April 2023

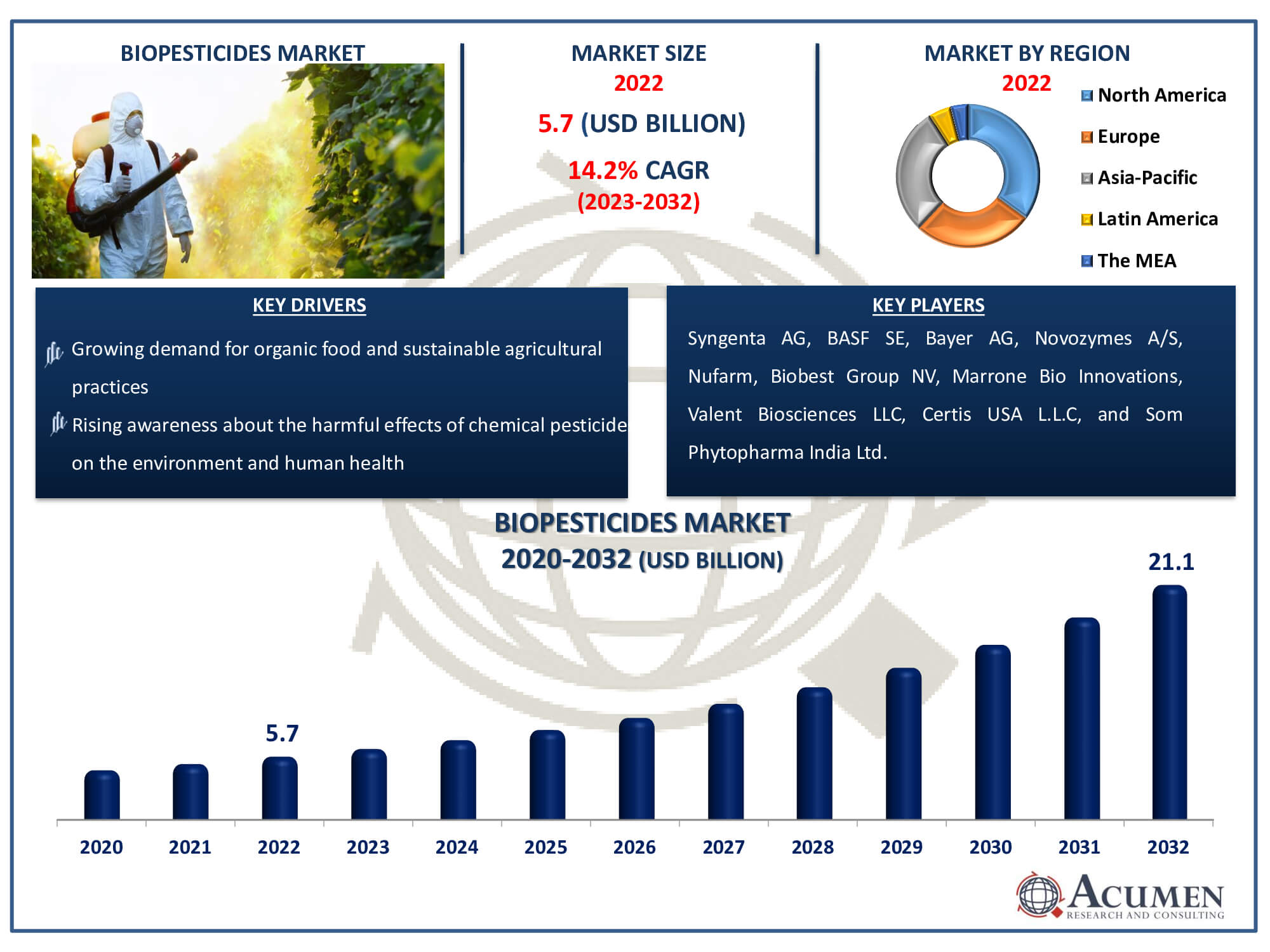

Biopesticides Market Size accounted for USD 5.7 Billion in 2022 and is estimated to achieve a market size of USD 21.1 Billion by 2032 growing at a CAGR of 14.2% from 2023 to 2032.

