June 2022

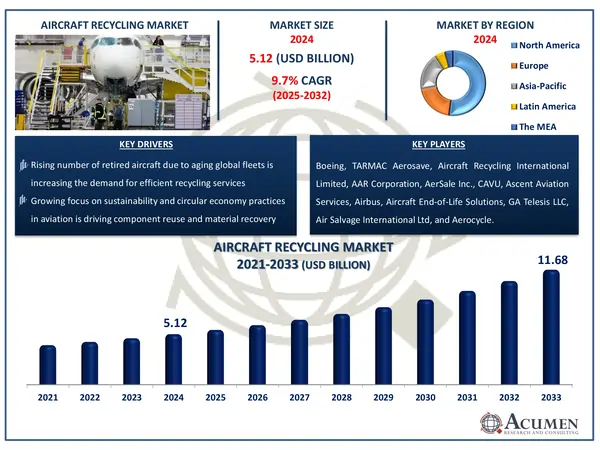

The Global Aircraft Recycling Market Size accounted for USD 5.12 Billion in 2024 and is estimated to achieve a market size of USD 11.68 Billion by 2033 growing at a CAGR of 9.7% from 2025 to 2033.

The Global Aircraft Recycling Market Size accounted for USD 5.12 Billion in 2024 and is estimated to achieve a market size of USD 11.68 Billion by 2033 growing at a CAGR of 9.7% from 2025 to 2033.

Aircraft recycling is the process of disassembling retired or decommissioned aircraft to recover and reuse valuable parts and components. It entails removing useable components such as engines, avionics, and landing gear, which can be repaired and resold. The residual structure, which is predominantly composed of aluminum, titanium, and composites, is subsequently treated for material recovery. Aircraft recycling improves sustainability by decreasing landfill trash, conserving natural resources, and lowering the carbon footprint of producing new parts. With an increasing number of aged airplanes worldwide, recycling has become an essential component of the aviation industry's environmental and economic policies, assuring responsible end-of-life management. A typical plane will fly for approximately 20 to 25 years before being retired. The retirement of a plane for commercial use does not imply that its components have lost value. This is where aircraft recycling comes in to save the parts and materials.

|

Market |

Aircraft Recycling Market |

|

Aircraft Recycling Market Size 2024 |

USD 5.12 Billion |

|

Aircraft Recycling Market Forecast 2033 |

USD 11.68 Billion |

|

Aircraft Recycling Market CAGR During 2025 - 2033 |

9.7% |

|

Aircraft Recycling Market Analysis Period |

2021 - 2033 |

|

Aircraft Recycling Market Base Year |

2024 |

|

Aircraft Recycling Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Aircraft Type, By Component, By Material, By End-Use, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Boeing, TARMAC Aerosave, Aircraft Recycling International Limited, AAR Corporation, AerSale Inc., CAVU, Ascent Aviation Services, Airbus, Aircraft End-of-Life Solutions, GA Telesis LLC, Air Salvage International Ltd, and Aerocycle. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

According to the Air Transport Action Group (ATAG) report, the majority of the materials used in aircraft components, particularly in the fuselage, are manufactured from sophisticated alloys that necessitate a costly manufacturing process, often involving more difficult-to-obtain elements, making recycling these materials increasingly important and having a significant impact on overall sustainability. Rather than separating out the various materials and alloys containing the panel, the traditional method is to simply recycle the materials collectively. This method is far less efficient, resulting in the processing of lower-value metals. Currently, a new initiative under the Clean Sky Program called the "European SENTRY Project" is working to change this process, allowing the materials to be re-used for their original purpose, which is to manufacture aircraft. This advanced recycling process will undoubtedly improve the overall sustainability of the aviation industry and eliminate the wasteful loss of these valuable materials from aviation.

Green aviation is one of the most significant contributors to global carbon emissions, and the aviation industry is well aware of its responsibilities in terms of mitigating the effects of carbon dioxide. Green aviation is an umbrella term for sustainable practices in aerospace that include increasing fuel efficiency through engineering, developing biofuels, and offering innovations through aircraft recycling, Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), and additive manufacturing. The international community is working hard to adopt more environmentally friendly practices. For example, in 2005, Airbus launched "PAMELA," project to establish itself as a leader in the field of aircraft recycling. The aim to recycle 85 percent of each aircraft's components could be safely and effectively recovered, recycled, and reused compared to only 60 percent prior to the project's inception. Such factors, combined with a strong support for green practices, will fuel the growth of the global aircraft recycling market.

According to the EEPCINDIA report, while custom laws in India allow free import and export of leased aircraft, there is no such regulation for dismantled parts. However, the Reserve Bank of India (RBI) has currently resolved this issue by offering a solution by exporting leased helicopters, aircraft, engines, and other parts-in complete or knocked-down condition. This minor change benefits India's start-up industry by making it a hub where retired aircraft are restored and make it reusable. One such significant change creates new opportunities for the maintenance, repair, and overhaul industry, thereby having a positive impact on the global aircraft recycling market's growth.

