April 2020

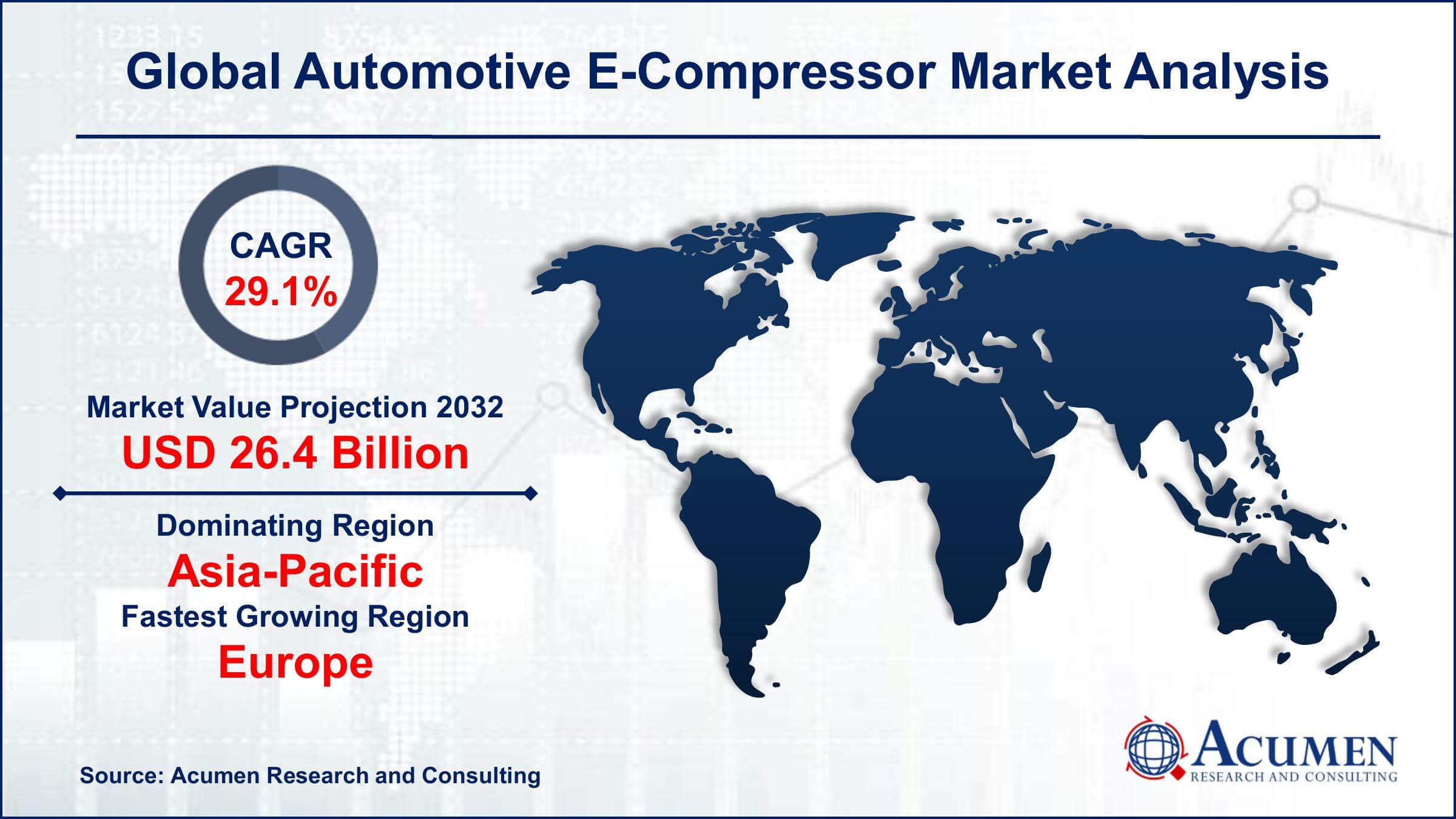

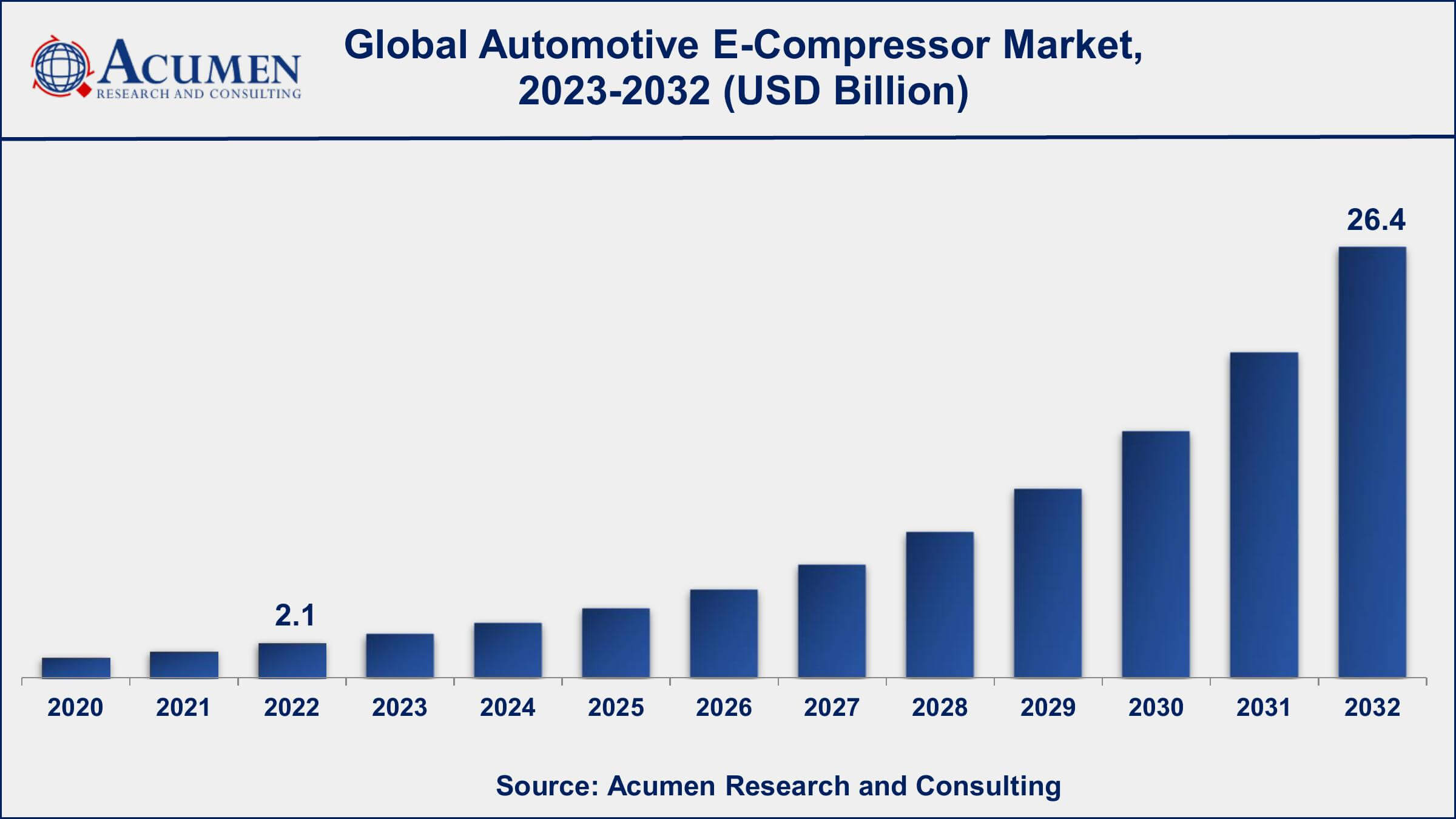

Automotive E-Compressor Market size was valued at USD 2.1 Billion in 2022 and is projected to reach USD 26.4 Billion by 2032 mounting at a CAGR of 29.1% from 2023 to 2032.

The global Automotive E-Compressor Market size was valued at USD 2.1 Billion in 2022 and is projected to reach USD 26.4 Billion by 2032 mounting at a CAGR of 29.1% from 2023 to 2032.

Automotive E-Compressor Market Highlights

Automotive e-compressors are tightly sealed types of compressors and function with their motor inside so that the compressor terminals are used for power transfer. The compressor terminal prevents leakage of the refrigerant and directs to transfer of a large amount of energy from the battery to the air conditioning compressor in hybrid and electric vehicles.

Currently, various development activities are conducted in automotive e-compressors by the market players. These involve electronic data capture services (EDCs) with high cooling capacity for cabin air conditioning and heat pump systems coupled with battery thermal management systems. Such compressors improve vehicle interior comfort and battery cooling during quick charging with a reduction in CO2 emissions as it requires low power consumption. However, the challenges in the e-compressor business are still acute due to the competitive market and the need for reduction in the size, weight, and improvement in efficiency.

