March 2023

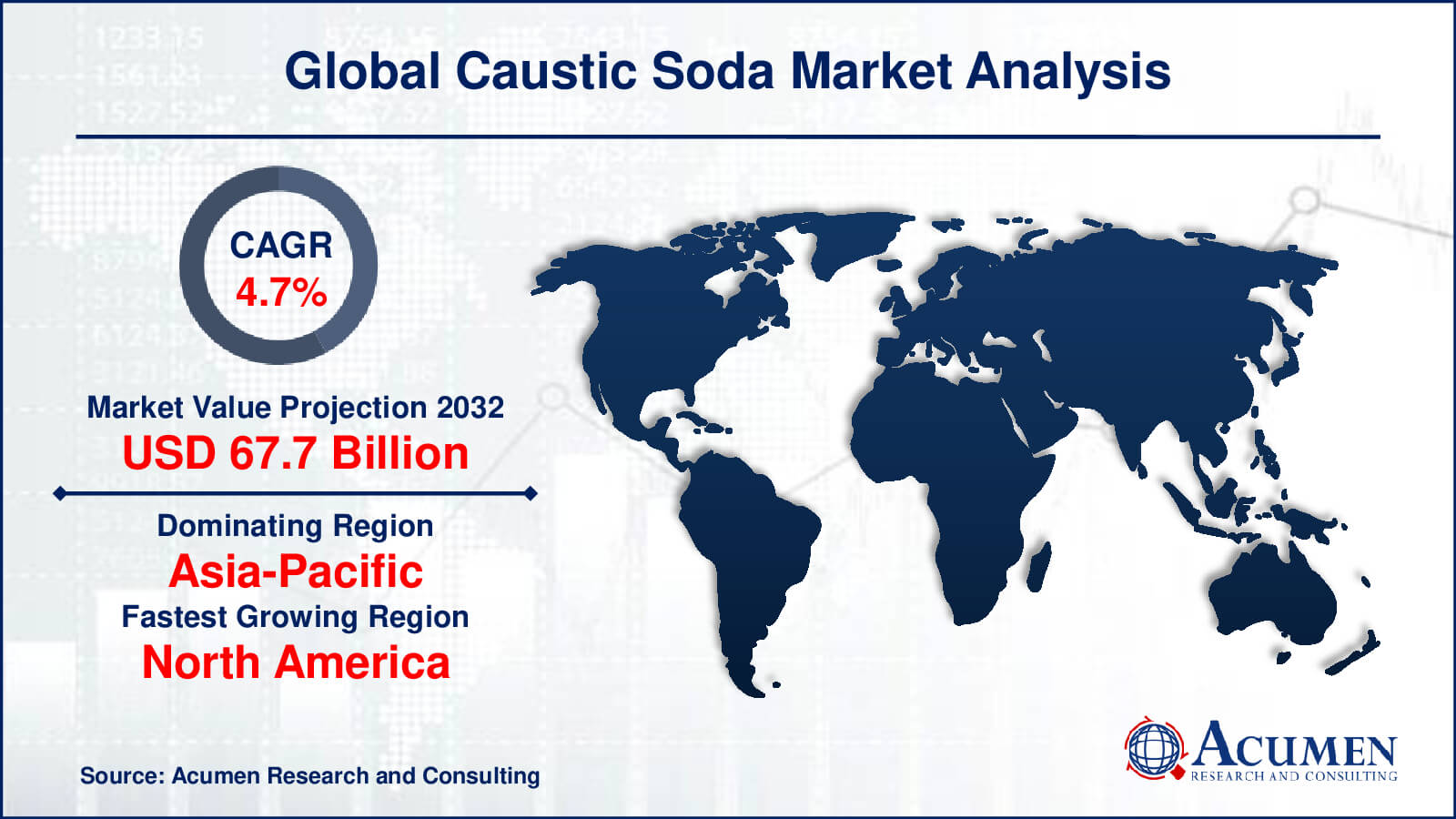

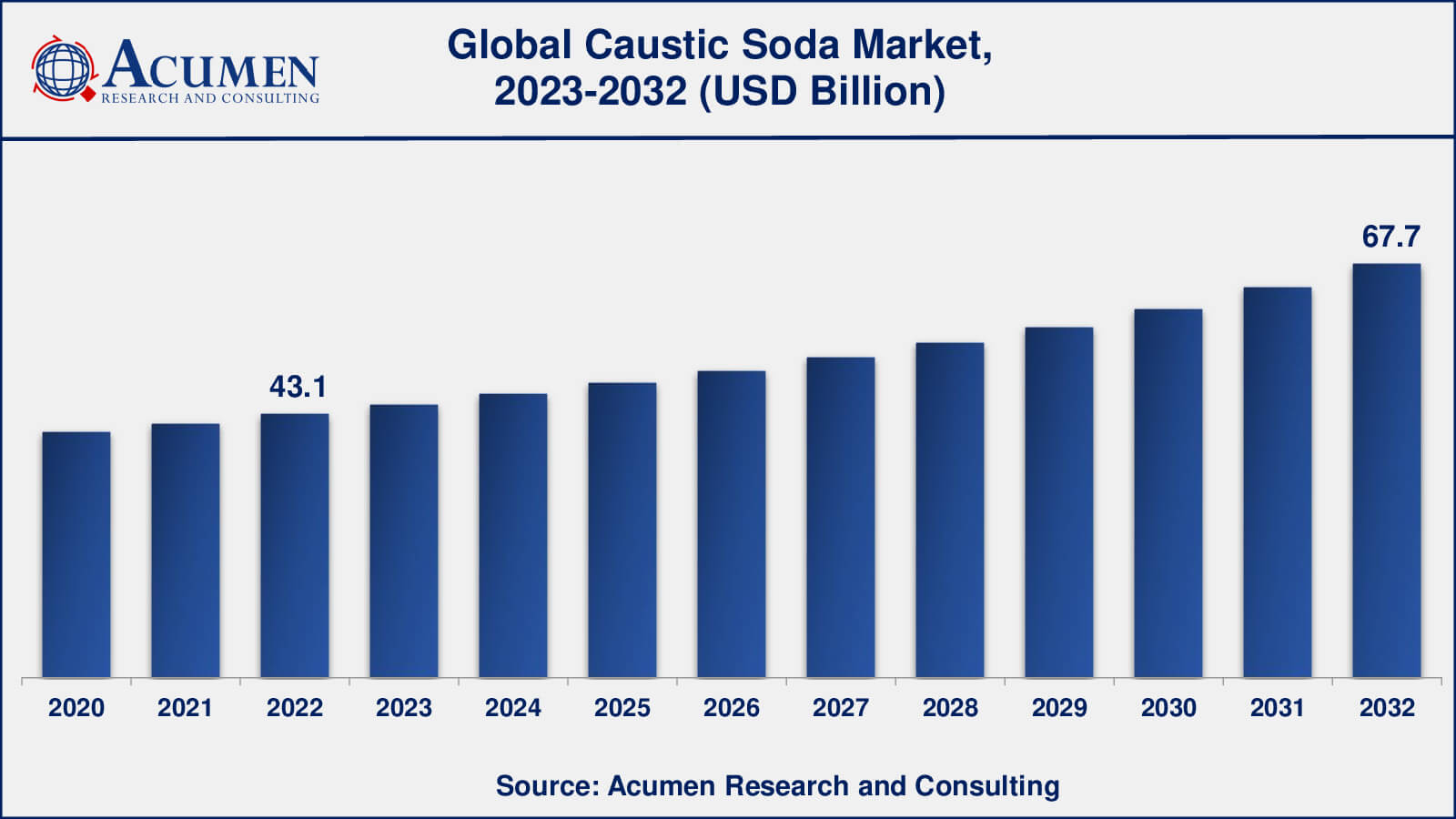

Caustic Soda Market Size accounted for USD 43.1 Billion in 2022 and is estimated to achieve a market size of USD 67.7 Billion by 2032 growing at a CAGR of 4.7% from 2023 to 2032.

The Global Caustic Soda Market Size accounted for USD 43.1 Billion in 2022 and is estimated to achieve a market size of USD 67.7 Billion by 2032 growing at a CAGR of 4.7% from 2023 to 2032.

