March 2021

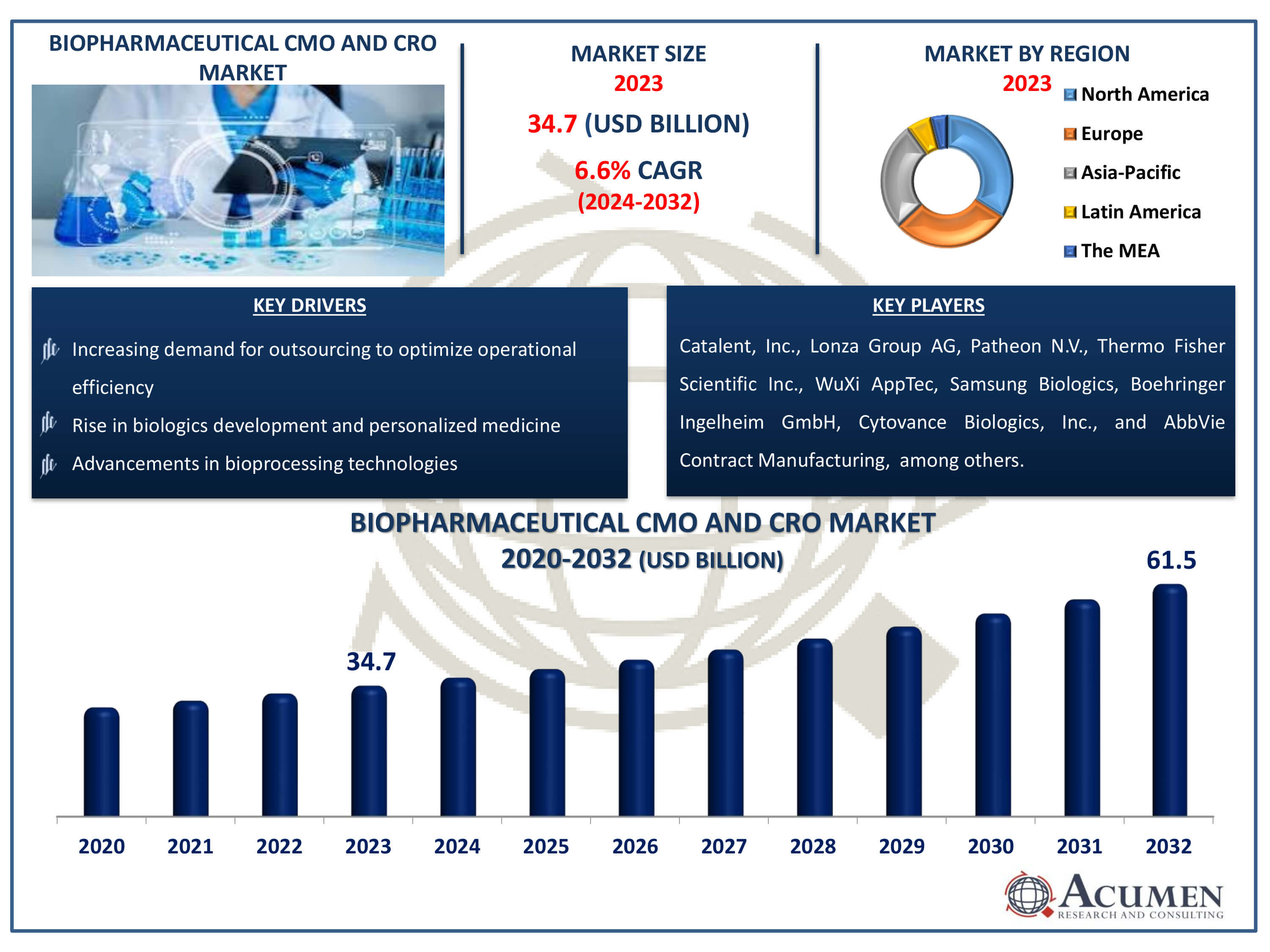

Biopharmaceutical CMO and CRO Market Size accounted for USD 34.7 Billion in 2023 and is estimated to achieve a market size of USD 61.5 Billion by 2032 growing at a CAGR of 6.6% from 2024 to 2032.

