May 2020

Carbon Credit Market (By Type: Compliance, Voluntary; By Project Type: Avoidance/Reduction Projects, Removal/Sequestration Projects; By End Use: Power, Energy, Transportation, Industrial, Others) - Global Industry Analysis, Size, Share, Trends and Forecast 2026 to 2035

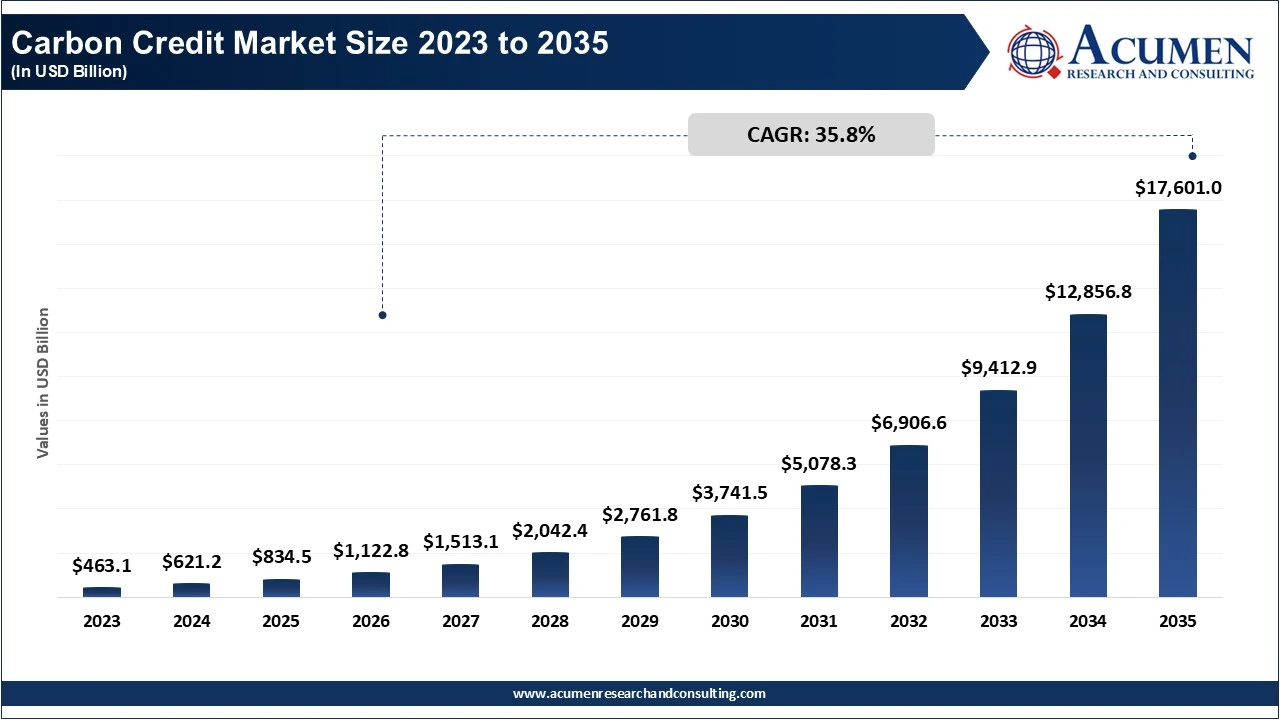

The global carbon credit market size was accounted for USD 834.5 billion in 2025 and is estimated to surpass around USD 17,601.0 billion by 2035 growing at a CAGR of 35.8% from 2026 to 2035. The growth in stringent climate policies and emission reduction targets is driving the growth or the carbon credit market. Further, the growing participation from the private sector and financial institutions continues to support the market demand.

Over the recent years, carbon credits have emerged as a robust financial incentive for organizations, governments, and NGOs that seek to alleviate their climate footprint. Carbon credit (СС) is a permit for emission for a certain amount of carbon dioxide and other greenhouse gases (GHGs). For every single carbon credit, an organization can release over one metric ton of CO2 or other GHG in the atmosphere. An organization is eligible to get credits if it reduces its emissions below a specific threshold. Organizations often produce removal credits for carbon with the help of their efforts and investments promoting energy conservation, reforestation, and renewable energy. There is also an option to buy carbon credits from organization that haven’t utilized them at all.

There are several advantages of carbon credits. Firstly, they influence businesses to reduce emissions, both immediately and for the long run. This, in turn, helps boost sustainability globally by promoting investments in R&D for exceptional strategies for emission reduction. For organizations that find it challenging to directly limit their emissions, carbon credit trading offers them the option to purchase credits from organizations that alleviate emissions in a more economic way. Additionally, CC development and trading helps bring countries and industries together to tackle climate change.