The Biopesticides Market Size accounted for USD 5.7 Billion in 2022 and is estimated to achieve a market size of USD 21.1 Billion by 2032 growing at a CAGR of 14.2% from 2023 to 2032.

Biopesticides Market Highlights

Biopesticides are derived from a variety of sources, including plants, fungi, bacteria, and virus-like microbes. Biochemical pesticides function similarly to their organic counterparts and provide environmentally benign pest control by imitating natural or synthetically generated substances. Microorganisms, such as Bacillus thuringiensis (BT) and several non-Bt variants, are the primary agents in microbial insecticides, which are designed to target particular pests. Genetically modified chemicals, or plant-incorporated defensive agents, enable plants to generate proteins or other molecules that deter or eradicate pests. By providing environmentally sustainable tailored pest management solutions, these advances support agriculture. The wide range of applications for biopesticides highlights their many functions in contemporary pest management tactics, offering efficient substitutes for traditional chemical pesticides while reducing environmental effects associated with farming operations.

Global Biopesticides Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Biopesticides Market Report Coverage

| Market | Biopesticides Market |

| Biopesticides Market Size 2022 | USD 5.7 Billion |

| Biopesticides Market Forecast 2032 | USD 21.1 Billion |

| Biopesticides Market CAGR During 2023 - 2032 | 14.2% |

| Biopesticides Market Analysis Period | 2020 - 2032 |

| Biopesticides Market Base Year |

2022 |

| Biopesticides Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Source, By Type, By Crop Type, By Formulation, By Mode of Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Syngenta AG, BASF SE, Bayer AG, Novozymes A/S, Nufarm, Biobest Group NV, Marrone Bio Innovations, Valent Biosciences LLC, Certis USA L.L.C, and Som Phytopharma India Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Biopesticides Market Insights

Several advantages drive the growth of the global market during the biopesticide industry forecast period. These include reducing environmental damage, targeted action, decreased coverage, and rapid decomposition, requiring smaller amounts. Additionally, the popularity of biopesticides has significantly increased in recent years due to extensive research. Moreover, techniques for mass production, storage, transport, and utilization of biopesticides have improved in recent years and are anticipated to be lucrative in the near future.

The rising environmental concerns regarding the use of synthetic pesticides, coupled with government support, have significantly driven the demand for biopesticides in many countries. Biopesticides, derived from renewable sources such as plants, animals, bacteria, and certain minerals, are utilized to monitor and mitigate the impact of weeds, pests, and insects on field crops. Additionally, the global biopesticides market's growth has been spurred by increasing health concerns associated with the use of synthetic chemical-based pesticides.

The expanding market for organic products worldwide has heightened consumer awareness of their advantages over synthetic alternatives, especially in developed economies. This transition to organic items has led to the growth of the global biopesticides market. Furthermore, several governments worldwide have actively advocated for the benefits of biopesticides, further fueling market expansion. However, a significant portion of the global population remains unaware of the advantages of biopesticides, impeding market growth.

Compared to the total pesticide market, the global biopesticides market remains relatively small and lacks the necessary profitability to sustain a significant presence in the market. Conversely, synthetic pesticides have dominated the global market for several decades, produced at relatively lower costs in comparison to biopesticides. Achieving economies of scale poses a challenging task for market participants. Nonetheless, the rapid adoption rates of biopesticides should significantly contribute to advancing their cause.

Biopesticides Market Segmentation

The worldwide market for biopesticides is split based on source, type, crop type, formulation, mode of application, and geography.

