October 2022

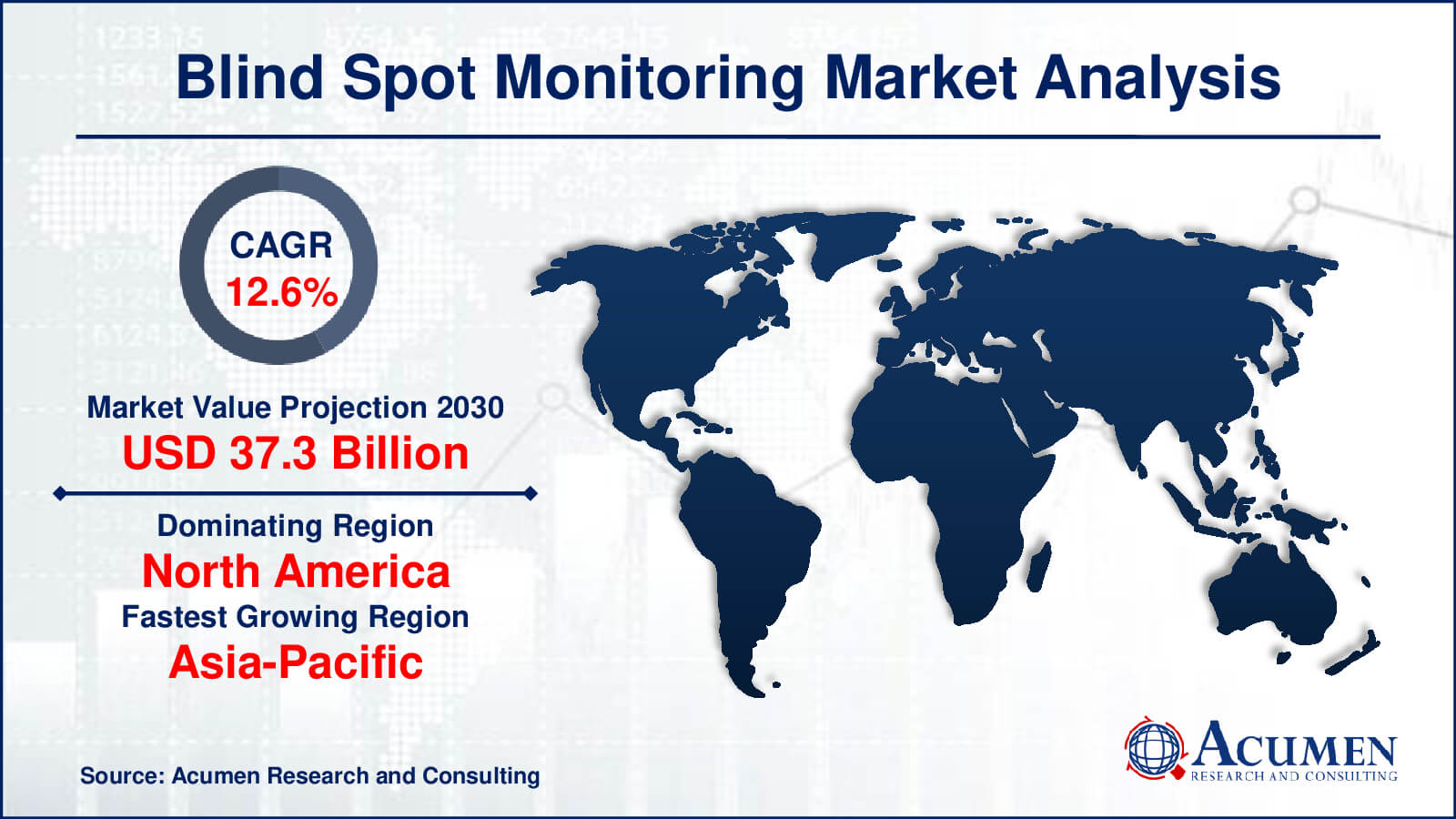

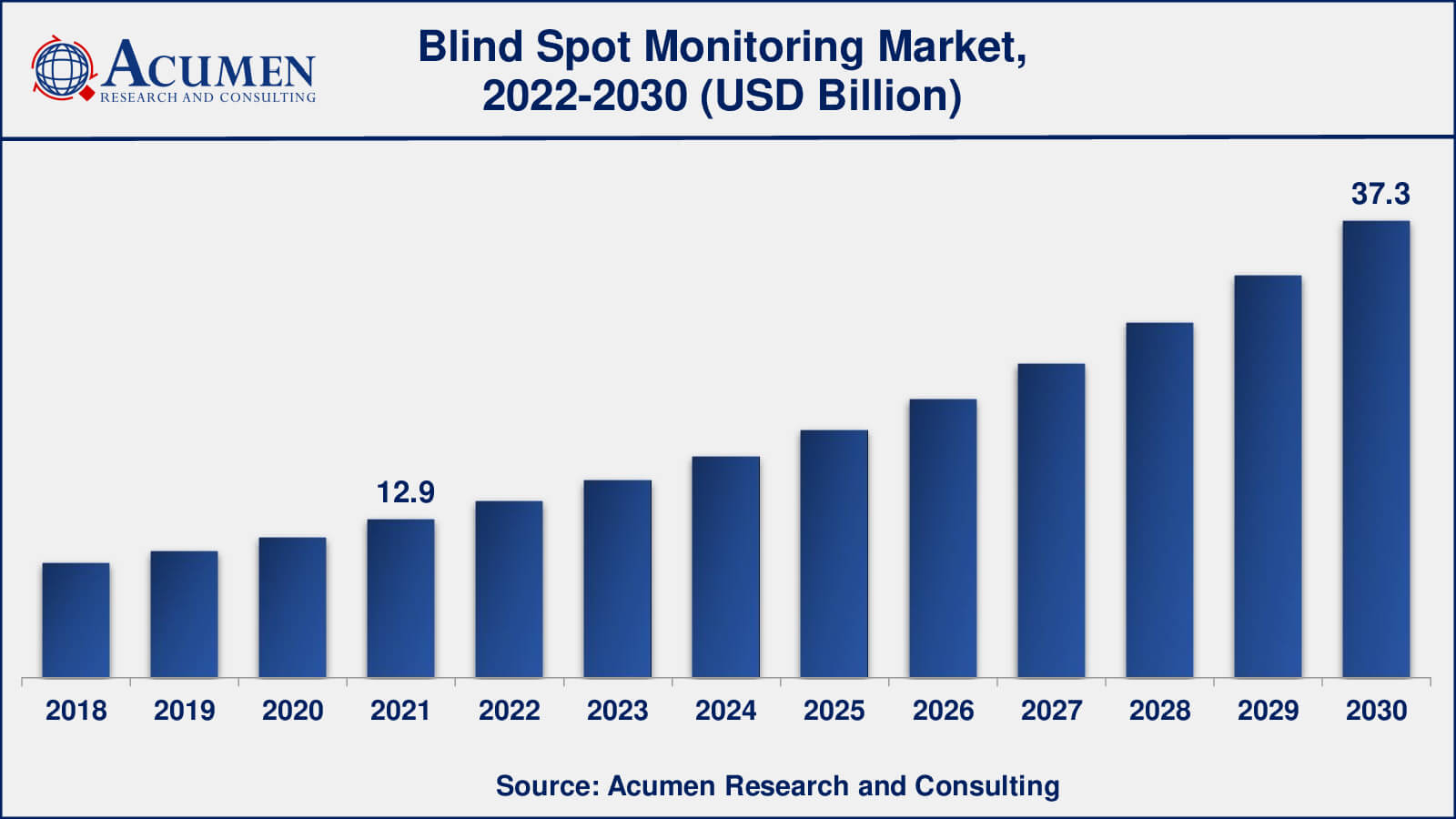

Blind Spot Monitoring Market gathered USD 12.9 Billion in 2021 and is expected to reach USD 37.3 Billion by 2030, growing at a CAGR of 12.6% from 2022 to 2030.

The global Blind Spot Monitoring Market gathered USD 12.9 Billion in 2021 and is expected to reach USD 37.3 Billion by 2030, growing at a CAGR of 12.6% from 2022 to 2030.

Blind Spot Monitoring Market Highlights

The blind spot monitor is a crucial sensor device in automobiles, designed to detect other vehicles lurking in the driver's concealed zones. This innovative system issues warnings to the driver through a variety of sensory cues, such as audible alerts, tactile feedback, visual signals, or even vibrations. However, the capabilities of blind spot monitors extend beyond mere side and rear monitoring. They can also integrate features like cross traffic alert, which provides a heads-up to drivers when backing out of parking spaces, alerting them to oncoming traffic from the sides.

