April 2021

AI Data Center Market (By Component: Hardware, Software, Services; By Deployment: On-Premises, Cloud-Based, Hybrid; By Data Center Type: Enterprise Data Centers, Colocation Data Centers, Hyperscale Data Centers, Edge Data Centers, Modular & Portable Data Centers; By Application: AI Model Training, AI Model Inference, Big Data Analytics, Computer Vision Processing, NLP, Autonomous Systems & Robotics, Cybersecurity & Fraud Detection; By Industry Vertical: IT & Telecom, BFSI, Healthcare, Retail & E-commerce, Manufacturing, Government & Defense, Energy & Utilities, Media & Entertainment, Automotive, Others) - Global Industry Analysis, Size, Share, Trends and Forecast 2026 to 2035

The global AI data center market size accounted for USD 17.42 billion in 2025 and is estimated to reach around USD 203.58 billion by 2035 growing at a CAGR of 27.9% from 2026 to 2035.

The AI data center market is expanding rapidly due to a tremendous increase in AI use across various industries, including healthcare, finance, automotive, and e-commerce. Due to the large amount of information generated by IoT devices, social media platforms, enterprise applications, and other sources, AI Data Centers provide extremely efficient computing infrastructures that provide the necessary tools for managing, analyzing, and storing these vast amounts of data. In addition, continuing development of specialized hardware, such as GPUs, TPUs, and FPGAs, will lead to an increased need for specialized data centers with the capacity to process data at high speeds while minimizing latency, thereby increasing both the speed of AI model training and speed of AI model inference.

Another major driver of AI data center market is an increasing trend toward the use of cloud-based AI solutions, along with the growth of edge computing technologies. Many businesses and providers of cloud computing technology are investing heavily to create facilities that are AI-Optimized to keep operating costs as low as possible, make its facilities as energy-efficient as possible, and be able to support and meet the sustainability goals of its customers. In addition, there are significant numbers of initiatives and incentives being offered by governments in order to support the advancement of AI development, digital transformation of skills/resources, and smart city development initiatives, which will also contribute to the overall expansion of this sector and related areas. Finally, the growing use of predictive maintenance technology and on-board energy optimization technology in conjunction with automated data center management systems for AI data center management is driving additional demand and growth by enhancing the overall operational efficiency of the operator.

The AI data center market is the sector responsible for the design, construction, and operation of data centers that are optimized to meet the needs of AI workloads. An AI Data Center combines high-performance computing (HPC) with graphics processing units (GPUs), AI accelerators, and advanced networking technologies to provide efficient processing power for large volumes of data associated with machine learning and deep learning activities. This allows enterprise and cloud service providers and research institutions a means of meeting their respective business needs.

Increasing AI Adoption Across Industries

Surge in Data Generation and Cloud Computing

High Capital and Operational Costs

Energy Consumption and Sustainability Challenges

Development of Energy-Efficient and Green AI Data Centers

Expansion in Emerging Markets

| Area of Focus | Details |

| AI Data Center Market Size 2025 | USD 17.42 Billion |

| AI Data Center Market Forecast 2035 | USD 203.58 Billion |

| AI Data Center Market CAGR During 2026 - 2035 | 27.9% |

| AI Data Center Market Analysis Period | 2021 - 2035 |

| AI Data Center Market Base Year | 2025 |

| AI Data Center Market Forecast Data | 2026 - 2035 |

| Segments Covered | By Component, By Deployment, By Data Center Type, By Application, By Industry Vertical, and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amazon Web Services, Inc., Arista Networks, Inc., Cisco Systems, Inc., Dell Technologies, Google LLC, Hewlett Packard Enterprise Development LP, Hitachi Vantara LLC, Intel Corporation, International Business Machines Corporation, Juniper Networks, Inc., Microsoft Corporation, and NVIDIA Corporation. |

| Report Coverage | Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The worldwide market for AI data center is split based on component, deployment, data center type, application, industry vertical, and geography.

Hardware is currently the leading component segment in the AI data center market due to massive demand for high performance graphics processing unit (GPU), tensor processing unit (TPU), application specific integrated circuits (ASIC), sophisticated server, liquid cool Technologies used to perform Artificial Intelligence (AI) training and inference workloads. The growth in generative AI and LLM development has quickened the pace of investments in hardware and increased the need for compute-intensive infrastructures to perform extensive data sets and complex deep learning operations.

| Component | Market Share (%) | Key Highlights |

| Hardware | 62% | Dominant due to high demand for GPUs, AI accelerators, servers, and advanced cooling needed for large-scale model training and inference. |

| Software | 18% | Growth driven by AI orchestration tools, workload optimization platforms, and data management systems. |

| Services | 20% | Fastest growing due to rising demand for integration, consulting, managed AI operations, and AI-as-a-Service deployment support. |

Services are the fastest growing segment of AI data center market, due to an increasing dependence on consulting, integration and management services to help businesses optimize AI workloads. Due to the complexities associated with deploying and managing an AI-ready infrastructure, businesses are relying increasingly on service providers for system integration, workload optimization, continuous monitoring and support in scaling their AI investments.

