April 2023

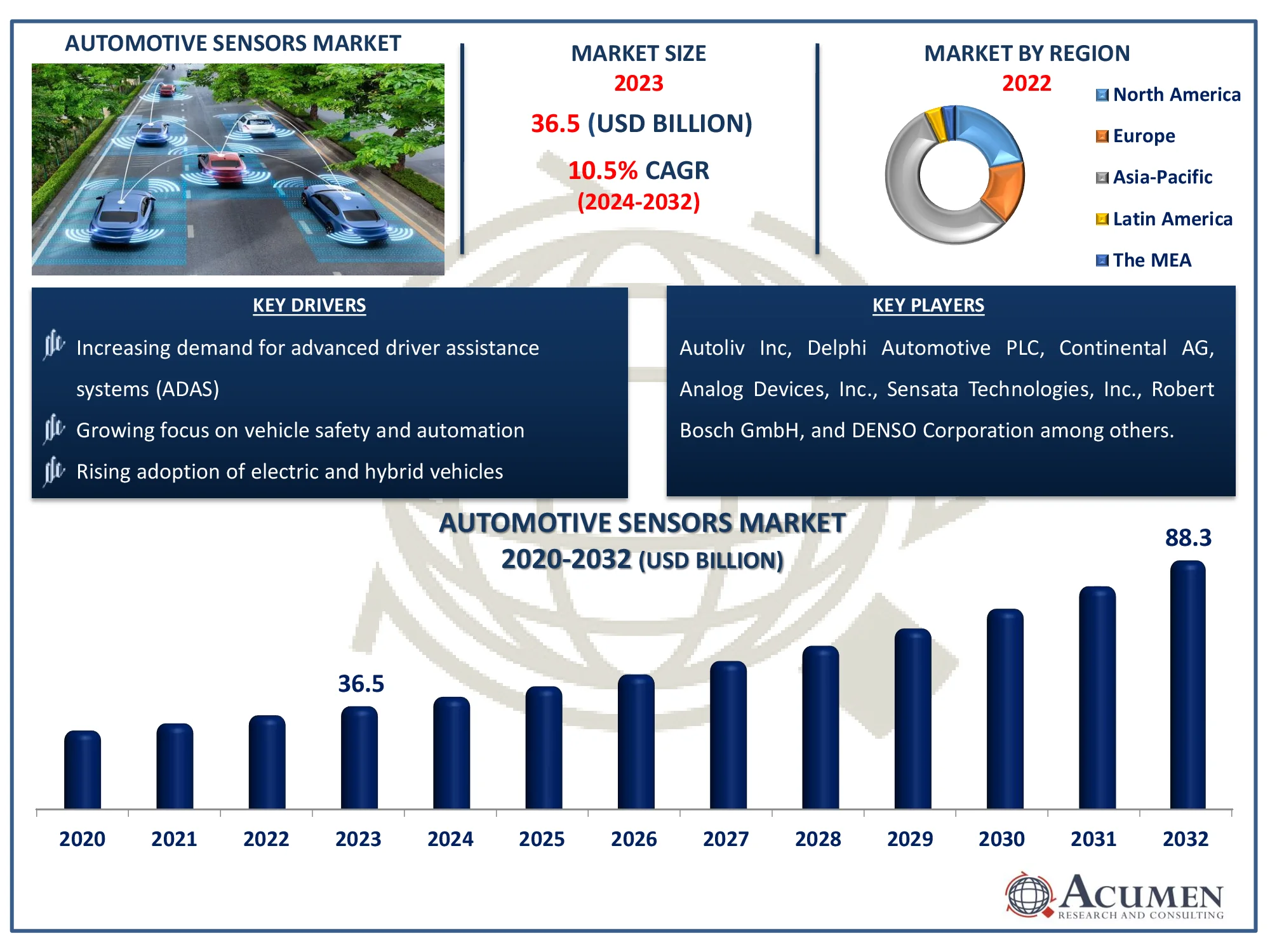

The global automotive sensors market is expected to grow from USD 36.5 billion in 2023 to USD 88.3 billion by 2032, with a CAGR of 10.5%. Stay updated on the latest trends and forecasts shaping this expanding market.

The Global Automotive Sensors Market Size accounted for USD 36.5 Billion in 2023 and is estimated to achieve a market size of USD 88.3 Billion by 2032 growing at a CAGR of 10.5% from 2024 to 2032

Automotive Sensors Market Highlights

Automotive sensors are integrated sections of the vehicle system that are often designed to show vehicle performance information, detect, and evaluate the vehicle's internal and exterior environments. Additionally, sensors are key components of car safety systems. Sensors are used to measure or record physical occurrences, detect them, and then respond by relaying data, changing system control, or making changes.

