in the production of aircraft by key market players such as Airbus and Boeing is projected to increase the demand for aerospace and defense fuel. Increasing enhancements in global financial conditions coupled with the availability of low-cost airlines, especially in Asia and the Middle East are some other major aspects likely to foster the demand for aerospace and defense fuel over the forecast period. However, stringent government regulations and increasing awareness of the reduction of carbon emissions are some key challenges in the global aerospace and defense fuel market.

Aerospace and Defense Fuel Market Segmentation

The global aerospace and defense fuel market segmentation is based on product type, application, and geography.

Aerospace and Defense Fuel Market By Product Type

According to an aerospace and defense fuel industry analysis, the avgas segment accounted for the largest market share in 2022. Avgas, or aviation gasoline, is a specialized type of fuel used in piston-engine aircraft. Avgas is primarily used in small general aviation aircraft, such as single and twin-engine piston planes. The fuel is used to power the aircraft's internal combustion engines and typically has a higher octane rating than automotive gasoline. Avgas is typically produced in low volumes compared to other aviation fuels and is subject to more stringent quality standards and safety regulations. In recent years, the demand for avgas has remained relatively stable due to the continued use of piston-engine aircraft in the general aviation market. In addition, there is a growing focus on the development of alternative aviation fuels, including biofuels and synthetic fuels, that have the potential to reduce emissions and improve the sustainability of the aviation industry.

Aerospace and Defense Fuel Market By Application

According to the aerospace and defense fuel market forecast, the aircraft segment is predicted to increase significantly in the coming years. The demand for aerospace and defense fuels in the aircraft application segment is driven by the growth of the aviation industry, as well as the increasing demand for military aircraft. The aviation industry has experienced steady growth over the past several years, and this trend is expected to continue in the coming years. As a result, the demand for aerospace and defense fuels is also expected to grow. One important factor in this market is the need for fuel efficiency. Aircraft manufacturers are continuously developing new technologies and materials to increase the fuel efficiency of their aircraft, which in turn reduces the demand for fuel. This has led to the development of new, more efficient fuels, such as biofuels, which are becoming increasingly popular in the aviation industry.

Aerospace and Defense Fuel Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Aerospace and Defense Fuel Market Regional Analysis

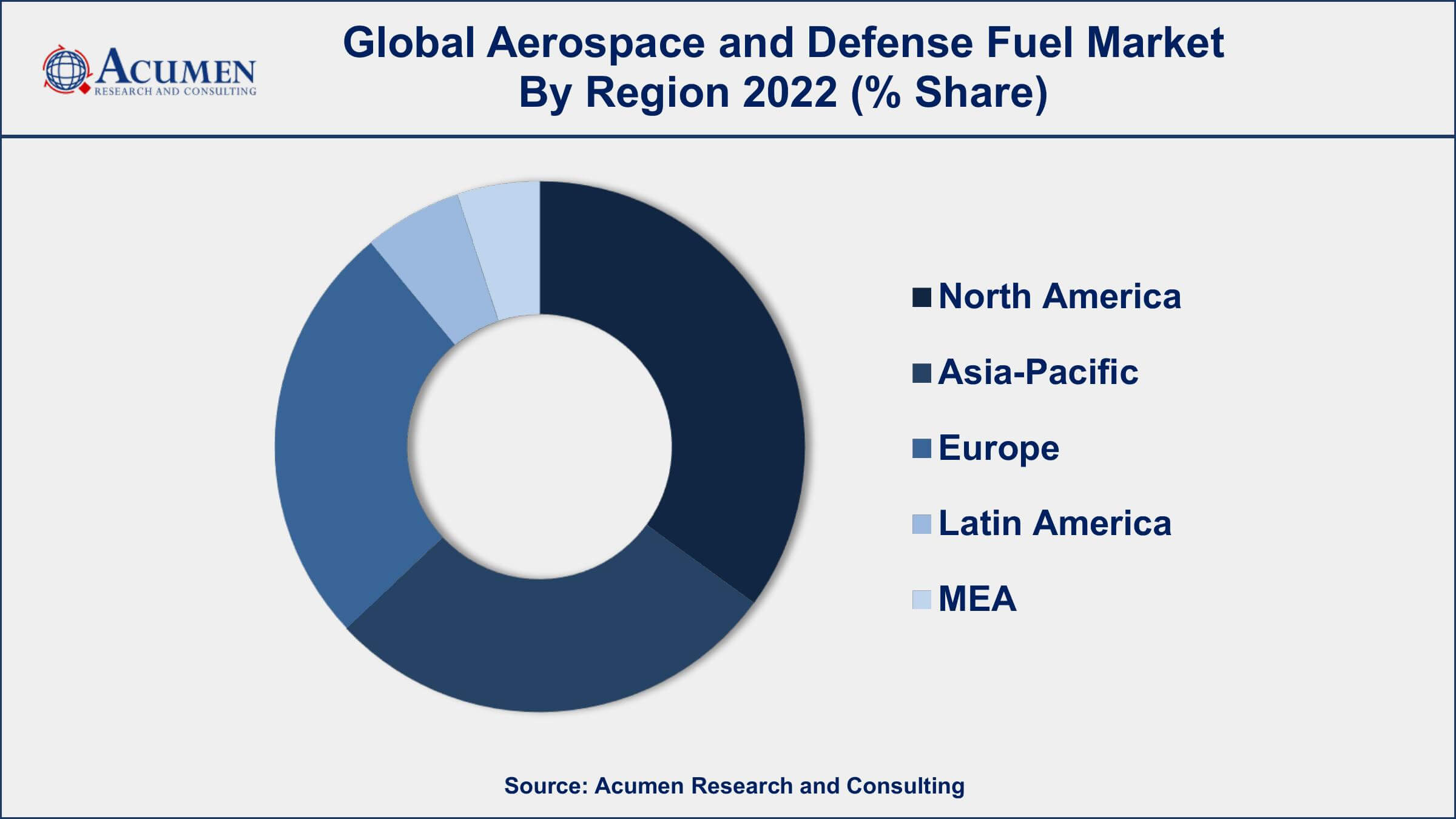

North America is the leading region in the aerospace and defense fuel market for a variety of reasons. One of the key factors is the region's large and established aviation industry. North America is home to many of the world's largest and most well-known airlines, as well as some of the largest defense contractors. This creates a significant demand for aerospace and defense fuels, which in turn has led to the development of a robust and sophisticated supply chain for these products.

Additionally, North America is home to many of the world's largest oil and gas companies, which are major players in the production and distribution of aviation fuels. These companies have invested heavily in developing the infrastructure necessary to produce and transport these fuels, which has helped to ensure a reliable supply of high-quality products. Furthermore, the region's focus on technological innovation has helped to drive the development of new and more efficient fuels. North American companies have been at the forefront of the research and development of alternative fuels, such as biofuels and synthetic fuels, which offer significant environmental benefits and help to reduce the industry's reliance on traditional fossil fuels.

Aerospace and Defense Fuel Market Player

Some of the top aerospace and defense fuel market companies offered in the professional report include Naseba, Royal Dutch Shell Plc., Chevron Corporation, Reliance Industries Limited, Essar, HPCL, BP p.l.c., Eaton, Exxon Mobil Corporation, Total, Indian Oil Corporation Ltd., Bharat Oman Refineries Limited, and China Petrochemical Corporation.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

September 2018

March 2025

April 2025

March 2023