January 2025

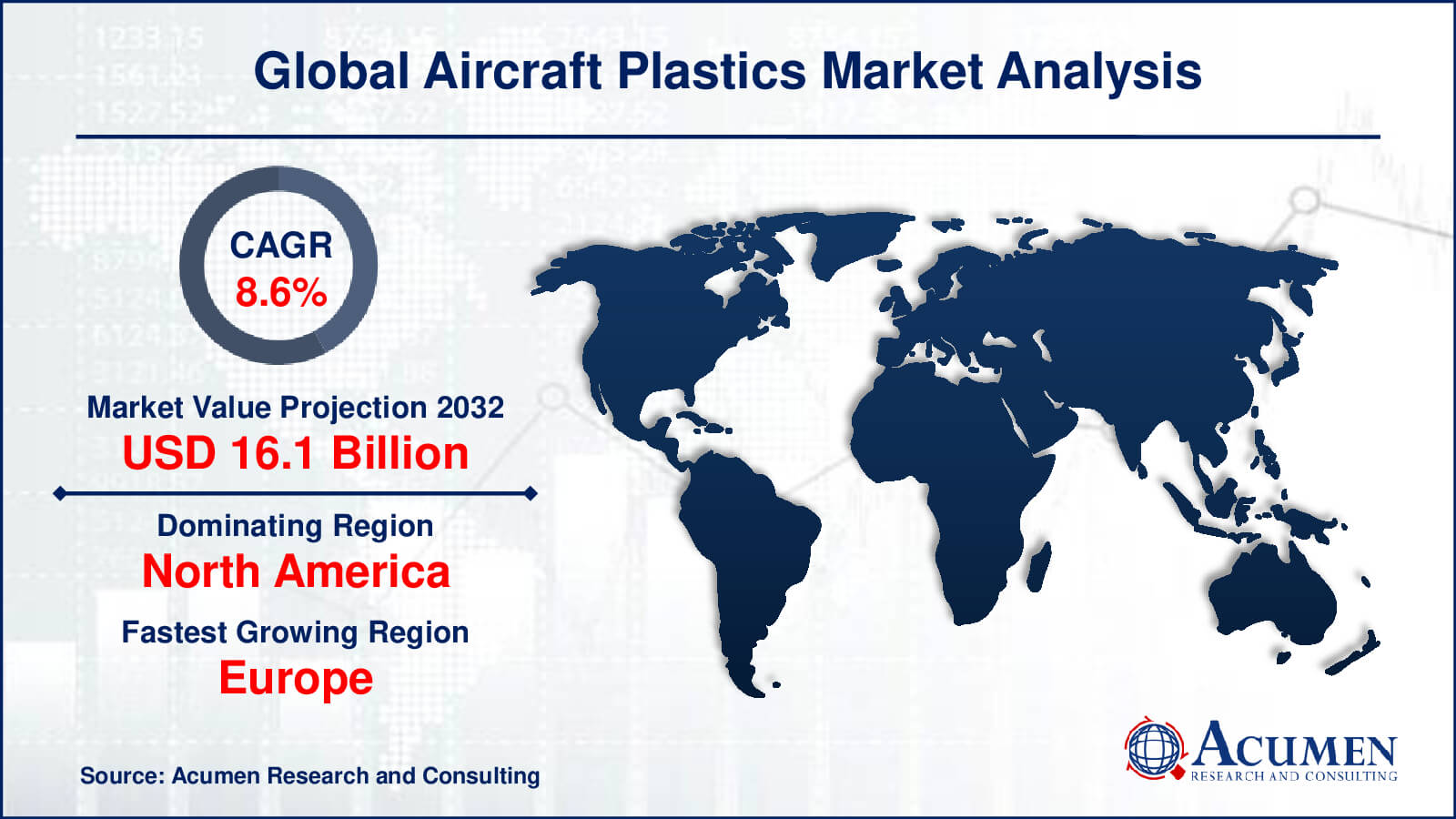

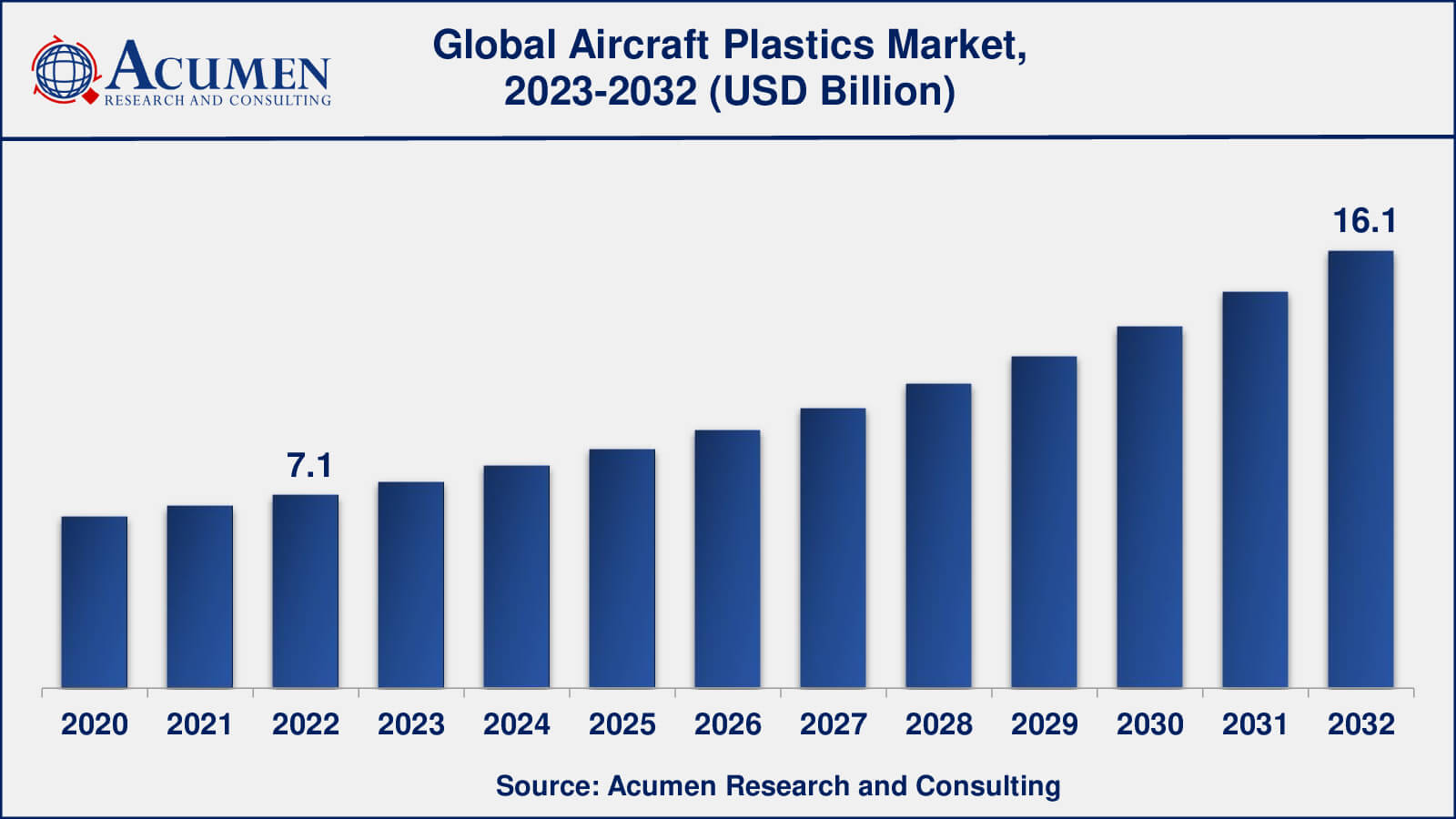

Aircraft Plastics Market Size collected USD 7.1 Billion in 2022 and is set to achieve a market size of USD 16.1 Billion in 2032 growing at a CAGR of 8.6% from 2023 to 2032.

The Global Aircraft Plastics Market Size collected USD 7.1 Billion in 2022 and is set to achieve a market size of USD 16.1 Billion in 2032 growing at a CAGR of 8.6% from 2023 to 2032.