Biopesticide Sources

According to biopesticides industry analysis, the microbials segment of the market is dominated by a wide variety of microorganisms that are used to manage pests, such as fungi, viruses, and bacteria. These compounds are safe for non-target organisms and environmentally friendly, with the added benefit of being highly specific in their pest targeting. The market dominance of microbial-based biopesticides has been fueled by their eco-friendliness and broad range of effectiveness against various pests. Microbials are the top category in the biopesticide market because of their capacity to offer environmentally friendly, integrated pest management practice-compliant, and sustainable pest management solutions.

Biopesticide Types

The market for biopesticides is led by the bioinsecticides sector because of its critical role in using naturally produced compounds to battle insect pests. Bioinsecticides, which are derived from microbes, plants, or other natural sources, provide specific pest control with low environmental risk. Their ability to effectively target and manage insect populations, in addition to being environmentally benign, drives their supremacy in the market. Bioinsecticides are becoming more and more popular due to growing concerns about the use of synthetic chemicals and the growing desire for sustainable pest management. Bioinsecticides are the most important category in the biopesticide industry because of their shown efficacy, safety, and crucial involvement in integrated pest control techniques.

Biopesticide Crop Types

Owing to various factors, the biopesticides market's fruits and vegetables category holds the largest share. Due to the enormous insect pressure that fruits and vegetables encounter, safe and effective pest management methods are required. Biopesticides are a customised approach that eliminates a particular insect without producing hazardous residues. Additionally, consumers' growing preference for organic produce is fueling the market's need for biopesticides. Because of their ecologically benign nature and capacity to fulfil strict residual restrictions, biopesticides are a preferred option for managing pests in fruits and vegetables, hence strengthening their dominance in the biopesticide market.

Biopesticide Formulations

In terms of biopesticides market analysis, the industry is dominated by the dry segment for several primary reasons. Dry formulations, as opposed to their liquid equivalents, provide better stability, a longer shelf life, and ease of handling and storage. These characteristics help make transportation and application more convenient and cost-effective. Furthermore, because of their adaptability to different application techniques, the dry formulations are effective in a range of agricultural environments. The Dry segment dominates the biopesticide market for effective and dependable pest management solutions because of its long-term stability and potency, as well as its practical advantages in handling and application.

Biopesticide Mode of Applications

With its direct application to plant leaves and adaptability, the foilar spray sector commands the highest market share for biopesticides. With foilar spray, pests can be efficiently controlled while causing the least amount of environmental damage and exposing non-target creatures to a minimum. It is more widely used because it is simple to apply to many crop varieties and growth stages. To add to its dominance are its large-scale coverage capabilities and versatility for integrated pest management tactics. Because of its superior delivery system, foilar spray is still the most popular way to apply biopesticides to plants. Its ease of use, accuracy, and efficiency are what ensure this.

Biopesticides Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Biopesticides Market Regional Analysis

