August 2023

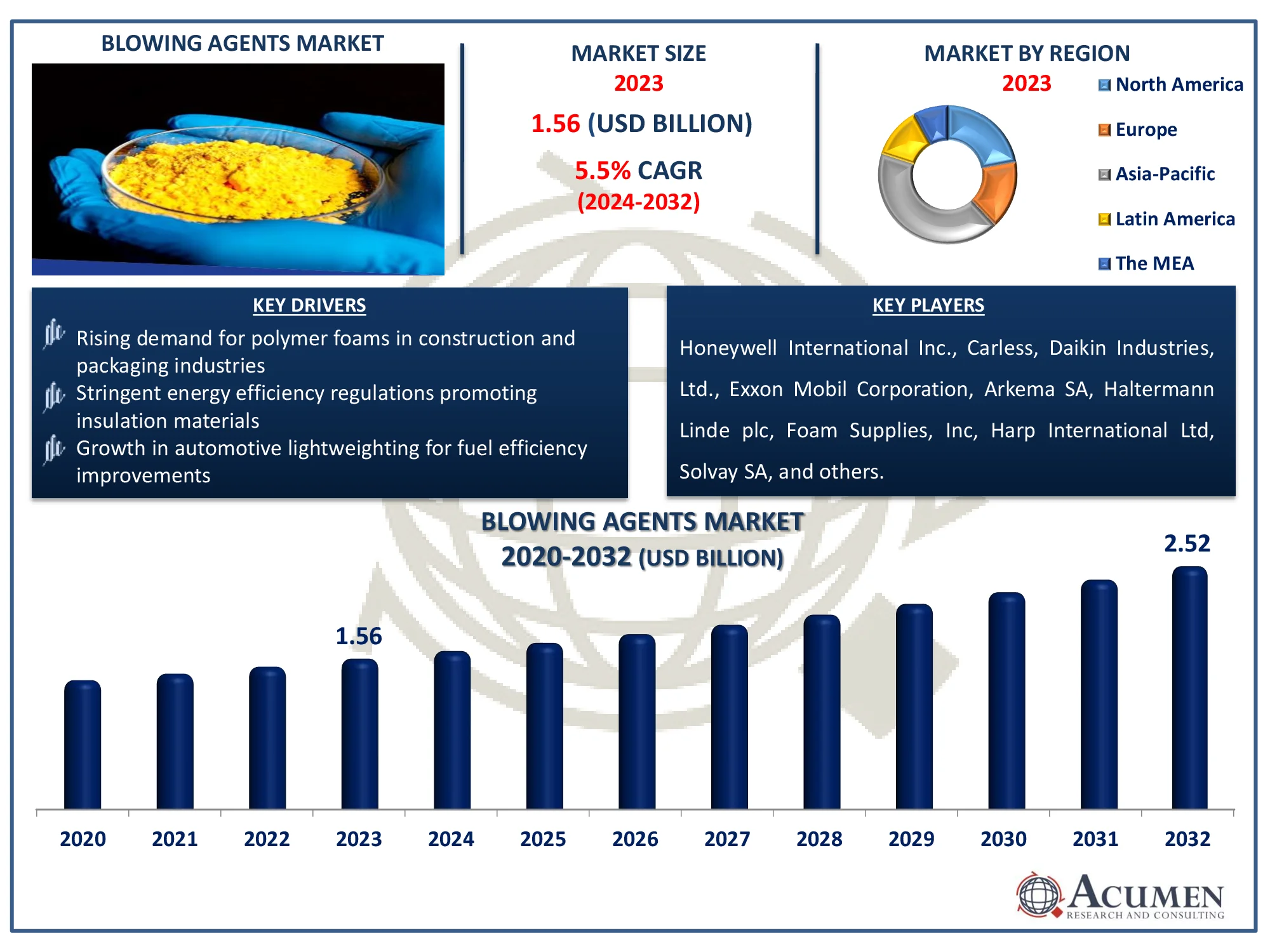

The Global Blowing Agents Market Size accounted for USD 1.56 Billion in 2023 and is estimated to achieve a market size of USD 2.52 Billion by 2032 growing at a CAGR of 5.5% from 2024 to 2032.

The Global Blowing Agents Market Size accounted for USD 1.56 Billion in 2023 and is estimated to achieve a market size of USD 2.52 Billion by 2032 growing at a CAGR of 5.5% from 2024 to 2032.