The primary highlight of blind spot monitoring is its role as a cornerstone technology within the realm of driver aids, offering comprehensive 360-degree electronic coverage around the vehicle. This safety net encompasses an array of features, including adaptive cruise control, front and rear parking sensors, parking cameras, and lane departure warnings. By enhancing driver safety, these systems encourage various automotive manufacturers to produce components that prioritize durability while harnessing advanced safety technologies.

Blind spots represent those tricky areas outside the driver's field of vision. While mirrors help mitigate blind spots to some extent, they can't entirely eliminate hidden areas. Here's where blind spot monitors come into play, equipped with an arsenal of sensors and cameras that diligently monitor these elusive zones around and behind the vehicle. These monitors stand guard, promptly alerting the driver whenever another vehicle, pedestrian, or obstacle encroaches into the blind spot territory. In this way, blind spot monitors have emerged as champions in the mission to prevent accidents on our roads.

Global Blind Spot Monitoring Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Blind Spot Monitoring Market Report Coverage

| Market | Blind Spot Monitoring Market |

| Blind Spot Monitoring Market Size 2022 | USD 12.9 Billion |

| Blind Spot Monitoring Market Forecast 2032 | USD 37.3 Billion |

| Blind Spot Monitoring Market CAGR During 2023 - 2032 | 12.6% |

| Blind Spot Monitoring Market Analysis Period | 2020 - 2032 |

| Blind Spot Monitoring Market Base Year |

2022 |

| Blind Spot Monitoring Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Clinical Trial Phase, By Service, By Type, By Therapeutic Area, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Continental AG, Denso Corporation, Robert Bosch GmbH, Aptiv PLC, Valeo SA, Autoliv Inc., ZF Friedrichshafen AG, Magna International Inc., Infineon Technologies AG, Panasonic Corporation, Texas Instruments Incorporated, and NXP Semiconductors N.V. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Blind Spot Monitoring Market Insights

The surging demand for vehicle safety solutions stands as a paramount driving force propelling the growth of the BSM market. This demand has become a pivotal factor in the configuration of premium cars, despite the considerable costs associated with implementing high-end security systems. Ensuring the safety of both passengers and vehicles has become a top priority, compelling a majority of automobiles to incorporate cutting-edge safety systems. Particularly noteworthy are the harrowing accidents involving blind spots around large trucks and buses. Given the substantial size and width of commercial vehicles compared to passenger cars, the risk of accidents escalates. Enter the blind spot sensor devices, effectively engineered to eliminate these blind spots and curtail the risks of injuries. This crucial safety imperative is a driving force behind the burgeoning demand for spot detection systems, fueling the growth of the spot detection system market for commercial vehicles.

Several factors are poised to catalyze the growth of this market further. The emerging regions are witnessing a surge in industrialization, bolstered by increased government investments, advanced technologies, a wealth of low-cost labor, and rising disposable incomes among the populace. Additionally, government policies favoring the blind spot monitoring (BSM) system market, alternative sources for automobile production, and the growing appetite for automated vehicles are set to open up promising avenues for future growth in this market. Moreover, the alarming increase in road accidents and the heightened awareness surrounding road safety are significant factors driving market expansion. Nevertheless, challenges lie ahead, such as the higher costs associated with this technology and the limited availability of systems in non-luxury vehicles, which may potentially hinder market growth.

One notable restraint in the BSM market is the elevated cost of technology. While the demand for advanced safety features is on the rise, the substantial expenses associated with implementing blind spot monitoring systems can pose a challenge for both manufacturers and consumers. Striking a balance between safety and affordability remains a key concern, particularly in the mainstream automobile segment.

Amid the challenges, there are promising opportunities on the horizon. The increasing emphasis on road safety and the pressing need to reduce accidents provide a fertile ground for growth. As technology continues to advance, the potential for more cost-effective and accessible blind spot monitoring solutions becomes apparent. Additionally, as consumer awareness grows, there is room for market expansion into various vehicle segments, beyond just luxury cars, further diversifying and strengthening the market.

Blind Spot Monitoring Market Segmentation

The worldwide market for blind spot monitoring is split based on technology, vehicle type, vehicle propulsion, sales channel, and geography.

Blind Spot Monitoring Technologies

As per the our market analysis, RADAR technology was one of the dominant technologies in the blind spot monitoring (BSM) market. RADAR-based BSM systems were widely used by many automotive manufacturers due to their effectiveness in detecting objects and vehicles in blind spots, even in adverse weather conditions. RADAR sensors can provide reliable information about the position and speed of nearby vehicles, making them a preferred choice for enhancing vehicle safety.