Global Automotive Sensors Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Automotive Sensors Market Report Coverage

| Market | Automotive Sensors Market |

| Automotive Sensors Market Size 2022 |

USD 36.5 Billion |

| Automotive Sensors Market Forecast 2032 | USD 88.3 Billion |

| Automotive Sensors Market CAGR During 2023 - 2032 | 10.5% |

| Automotive Sensors Market Analysis Period | 2020 - 2032 |

| Automotive Sensors Market Base Year |

2022 |

| Automotive Sensors Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Vehicle Type, By Sales Channel, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Autoliv Inc, Delphi Automotive PLC, Continental AG, Analog Devices, Inc., Sensata Technologies, Inc., Robert Bosch GmbH, DENSO Corporation, NXP Semiconductor, STMicroelectronics, Infineon Technologies AG, and among others. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Sensors Market Insights

The primary element driving market growth at a rapid pace is severe government regulations that require the integration of technology and gadgets to ensure the safety of passengers and drivers while driving. Furthermore, significant increase in the adoption of advanced driver assistance systems (ADAS) in new vehicles is expected to fuel the automotive sensors market. For instance, Allegro Microsystems Inc. introduced the A33110 and A33115 magnetic position sensors in June 2022, designed primarily for use in advanced driver assistance systems (ADAS). Furthermore, the usage of automotive sensors is critical in managing and monitoring physical processes when changes occur in autos. The widespread use of automobile sensors is expected to reflect a shift in people's attitudes toward safe driving.

Furthermore, the growing market for hybrid automobiles has resulted in a strong demand for automotive sensors, which have a wide range of applications, including hydrogen leak detection, motor speed, and monitoring, position, and temperature management. For instance, Stellantis announced in March 2024 a 30 billion reais (USD 6.1 billion) investment to strengthen flex-hybrid car production in South America as part of its commitment to advancing eco-friendly technologies. This investment will enable the introduction of more than 40 new goods over the next five years, as well as the adoption of innovative decarbonization methods and bio-hybrid technologies. However, pricing pressure from significant competitors is impeding market expansion. As a result, the potential for market growth during the projection period include the development of new products and the upgrade of existing sensors to meet the needs of customers.

Automotive Sensors Market Segmentation

The worldwide market for automotive sensors is split based on type, vehicle type, sales channel, application, and geography.

Automotive Sensors Type

According to the automotive sensors industry analysis, image sensors are the main technology used in automotive sensors because they help with advanced driver assistance systems (ADAS) and self-driving cars. These sensors allow vehicles to perceiving their surroundings by capturing visual data, which is needed for tasks like detecting lanes, recognizing obstacles, and assisting with parking. As cars become smarter and safer, the need for image sensors is growing rapidly.

Automotive Sensors Vehicle Type

According to the automotive sensors industry analysis, passenger cars lead the market because they are made in large numbers and need many sensors for safety and performance. These sensors help with functions like engine monitoring and driver assistance, making essential in modern cars. As more advanced technologies are integrated into these vehicles, the need for sensors increases.

Automotive Sensors Sales Channel

According to the automotive sensors market forecast, original equipment manufacturers (OEMs) sales channel expected to show notable growth in market. This is because sensors are essential parts that are installed in vehicles during production. Car manufacturers require a large number of these sensors to meet safety and quality standards for new cars.

However, the aftermarket also plays significant role in industry, especially as vehicles get older and need sensor replacements or upgrades. The aftermarket is growing, driven by the need for advanced systems like advanced driver assistance systems (ADAS) in older vehicles.

Automotive Sensors Application

According to the automotive sensors industry analysis, the powertrain application is anticipated to dominates in industry. Powertrain sensors are crucial for monitoring and managing various aspects of a vehicle’s engine, transmission, and other components related to power delivery and efficiency. These sensors are vital for optimizing fuel efficiency, reducing emissions, and ensuring the overall performance and reliability of the vehicle.

