November 2023

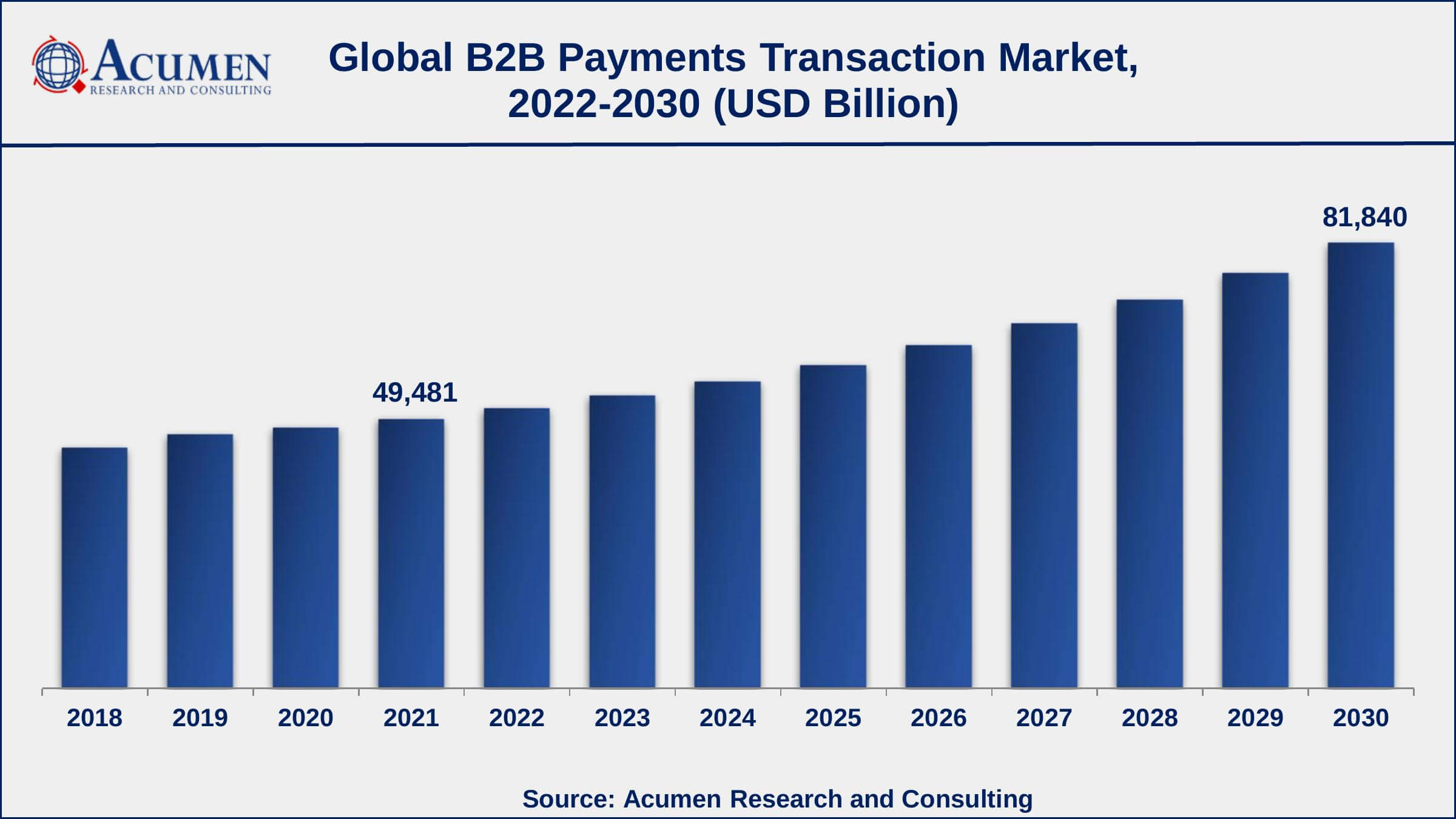

B2B Payments Transaction Market Size accounted for USD 49,481 Billion in 2021 and is projected to achieve a market size of USD 81,840 Billion by 2030 rising at a CAGR of 6% from 2022 to 2030.

The Global B2B Payments Transaction Market Size accounted for USD 49,481 Billion in 2021 and is projected to achieve a market size of USD 81,840 Billion by 2030 rising at a CAGR of 6% from 2022 to 2030. B2B payments are payments between two merchants for goods and services. Paper checks are still the most popular payment method for businesses. A digital B2B payment solution is a speed payment method, which all can enhance the cash flow of a company, including issuing, receiving and processing systems.