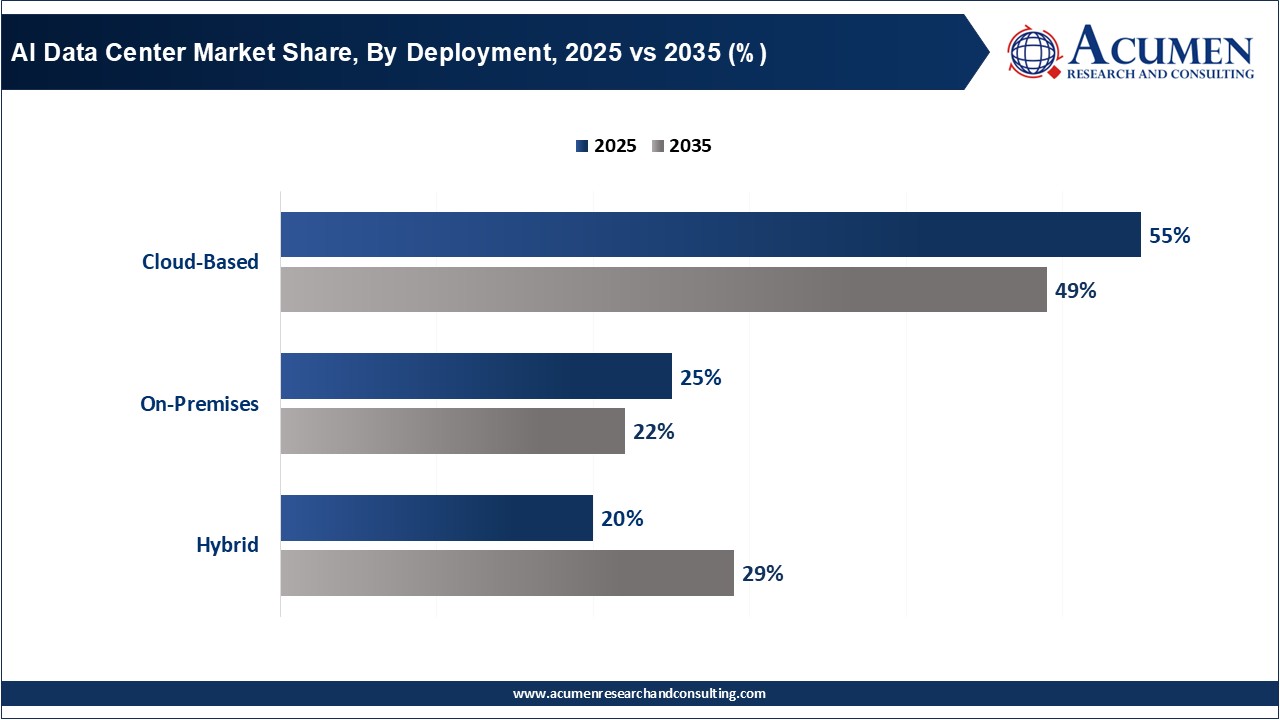

The cloud-based deployment is currently the dominant market, supported by a scalable infrastructure provided by hyperscalers such as AWS, Google Cloud Platform, and Microsoft Azure. On-demand AI compute capabilities, specialized hardware accelerators, and much built-in AI tooling enable organizations to reduce their large up-front investment in capital. By enabling organizations to quickly scale their training computing resources for LLMs and AI apps, cloud has become the favoured deployment model for companies around the world.

| Deployment | Market Share (%) | Key Highlights |

| Cloud-Based | 55% | Leads due to scalable access to AI compute, reduced capex, and strong adoption from AWS, Google Cloud, and Azure. |

| On-Premises | 25% | Preferred for data-sensitive industries needing full control, security, and compliance. |

| Hybrid | 20% | Fastest growing as enterprises combine on-prem control with cloud scalability for flexible AI workload management. |

The hybrid deployment is the fastest-growing segment, due to organisations are facing pressure to adopt both the flexibility of cloud and the security and compliance of on-premises infrastructures in their business processes. Organisations that operate within regulated industry sectors of the economy are increasingly using hybrid architectures that allow sensitive data to remain on-prem while using the cloud for large-scale AI training and analytics. The hybrid deployment offering provides benefits associated with operational control, improved cost efficiencies, and added agility to the infrastructure, leading to rapid growth in adoption rates for both mid-tier and larger enterprise organisations alike.

