November 2021

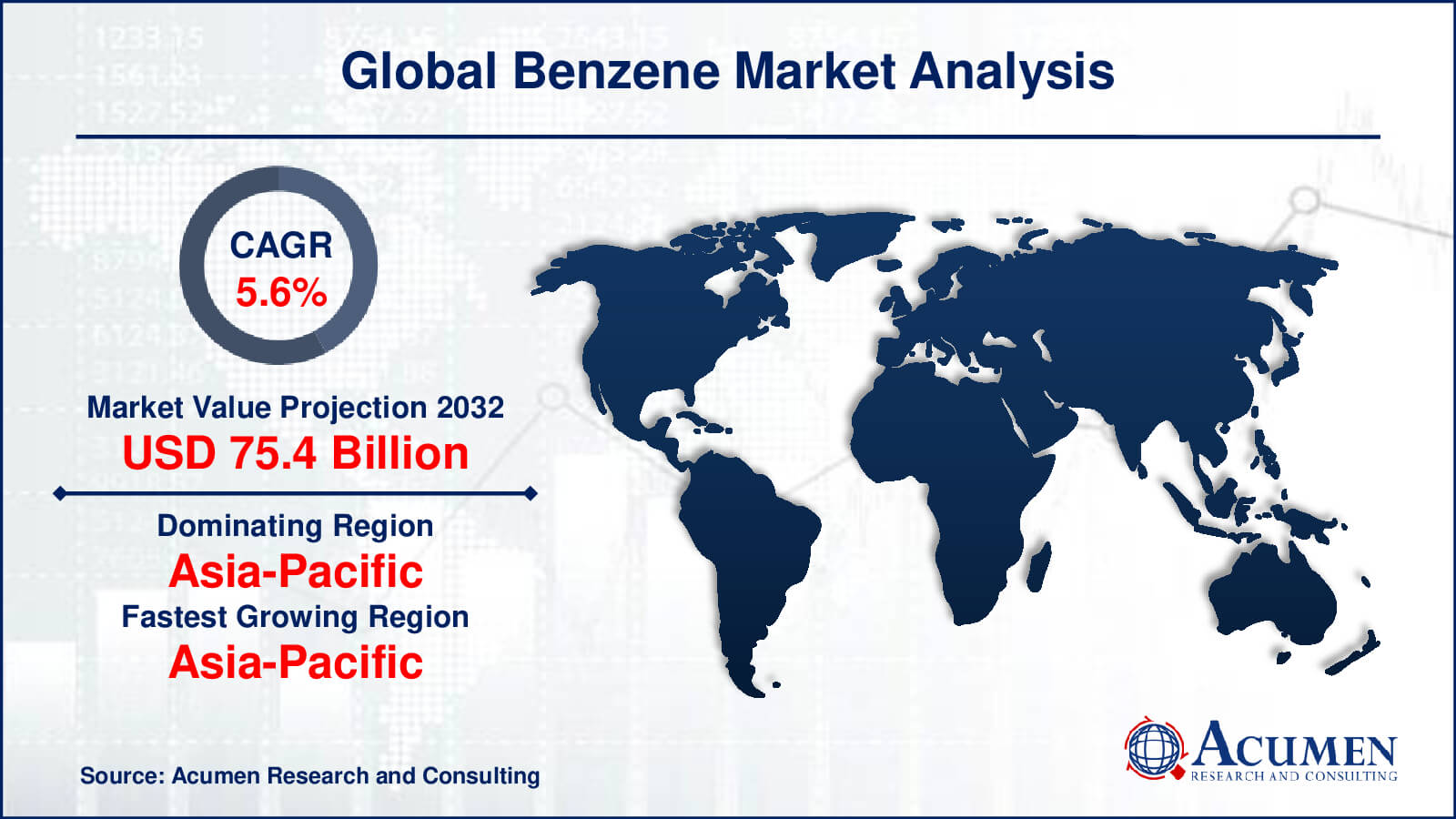

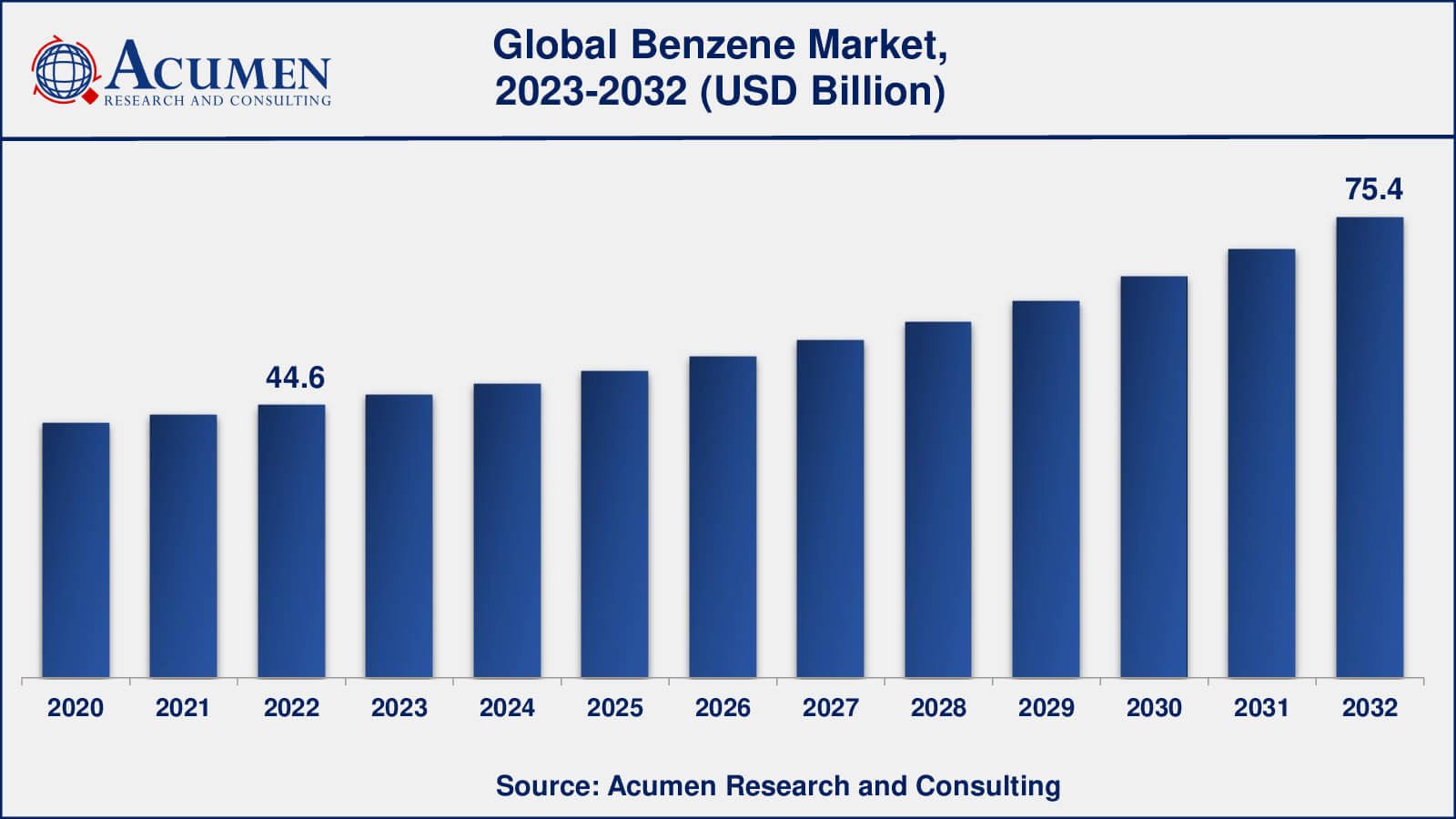

Benzene Market Size accounted for USD 44.6 Billion in 2022 and is estimated to achieve a market size of USD 75.4 Billion by 2032 growing at a CAGR of 5.6% from 2023 to 2032.

The Global Benzene Market Size accounted for USD 44.6 Billion in 2022 and is estimated to achieve a market size of USD 75.4 Billion by 2032 growing at a CAGR of 5.6% from 2023 to 2032.

Benzene Market Highlights

Benzene is a colorless or light-yellow liquid at room temperature with a pleasant odor, and it is extremely flammable. Benzene evaporates quickly into the air, and its vapor, being heavier than air, can sink to the ground in low-lying areas. It serves as a critical feedstock for the production of various chemicals, which are then used in a variety of industries including building and construction, textiles, electrical and electronics, and automotive manufacturing. Additionally, benzene can be found in inks, as well as a range of painting products such as sprays, lacquers, paints, sealers, and stains. It is used in the manufacturing of plastic and chemical products.