When discussing issues that are associated with carbon credits, it is crucial to consider the ethical concerns related to the effectiveness of counterbalancing emissions with the help of credit purchases. Adjusting to the credit industry enables some companies, specifically the more profitable ones, to continue emit GHGs. They do not see the need to involve in sustainable practices when they can simply purchase all the credits they require.

Stringent Climate Policies and Emission Reduction Targets

Growth in Digital Trading Platforms

Lack of Standardization

Price Volatility and Regulatory Uncertainty

Expansion of Nature-based and Technology-driven Carbon Removal Projects

Rising Corporate Net-zero Commitments and ESG-driven Investments

| Area of Focus | Details |

| Carbon Credit Market Size 2025 | USD 834.5 Billion |

| Carbon Credit Market Forecast 2035 | USD 17,601.0 Billion |

| Carbon Credit Market CAGR During 2026 – 2035 | 35.8% |

| Carbon Credit Market Analysis Period | 2023 – 2035 |

| Carbon Credit Market Base Year | 2025 |

| Carbon Credit Market Forecast Data | 2026 – 2035 |

| Segments Covered | By Type, By Project Type, By End Use, and By Geography |

| Regional Scope | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Carbon Care Asia Ltd., CarbonBetter, 3Degrees Group, Inc., ClearSky Climate Solutions, Finite Carbon, EKI Energy Services Ltd., NativeEnergy, Torrent Power Ltd., South Pole Group, and WGL Holdings Inc. |

| Report Coverage | Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The worldwide market for carbon credit is split based on type, project type, end use, and geography.

| Type | Market Share (%) | Key Highlights |

| Compliance | 95% | Dominant as government-supported emission reduction regulations are mandatory to implement by industries. |

| Voluntary | 5% | Rising corporate net-zero commitments are driving strong growth in the voluntary carbon market, with companies increasingly prioritizing high-integrity, nature-based and technology-backed carbon removal credits. |

The compliance dominated the market as government-backed emission reduction regulations are compulsory in nature, and there is an increasing enforcement of national and international climate policies. Moreover, industries that are regulated have to offset their surplus GHG emissions due to cap-and-trade and emission trading schemes. These regulatory frameworks have driven power generation, manufacturing, oil & gas, and heavy industries into the structured carbon markets, thereby driving higher demand for compliance-based carbon credits compared to mechanisms that are of a voluntary nature.

| Project Type | Market Share (%) | Key Highlights |

| Avoidance/Reduction Projects | 65% | Dominant as there is a growing shift toward higher-quality avoidance and reduction projects, such as renewable energy, energy efficiency, and methane capture. |

| Removal/Sequestration Projects | 35% | Rising preference for long-term carbon removal solutions, including reforestation, soil carbon sequestration, biochar, and direct air capture, as buyers increasingly seek durable, high-integrity credits with measurable and permanent climate impact. |

The avoidance/reduction segment dominates the carbon credit sector. These projects include the execution of different strategies to avoid or limit carbon emissions by taking proper measures to improve the overall energy efficiency of the system and initiate renewable energy projects. According to the World Meteorological Organization (WMO), the average annual rate of growth in near-surface global temperatures from 2023 to 2027 is projected to be over 1.5 above the pre-industrial levels due to the emissions from greenhouse gases.