The hyperscale data center segment dominates the market, due to companies are investing billions of dollars in building large AI-optimized facilities to support generative AI, cloud computing and enterprise AI workloads. These types of facilities allow for extremely high processing power, dense clusters of GPUs, advanced cooling solutions and highly automated operations that form the foundation of the global infrastructure for AI technology. The ability of these facilities to store and process multi-petabyte data sets and perform large-scale training on AI models is what keeps them well-positioned at the forefront of the marketplace.

| Data Center Type | Market Share (%) | Key Highlights |

| Hyperscale Data Centers | 48% | Dominant due to massive AI workloads, large GPU clusters, and continuous investments by global tech giants. |

| Enterprise Data Centers | 18% | Used by corporations requiring dedicated AI infrastructure for internal operations and data security. |

| Colocation Data Centers | 14% | Growth driven by demand for outsourced infrastructure with high uptime and reduced operational costs. |

| Edge Data Centers | 12% | Fastest growing due to low-latency needs for IoT, autonomous systems, and real-time analytics. |

| Modular & Portable Data Centers | 8% | Increasing adoption for rapid deployment and scalability in remote and temporary AI workloads. |

The edge data center segment is growing the fastest, due to increased demand for real-time AI Processing in applications such as autonomous vehicles, IoT analytics, smart cities and robotics. By processing data where it is generated, edge deployments reduce latency and increase responsiveness and reliability in mission critical AI applications. The rapid expansion of edge data centers across all industries as the need for low latency inference increases.

AI model training is the dominant segment, due it requires very high amounts of processing power (compute), large groups of Graphics Processing Units (GPU), and very high-speed connections between data centers to train Large Language Models (LLM), computer vision systems, and deep learning networks. As AI continues to rapidly evolve, the demand for AI training environments has surged as multimodal and generative technology develops.

| Application | Market Share (%) | Key Highlights |

| AI Model Training | 42% | Dominant due to extremely compute-intensive workloads, LLM development, and deep learning training demands. |

| AI Model Inference | 20% | Growth supported by real-time AI applications across enterprises, retail, and telecom. |

| Big Data Analytics | 15% | Driven by large-scale data processing requirements for insights, automation, and forecasting. |

| Computer Vision Processing | 10 | Used in surveillance, manufacturing automation, autonomous vehicles, and quality control systems. |

| Natural Language Processing (NLP) | 8% | Fastest growing due to explosion of generative AI, chatbots, LLMs, and conversational AI deployments. |

| Autonomous Systems & Robotics | 3% | Growing demand from automotive, smart factories, and defense applications. |

| Cybersecurity & Fraud Detection | 2% | Adoption rising for real-time threat detection using AI-driven models. |

Natural Language Processing (NLP) is the fastest-growing segment, driven by widespread adoption of chatbots, voice assistants, generative AI as well as large language models. Companies deploy NLP solutions in usage areas such as providing customer service and generating content, automating tasks and also analyzing data, with enterprises needing high-performance infrastructure of an AI Data Centre. Because of the vast increase in the number of companies deploying conversational AI and the increased use of LLMs, the application area for NLP has expanded rapidly.

The IT & Telecom is the dominant segment, supported by AI data centers, with cloud providers and telecoms relying on these infrastructures to enable to provide network automation, predictive analytics, 5G services, and high-volume cloud computing through their global digital operations. Companies in this vertical have focused heavily on investing in AI-enhanced infrastructure for the purpose of enabling global digital businesses and maintaining their leadership position in the marketplace.

| Industry Vertical | Market Share (%) | Key Highlights |

| IT & Telecom | 27% | Dominates due to cloud computing growth, 5G expansion, network automation, and large-scale AI service demand. |

| BFSI | 14% | Driven by AI adoption in fraud detection, risk modeling, and algorithmic trading. |

| Healthcare | 12% | Fastest growing due to AI in diagnostics, imaging, genomics, and predictive care. |

| Retail & E-commerce | 10% | Growth based on AI for personalization, recommendation engines, and demand forecasting. |

| Manufacturing | 9% | Supported by industrial automation, predictive maintenance, and robotics. |

| Government & Defense | 8% | Increased spending on AI surveillance, cybersecurity, biometrics, and smart infrastructure. |

| Media & Entertainment | 7% | Rising AI usage in content generation, VFX, streaming optimization, and personalization. |

| Automotive | 7% | Driven by autonomous systems, ADAS, and vehicle data analytics. |

| Energy & Utilities | 6% | Adoption for grid optimization, predictive maintenance, and renewable integration. |

The healthcare is the fastest-growing segment, due to the increasing adoption of artificial intelligence to perform functions such as diagnosing patient disease, providing medical imaging, conducting genomic analyses, monitoring patients remotely through devices, and discovering new drugs. The move toward more accurate predictions in the area of medicine and the digitization of medical records has created an extremely large demand for processing this data.