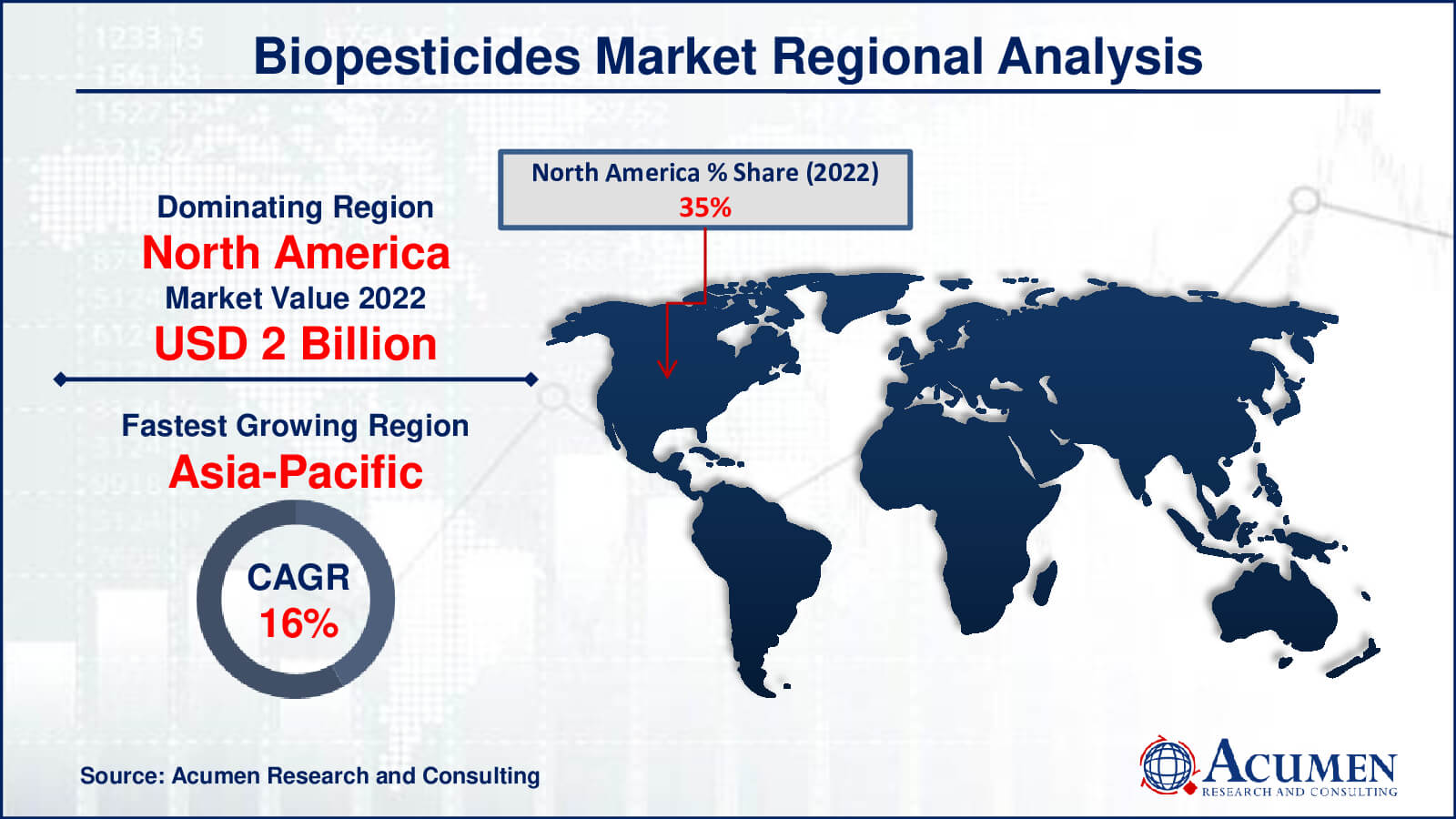

In 2022, North America held the leading share in the global biopesticides market, both in terms of volume and value. The United States stands as a key biopesticidal country, hosting major industry players alongside numerous local and unorganized manufacturers. The region's substantial land areas and the increasing demand for organic agricultural products, driven by stringent environmental regulations on synthetic pesticides, significantly contribute to the growth of the biopesticides market.

The Asia Pacific region is projected to witness rapid expansion during the biopesticides market forecast period. The surge in demand for food crops, particularly cereals, grains, fruits, and vegetables due to a burgeoning population, fuels the need for efficient agrochemicals. Additionally, growing farmer awareness about the advantages of bio-based agrochemicals amplifies the demand for biopesticides. Government initiatives, such as subsidies and educational programs for farmers highlighting the drawbacks of chemical-based pesticides, are expected to further boost the popularity of biopesticides in the region.

Anticipated growth is expected to be rapid in Europe and Latin America, while the Middle East and Africa may experience slower growth between biopesticides industry forecast period 2023 and 20232.

Biopesticides Market Players

Some of the top biopesticides companies offered in our report includes Syngenta AG, BASF SE, Bayer AG, Novozymes A/S, Nufarm, Biobest Group NV, Marrone Bio Innovations, Valent Biosciences LLC, Certis USA L.L.C, and Som Phytopharma India Ltd.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2023

November 2022

July 2022

July 2022