Global Automotive E-Compressor Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Automotive E-Compressor Market Report Coverage

| Market | Automotive E-Compressor Market |

| Automotive E-Compressor Market Size 2022 | USD 2.1 Billion |

| Automotive E-Compressor Market Forecast 2032 | USD 26.4 Billion |

| Automotive E-Compressor Market CAGR During 2023 - 2032 | 29.1% |

| Automotive E-Compressor Market Analysis Period | 2020 - 2032 |

| Automotive E-Compressor Market Base Year | 2022 |

| Automotive E-Compressor Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, Vehicle Type, Drivetrain, Cooling Capacity, Component, Sales Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Denso Corporation, Sanden Holdings Corporation, Valeo SA, Hanon Systems, MAHLE GmbH, Mitsubishi Heavy Industries Thermal Systems, Ltd., LG Electronics Inc., Panasonic Corporation, Calsonic Kansei Corporation, Delphi Technologies (now part of BorgWarner Inc.), Robert Bosch GmbH, GREE Electric Appliances Inc. (Gree Electric), Continental AG Behr Hella Service GmbH, and Hitachi Automotive Systems, Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive E-Compressor Market Insights

The continued use of hybrid and electric cars is a significant driver of the automotive e-compressor industry. The fuel-saving benefits of automobile e-compressors increase consumer desire for hybrid and electric cars. Rising government backing for the car sector boosts future growth of electric vehicles (EVs), which eventually boosts demand for the automotive ecompressor market.

According to the Ministry of Heavy Industries and Public Enterprises (MHIPE), 2019 was considered a positive year for India’s evolving electric vehicles industry. The government support with approval of Rs. 10,000 crore programs under the FAME-2 scheme for the promotion of electric and hybrid vehicles. Till November 2019 close to 285,000 buyers of electric and hybrid vehicles benefitted from subsidies under the FAME-2 scheme that marked revenue of INR 3.6 Bn. However, low information distributed among buyers towards electric and hybrid vehicles ultimately limits the growth of automotive e-compressors. Moreover, less knowledge among buyers regarding the servicing and charging operations of EVs and hybrid vehicles restrains the market from growing worldwide.

In addition, electric connections for the compressor and feed-through are still critical coupled with high-voltage connections. This factor acts challenge for the automotive e-compressor market to expand worldwide. But with the automobile industry commitment in respective regions towards developing green sustainable mobility acts as an emerging business opportunity worldwide.

COVID-19 Impact on Automotive E-Compressor Market

Automobile industries existing in the global markets were induced by COVID-19's negative impact on electronic vehicles (EVs). One of the first causalities witnessed was the economic crisis with falling crude oil prices worldwide. Low oil prices at the pump reduce the economic viability of EV adoption with combustion vehicles, especially in countries with limited fiscal incentives for EVs. Another risk factor associated with EV adoption comes with disruptions in supply chains. Also, lockdowns and social distancing norms had a serious impact on the cash flows for mobility service providers. Financial stress, bankruptcies, and consolidation in the mobility service market delayed Ev's manufacturing.

Automotive E-Compressor Market Segmentation

The worldwide market for automotive e-compressor is split based on type, vehicle type, drivetrain, cooling capacity, component, sales channel, and geography.

Automotive E-Compressor Types

According to automotive e-compressor industry analysis, the scroll kind of compressor has been the most popular choice in the automobile e-compressor market. Because of their efficiency and dependability, scroll compressors are commonly employed in vehicle air conditioning systems. These compressors compress the refrigerant using two interleaved scrolls, providing smooth and continuous operation with minimum noise and vibration.

While the other varieties you listed, such as Swash, Wobble, Screw, and Others, have uses in certain sectors or systems, they are not as common or prominent in the automotive e-compressor market as the Scroll type. Scroll compressors are popular in the automobile industry because of their small size, energy economy, and enhanced performance in air conditioning and temperature control systems.