The worldwide market for aircraft recycling is split based on aircraft type, component, by material, end-use, and geography.

According to aircraft recycling industry analysis, based on aircraft, narrow-body aircraft are expected to dominate the global market and will continue to do so throughout the forecast period. Currently, low-cost carriers around the world rely on narrow body aircraft fleets (and often the smaller aircraft in that group), providing some evidence that small aircraft are more fuel efficient, and thus cost effective, than large aircraft. Such factors contribute to segmental growth, which in turn contributes to market growth overall.

In terms of product, the engine segment will provide profitable opportunities for the overall market in the coming years. According to the ATAG report, aircraft engine manufacturer Rolls-Royce has designed a recycling program that is now in operation at over 100 locations worldwide to recover and recycle exotic materials. Previously, the company developed new processes for removing coatings, separating alloys, and cleaning waste metal. Unusable engine parts and waste metal from titanium machining are recovered and reused. Almost half of a used engine can now be recycled, and the quality of the recovered material is now high enough that the metals can be safely reused in the development of new engines. Furthermore, the end result is a reduction in the need for raw materials and a measurable reduction in the environmental impact of the manufacturing process. Such factors are to blame for the overall dominance of the aircraft recycling market.

Aluminum is predicted to be the largest material segment in the aircraft recycling market. This supremacy stems principally from the widespread usage of aluminium alloys in commercial and military aircraft constructions, particularly airframes and fuselage components. Aluminum's great recyclability, lightweight characteristics, and advantageous strength-to-weight ratio make it a popular material for aircraft manufacture, providing consistent availability in end-of-life aircraft. Additionally, aluminum is generally simple and inexpensive to extract and process during dismantling, which contributes to its high recovery value. As an increasing number of older fleets are retired, particularly narrow-body aircraft with high aluminum content, recyclers are focusing on maximizing the extraction of this metal to meet demand from sectors looking for sustainable and cost-effective raw materials.

According to aircraft recycling market forecast, maintenance, repair, and overhaul (MRO) providers are likely to have a significant portion of the industry. This is largely due to the increasing demand for low-cost, used serviceable materials (USMs) to support aging aircraft fleets and minimize maintenance costs. Recycled components including aircraft engines, avionics, and landing gear are far less expensive than new parts, making them very appealing to MROs with limited resources. Furthermore, tight regulations ensure that recycled parts fulfill high safety and performance criteria, which promotes adoption. As airlines delay new aircraft acquisitions by extending the operational life of existing aircraft, the demand for dependable, affordable components from recycled sources grows, establishing MRO providers as a critical end-use segment within the aircraft recycling value chain.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

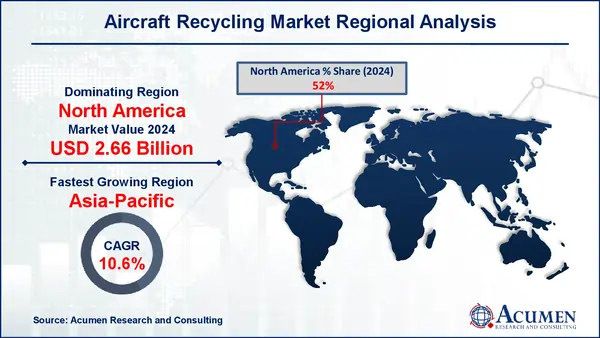

North America accounted for a sizable share of aircraft recycling in 2024 and is expected to maintain this trend throughout the forecast period. Among North American provinces, the United States is constructing one of the world's largest aircraft recycling hubs. The expansion will result in a large number of new jobs for Aircraft Solutions. The United States invests nearly $100 Mn in its new aircraft recycling facility.

Asia-Pacific is projected to be the fastest-growing region in the aircraft recycling market during the forecast period from 2025 to 2033. This growth is primarily driven by the rapid expansion of commercial aviation across emerging economies such as China, India, Indonesia, and Vietnam. These countries are witnessing a substantial increase in air traffic, leading to larger fleet sizes and, consequently, a higher number of aircraft reaching end-of-life. According to the International Air Transport Association (IATA), Asia-Pacific will account for over 40% of global air passenger traffic by 2035, which directly correlates with greater fleet turnover. Additionally, several aircraft recycling hubs are emerging in countries like China and Singapore, supported by favorable government policies and growing investments in MRO infrastructure. The region’s emphasis on sustainability, resource recovery, and the circular economy is further accelerating adoption of recycling practices, positioning Asia-Pacific as a crucial growth engine for the global aircraft recycling industry.

Some of the top aircraft recycling companies offered in our report include Boeing, TARMAC Aerosave, Aircraft Recycling International Limited, AAR Corporation, AerSale Inc., CAVU, Ascent Aviation Services, Airbus, Aircraft End-of-Life Solutions, GA Telesis LLC, Air Salvage International Ltd., and Aerocycle.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

June 2022

December 2024

December 2023

April 2023