The Biopharmaceutical CMO and CRO Market Size accounted for USD 34.7 Billion in 2023 and is estimated to achieve a market size of USD 61.5 Billion by 2032 growing at a CAGR of 6.6% from 2024 to 2032.

Biopharmaceutical CMO and CRO Market Highlights

A biopharmaceutical contract manufacturing organization (CMO) specializes in the production of biologically derived drugs, offering expertise in complex bioprocessing techniques such as cell culture and fermentation. They cater to biotech and pharmaceutical companies seeking outsourced manufacturing solutions, ensuring compliance with stringent regulatory standards and optimizing production processes for biologics. Contract Research Organizations (CROs) dedicated to biopharmaceuticals provide a comprehensive suite of services spanning preclinical and clinical research phases. They conduct specialized studies including pharmacokinetics, pharmacodynamics, and bioanalytics, supporting the development of biologic therapies from early-stage research to regulatory approval.

Global Biopharmaceutical CMO and CRO Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Biopharmaceutical CMO and CRO Market Report Coverage

| Market | Biopharmaceutical CMO and CRO Market |

| Biopharmaceutical CMO and CRO Market Size 2023 | USD 34.7 Billion |

| Biopharmaceutical CMO and CRO Market Forecast 2032 |

USD 61.5 Billion |

| Biopharmaceutical CMO and CRO Market CAGR During 2024 - 2032 | 6.6% |

| Biopharmaceutical CMO and CRO Market Analysis Period | 2020 - 2032 |

| Biopharmaceutical CMO and CRO Market Base Year |

2023 |

| Biopharmaceutical CMO and CRO Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Source, By Service Type, By Product, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Catalent, Inc., Lonza Group AG, Patheon N.V., Thermo Fisher Scientific Inc., WuXi AppTec Co., Ltd., Samsung Biologics, Boehringer Ingelheim GmbH, Cytovance Biologics, Inc., AbbVie Contract Manufacturing, Fujifilm Diosynth Biotechnologies, and AGC Biologics. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Biopharmaceutical CMO and CRO Market Insights

In the biopharmaceutical sector, major players are heavily investing to enhance productivity and efficiency. This strategic focus on optimization has prompted smaller biomarks to increasingly turn to outsourcing for various tasks. Notably, some biomarks are entrusting entire biopharmaceutical processes to specialized Contract Development and Manufacturing Organizations (CDMOs), thereby intensifying demand for contract-based services. Facilitating this trend are mergers and acquisitions within the industry, which enable CMOs to offer integrated bioprocessing services. By consolidating resources and expertise, CMOs and Contract Research Organizations (CROs) become attractive partners for companies seeking expedited product launches. Recent years have witnessed a significant number of consolidations in the biopharmaceutical sector, driven by a desire to expand business operations and maintain competitiveness in the rapidly evolving market landscape.

While the biopharmaceutical CMO and CRO industries have reached a level of sophistication, the pursuit of innovation remains paramount. This pressure prompts these organizations to continually evolve their business models to meet the evolving needs of their clients and stakeholders. From adopting cutting-edge bioprocessing technologies to exploring novel therapeutic avenues, CDMOs are exploring diverse strategies to stay ahead in the competitive landscape. Moreover, CMOs are contributing to cost-effective production through the integration of single-use systems into manufacturing facilities. These systems offer advantages such as rapid turnaround times and reduced operational complexities. However, despite the benefits, negotiations between CMOs and their clients can pose challenges. Issues related to intellectual property rights, quality assurances, pricing structures, and project timelines often require careful consideration and negotiation to ensure mutually beneficial agreements.

