September 2022

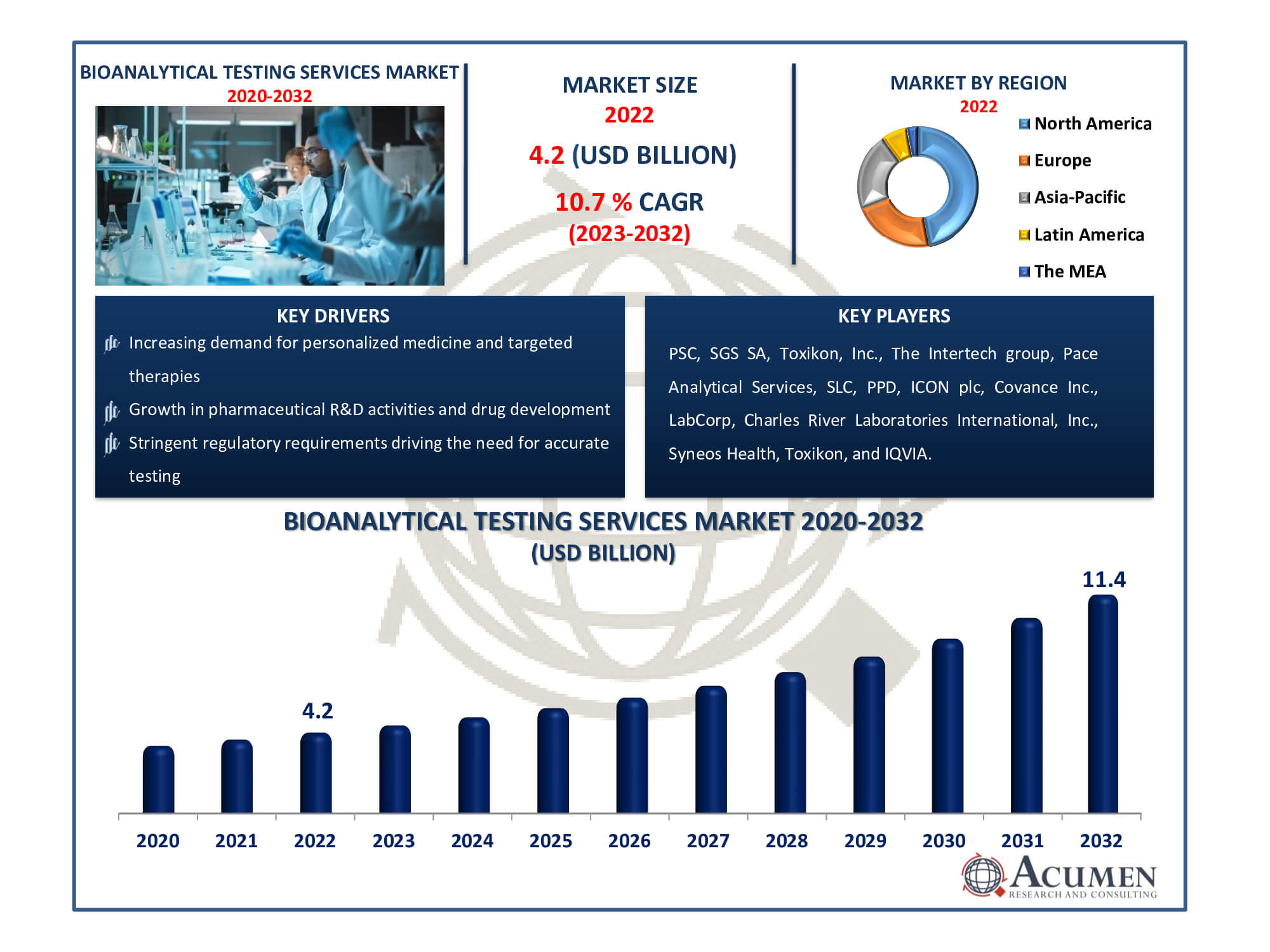

Bioanalytical Testing Services Market Size accounted for USD 4.2 Billion in 2022 and is estimated to achieve a market size of USD 11.4 Billion by 2032 growing at a CAGR of 10.7% from 2023 to 2032.