Automotive Sensors Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

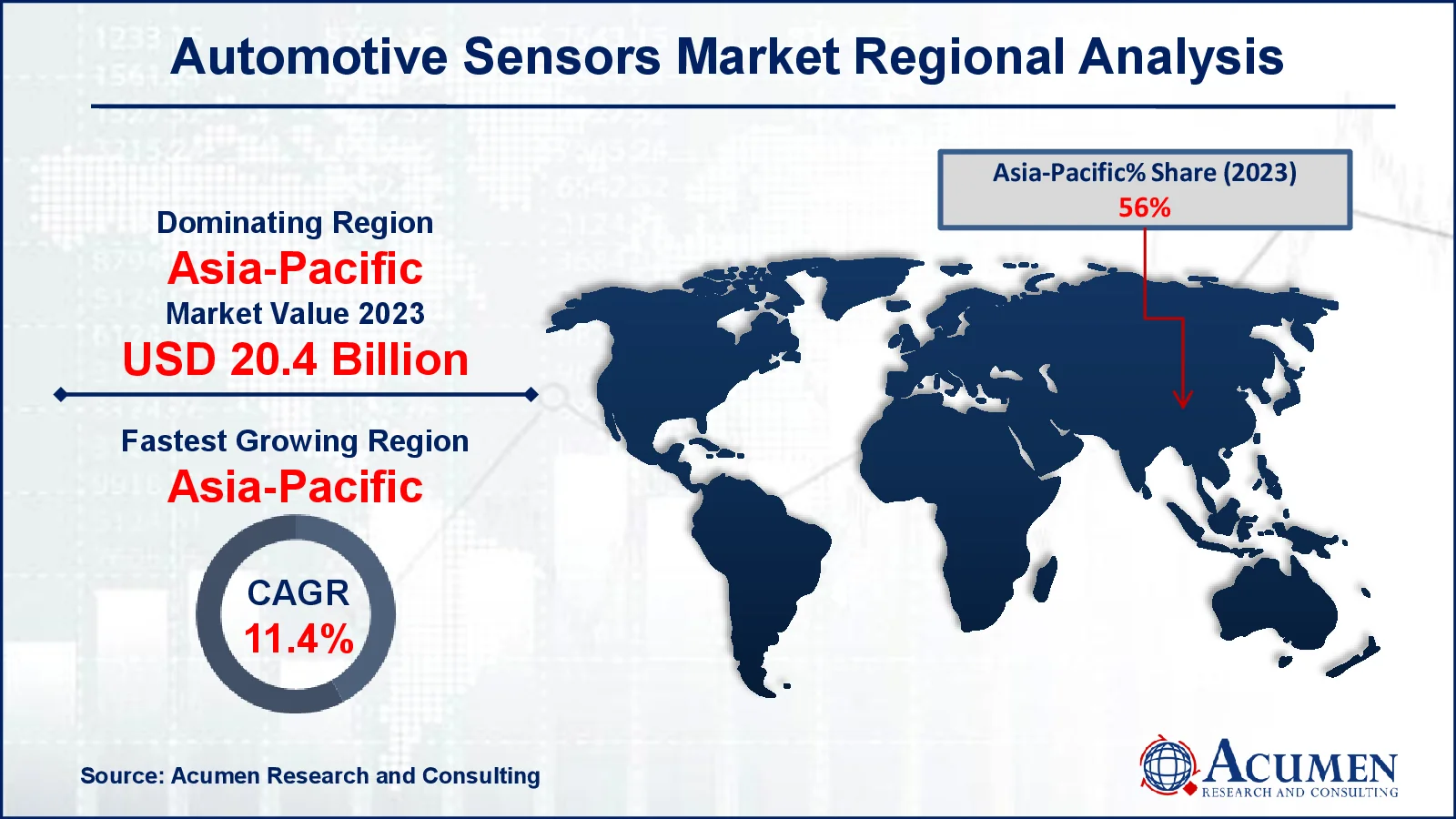

Automotive Sensors Market Regional Analysis

For several reasons, Asia-Pacific dominates the automotive sensor market due to its massive automotive sector and technical improvements. Countries such as China, Japan, and South Korea are significant contributors, boosting demand through increased car manufacturing and sensor technology innovation. The region's significant emphasis on improving vehicle safety and performance accelerates market expansion. Furthermore, rising consumer demand for innovative automotive features reinforces this dominance.

Europe and North America shows significant growth in the automotive sensor market because rising demand for advanced safety features and better vehicle performance. For instance, NXP Semiconductors N.V. (NXP) announced at CES 2023 that it will participate in the early development phases of new VinFast automotive projects. VinFast will work to use NXP CPUs, semiconductors, and sensors, while NXP will provide top-tier solutions to reduce time-to-market. The collaborative expert collaboration will concentrate on developing solutions for designing and manufacturing cutting-edge EVs using NXP's well renowned reference evaluation platforms and software layers. Innovative sensors help with features like avoiding accidents and keeping lanes. Tighter safety and emissions rules are also increasing the demand for these sensors.

Automotive Sensors Market Players

Some of the top automotive sensors companies offered in our report include Autoliv Inc, Delphi Automotive PLC, Continental AG, Analog Devices, Inc., Sensata Technologies, Inc., Robert Bosch GmbH, DENSO Corporation, NXP Semiconductor, STMicroelectronics, Infineon Technologies AG, and among others.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2023

February 2023

August 2020

September 2020