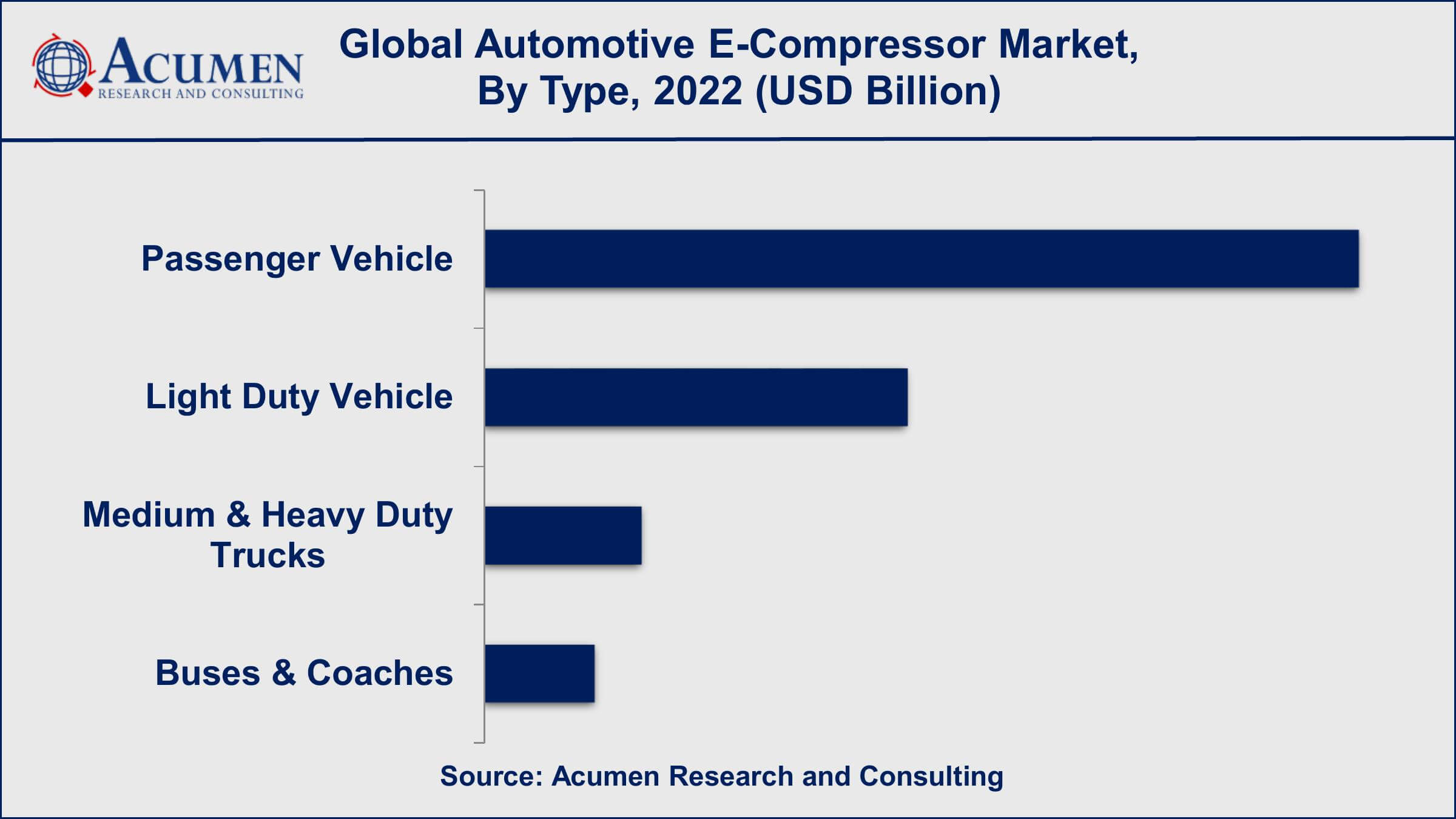

Automotive E-Compressor Vehicle Types

The passenger car category has dominated the automotive ecompressor industry. Sedans, hatchbacks, SUVs, and other vehicles meant for personal usage are examples of passenger vehicles. These cars frequently incorporate air conditioning systems and temperature control features that necessitate the use of e-compressors to deliver cooling and heating.

Passenger vehicles have a sizable market share due to their large number of sales and extensive use of air conditioning systems. As customer demand for comfort and convenience features grows, so does the need for automotive e-compressors in passenger vehicles.

While e-compressors are employed in various vehicle sectors such as light-duty vehicles, medium and heavy-duty trucks, and buses/coaches, passenger vehicles have the biggest market share in terms of e-compressor usage. However, it is worth mentioning that the use of electric and hybrid cars is spreading across multiple vehicle categories, which may affect future market dynamics for automotive e-compressors.

Automotive E-Compressor Drivetrains

According to the automotive e-compressor market forecast, electric vehicles (EVs) are expected to acquire utmost market shares from 2023 to 2032. The automotive industry has shifted significantly towards electric vehicles (EVs). As a result, electric cars are gaining popularity and will likely dominate the automotive e-compressor industry in the future years.

While internal combustion engine (ICE) cars have historically been the principal consumers of automotive e-compressors for their air conditioning systems, the growing popularity of electric vehicles is altering the picture. E-compressors are used in electric cars, including battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs), for air conditioning and climate control.