Aircraft Plastics Market Report Statistics

Technical advancements in polymers have created a revolution in the aerospace industry. Aircraft plastics are becoming more ubiquitous in the aerospace industry due to their extra-beneficial characteristic properties. Aircraft plastics play an important role in the overall weight reduction of an aircraft, thus making it safer, lighter, and relatively more economical. The consumption of carbon fiber-reinforced plastics, glass-reinforced plastics, and aramid-reinforced plastic is expected to witness significant growth owing to its unique characteristics coupled with the rapidly growing aviation industry. Technical polymers contribute to a vital extent in making applications more competitive and efficient in various industrial fields. The aerospace industry creates high demands for polymers and other aircraft materials. The extraordinary properties of high-performance polymers and plastics include fire-resistant behavior and low weight. The nose, tailplane, aircraft fairing components, wings, airframe, and fuselage are made up of a large number of polymer materials. These materials have efficient mechanical and thermal properties coupled with better resistance to aging. Since plastics are deployed in making seats, cooling systems, lighting systems, on-board kitchen and oxygen supply systems, disposal systems, drinking water systems, and freight loading facilities, supplementary specifications including fungus test, FDA, and drinking water approvals are required from various organizations.

Global Aircraft Plastics Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Aircraft Plastics Market Report Coverage

| Market | Aircraft Plastics Market |

| Aircraft Plastics Market Size 2022 | USD 7.1 Billion |

| Aircraft Plastics Market Forecast 2032 | USD 16.1 Billion |

| Aircraft Plastics Market CAGR During 2023 - 2032 | 8.6% |

| Aircraft Plastics Market Analysis Period | 2020 - 2032 |

| Aircraft Plastics Market Base Year | 2022 |

| Aircraft Plastics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Plastic Type, By Process, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ensinger GmbH, Hexcel Corporation, SABIC, Toho Tenax Company Limited, Mitsubishi Heavy Industries Limited, Premium Aerotec, HITCO Carbon Composites Inc., Tech-Pool Plastics, Cytec Industries Inc. and Zoltec Companies Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Aircraft Plastics Market Growth Factors

Material engineering is crucial in aerospace engineering and this practice is defined by international bodies that manage and maintain standards for the processes and materials involved. Each extra pound added to a plane's weight, in turn, adds energy costs and thus money. The use of reinforcing fibers and polymers to achieve lightweight structures and fuel savings is a key factor driving the aircraft plastics market. Plastics are 50% lighter than other metal alloys such as aluminum and titanium and do not usually corrode. By using plastics in making aircraft structures, a high degree of freedom in design can be achieved. Plastics having customized sliding properties are mostly used under extreme conditions since transparent plastics are lighter and impact resistant as compared to glass.

Increasing growth of the aircraft industry, especially in Asia-Pacific and the Middle East is anticipated to fuel the growth of the global aircraft plastics market. Increasing air traffic in defense and commercial aerospace segments is a key factor responsible for the significant aircraft plastics market growth in Europe and North America. Moreover, government regulations for the use of aircraft plastics coupled with high financial support are some major reasons anticipated to drive the global aircraft plastics market. Rapid growth in the aerospace industry owing to its strength-to-weight ratio as well as the rising adoption of aircraft plastics in the aerospace industry are some of the key factors driving the aerospace plastics market. Various organizations like Environmental Protection Agency and Greenpeace impose regulations on the production and manufacturing processes of aircraft plastics which is a key factor hampering the growth of the global aircraft plastics market. In addition, the high cost of raw materials required in the manufacturing of aircraft plastics acts as a major limiting factor to the growth of the global aircraft plastics market. Also, strict regulations for petro-based polymer products are expected to hinder the availability of raw materials. Various, aircraft manufacturers use thermoplastic composites and metal alloys in aircraft structures to decrease fuel emissions and ensure passenger comfort.

Aircraft Plastics Market Segmentation

The worldwide aircraft plastics market is categorized based on plastic type, process, application, end-use, and geography.

