December 2024

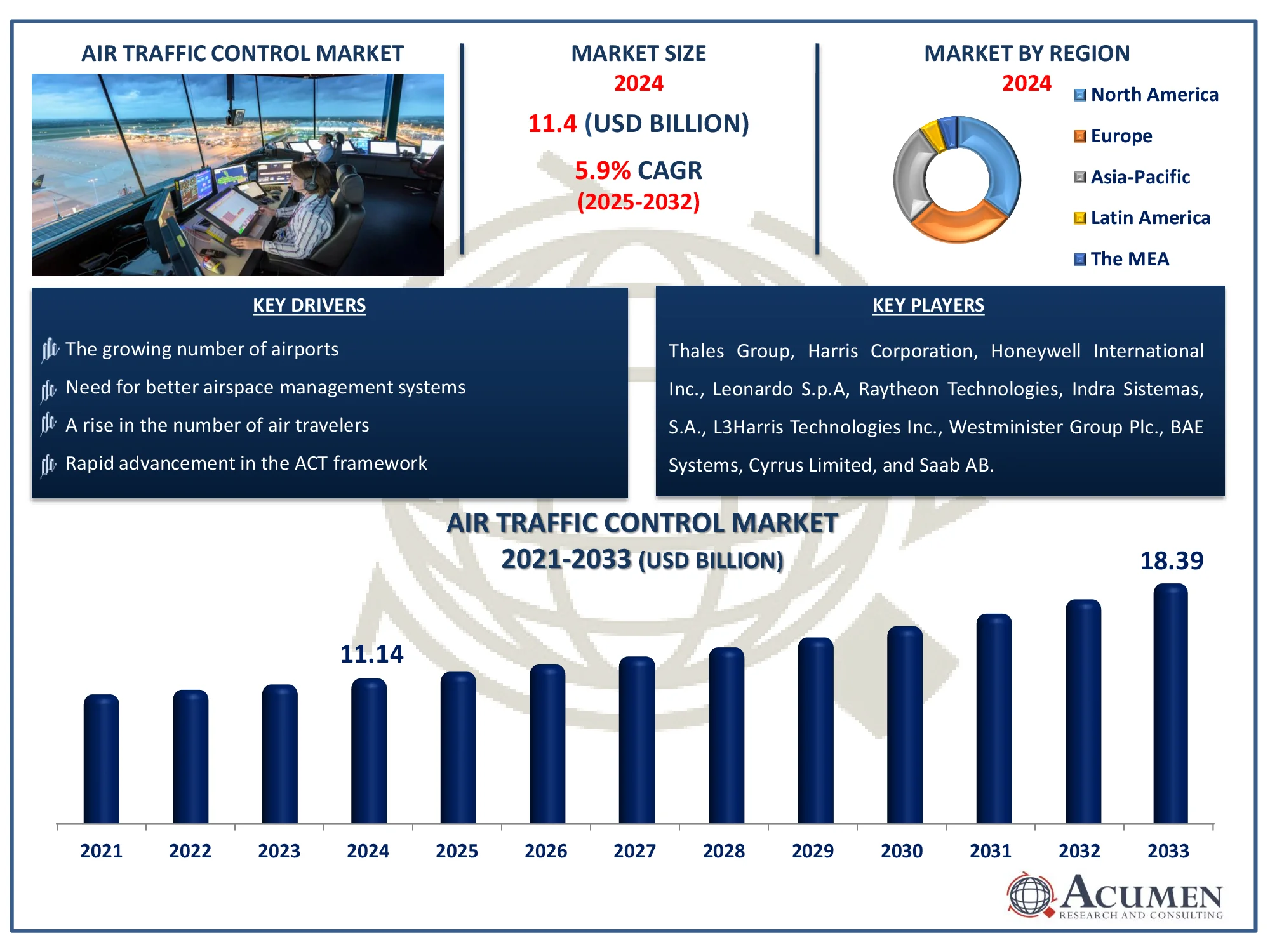

Air Traffic Control Market Size accounted for USD 11.14 Billion in 2024 and is estimated to achieve a market size of USD 18.39 Billion by 2033 growing at a CAGR of 5.9% from 2025 to 2033.

