April 2023

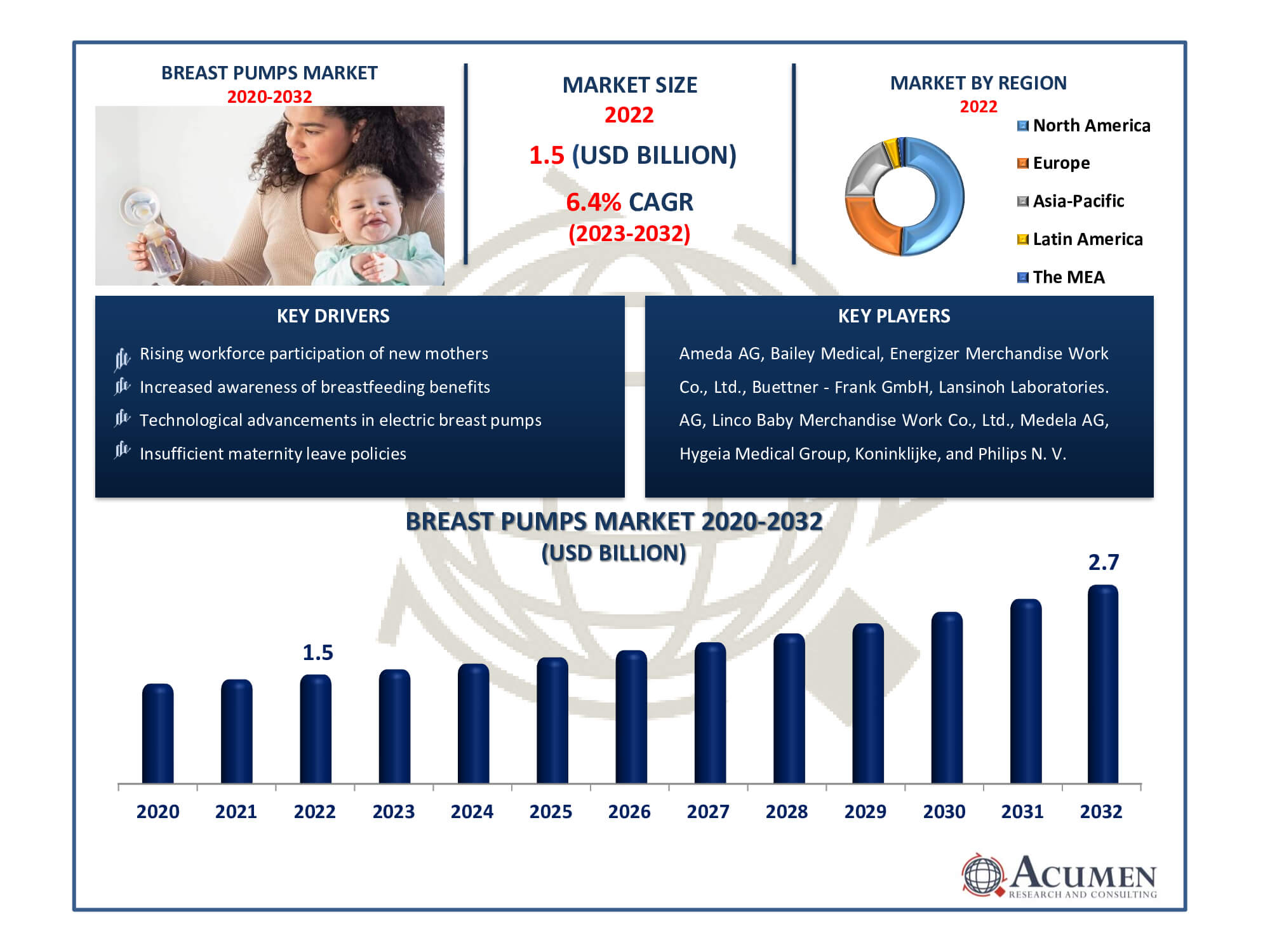

Breast Pumps Market Size accounted for USD 1.5 Billion in 2022 and is estimated to achieve a market size of USD 2.7 Billion by 2032 growing at a CAGR of 6.4% from 2023 to 2032.

The Breast Pumps Market Size accounted for USD 1.5 Billion in 2022 and is estimated to achieve a market size of USD 2.7 Billion by 2032 growing at a CAGR of 6.4% from 2023 to 2032.

Breast Pumps Market Highlights

Breast pumps are equipment that moms use to extract breast milk for feeding their babies when they are away or unable to nurse directly. These pumps are useful instruments for efficiently and pleasantly collecting milk. The market offers a variety of sorts, ranging from manual pumps that are operated by hand to electric pumps that are driven by batteries or electricity and provide varying levels of ease and speed. Breast pumps market serves new mothers who want flexibility and convenience when feeding their newborns. These pumps have gotten more user-friendly, quieter, and easier to clean as technology has advanced, increasing their appeal among modern parents. The market is growing due to increased awareness of the benefits of breastfeeding, supportive government policies, and a growing workforce of working women looking for solutions for effective milk expression and storage.