Biopharmaceutical CMO and CRO Market Segmentation

The worldwide market for biopharmaceutical CMO and CRO is split based on source, service type product, and geography.

Biopharmaceutical CMO and CRO Sources

According to biopharmaceutical CMO and CRO industry analysis, mammalian cell lines stand as the primary production systems for large molecules due to their capability to generate complex protein therapies with human-like post-translation modifications. This segment is witnessing significant advancements in expression systems, process monitoring solutions, cell line engineering tools, and automated screening methods, resulting in enhanced productivity and efficiency in biologics production. Additionally, non-mammalian cell lines, such as microbial cell lines, are gaining recognition, with innovative strategies aimed at harnessing their potential. This shift is expected to drive profitable growth in the non-mammalian biopharmaceutical sector over the biopharmaceutical CMO and CRO industry forecast period.

Biopharmaceutical CMO and CRO Service Types

Contract manufacturing is on the dominating position among service type segment and it is expected to grow throughtout the biopharmaceutical CMO and CRO market forecast period. Various entities in the market offer a spectrum of biopharmaceutical manufacturing services, spanning from research and discovery to product launch. Space-based and opportunistic CMOs play a crucial role, providing comprehensive services from cell lines to fillings, with a notable focus on the production aspect of product development programs. Conversely, CROs are exploring avenues in the biopharmaceutical sector, attracting new market entrants and smaller players focusing on biofarmaceutical development, particularly in contracting research services for discovery programs.

Biopharmaceutical CMO and CRO Products

Biologics segment is holding maximum share within the product category. Contracting services are increasingly becoming a cost-effective method for producing large molecules, including biological and biosimilar products, reliably and efficiently. With the rising popularity of biological treatments, traditional pharmaceutical manufacturers are seeking entry into the biological market. This segment's dominance stems from its high biological complexity, intricate production processes, and higher success rates compared to other drug molecules. CMOs are meeting the growing demand for biological production services by leveraging single-use bioreactors, disposable containers, continuous purification processes, and real-time quality analysis. Moreover, investments in biosimilar development aim to surpass earlier innovative medicines in safety, effectiveness, disposal, or cost, intensifying competition among innovator manufacturers and benefiting CMOs.

Biopharmaceutical CMO and CRO Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