Global Benzene Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Benzene Market Report Coverage

| Market | Benzene Market |

| Benzene Market Size 2022 | USD 44.6 Billion |

| Benzene Market Forecast 2032 | USD 75.4 Billion |

| Benzene Market CAGR During 2023 - 2032 | 5.6% |

| Benzene Market Analysis Period | 2020 - 2032 |

| Benzene Market Base Year | 2022 |

| Benzene Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Derivatives, By Production Process, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Dow, INEOS Group, LyondellBasell Industries Holdings B.V., Royal Dutch Shell Plc, Reliance Industries Limited, Chevron Phillips Chemical Company LLC, China Petrochemical Corporation, Marathon Petroleum Corporation, LG Chem, Exxon Mobil Corporation, and Total S.A. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Benzene Market Insights

The demand for benzene in the global market has increased due to the growing consumption of benzene derivatives in the automotive industry, particularly for the production of synthetic rubber. Moreover, the rising demand for polyester is a significant factor driving market growth, along with increased crude oil production, low feedstock costs, and an economically viable commodity product.

In the Asia-Pacific region, several major factors are driving the benzene market. These include the increased consumption of phenol and the rising demand for methylene diphenyl diisocyanate. The global benzene market is also being propelled by the rising need for cumene, used in the production of acetone for both the automotive and architectural industries.

The growing consumption of benzene derivatives in the automotive industry for manufacturing synthetic rubber presents an opportunity for the market. Benzene is produced through both natural and human processes. Natural sources such as volcanoes and forest fires emit benzene, and it's also found in crude oil, gasoline, and cigarette smoke. In the United States, benzene finds wide usage, ranking among the top 20 chemicals in terms of production volume. Various industries utilize benzene to create other chemicals, including plastics, resins, nylon, and synthetic fibers. Additionally, benzene plays a role in the production of lubricants, rubbers, dyes, detergents, pharmaceuticals, and pesticides.

Health Effects of Exposure to Benzene

Human exposure to benzene has been linked to a range of short- and long-term negative health effects and disorders, including cancer and aplastic anemia. Exposure can occur both at work and at home due to the widespread use of benzene-containing petroleum products, such as motor fuels and solvents. Since benzene is highly volatile, the majority of exposure happens through inhalation. However, increased public awareness regarding sources of benzene exposure and the implementation of risk mitigation measures, along with ongoing educational efforts to discourage the use of benzene or petrol for cleaning and degreasing in both industries and households, are significant concerns for organizations. These factors are hindering the growth of the global benzene market.

Benzene Market Segmentation

The worldwide market for benzene is split based on derivatives, production process, application, end-user, and geography.