The Bioanalytical Testing Services Market Size accounted for USD 4.2 Billion in 2022 and is estimated to achieve a market size of USD 11.4 Billion by 2032 growing at a CAGR of 10.7% from 2023 to 2032.

Bioanalytical Testing Services Market Highlights

A variety of procedures are used in bioanalytical testing services to quantify pharmaceuticals and their metabolites in biological samples. Through accurate characterization of drug concentrations in biological matrices, these procedures are critical in pharmaceutical development, assuring drug efficacy, safety, and conformance to regulatory criteria. Bioanalytical testing services encompass various methods to quantify active drugs and their metabolites within the human body. This testing is pivotal in drug development, ensuring the efficacy and success of medications. Forecasts suggest a rising demand for fast-acting medications addressing chronic diseases, driving the need for bioanalytical testing services. Ongoing advancements in research and development (R&D) support this trend, facilitating rapid biologic development for quicker clinical trials, notably impacting treatment options for severe illnesses like cancer. Additionally, the outsourcing of R&D to contract research organizations is expected to significantly increase demand for bioanalytical testing services.

Global Bioanalytical Testing Services Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Bioanalytical Testing Services Market Report Coverage

| Market | Bioanalytical Testing Services Market |

| Bioanalytical Testing Services Market Size 2022 | USD 4.2 Billion |

| Bioanalytical Testing Services Market Forecast 2032 | USD 11.4 Billion |

| Bioanalytical Testing Services Market CAGR During 2023 - 2032 | 10.7% |

| Bioanalytical Testing Services Market Analysis Period | 2020 - 2032 |

| Bioanalytical Testing Services Market Base Year |

2022 |

| Bioanalytical Testing Services Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Molecule Type, By Test Type, By Workflow, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | PSC, SGS SA, Toxikon, Inc., The Intertech group, Pace Analytical Services, SLC, PPD, ICON plc, Covance Inc., LabCorp, Charles River Laboratories International, Inc., Syneos Health, Toxikon, and IQVIA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Bioanalytical Testing Services Market Insights

Anticipated advancements in biological development during the forecast period are poised to stimulate market demand. Patent expirations and essential clinical trials for diverse medications are expected to positively impact the bioanalytic testing services market. The outsourcing of testing services to contract research organizations in developing economies is likely to propel market growth. Additionally, the increasing prevalence of cancer and other chronic diseases necessitating blockbuster medications is anticipated to drive market demand in the forthcoming years. Nevertheless, the high costs of drugs may present a challenge to market growth.

The increasing trend of major pharmaceutical companies outsourcing R&D activities to focus on core competencies is a key driver. The economic efficiency offered by outsourcing, rather than conducting internal studies, continues to fuel demand. Patent expirations among large sellers are prompting drug manufacturers to invest in replenishing their pipelines, a significant factor driving growth in the bioanalytical testing services market. Contract Research Organizations (CROs) are witnessing growing demand from the pharmaceutical sector due to their diversified expertise, particularly in clinical trials across different regions and drug development within specific therapeutic sectors compared to pharmaceutical companies.

In the pharmaceutical analytical testing services market, outsourcing significantly amplifies the complexity and standards that individual molecules must adhere to. Alongside evolving standards, companies must vigilantly track regulatory updates and harness expertise and advisory services. International organizations like the International Council on Harmonization (ICH) routinely update harmonized guidelines.

The rise of biosimilars, combination molecules, and other innovative drugs has spurred heightened demand for specific types of tests. Additionally, when businesses expand to new locations, adherence to local standards becomes imperative, often necessitating specific types of testing.

Bioanalytical Testing Services Market Segmentation

The worldwide market for bioanalytical testing services is split based on molecule type, test type, workflow, end-user, and geography.

Bioanalytical Testing Services Molecule Types

The bioanalytical testing services market segments molecules into small and large categories. In recent years, the small molecular sector held a significant market share, housing the majority of both generic and branded drug compounds. As many blockbuster medicines patents expired, generic manufacturers had to conduct bioanalytical tests, driving growth in this segment for the subsequent years.