The Global Air Traffic Control Market Size accounted for USD 11.14 Billion in 2024 and is estimated to achieve a market size of USD 18.39 Billion by 2033 growing at a CAGR of 5.9% from 2025 to 2033.

Air traffic control (ATC) is necessary for a safe, efficient, and effective aviation system as it keeps planes effectively separated from one another to prevent collisions, but it also serves to organize the flow of air traffic. Surveillance (confirmation of where planes are), communications (passing data and instructions between pilots and controllers), and navigation are the three essential functions of air traffic control (assisting pilots to direct their plans along safe paths). Rising air passenger traffic will drive the air traffic control market growth. Furthermore, the increasing adoption of machine learning and IoT technologies at airports is boosting the air traffic control market value in the coming years.

|

Market |

Air Traffic Control Market |

|

Air Traffic Control Market Size 2024 |

USD 11.14 Billion |

|

Air Traffic Control Market Forecast 2033 |

USD 18.39 Billion |

|

Air Traffic Control Market CAGR During 2025 - 2033 |

5.9% |

|

Air Traffic Control Market Analysis Period |

2021 - 2033 |

|

Air Traffic Control Market Base Year |

2024 |

|

Air Traffic Control Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Airspace, By Offering, By Investment Type, By Sector, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Thales Group, Harris Corporation, Honeywell International Inc., Leonardo S.p.A, Northrop Grumman Corporation, Raytheon Technologies, Indra Sistemas, S.A., L3Harris Technologies Inc., Westminister Group Plc., BAE Systems, Cyrrus Limited, and Saab AB. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Several challenges are putting pressure on the ecosystem, which includes a growing diversity of aerospace users and business models, innovative new technologies that necessitate innovative integrations, aging and possibly cyber-insecure infrastructure, and so on. The National Airspace System (NAS) predicts that the scope of air traffic control (ATC) will expand exponentially in the coming years, necessitating new training requirements and, possibly, a paradigm shift in mindset. With more automation and artificial intelligence (AI) tools, future NAS operations will provide safe and efficient access to a diverse set of users. There will also be a strong emphasis on airspace management or air traffic management (ATM), with operational approvals based on performance requirements and risk levels. Furthermore, in order to improve overall operational efficiency for users and air navigation service providers (ANSPs), the current ATM infrastructure should be upgraded to fully incorporate technological advances. Cutting-edge capabilities such as digitization, digital twins, data analytics, 5G, Wi-Fi, Internet of Things (IoT), machine learning, and precision tracking are driving the market growth.

According to the European Commission's report, the European Commission is proposing an upgrade to the Single European Sky regulatory framework that focuses on the European Green Deal. The primary goal is to modernize European airspace management in order to establish more sustainable and efficient flight paths. This reduces air transport emissions by 10% in the long run. The European Green Deal, combined with new technological advancements involving the increased use of drones, has placed digitalization and decarbonization of transportation at the heart of EU aviation policy. As a result, the Single European Sky serves as a gateway to European airspace that is optimally used to fuel modern technologies. Such factors have had a positive impact on the global air traffic control market's growth.

According to a report released by the United States Department of Transportation, there are efforts underway to make flights more efficient, including free flight, and are supported by commercial air carriers, for whom poor weather or crowded skies result in significant financial losses. Sustainability Master Plans fully integrate sustainability into the long-term planning of an airport. The primary goal of the Sustainability Master Plan is to identify sustainability objectives that will reduce environmental impact, realize economic benefits, and improve community relations. FAA programs such as the Noise Compatibility Program and the Voluntary Airport Low Emissions (VALE) Program assist airports in meeting these objectives.

Air Traffic Control Market Segmentation

Air Traffic Control Market SegmentationThe worldwide market for air traffic control is split based on airspace, offering, investment type, sector, application, and geography.