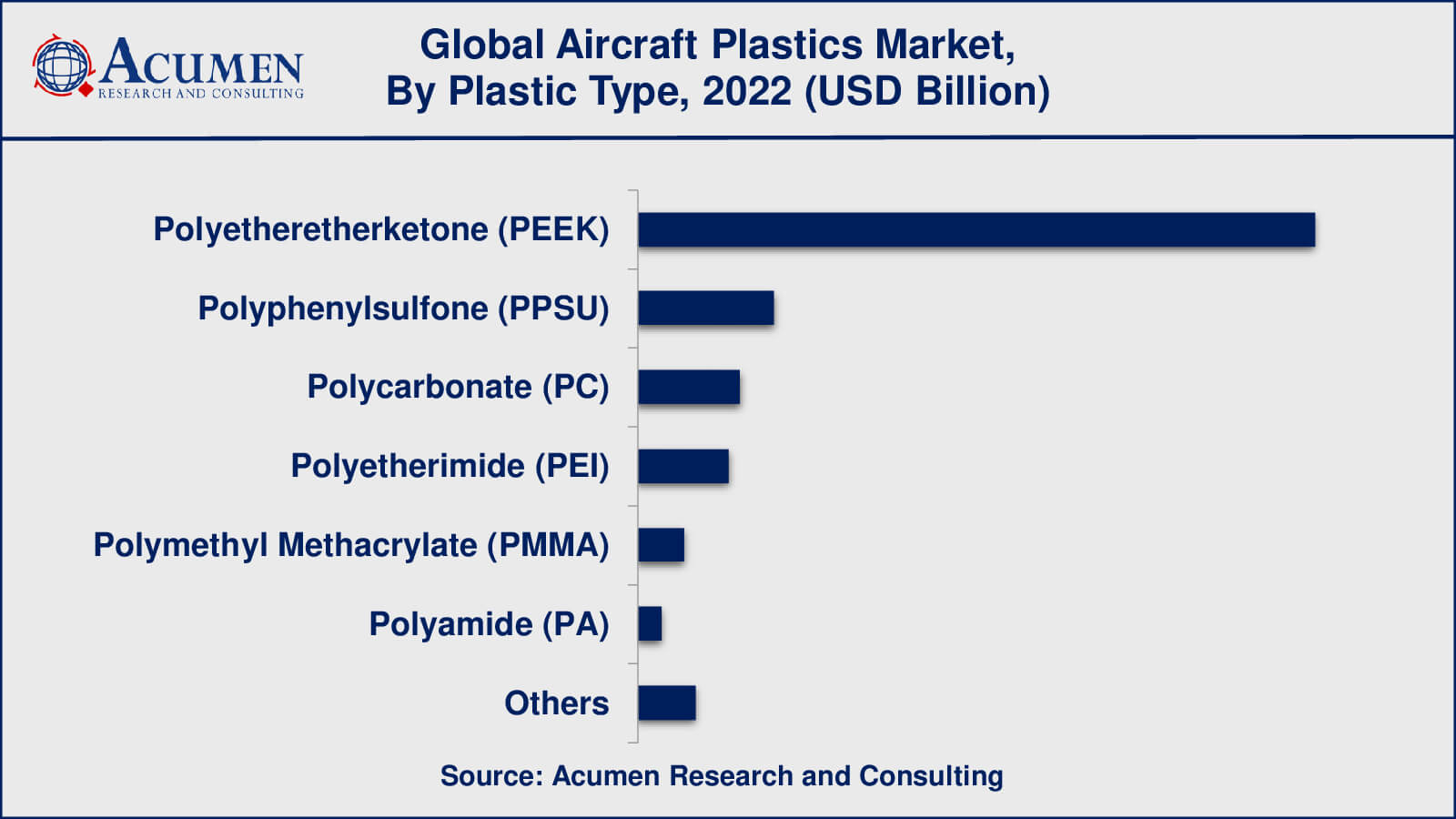

Aircraft Plastics Market By Plastic Type

According to the aircraft plastics market forecast, polyetheretherketone (PEEK) is expected to gather largest market share from 2023 to 2032. This is due to its high strength, stiffness, and resistance to heat and chemicals. PEEK is widely used in a wide range of applications, including structural components, engine parts, and electrical insulation. Polycarbonate (PC) and Polyetherimide (PEI) are two other plastics commonly used in the aircraft plastics market because of their high strength and resistance to impact and temperature extremes. Polyphenylsulfone (PPSU) is becoming increasingly popular in aircraft interiors due to its high impact resistance, chemical resistance, and low smoke and toxicity. Polymethyl Methacrylate (PMMA) is used for aircraft windows and canopies due to its high optical clarity and impact resistance, whereas Polyamide (PA) and PolyPhenyleneSulfide (PPS) are used in a variety of applications due to their high strength, stiffness, and resistance to heat and chemicals.

Aircraft Plastics Market By Process

Injection moulding is one of the most broadly used and popular processes for manufacturing aircraft plastic parts because of its capacity to produce high-quality, complex parts with tight tolerances and consistent quality. Injection moulding is the process of injecting molten plastic material into a mould cavity, where it cools and solidifies to form the desired shape. This process is widely used in the aircraft industry to produce interior components, structural parts, and electrical connectors. Another popular process in the aircraft plastics market is thermoforming, which is used to make large, flat, low-cost parts such as aircraft seatbacks and trays. This method entails heating a plastic sheet until it becomes pliable and then shaping it with a mould or vacuum. CNC machining is also used in the aircraft plastics market to produce high-precision and complex parts. Using computer-controlled machines, material is removed from a block of plastic material to form the shape of choice.