A blowing agent is a chemical that can form cellular structures. It is typically changed from liquid to foam. The cellular form of the matrix reduces density while improving acoustic and thermal insulation. Several forms of foam are employed, including polyurethane foam, phenolic foam, polystyrene foam, and others. These foams have found numerous applications in industries such as automotive, construction, and furniture.

|

Market |

Blowing Agents Market |

|

Blowing Agents Market Size 2023 |

USD 1.56 Billion |

|

Blowing Agents Market Forecast 2032 |

USD 2.52 Billion |

|

Blowing Agents Market CAGR During 2024 - 2032 |

5.5% |

|

Blowing Agents Market Analysis Period |

2020 - 2032 |

|

Blowing Agents Market Base Year |

2023 |

|

Blowing Agents Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Foam Type, By Product Type, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Honeywell International Inc., Daikin Industries, Ltd., Exxon Mobil Corporation, Arkema SA, Haltermann Carless, Linde plc, Foam Supplies, Inc, Harp International Ltd, Solvay SA, and The Chemours Company. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Blowing agents, which are known for their insulating characteristics, are the most widely utilized materials in construction. Because of their thermal insulation properties, they are used in a variety of electrical appliances. The market is being driven by rising demand for construction and electrical appliances, as well as enhanced insulating materials for automobile components. For example, the International Trade Administration estimates that the UAE's construction sector would revive substantially over the next five years, with construction industry value increasing by up to 4.7% annually, according to experts. The Abu Dhabi National Oil Company's (ADNOC) Al-Nouf seawater treatment plant, the Dubai Municipality's plan to build a strategic sewerage tunnel, and other construction projects such as the redevelopment of Dubai's Mina Rashid and the Dubai International Financial Centre Expansion 2.0 have all recently been announced.

Furthermore, acute supply restrictions, notably in Europe and the Americas, have increased demand for these commodities, propelling the market forward. However, the development of new materials has resulted in alternative product possibilities, hence reducing market growth.

Stricter environmental restrictions have increased demand for blowing agents with low global warming potential (GWP) that do not deplete the ozone layer. Companies are investing in hydrofluoroolefins (HFOs) and other eco-friendly alternatives to suit regulatory and customer demands. According to the US Sustainable Investment Forum, the US SIF Foundation has identified $1.2 trillion in sustainable investments for 2022, including ESG-compliant funds. As ESG investment grows, more companies are investing in hydrofluoroolefins (HFOs) and other ecologically friendly blowing agents. This transformation is being fueled by the desire for environmentally friendly and energy-efficient solutions in industries like construction. Such measures benefit the blowing agent industry by encouraging the use of low-GWP alternatives.

Blowing Agents Market Segmentation

Blowing Agents Market SegmentationThe worldwide market for blowing agents is split based on foam type, product type, application, and geography.

According to the blowing agents industry analysis, polyurethane (PU) foam is expected to grow the market because to its versatility, insulating properties, and many applications. It is commonly used in construction, particularly for thermal insulation, refrigeration, and cushioning in the furniture and automotive sectors. The growing need for energy-efficient constructions and lightweight materials in automobiles boosts PU foam consumption. Furthermore, current advancements in ecologically friendly blowing agents for PU foam manufacturing ensure that the market continues to grow.

Hydrocarbons (HCs), including pentane and butane, is anticipated to grow the blowing agent business due to their low cost, high efficiency, and environmental friendliness. They are commonly used in polyurethane and polystyrene foams, mostly for insulation and packaging. Unlike fluorinated alternatives, HCs have no ozone depletion potential (ODP) and a low global warming potential (GWP), making them the preferred option under strict environmental regulations. As businesses seek more sustainable solutions, the need for HC-based blowing agents increases.

According to the blowing agents market forecast, building and construction industry is quickly developing due to increased demand for energy-efficient and sustainable insulation materials. Blowing agents are necessary for the production of foams used in thermal insulation, which reduces energy consumption in buildings. As construction trends shift toward greener, more environmentally friendly solutions, the demand for innovative blowing agents that meet regulatory requirements rises. The increased emphasis on energy efficiency and sustainability is expected to boost demand for blowing agents in the coming years.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