B2B Payments Transaction Market Report Statistics

Global B2B Payments Transaction Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

B2B Payments Transaction Market Report Coverage

| Market | B2B Payments Transaction Market |

| B2B Payments Transaction Market Size 2021 | USD 49,481 Billion |

| B2B Payments Transaction Market Forecast 2030 | USD 81,840 Billion |

| B2B Payments Transaction Market CAGR During 2022 - 2030 | 6% |

| B2B Payments Transaction Market Analysis Period | 2018 - 2030 |

| B2B Payments Transaction Market Base Year | 2021 |

| B2B Payments Transaction Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Payment Type, By Enterprise Size, Payment Mode, By Industry Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | American Express Co. Inc., Ant Financial Services Co. Ltd., Bottomline Technologies Inc., Coupa Software Inc., FleetCor Technologies Inc., Intuit Inc., JPMorgan Chase & Co., MasterCard Inc., PayPal Holdings Inc., SAP, TransferWise Ltd., and Visa Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

B2B Payments Transaction Market Growth Factors

Factors that are expected to propel the growth of target market are growing trade activities across the globe, increase in number of online payment activities and initiatives from the government of developing countries for cashless economy. Consumer’s preference towards online payment is increasing as it lower the risk of carrying money, or loss. Availability of smart application from banks and other players makes it easy for them to carry out daily transition online.

Moreover, technological shift towards digitalization, growing consumer’s preference for instant and real time payment system is expected to support the growing market traction to a certain extent. Bank is providing various applications for instant payment settlement with high transparency. As this lower the cost associated to credit card, debit card, and other membership fees. In 2016, Indian Banks Association launched the Unified Payments Interface (UPI) and the NPCI developed the Bharat Interface for Money (BHIM) app. UPI manages multiple bank accounts within one mobile application of any participating bank. In addition, availability of advanced infrastructure in order to support safe and reliable transaction is another important supporting the market growth.

However, incidences related to identity and data theft resulting in loss of money is a major factor hampering the market growth. Presence of phishing website from hackers and availability of high speed internet make it easy for hackers to steal data of consumers. According to World Economic Forum, two billion data records were compromised in 2017, and more than 4.5 billion records were breached in the first half of 2018.

High government spending in order to strengthen the online payment system and growing cross-border payments, coupled with approach towards improving the cross-border payment that lagged in terms of efficiency and transparency are some factors creating revenue opportunities for market players.

B2B Payments Transaction Market Segmentation

The global B2B payments transaction market is segmented based on payment type, enterprise size, payment mode, industry vertical, and geography.