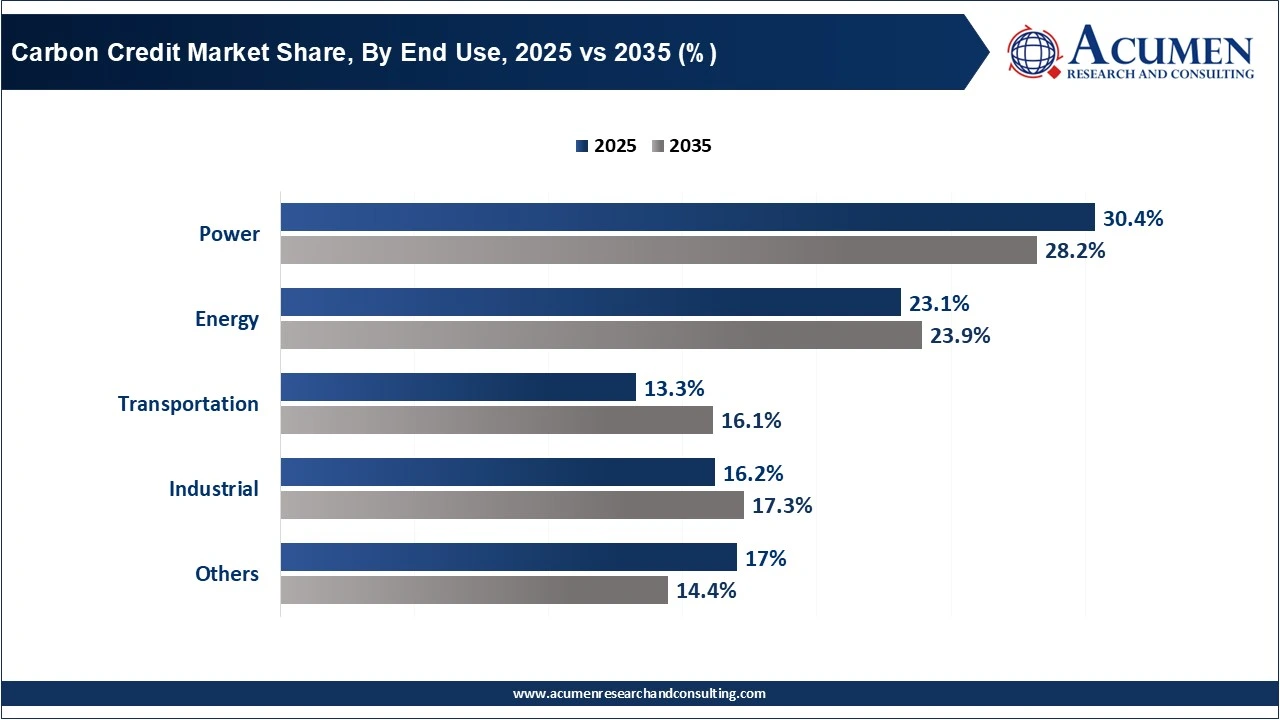

| End Use | Market Share (%) | Key Highlights |

| Power | 30% | Dominant as it is the largest emitting industry and experiences increasing integration of renewable energy-based carbon credit projects. |

| Energy | 23% | Growing adoption of carbon capture, utilization, and storage (CCUS) projects to generate carbon credits from hard-to-mitigate energy infrastructure and upstream operations. |

| Transportation | 13% | Rising demand for carbon credits from electric mobility and sustainable fuel projects, including electric vehicle (EV) adoption, biofuels, and sustainable aviation fuel (SAF) initiatives. |

| Industrial | 16% | Expansion of low-carbon manufacturing processes, including green hydrogen use, waste heat recovery, and energy efficiency upgrades are driving the creation of industrial decarbonization credits. |

| Others | 17% | Increasing development of nature-based solutions and waste management–linked carbon credit projects, such as landfill gas capture, composting, and afforestation, to diversify credit supply. |

The power segment is projected to dominate the industry. The power sector is the largest emitting industry and it deploys low GHG mechanisms to adopt carbon-offsetting schemes and projects. Companies across the world are taking efforts to integrate renewable energy sources, including solar energy, geothermal energy, and wind energy, to limit their carbon emissions and make carbon credits. These credits can be bought by other organizations for additional revenue generation. Carbon offsets are used to alleviate GHG emissions in the power sector.

Geographically, Europe accounts for the largest share of the carbon credit market, mainly because of the early and strong commitment to climate action due to widespread implementation of strict environmental regulations and the presence of the European Union Emissions Trading System (EU ETS), which is the largest and most established carbon trading framework in the world. Aggressive net-zero emission targets set by European governments, besides mandatory emission caps on high-emitting industries, have been driving consistent demand for carbon credits. Secondly, strong corporate sustainability commitments, high awareness of climate risks, and robust monitoring, reporting, and verification systems further support market growth across the region.

| Region | Market Share (%) | Key Highlights |

| North America | 26% | Rising corporate participation in the voluntary carbon market is driven by strict ESG reporting requirements and net-zero commitments. |

| Europe | 44% | Dominant because of strong and early commitment to climate action and stringent environmental regulations. |

| Asia-Pacific | 19% | The demand for energy generation with fossil fuels is increasing in the region owing to the increased consumption in countries including China and India. |

| MEA | 6% | Growth is driven by increasing investment in large-scale renewable energy and nature-based carbon credit projects supported by government-backed sustainability programs. |

| Latin America | 4% | Expansion of forest conservation and reforestation-based carbon credit projects, especially in the Amazon region is attracting strong international demand. |

There is expected to be a considerable growth of the carbon credit market in the Asia-Pacific region. The demand for energy generation with fossil fuels is increasing in the region owing to the increased consumption in countries including China and India. This is projected to result in rising carbon emissions in the region, which is boosting the market demand. The growth in building & construction activities in China is opportunistic for the market growth. Moreover, government-led climate initiatives and national carbon trading schemes further strengthen market dynamics in the region. Growing participation from multinational corporations and ESG-focused investment further encourages compulsory and voluntary adoptions of carbon offset mechanisms. In addition, regional carbon exchanges are also expanding their operations, enhancing market transparency and liquidity.

Some of the top carbon credit companies offered in our report include Carbon Care Asia Ltd., CarbonBetter, 3Degrees Group, Inc., ClearSky Climate Solutions, Finite Carbon, EKI Energy Services Ltd., NativeEnergy, Torrent Power Ltd., South Pole Group, and WGL Holdings Inc.

By Type

By Project Type

By End Use

By Region

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

May 2020

June 2020

March 2024

November 2023