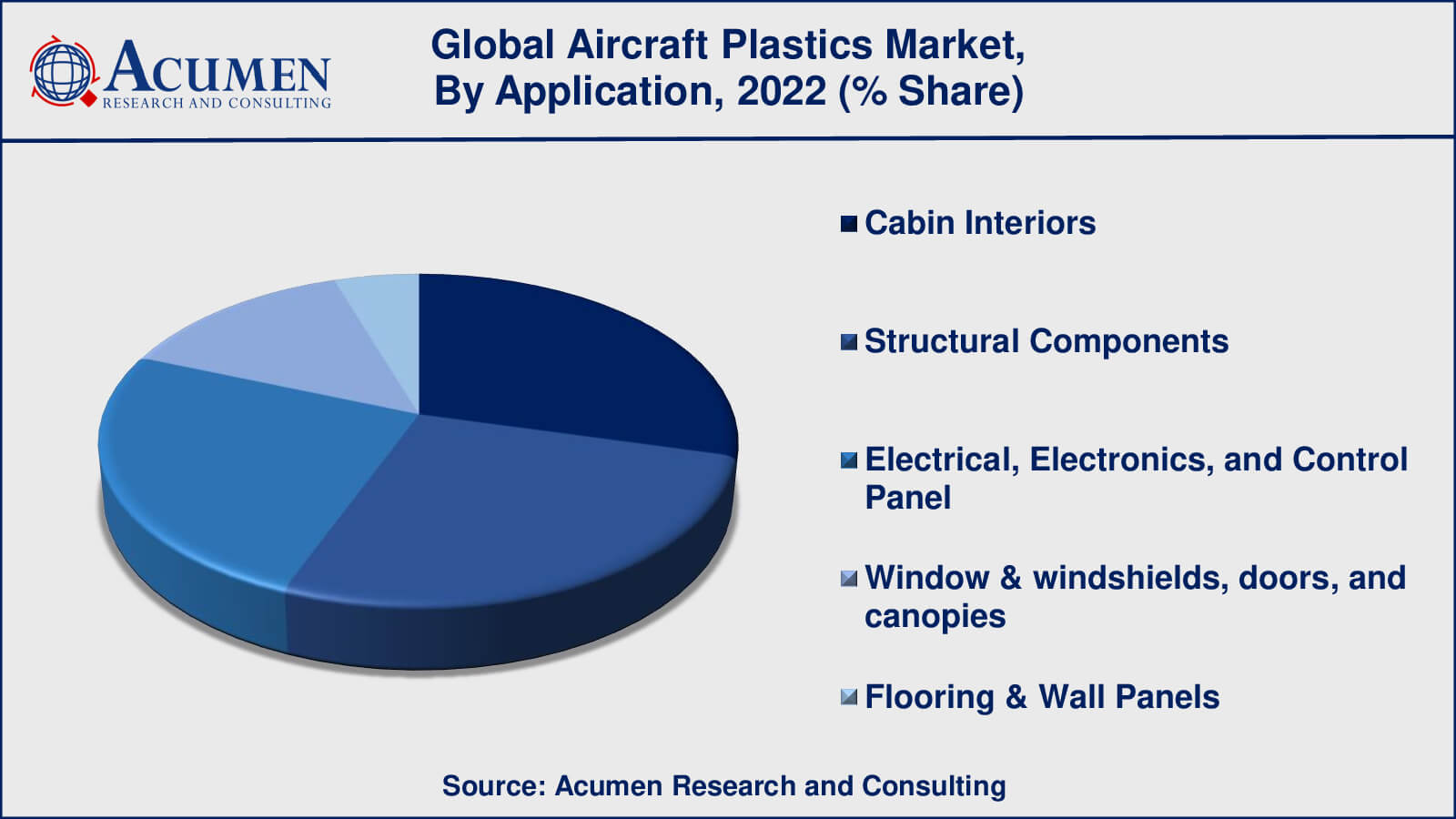

Aircraft Plastics Market By Application

According to aircraft plastics industry analysis, the cabin interiors application is one of the most important segments in the aircraft plastics market due to rising demand for lightweight yet strong materials for aircraft seating, flooring, wall panels, and other interior components. As aircraft manufacturers aim to lower weight and improve fuel efficiency while maintaining strength and durability, demand for structural components is also increasing rapidly. Composites and thermoplastics are progressively being used in structural components like wings, fuselages, and engine components. Another significant segment of the aircraft plastics market is electrical, electronics, and control panel applications, as plastic materials provide excellent electrical insulation as well as resistance to heat and chemicals. Plastics are widely used in the aircraft industry to make electrical connectors, cable insulation, and other components.

Aircraft Plastics Market By End-Use

The commercial and freighter aircraft end-use segment is one of the largest and most significant segments in the aircraft plastics market because of the increasing demand for lightweight and durable materials for various aircraft components,. Lightweight and high-performance materials are required for commercial and freighter aircraft to improve fuel efficiency and lower maintenance costs. Plastic materials have excellent properties such as high strength-to-weight ratio, corrosion resistance, and thermal stability, making them ideal for structural parts, interior components, and electrical connectors in commercial and freighter aircraft. With increasing demand for lightweight and cost-effective materials for manufacturing aircraft components, general aviation is another significant end-use segment in the aircraft plastics market. Plastic materials are widely used for general aviation applications such as cockpit components, seating, and interior panels.