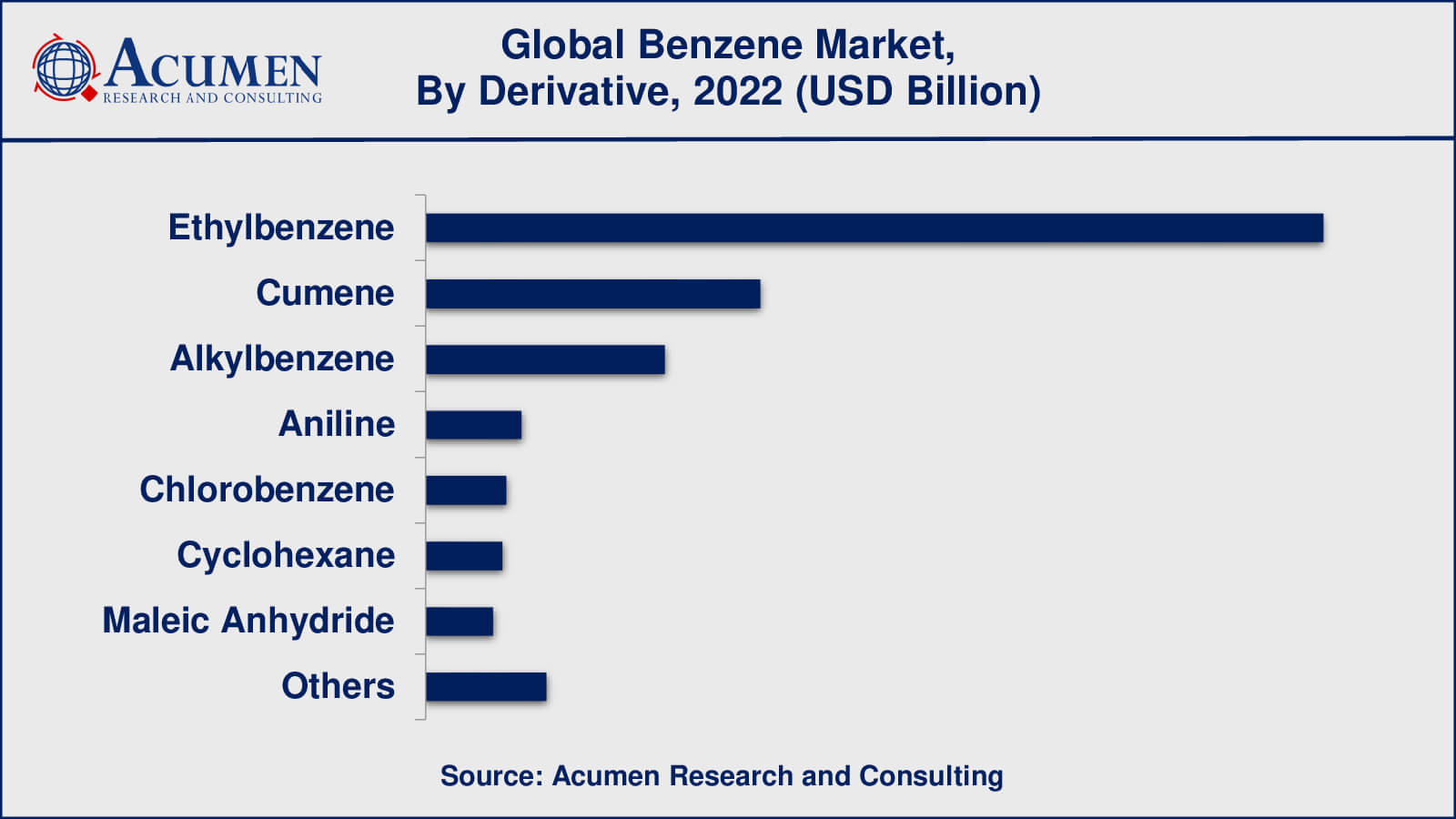

Benzene Derivatives

Based on its derivatives, the ethylbenzene segment dominated the market in the past year. Ethylbenzene is a high-yield aromatic hydrocarbon primarily used in the production of styrene. Styrene serves as a foundational chemical in the manufacturing of various products that have significantly enhanced the quality of everyday life. Globally, approximately 60% of all styrene is utilized to produce polystyrene, a versatile plastic available in multiple forms such as solid, foam, and film.

In addition to its intended applications, ethylbenzene can be found in low concentrations in fuels and automobile exhaust. In the United States alone, hundreds of metric tons of ethylbenzene are produced annually. Ethylbenzene finds its primary use in the production of another chemical-styrene. Other applications include its use as a solvent, in fuels, and in the production of various other chemicals.

