October 2024

The Global Animal Food Market Size accounted for USD 608.9 Billion in 2024 and is estimated to achieve a market size of USD 890.8 Billion by 2033 growing at a CAGR of 4.4% from 2025 to 2033.

The Global Animal Food Market Size accounted for USD 608.9 Billion in 2024 and is estimated to achieve a market size of USD 890.8 Billion by 2033 growing at a CAGR of 4.4% from 2025 to 2033.

Animal food, often known as animal feed, is a type of food product that is specifically created and made to suit the nutritional needs of domesticated animals such as cattle and pets. It is essential for animal health, production, and well-being. Animal food is often made up of a variety of vital components such as proteins, carbs, fats, vitamins, and minerals that are customized to the individual nutritional needs of different animal species. It is available in a variety of forms, including pellets, mash, crumbles, and liquid supplements, depending on the age, purpose, and health of the animal. The animal food industry supports numerous sectors, including cattle, poultry, swine, aquaculture, equine, and companion animals, and is critical to global agriculture, food production, and the pet care industry.

Animal food, often known as animal feed, is a type of food product that is specifically created and made to suit the nutritional needs of domesticated animals such as cattle and pets. It is essential for animal health, production, and well-being. Animal food is often made up of a variety of vital components such as proteins, carbs, fats, vitamins, and minerals that are customized to the individual nutritional needs of different animal species. It is available in a variety of forms, including pellets, mash, crumbles, and liquid supplements, depending on the age, purpose, and health of the animal. The animal food industry supports numerous sectors, including cattle, poultry, swine, aquaculture, equine, and companion animals, and is critical to global agriculture, food production, and the pet care industry.

|

Market |

Animal Food Market |

|

Animal Food Market Size 2024 |

USD 608.9 Billion |

|

Animal Food Market Forecast 2033 |

USD 890.8 Billion |

|

Animal Food Market CAGR During 2025 - 2033 |

4.4% |

|

Animal Food Market Analysis Period |

2021 - 2033 |

|

Animal Food Market Base Year |

2024 |

|

Animal Food Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Type of Animal, By Product Type, By Distribution Channel, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Cargill Inc., Archer Daniels Midland Company, Land O'Lakes Inc., Nutreco NV, Charoen Pokphand Foods PCL, New Hope Liuhe Co. Ltd., Alltech Inc., Purina Animal Nutrition LLC, ForFarmers NV, and Guangdong Haid Group Co. Ltd. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The rising trend of animal husbandry and pet care is anticipated to create a better opportunity for animal food suppliers in the coming years. The market is characterized by the presence of a high level of competition among different manufacturers. Increasing awareness of animal owners towards their animal health coupled with rising disposable income is the primary factor predicted to increase the demand for animal food during the forecast period, thereby creating a better opportunity for various branded and packaged food manufacturers. Moreover, the increasing trend of nuclear families across the globe is also predicted to indirectly affect the demand for animal food positively. The rising trend of the nuclear family increases the demand for animals for companion purposes. This, in turn, is anticipated to boost the demand for animal food across various regions.

However, allergies associated with the hair of animals are a major factor predicted to deter the demand for animals. This, in turn, is expected to affect the pet food market of animal food negatively. In addition, different government regulations across the globe act as restraining factors for the growth of the animal food market. Moreover, the rising cost of feeding animals along with various social and cultural regulations also limit the growth of the animal and pet food market across various regions, especially in the Middle East.

Animal Food Market Segmentation

Animal Food Market SegmentationThe worldwide market for animal food is split based on type of animal, product type, distribution channel, and geography.

According to animal food industry analysis, poultry feed is currently the largest segment of the market. This dominance is due to the huge global consumption of poultry meat and eggs, which creates significant demand for efficient and cost-effective feed solutions. Advances in feed formulations and expanding poultry farming methods, particularly in emerging nations, are driving the segment's growth. Moreover the cattle feed sector will observe a considerable share in the market in 2024. Cattle feed demand is increasing as the global demand for meat and dairy products grows. Cattle feed is designed to suit the specific nutritional requirements of cows, such as protein, carbs, and minerals. The cattle feed industry is predicted to expand in the next years as farmers increasingly employ precision farming techniques, which allow them to monitor and manage their cattle's nutritional demands. Furthermore, there is a growing demand for organic and natural cattle feed, as people become more worried about the use of antibiotics and growth hormones in animal feed. The rise of alternative proteins, such as insect and algae-based feed, is also creating new prospects for the cattle feed market.

Concentrates are a prominent product type in the animal feed market. Concentrates are typically high in protein and energy, and they can be used to complement other types of feed or as a whole diet for animals with minimal nutritional needs. Concentrates are in high demand due to expanding animal protein consumption and the need to increase cattle output. Concentrates are widely utilized in the manufacture of feed for poultry, pigs, and ruminants like cattle and sheep. The concentrates product category is likely to expand in the animal food market forecast period, driven by the increased use of precision farming techniques and the demand for high-quality animal feed market.

According to the animal food market forecast, direct sales to farmers are expected to grow rapidly in the market over the next few years. Direct sales to farmers are becoming increasingly popular due to the growing trend towards precision farming, where farmers monitor and manage their livestock's nutritional needs. The direct sales channel allows farmers to obtain high-quality animal feed quickly and efficiently, which can help improve the productivity of their livestock. Direct sales to farmers also allow manufacturers to develop close relationships with their customers, providing them with valuable feedback that can help improve their products. The increasing adoption of e-commerce platforms is also making it easier for manufacturers to sell their products directly to farmers, which is opening up new opportunities for this distribution channel.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Animal Food Market Regional Analysis

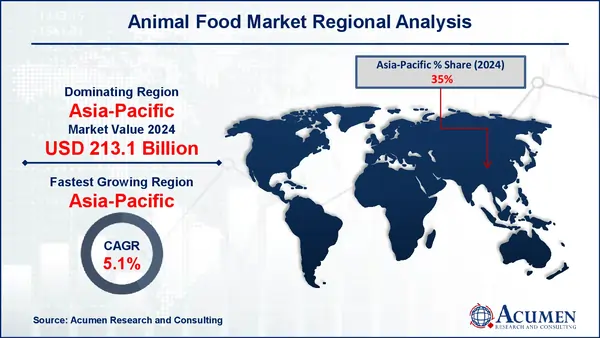

Animal Food Market Regional AnalysisAsia-Pacific dominates the animal food market due to its high demand for high-quality animal products such as meat, dairy, and eggs. The Asia-Pacific population has a great desire for animal protein, hence the region has a thriving animal feed business. The Asia-Pacific animal and pet food market is being pushed by the expansion of the cattle industry, which is one of the largest in the world. The India and China dominate this sector, with a high number of animal feed manufacturers and suppliers. The region's robust economy, modern technology, and favorable government regulations have all contributed to the animal food market's expansion.

Moreover, the North America region has a well-established regulatory framework for animal food production, ensuring that the industry meets high quality and safety standards. The United States Department of Agriculture (USDA) and the Canadian Food Inspection Agency (CFIA) are in charge of ensuring that all animal food products meet tight rules before they are supplied to customers. This has contributed to increased trust in the animal food business and has fueled the expansion of the regional market share.

Some of the top animal food companies offered in our report include Cargill Inc., Archer Daniels Midland Company, Land O'Lakes Inc., Nutreco NV, Charoen Pokphand Foods PCL, New Hope Liuhe Co. Ltd., Alltech Inc., Purina Animal Nutrition LLC, ForFarmers NV, and Guangdong Haid Group Co. Ltd.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

October 2024

October 2022

October 2018

April 2023