Aircraft Plastics Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Aircraft Plastics Market Regional Analysis

North America is one of the foremost regions in the aircraft plastics market due to the presence of an abundance of aircraft manufacturers and suppliers. Lightweight and durable materials are in high demand in the region to improve fuel efficiency and lower maintenance costs. North America's largest market is the United States, followed by Canada and Mexico.

Europe is also a prominent area in the aircraft plastics market because of rising demand for lightweight materials for numerous aerospace applications. The region has a well-established aviation industry, and advanced composite materials and thermoplastics for aircraft component manufacturing are in high demand. Europe's major markets are Germany, France, the United Kingdom, and Italy. Because of rising air travel demand and the region's expanding aviation industry, the Asia-Pacific region is expected to see significant growth in the aircraft plastics market. Growing middle-class populations and rising disposable income in countries such as China and India are driving demand for new aircraft, which is expected to drive demand for aircraft plastics in the region.

Aircraft Plastics Market Players

Some of the global aircraft plastics companies profiled in the report include Ensinger GmbH, Hexcel Corporation, SABIC, Toho Tenax Company Limited, Mitsubishi Heavy Industries Limited, Premium Aerotec, HITCO Carbon Composites Inc., Tech-Pool Plastics, Cytec Industries Inc. and Zoltec Companies Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

January 2025

November 2023

March 2025

February 2023