With the worldwide desire to reduce emissions and address environmental issues, electric transportation is becoming more popular. Governments throughout the world are enacting stronger pollution standards and providing incentives to encourage the use of electric vehicles. This trend is predicted to boost the need for automotive e-compressors in electric cars, eventually overtaking ICE vehicle demand.

Automotive E-Compressor Cooling Capacities

The cooling capacity of automobile ecompressors is commonly measured in cubic centimetres (CC). However, depending on the vehicle type, use, and regional preferences, the specific cooling capacity dominating the automotive e-compressor market might vary. Having stated that, the 20 to 40 CC cooling capacity range has been widely employed and dominating in the automobile e-compressor sector. This range is appropriate for a broad variety of passenger cars, such as sedans, SUVs, and hatchbacks. To provide efficient air conditioning and temperature control performance, these cars require e-compressors with modest cooling capacity.

While e-compressors with cooling capacities less than 20 CC or greater than 60 CC may find applications in specific vehicle types or market segments, the 20 to 40 CC range is generally the most common in the automotive industry due to its compatibility with standard passenger vehicle air conditioning systems.

Automotive E-Compressor Components

The compressor portion is often the component that dominates the automobile e-compressor market. The compressor section is the main component in charge of compressing the refrigerant and circulating it through the vehicle's air conditioning system.

The compressor component of the automobile e-compressor is critical to its overall performance and efficiency. It is in charge of delivering the necessary cooling capacity and keeping the car interior at the proper temperature.

While the other components you mentioned, such as the motor, inverter, and oil separator, are all necessary components of an automobile e-compressor system, the compressor portion is frequently regarded as the most important in terms of market domination. The compressor section's efficiency, dependability, and performance are critical variables in determining the overall quality and efficacy of the e-compressor.

Automotive E-Compressor Sales Channels

As per the automotive e compressor market analysis, the original equipment manufacturer (OEM) sales channel normally dominates. OEM sales are manufacturers' direct sales of e-compressors to car manufacturers for installation during the vehicle production process. Because of the enormous amount of e-compressors installed into automobiles during manufacture, the OEM sales channel is dominating. As a key component of the vehicle's HVAC (Heating, Ventilation, and Air Conditioning) system, automotive e-compressors are frequently integrated into the air conditioning systems.

While the OEM sales channel is dominant, there is also a significant presence of e-compressor sales in the aftermarket. The aftermarket sales channel involves the sale of e-compressors as replacement parts for existing vehicles. These e-compressors are typically sold through various channels, including automotive parts suppliers, dealerships, and online platforms.

Automotive E-Compressor Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Automotive E-Compressor Market Regional Analysis

Based on regions, Asia-Pacific is leading the overall e-compressor market globally followed by Europe. China is recognized as the world’s largest automobile manufacturer since the past. It is anticipated that in the next five years, China will grab a market share of 30% worldwide in the car segment. The Chinese government has a high focus on the development of new energy vehicles which is a high priority supported by policies and incentives.

The automotive industry in the United States accounts for 4-5% of the US gross domestic product which resulted in the employment of 716,900 workforce in 2011 whereas Japan almost comprised 7, 90,000 people to work directly in the automotive industry.

On the other hand, Europe is gaining a strong pace in the regional market for automotive e-compressors. This can be attributed to the prominent automotive market player’s presence in this region which is likely to boost the automotive e-compressor market in Europe. In the European Union (EU), around 16 million units are manufactured which is about 26% of the world’s annual production. Hence, the annual turnover of the cars segment is US$ 852.75 billion. Further, the high focus of the European automobile industries on R&D activities bolsters the regional growth of the automotive e-compressor market.

Europe comprises 210 production plants of which the automotive industry exports US$ 852.75 billion in net trade annually, Also, recognized as the largest sector in private R&D investments with more than 5,800 patents filed in 2011. In Europe, Germany consists of 750,000 + employees working directly in the automotive sector in more than 45 plants.

Automotive E-Compressor Market Players

Some of the top automotive e-compressor companies offered in our report include Denso Corporation, Sanden Holdings Corporation, Valeo SA, Hanon Systems, MAHLE GmbH, Mitsubishi Heavy Industries Thermal Systems, Ltd., LG Electronics Inc., Panasonic Corporation, Calsonic Kansei Corporation, Delphi Technologies (now part of BorgWarner Inc.), Robert Bosch GmbH, GREE Electric Appliances Inc. (Gree Electric), Continental AG Behr Hella Service GmbH, and Hitachi Automotive Systems, Ltd.

Automotive E-Compressor Industry Recent Developments

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2020

June 2022

October 2024

May 2020