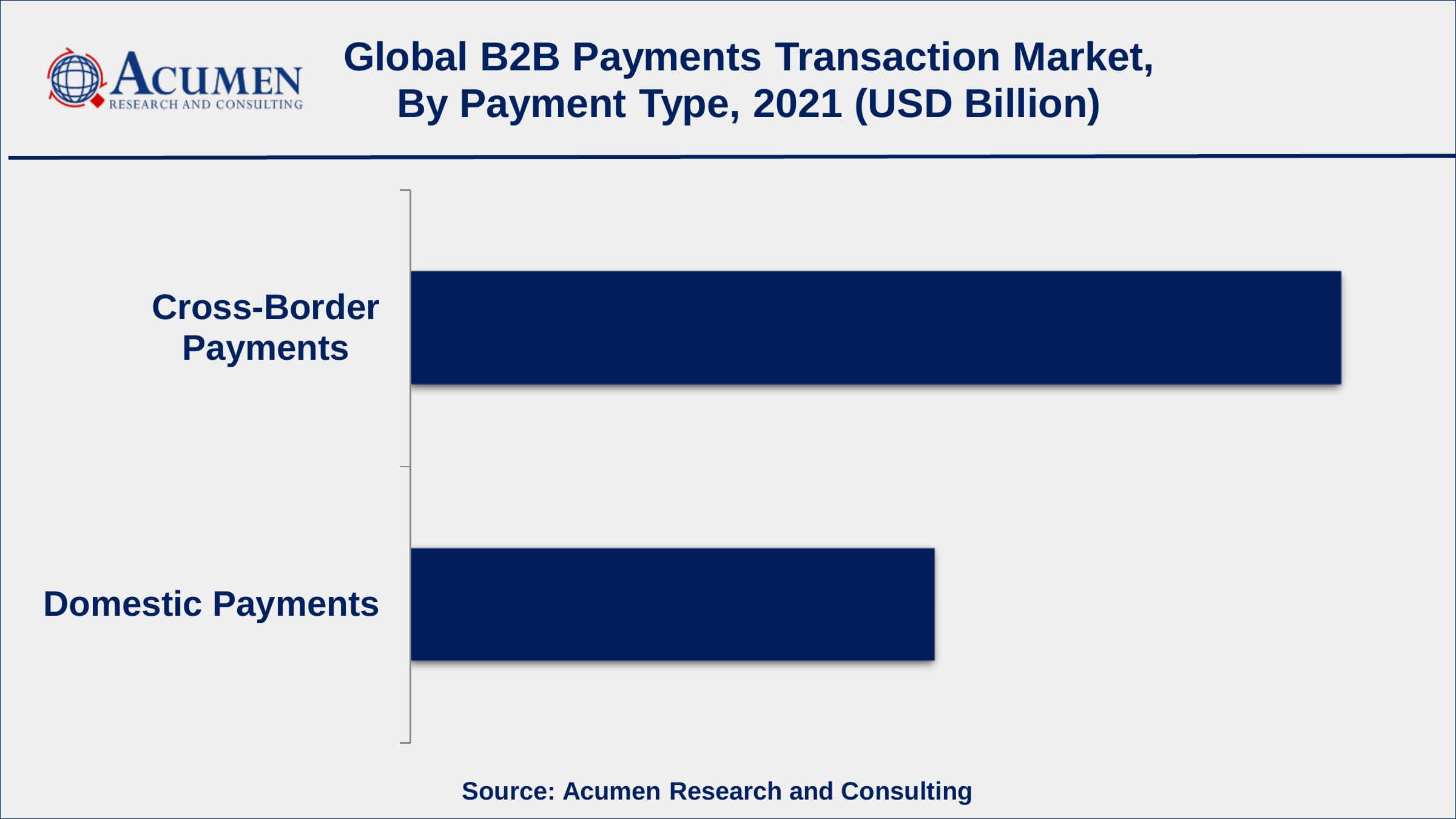

B2B Payments Transaction Market By Payment Type

According to the B2B payments transaction industry analysis, domestic payments sub-segment generated the largest revenue in 2021 and is expected to continue its trend during the projected timeframe 2022 to 2030. The increasing numbers of small & medium enterprises in countries like China and India is primarily driving the b2b payments transaction industry. On the other hand, cross-border payments are gaining significant impetus in the forthcoming years due to the rise in international trade and fueling global import and export activities.

B2B Payments Transaction Market By Enterprise Size

As per the B2B payments transaction market forecast, the large enterprises sub-segment accounted for more than half of the market shares during the estimated timeframe of 2022 to 2030. The huge amounts of transaction between large enterprises create significant opportunities for players operating in the industry. However, small & medium sized enterprises sub-segment is likely to witness substantial growth rate in the coming years owing to the rising number of these enterprises and increasing acceptance of digital payments.