Conversely, a robust growth trajectory is anticipated for the large molecular sector during this market forecast period. This growth is attributed to a rich pipeline of biofuel or amino acid-based molecules, necessitating technical expertise and advanced analytical instruments for testing. Service providers in bioanalytical services possess the necessary infrastructure, making externalization of these molecules a prevalent trend in the forecast period.

Large molecules, known as biologics, are protein-based with therapeutic effects, comprising several thousand amino acids and weighing up to 150kDa. The entire development process necessitates bioanalytical testing for these large molecular drugs. The biological pipeline is burgeoning, leading to exponential growth in biological sales over the years.

Bioanalytical Testing Services Test Types

The market segments are based on test types such as MTS Excretion (ADME), pH, Pharmacokinetics (PD), bioavailability, bioequivalence, and others. According to the bioanalytical testing services industry analysis the bioavailablity subsegment is the largest. High demands for bioavailability (BA) and bioequivalence (BE) studies, particularly in generic drug production, led to significant market shares.

Pharmacokinetics (PK) pertains to the post-administration phase of pharmacology, governing drug fate. Essential PK parameters, frequently measured, include dosage interval, peak plasma concentration (Cmax), time to peak plasma concentration (tmax), and volume of distribution. Companies employ advanced methods for determining PK parameters. For instance, SGS technology using Dry Blood Spot (DBS) offers numerous advantages over traditional methods. DBS methods require minimal samples, eliminate post-collection processing, facilitate convenient sample delivery and storage, and entail low biohazard risks.

Bioanalytical Testing Services Workflows

Sample analysis dominates the workflow sector of the bioanalytical testing services market due to its vital function in analysing drug concentration levels and metabolites in biological samples. It is a critical stage in guaranteeing drug safety and efficacy, as well as affecting regulatory approvals and clinical decisions. As pharmaceutical R&D becomes more intense, there is a greater demand for precise and thorough sample analysis to meet tight regulatory standards. Furthermore, advances in analytical techniques and technology increase demand for robust sample analysis services, reinforcing its market leadership.

Bioanalytical Testing Services End-Users

According to the bioanalytical testing services market forecast, the pharmaceutical and biotechnology companies lead the industry because they undergo considerable research and development, needing thorough testing to assure drug efficacy, safety, and regulatory compliance. These companies are involved in various drug development phases, from discovery to commercialization, and they require extensive bioanalytical services. With a focus on novel therapeutics and high regulatory standards, these companies primarily rely on robust testing services to progress their pipelines, securing their significant position of the bioanalytical testing market.

Bioanalytical Testing Services Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Bioanalytical Testing Services Market Regional Analysis