According to the air traffic control industry analysis, the air traffic control tower (ATCT) segment is expected to record the maximum share in the coming years responsible for the growth of the overall market. Takeoffs and all movement within the airport terminal control area are managed and handled directly by the air traffic control tower. As a result, the workload of the terminal air traffic controllers at the destination airport is significantly reduced. The flow control system is retained as air traffic controller staffing levels gradually increase, owing to a reduction in air traffic controller stress and workload on the ground, rather than in the air. Such factors have a positive impact on segmental growth, which ultimately contributes to ATC market growth.

According to the air traffic control market forecast, the hardware segment is the largest within market also the software and solution category is expected to grow the most during the estimated period. This surge is primarily driven by the growing need for real-time data processing, enhanced decision-making capabilities, and increased automation across air traffic management (ATM) systems. Software plays a vital role in integrating surveillance, communication, and navigation systems, allowing controllers to manage growing air traffic volumes more efficiently. Additionally, the rise of AI, machine learning, and cloud-based platforms is enabling predictive analytics and streamlined coordination between ground stations and airborne systems. As aviation authorities continue to modernize their operations, the demand for sophisticated, adaptive, and scalable software solutions is expected to accelerate significantly.

According to the investment type, the brownfield segment is predicted to increase significantly in the market over the next several years. A brownfield investment occurs when a firm or government organization purchases or rents old manufacturing facilities in order to begin a new manufacturing activity. In the context of air traffic control, this typically involves upgrading existing airport infrastructure with advanced ATC systems, enhancing operational efficiency, and reducing implementation costs. These projects also allow for faster deployment compared to new constructions, making them a preferred choice for expanding air traffic networks.

In terms of sector, the commercial segment is garnering substantial market attention in the air traffic control market forecast period. Commercial aircraft is a subset of civil aviation that includes scheduled airline services that use aircraft to transport cargo and passengers. As international tourism develops and becomes increasingly accessible to the general public, airline companies will want to expand their fleets, propelling the worldwide commercial aircraft market to outstanding growth in the ATC market forecast period.

In terms of application, the automation segment is predicted to rise significantly in the market over the next few years. This expansion can be ascribed to the growing global need for smart as well as green airports, as well as the rising demand for IoT-based solutions. Furthermore, the rising need for an interactive technology ecosystem fuels the expansion of the autonomous sector.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

North America dominated the air traffic control market in 2024, and this trend is expected to continue throughout the forecast period. Technological advancement greatly aids North American airports in controlling air traffic and is regarded as one of the most important factors contributing to the growth of the regional market. For example, Performance-Based Navigation (PBN) technology allows aircraft to fly precise routes. Apart from that, the Federal Aviation Administration (FAA) is the national airspace regulator, with powers delegated by the U.S. government. It is in charge of terminal airspace management at the local level. Once outside of terminal airspace, planes are managed by the FAA’s en route centers, which provide nationwide air traffic control services. Furthermore, airspace is managed at both the national and international levels. The NextGen initiative was established in the past to improve the efficiency of airspace use and management across North America. Furthermore, the FAA contributed through the NAS Plan, which outlines current strategies on how to use airspace more efficiently.

The Asia-Pacific, on the other hand, will have the fastest-growing CAGR in the air traffic control market forecast period. According to an IEEE report, demand for air transport in the Asia-Pacific region will skyrocket in the twenty-first century. This is due to the addition of new airports and the expansion of existing ones in Singapore, Hong Kong, Shanghai, and Korea. North Pacific traffic volumes are expected to be 2.9 times higher than the previous year. In order to deal with such air traffic, the new Communication, Navigation, Surveillance/Air Traffic Management (CNS/ATM) system via Multi-Function Transport Satellite (MTSAT) is required. Such factors have a positive impact on the growth of the Asia-Pacific regional market, which in turn contributes to the overall growth of air traffic control.

Some of the top air traffic control companies offered in our report include Thales Group, Harris Corporation, Honeywell International Inc., Leonardo S.p.A, Northrop Grumman Corporation, Raytheon Technologies, Indra Sistemas, S.A., L3Harris Technologies Inc., Westminister Group Plc., BAE Systems, Cyrrus Limited, and Saab AB.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

December 2024

August 2024

July 2023

February 2023