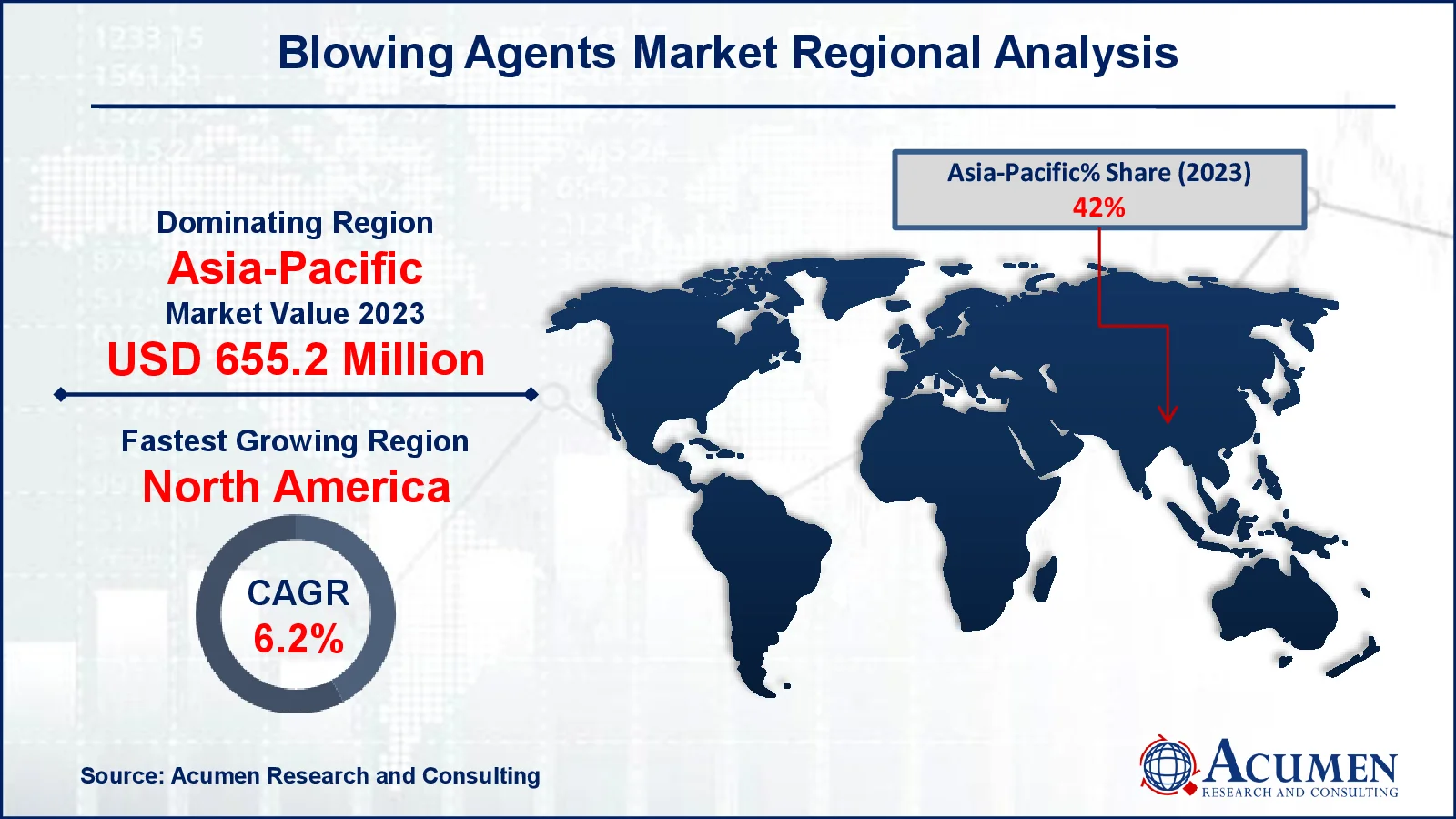

Blowing Agents Market Regional Analysis

Blowing Agents Market Regional AnalysisFor several reasons, Asia-Pacific dominates the blowing agent market, owing to increased industrialization, urbanization, and construction activity, particularly in China and India. According to Invest India, the government boosted capital investment by 11.1% in fiscal year 2024-25, totaling $133 billion or 3.4% of GDP. Such investments have the potential to drive construction growth, hence encouraging the development of modern infrastructure at the national level. Furthermore, government projects such as the Pradhan Mantri Awas Yojana-Urban (PMAY-U) have seen significant progress, with 1.18 crore housing units sanctioned, 86.6 lakh finished, and 1.15 crore under construction as of September 10, 2024. Furthermore, the region's strong manufacturing base and growing need for energy-efficient insulating materials are driving market growth.

North America's blowing agents market is predicted to rise significantly, owing to an increased emphasis on energy-efficient building and rigorous environmental regulations. For example, the US Environmental Protection Agency stated that the HFC Allocation program, which began in 2021, aims to cut US HFC production and consumption by 85% by 2036 under the AIM Act. A global reduction in HFCs could help prevent up to 0.5°C of warming by 2100. To encourage ecologically friendly alternatives, the Technology Transitions project will limit the use of HFCs in over 40 industries beginning in October 2023. The Emissions Reduction & Reclamation effort, established in October 2024, aims to improve HFC management and recycling. These guidelines will benefit the blowing agent industry by increasing demand for low-GWP, sustainable alternatives. Furthermore, growing infrastructure construction and restoration projects are boosting demand for high-performance insulating materials.

Some of the top blowing agents companies offered in our report include Honeywell International Inc., Daikin Industries, Ltd., Exxon Mobil Corporation, Arkema SA, Haltermann Carless, Linde plc, Foam Supplies, Inc, Harp International Ltd, Solvay SA, and The Chemours Company.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

August 2023

May 2023

July 2024

January 2025