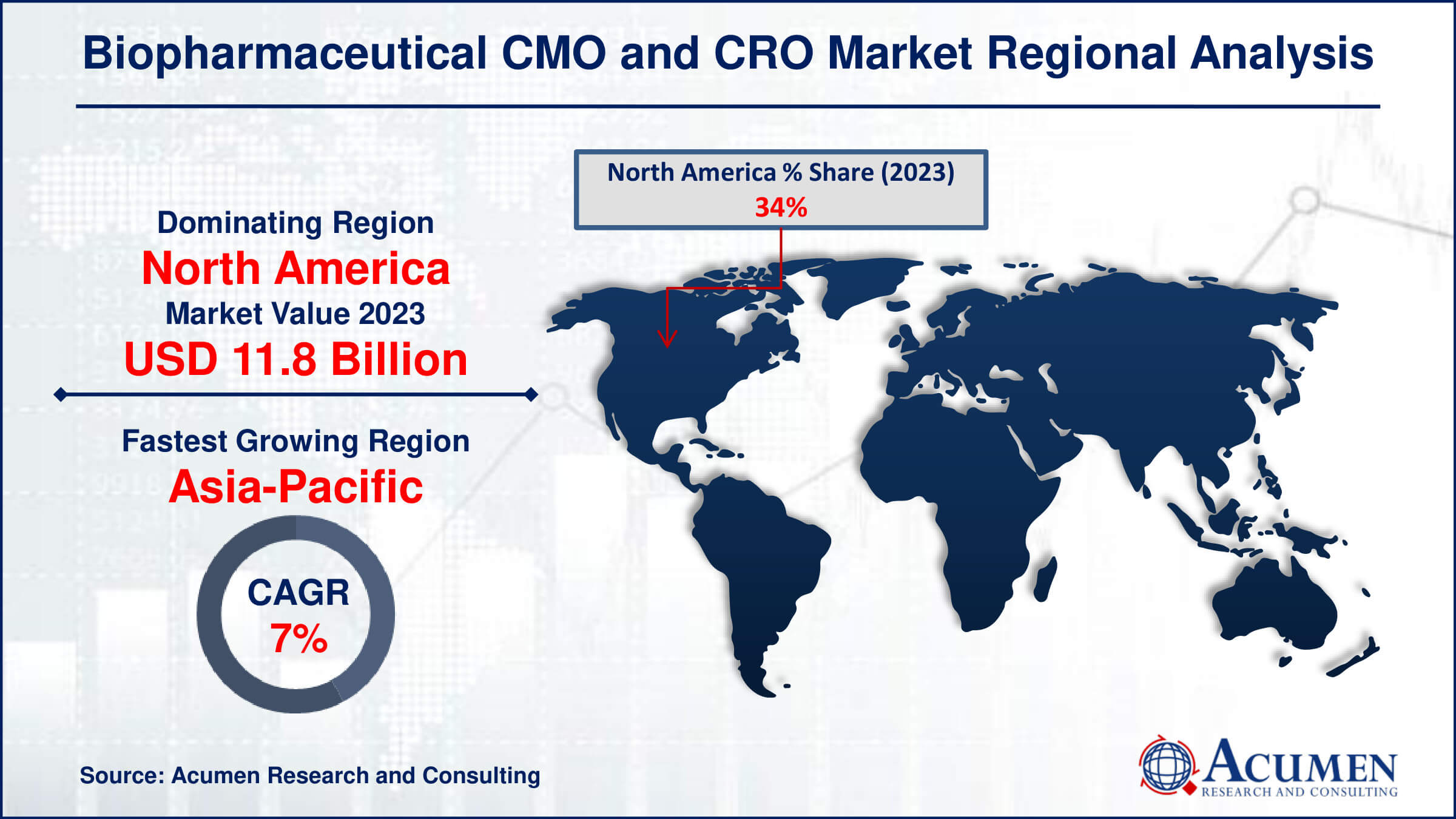

Biopharmaceutical CMO and CRO Market Regional Analysis

In terms of biopharmaceutical CMO and CRO market analysis, North America is the largest region in the industry. In the USA, Contract Manufacturing Organizations (CMOs) thrive with numerous approved products. However, many small to medium-sized biopharmaceutical companies (SMEs) struggle with limited resources and budgets to establish their own facilities. As a result, there's a growing reliance between CMOs and SMEs in the U.S., leading to the dominance of the U.S. market.

In the Asia Pacific region, the compound annual growth rate (CAGR) is expected to soar, especially in the biopharmaceutical market for CMOs & CROs. One of the main reasons for this growth is the cost advantages, including lower labor and operating expenses, driving the outsourcing trend. India, in particular, is poised for significant progress due to its substantial volume of molecular production.

The lack of global regulatory alignment for biosimilar approvals has significantly impacted the Indian market. By 2016, India had approved 50 biosimilars, far surpassing the approvals in Europe (24) and the United States (5). This regulatory discrepancy has fueled the growth of the biosimilar market in India.

Biopharmaceutical CMO and CRO Market Players

Some of the top biopharmaceutical CMO and CRO companies offered in our report includes Catalent, Inc., Lonza Group AG, Patheon N.V., Thermo Fisher Scientific Inc., WuXi AppTec Co., Ltd., Samsung Biologics, Boehringer Ingelheim GmbH, Cytovance Biologics, Inc., AbbVie Contract Manufacturing, Fujifilm Diosynth Biotechnologies, and AGC Biologics.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2021

July 2023

November 2023

January 2024