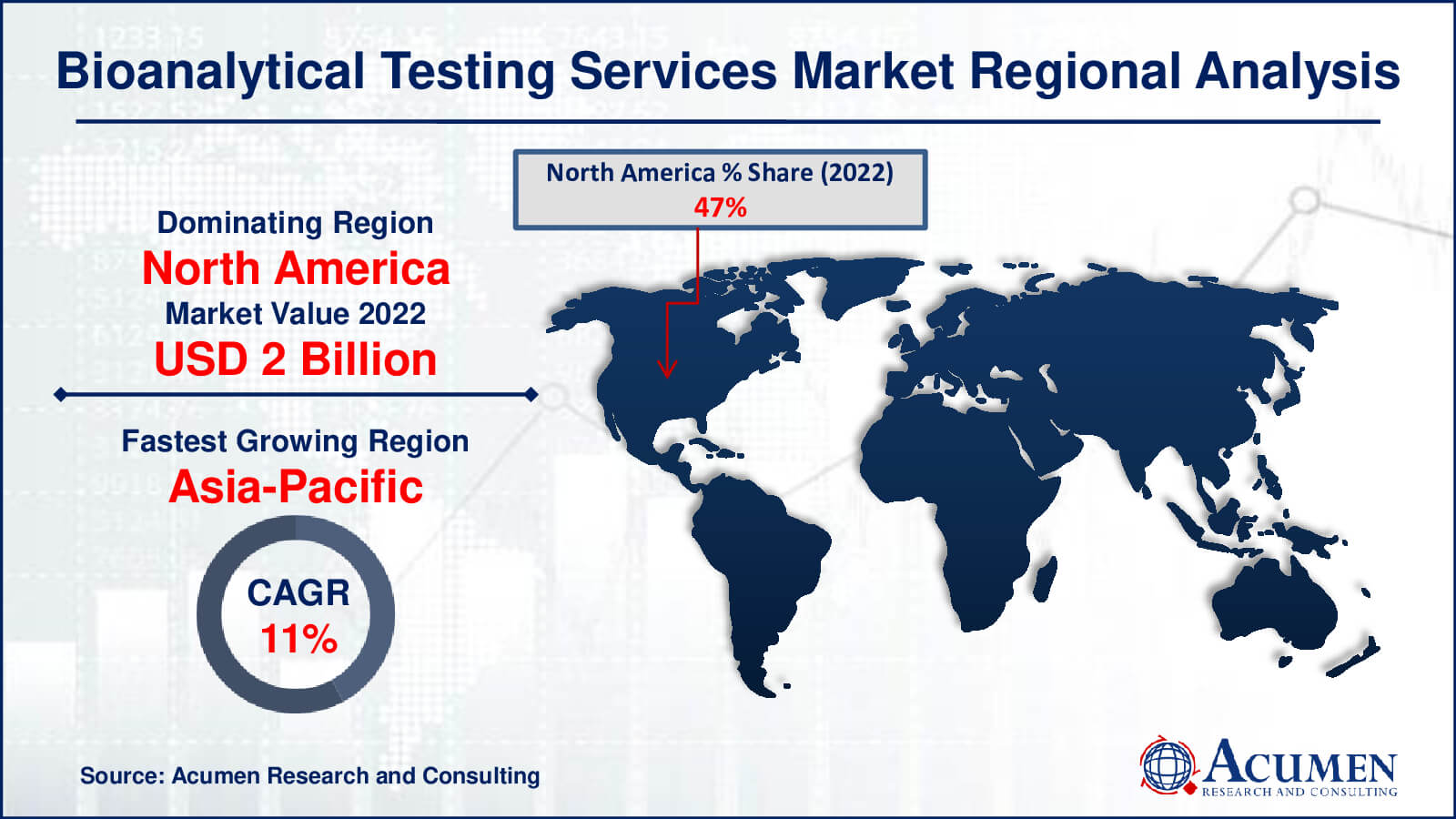

In 2022, North America led the global market for bioanalytical testing services due to its status as a highly reliable and sophisticated pharmaceutical manufacturing hub. Consequently, Original Equipment Manufacturers (OEMs) swiftly partnered with electronic service providers to efficiently manage the increasing electronic components within pharmaceutical products.

The market's growth in North America is primarily driven by the rapid expansion of pharmaceutical production to meet the escalating healthcare demand. Anticipated increments in state support for healthcare costs further fuel the region's pharmaceutical outsourcing market. In addition to its supremacy in bioanalytical testing services, North America's pharmaceutical manufacturing sector is propelled by the region's concentration on innovation and cutting-edge technologies. This innovative methodology promotes relationships between academic institutions and industry participants, promoting breakthroughs in drug development and analytical testing procedures. Simultaneously, Asia Pacific's outsourcing growth is driven by its rising talent pool and cost-effective solutions, which are attracting global attention and fostering partnerships, ultimately transforming the area into a significant pharmaceutical outsourcing destination and propelling its rapid market rise.

In the Asia-Pacific region, the most rapid growth in outsourcing services is expected, particularly in relatively untapped markets. Supply centers in China, Manila, and India typically support outsourcing services in this region. China, increasingly popular as an onshore and offshore outlet, attracts customers from Japan and other regions.

Bioanalytical Testing Services Market Players

Some of the top bioanalytical testing services companies offered in our report includes PSC, SGS SA, Toxikon, Inc., The Intertech group, Pace Analytical Services, SLC, PPD, ICON plc, Covance Inc., LabCorp, Charles River Laboratories International, Inc., Syneos Health, Toxikon, and IQVIA

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

September 2022

June 2024

February 2021

September 2022