Global Breast Pumps Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Breast Pumps Market Report Coverage

| Market | Breast Pumps Market |

| Breast Pumps Market Size 2022 | USD 1.5 Billion |

| Breast Pumps Market Forecast 2032 | USD 2.7 Billion |

| Breast Pumps Market CAGR During 2023 - 2032 | 6.4% |

| Breast Pumps Market Analysis Period | 2020 - 2032 |

| Breast Pumps Market Base Year |

2022 |

| Breast Pumps Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ameda AG, Bailey Medical, Energizer Merchandise Work Co., Ltd., Buettner - Frank GmbH, Lansinoh Laboratories. AG, Linco Baby Merchandise Work Co., Ltd., Medela AG, Hygeia Medical Group, Koninklijke, and Philips N. V. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Breast Pumps Market Insights

The market's growth is attributed to several factors, notably inadequate maternity leave, a rapid rise in the workforce, and increased awareness of the benefits of breastfeeding. Other significant contributors include technological advancements in electric breast pumps, rising government health expenditure, and favorable reimbursement scenarios. However, challenges are expected in underdeveloped countries like Afghanistan, Bhutan, and Nigeria. These challenges stem from high maintenance requirements of electrical and hospital-grade pumps, increased contamination risks with open system breast pumps, elevated costs of breast pumps, and low awareness levels.

Major drivers for growth include supportive government initiatives aiming to raise consumer awareness, enhance employment opportunities for women, and improve healthcare facilities in emerging economies. Initiatives like the United Kingdom's UNICEF breastfeeding campaign are expected to positively influence market growth. These efforts have notably increased lactation rates, resulting in heightened demand for breast pumps in Europe.

Similarly, in the US, the world's largest market, government provisions mandating national insurance coverage for breastfeeding equipment and services, such as breast pumps and lactation counseling, play a pivotal role without costs incurred by patients. Consequently, there's been a significant rise in demand for breast pumps. Furthermore, there's an increasing understanding among lactating mothers about the advantages of breastfeeding. This heightened awareness, coupled with rising literacy rates globally, has driven a desire among people to incorporate advanced medical technologies into their daily lives. This trend is propelled by increased access to cutting-edge equipment and the widespread presence of major market players.

Breast Pumps Market Segmentation

The worldwide market for breast pumps is split based on product, technology, application, and geography.

Breast Pump Products

According to the breast pumps industry analysis, the market is categorized into open system and closed system breast pumps based on product types. In 2022, the closed system dominated the sales market due to its superior hygiene and contamination-free nature, making it the fastest-growing segment in the forecast. Closed systems prevent milk contamination between the pumping unit and motor, acting as a barrier against milk particulate matter entering pump tubes or engines. These devices ensure enhanced child health safety, maximize impurity removal, and offer ease of cleaning. Ameda plans to introduce portable instruments like the Ameda HygieniKit, expected to drive growth in the breast pumps market forecast period.

Breast Pump Technologies

Electric breast pumps are predicted to increase at the fastest rate due to a rising preference for technologically sophisticated products. Powered by an engine and supplyed through plastic tube by electric breast pumps to the horn which is mounted on the nib. The efficient suction allows pumping considerably faster, thus enabling both breasts to be pumped simultaneously. In general, working mothers prefer using electric pumps, because in a less time they can easily extract more milk. Compared to normal pumps, double pumping requires less time. Electric pumps often have a lot of loudness and noisyness, but the companies still use state-of - the-art technology to produce lighter, less noise generating pumps. Moms who do not allow the pump to buy a new pump and require it for a short time are also offered electric pumps on rent. The Pure Your Ultra Breast Pump from AMEDA AG and Isis iQDuo Breast Pump from Philips AVENT are some of the major brands in this segment. Technological progress has led to the introduction of portable instruments, such as AMEDEA's Platinum Electric Breast Pump and Medela's Electric Swing Breast Pumps, which should be the market driver over the breast pumps market forecast period.

Breast Pump Applications

According to the breast pumps market analysis, the rapid growth in hospital-grade pumps is expected due to increased breastfeeding awareness and rising demand for breast pumps resulting from higher female employment rates. These pumps are larger, more robust, durable, and specifically designed for multiple users. They effectively stimulate breast milk production by elevating prolactin and oxytocin hormone levels. FDA approval ensures these hospital-grade pumps are safe for multiple users, preventing cross-contamination with barriers. Their design for frequent, daily pumping makes them adaptable for various pumping situations. The introduction of portable instruments such as Ameda's Elite and Lactina, as well as Medela's Lact-e and Symphony, is anticipated to drive the market in the upcoming years.

Breast Pumps Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Breast Pumps Market Regional Analysis

North America attained the highest market share in 2022 due to factors such as high women's employment rates, healthcare expenditure, robust health infrastructure, and heightened patient consciousness levels, resulting in significant market penetration. The Affordable Care Act grants working mothers the right to take breaks during work hours for breastfeeding, expected to sustain market growth in North America throughout the forecast period. Additionally, laws supporting public breastfeeding aim to raise awareness and further stimulate market expansion in the region.

During the projection period, Asia-Pacific is anticipated to witness the most rapid expansion, with its market share expected to increase in near future. This growth is driven by prevalent unmet consumer demand, continuous improvements in healthcare infrastructure, and increased customer awareness and disposable income levels.

Europe is the second-largest region in the breast pumps market, with a high market share. This significance is primarily due to a competent healthcare system, increased awareness about the benefits of breastfeeding, and supportive government measures. The region's cultural acceptability of breastfeeding is also critical to its market position. Furthermore, policies that promote maternal health and women's rights help the industry flourish. Some European countries, for example, give prolonged maternity leave and workplace breastfeeding support, establishing a supportive environment for breastfeeding women. These reasons combine to drive the adoption of breast pumps in Europe, catering to the needs of working women and those seeking flexibility in feeding their infants, cementing its place as a major market player in the breastfeeding business.

Breast Pumps Market Players

Some of the top breast pumps companies offered in our report include Ameda AG, Bailey Medical, Energizer Merchandise Work Co., Ltd., Buettner - Frank GmbH, Lansinoh Laboratories. AG, Linco Baby Merchandise Work Co., Ltd., Medela AG, Hygeia Medical Group, Koninklijke, and Philips N. V.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2023

November 2018

April 2023

December 2017