However, it's important to note that the dominance of specific technologies in the BSM market can evolve over time as new advancements and innovations occur. Camera and ultrasound-based BSM systems have also been used and may continue to gain prominence, especially with the development of more advanced sensor technologies and the integration of multiple sensor types to provide comprehensive blind spot monitoring.

Blind Spot Monitoring Vehicle Types

In 2022, passenger cars were one of the primary vehicle types that dominated the blind spot monitoring (BSM) market. BSM systems were more commonly integrated into passenger cars, especially in the mid-range and premium segments, as a standard or optional safety feature. This was driven by the increasing consumer demand for advanced safety technologies in passenger vehicles.

Government regulations have made passenger safety a primary concern for all automotive manufacturers. Safety systems are designed to assist in maintaining control of the car, preventing vehicle accidents, and protecting passengers from injuries. These systems are fully automated to compensate for human error, thereby helping to prevent crashes. Various systems, including electronic control units like adaptive cruise control, night vision systems, engine stability programs, lane departure warning systems (LDWS), and intelligent parking assistance systems, are increasingly being integrated into automobiles.

While BSM systems were prevalent in passenger cars, they were also being adopted in heavy commercial vehicles and light commercial vehicles to improve safety, but to a lesser extent compared to passenger cars.

Blind Spot Monitoring Vehicle Propulsions

According to the blind spot monitoring market forecast, blind spot monitoring (BSM) technology is gaining significant traction in electric vehicles (EVs) for several compelling reasons. EVs are at the forefront of technological innovation in the automotive industry, often equipped with cutting-edge features to enhance safety and driver assistance. As EV manufacturers strive to provide a comprehensive and appealing package to attract consumers, integrating BSM systems aligns perfectly with their commitment to safety and advanced technology. BSM adds an extra layer of safety to EVs, assuring drivers that these eco-friendly vehicles are not only clean and efficient but also equipped with state-of-the-art safety measures.

The integration of Blind Spot Monitoring technology in electric vehicles not only aligns with the industry's commitment to innovation and safety but also addresses specific challenges related to pedestrian safety in quiet EVs. As the adoption of electric vehicles continues to grow, BSM is likely to become an increasingly common feature, contributing to the overall appeal and safety of electric mobility

Blind Spot Monitoring Sales Channels

OEM sales refer to BSM systems that are integrated into vehicles by manufacturers during the production process. Many automakers include BSM as a standard or optional feature in their vehicles to enhance safety and meet consumer demand for advanced safety technologies. In the passenger car segment, especially in mid-range and premium vehicles, OEM-installed BSM systems were common. OEM integration ensures that BSM systems are seamlessly incorporated into the vehicle's design and function.

The aftermarket sales channel involves BSM systems that are installed in vehicles after they have left the factory. Consumers who own vehicles without factory-installed BSM systems could purchase and install aftermarket BSM kits to add this safety feature to their vehicles. Aftermarket BSM solutions were particularly popular for retrofitting older vehicles or for consumers who preferred to customize their vehicles with specific BSM feature.

Blind Spot Monitoring Market Regional Segmentation

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Blind Spot Monitoring Market Regional Analysis

The report encompasses market size and volume for various segments across different regions. Europe and North America hold the largest market share in automotive blind spot detection systems, as these regions are home to major players in the blind spot detection system industry. Countries such as Germany, Great Britain, and France have played pivotal roles in Europe, with rising sales of luxury and premium vehicles contributing to the growth of the Blind Spot Monitoring market. Additionally, blind spot monitoring has gained popularity in this market segment. Moreover, stringent government regulations, such as "The United States New Car Assessment Program (US NCAP)," continue to drive demand for advanced safety features in automobiles, including blind spot detection.

The Asia-Pacific region is poised to exhibit the fastest growth in the upcoming period, primarily driven by Japan, India, and China. Factors contributing to this growth include the increased production of premium vehicles, the development of enhanced safety standards, and stringent government regulations aimed at reducing fatal accidents.

Blind Spot Monitoring Market Players

Some of the top blind spot monitoring companies offered in our report includes Continental AG, Denso Corporation, Robert Bosch GmbH, Aptiv PLC, Valeo SA, Autoliv Inc., ZF Friedrichshafen AG, Magna International Inc., Infineon Technologies AG, Panasonic Corporation, Texas Instruments Incorporated, and NXP Semiconductors N.V.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

October 2022

October 2024

November 2020

August 2020