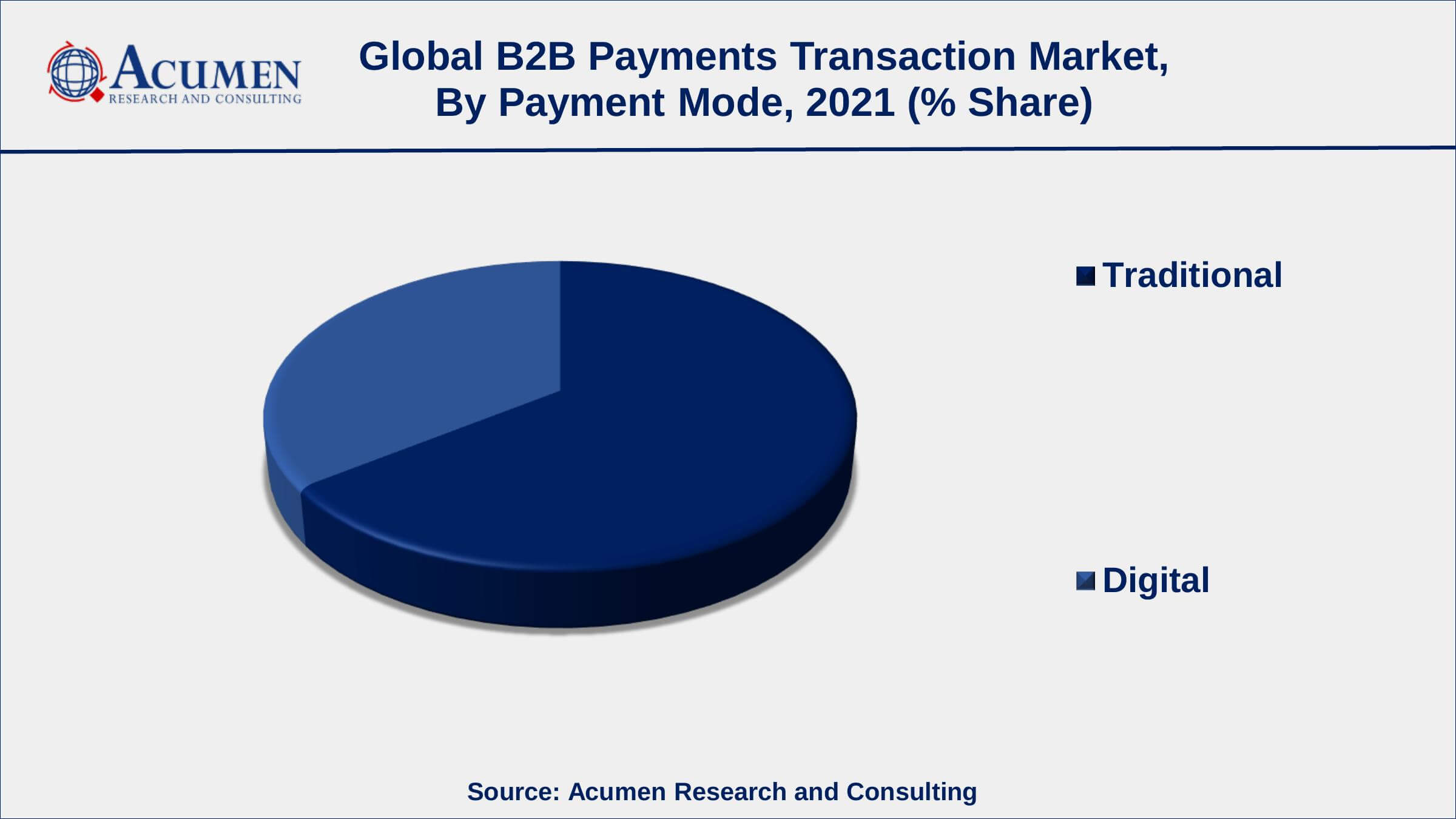

B2B Payments Transaction Market By Payment Mode

Among the transaction type segment, the digital segment is gaining traction due to digitalization approach from the government of developing countries. From the total UPI transactions around 16.5 Million transactions amounting to INR 6,8872.57 crore were done through the BHIM app. The interface handled 93,000 transactions worth US$ 30 Mn for 21 banks.

B2B Payments Transaction Market By Industry Vertical

Based on industry vertical segment, BFSI conquered a bulk market share from 2022 to 2030. Since banking, financial services and insurance are dedicated to funds transfer and other banking activities they are ranking number 1 in the industry vertical list. The growing number of small & medium industries, growing workforce, rising international trades, increasing preference of business for cashless transaction, and the impact of COVID-19 pandemic have all upsurged the BFSI sector from past few years.

B2B Payments Transaction Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

B2B Payments Transaction Market Regional Analysis

North America is expected to account for high revenue share due to availability of advanced infrastructure in order to facilitate online payment. Canada is the world's second largest user of per capita credit cards, and its POS environment was dominated by B2B payment transaction credit cards few years back. During this era, credit card ownership extended to more than 90 percent of adult Canadians, while there was a powerful overall trend away from paper payment types–such as checks–to electronics. Because of benefits and comfort, credit cards have increased in popularity in big part.

High government spending on securing the transaction network, along with availability of standard regulation related to online payment is expected to support the growth of the market in this region.

Asia Pacific market is expected to witness faster growth due to high penetration of smart phone, internet, and high spending capacity of customers. In addition, major players approach towards developing countries in order to track the untapped market is expected to further support the regional market growth.

B2B Payments Transaction Market Players

The players profiled in the report include American Express Co. Inc., Ant Financial Services Co. Ltd., Bottomline Technologies Inc., Coupa Software Inc., FleetCor Technologies Inc., Intuit Inc., JPMorgan Chase & Co., MasterCard Inc., PayPal Holdings Inc., SAP, TransferWise Ltd., and Visa Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

November 2023

March 2023

January 2020

February 2023