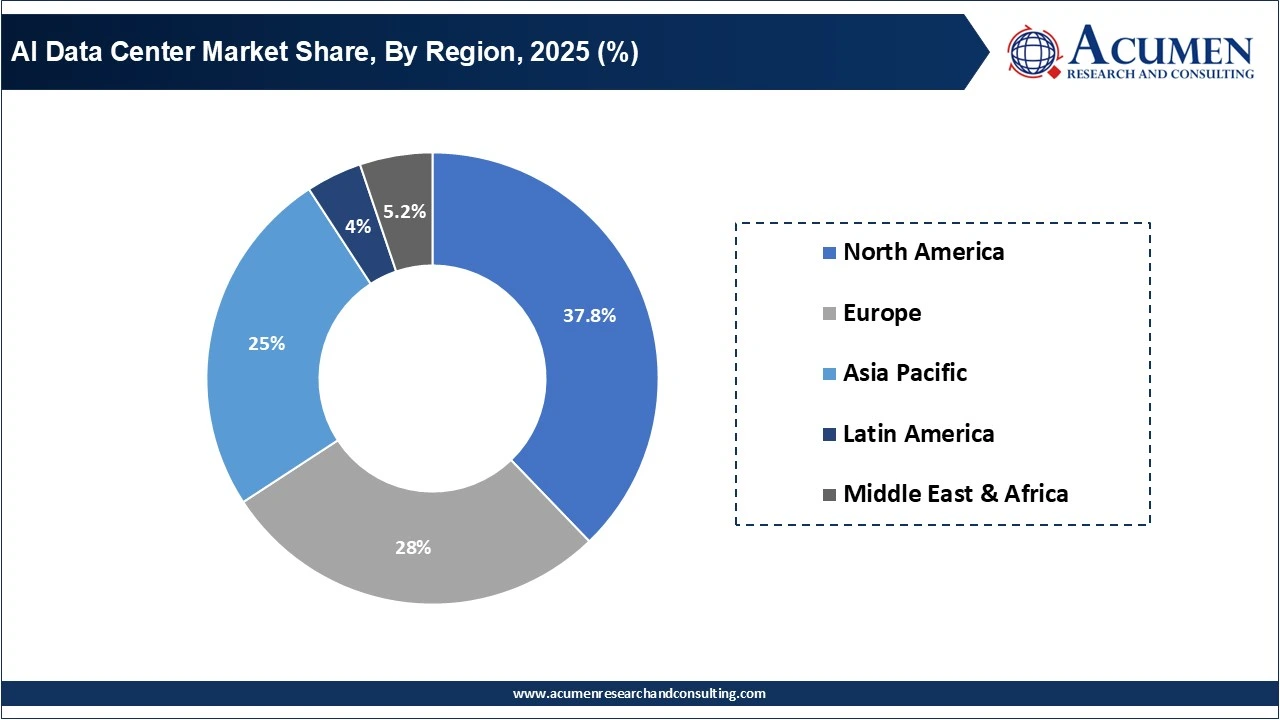

North America currently dominates the AI data center market, driven by strong digital infrastructure, a significant number of hyperscaler cloud service providers, and a rapid adoption of AI technology across numerous industries. There is currently a trend towards hyperscale data centers being developed by major technology companies in the U.S.A. such as Amazon, Google, Microsoft, Meta, and NVIDIA who continue to invest heavily in building large, AI-optimized data centers in order to support their generative AI services, LLM training and cloud AI services. The North American region has a high level of mature technical ecosystems (technology clusters), high levels of AI R&D investment, good regulatory frameworks and the early deployment of modern hardware such as GPUs, accelerators, and liquid cooling. The combination of the above factors creates the conditions necessary for North America to continue as the global center of excellence for AI training infrastructure and enterprise AI workloads.

Asia Pacific is the fastest-growing region in the AI data center market, due to rapidly developing digital transformations, the rapid expansion of cloud infrastructure, and government-supported programs designed to promote the adoption of AI. Countries such as China, India, Korea, Japan and Singapore are experiencing a huge increase in demand for AI-enabled applications in e-commerce, FinTech, manufacturing, telecommunications, smart cities, and many other industries. The Asia Pacific Region has substantial investments in building either hyperscale or edge data centers to accommodate the growing needs of automation, AI inference, and real-time analytics capabilities. The combination of growing Internet penetration in Asia Pacific, increasing numbers of startups, and the growing number of enterprises that have adopted AI-supported services will continue to accelerate the overall growth of the Asia Pacific region, making it the fastest-growing and most dynamic market in the world for AI data centre infrastructure.

By Component

By Deployment

By Data Center Type

By Application

By Industry Vertical

By Region

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2021

September 2023

October 2023

January 2023