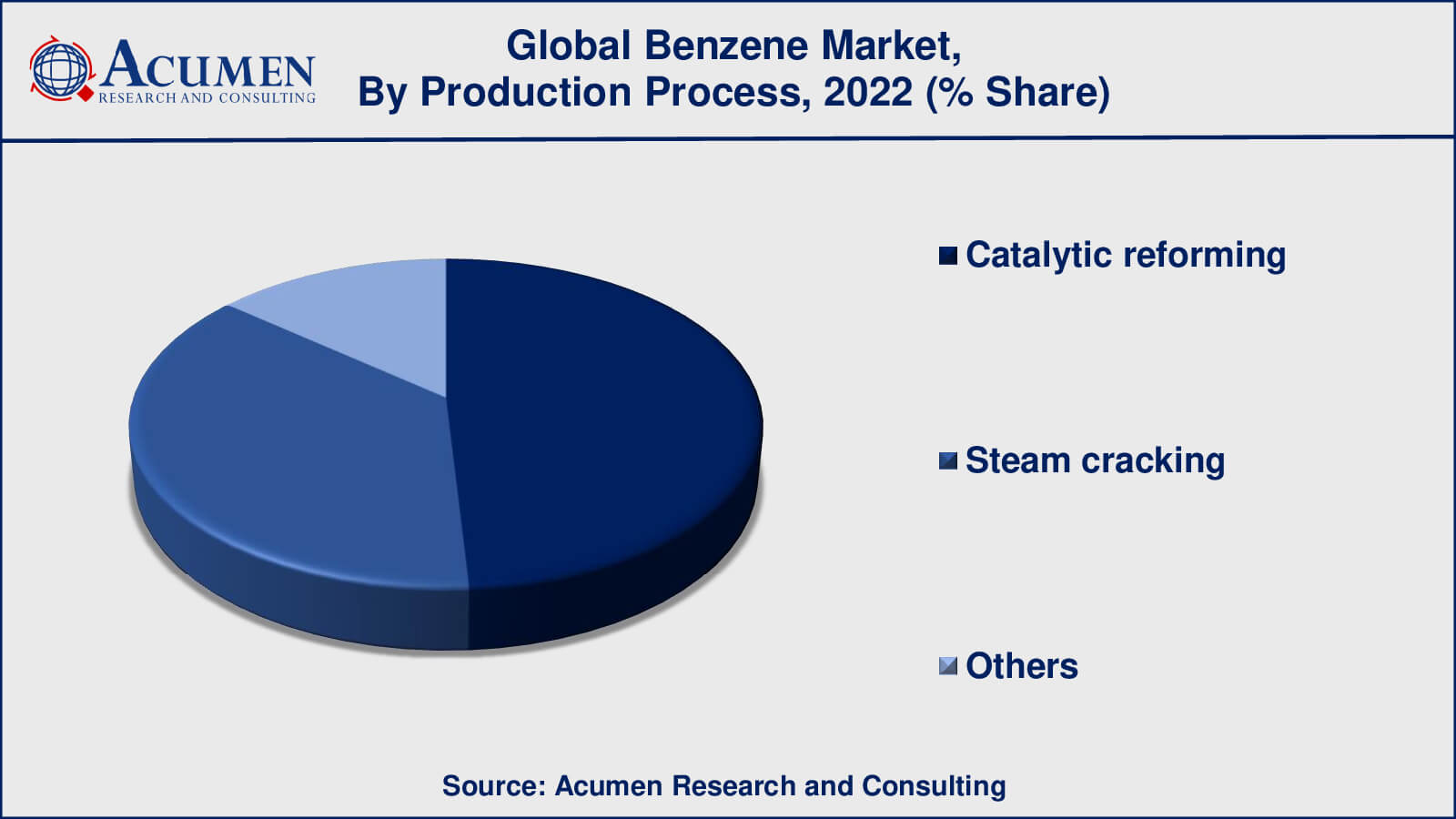

Benzene Production Processes

According to the benzene industry analysis, the production process segment is divided into catalytic reforming, steam cracking, and others. Within the production process segment, the catalytic reforming category emerged as the leader in terms of revenue share in previous years. This segment holds nearly 50% of the market share. Hydrogen, provided by the catalytic reforming segment, is used for producing clean fuels through hydroprocessing units. The steam cracking segment is expected to be the second-largest growing segment in the benzene market during the forecast period.

Benzene Applications

In terms of applications, the plastics segment holds the largest benzene market share in recent years. Benzene primarily serves as a feedstock or raw material for the production of various industrial chemicals, including ethylbenzene, cumene, and cyclohexane. These chemicals are subsequently utilized in the manufacturing of a wide range of materials and plastics such as polystyrene, ABS, and nylon. Additionally, benzene finds use as a solvent in the chemical and pharmaceutical industries.

Benzene End-Users

In terms of the end-user segments, the benzene market is classified into oil & gas and petrochemicals, automotive, mechanical & engineering, construction, chemicals, and others. According to the benzene market forecast, the oil & gas and petrochemical segments have dominated the market share and are likely to maintain their dominance throughout the forecasted timeframe from 2023 to 2032. The increasing demand for oil and gas in today's essential industries will drive the growth of this segment.

In terms of growth rate, the pharmaceuticals segment is experiencing the fastest revenue growth, with a high compound annual growth rate (CAGR) during the forecast period. The rising global demand for drugs that are based on benzene is a key factor contributing to the growth of this segment.

Benzene Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Benzene Market Regional Analysis

The Asia-Pacific region consumes the most benzene and is also expected to be the fastest-growing market. This growth can be attributed to rising demand from end-users in sectors such as packaging, construction, electronics, and home appliances, all of which contribute to an increased demand for styrene. China, due to its increased utilization of plastic in automotive applications and the growing use of polyurethane foams in the furniture industry, stands out as the leading producer and consumer in the Asia-Pacific region.

Furthermore, an increase in pygas production and gasoline consumption will further drive the demand for benzene in the key Asia-Pacific region. Benzene is a plentiful commodity and has served as one of the low-cost feedstocks driving the growth of the burgeoning petrochemicals industry in Asia's developing economies.

Benzene Market Players

Some of the top benzene companies offered in our report include BASF SE, Dow, INEOS Group, LyondellBasell Industries Holdings B.V., Royal Dutch Shell Plc, Reliance Industries Limited, Chevron Phillips Chemical Company LLC, China Petrochemical Corporation, Marathon Petroleum Corporation, LG Chem, Exxon Mobil Corporation, and Total S.A.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

November 2021

January 2024

April 2023

January 2025