Caustic Soda Market Highlights

Caustic soda, also known as lye or sodium hydroxide (NaOH), is a crucial ingredient in everyday essentials. It can also refer to potassium hydroxide. The pure form of caustic soda is used in soap and candle production, while impure caustic soda serves as a drain cleaner. Over the past few decades, the demand for caustic soda has significantly increased due to the boundless needs of the growing global population. With its applications spanning numerous industries, the demand for caustic soda is skyrocketing and is expected to continue growing rapidly throughout the forecast period.

Global Caustic Soda Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Caustic Soda Market Report Coverage

| Market | Caustic Soda Market |

| Caustic Soda Market Size 2022 | USD 43.1 Billion |

| Caustic Soda Market Forecast 2032 | USD 67.7 Billion |

| Caustic Soda Market CAGR During 2023 - 2032 | 4.7% |

| Caustic Soda Market Analysis Period | 2020 - 2032 |

| Caustic Soda Market Base Year | 2022 |

| Caustic Soda Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Production Process, By Product Type, By Grade, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AkzoNobel, Dow Chemical Company, FMC Corporation, Formosa Plastics Corporation, Hanwha Chemical Corporation, INEOS Group Limited, Occidental Petroleum Corporation, PPG Industries, Solvay SA, Tosoh Corporation, and others. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Covid-19 Impact on Caustic Soda Industry

The demand for caustic soda remained strong, with most sectors exhibiting a consistent increase in recent years. However, when the COVID-19 pandemic struck, the market swiftly transitioned from having abundant supply and high inventories to a much tighter market due to reduced operating rates stemming from low chlorine demand. This disruption had a notable impact on caustic soda's supply chain and manufacturing processes. The COVID-19 outbreak led to an increase in the use of disposable paper products, subsequently raising the demand for caustic soda. Furthermore, sectors like pulp and paper, water treatment, and chemical manufacturing have grown in tandem with the expansion of the caustic soda market.

Caustic Soda Market Insights

The global caustic soda market is primarily driven by the growth of the alumina industry. The extensive application of caustic soda in alumina production, which is a precursor to aluminum manufacturing, has played a pivotal role in supporting the market's growth. For instance, Emirates Global Aluminium, the UAE's largest non-oil industrial business, announced in 2018 that it had received the initial shipment of caustic soda for its Al Taweelah alumina refinery.

Likewise, the increasing utilization of caustic soda in the paper and pulp as well as textile industries has yielded positive results during the forecast period. In the pulp and paper sector, caustic soda functions as a commodity chemical. Its uses range from cooking and processing Kraft pulps to extracting lignin during pulp bleaching sequences, and even in the on-site production of sodium hypochlorite.

However, the highly reactive and corrosive nature of caustic soda mandates careful and cautious handling. Both solid and liquid forms can cause skin and eye irritation upon direct contact. Furthermore, it is important to note that when sodium hydroxide interacts with metals such as tin, aluminum, copper, zinc, and others, it can lead to explosive gas combinations and the formation of poisonous compounds.

Moreover, innovations and advancements in the production processes of caustic soda, coupled with growing product demand from emerging economies, are poised to create numerous growth opportunities for the market in the upcoming years. Another factor contributing to the demand surge for caustic soda is its increased applications in the pharmaceutical and chemical industries. From basic pain relievers like aspirin to anticoagulants that prevent blood clots and cholesterol-lowering pharmaceuticals, caustic soda is utilized in the production of a wide array of medicines and pharmaceutical products.

Caustic Soda Market Segmentation

The worldwide market for caustic soda is split based on production process, product type, grade, application, and geography.

Caustic Soda Production Process

The caustic soda market is categorized based on production processes, including membrane cells, diaphragm cells, and others. According to caustic soda industry analysis, membrane cells have dominated the production process segment in recent years. Membrane cell technology is a crucial advancement in modern caustic soda production. This technology employs an electrochemical process to convert salt and other chemicals into caustic soda. The numerous advantages of this technology contribute to its dominance, and as a result, the caustic soda market is expected to experience significant growth in the coming years.

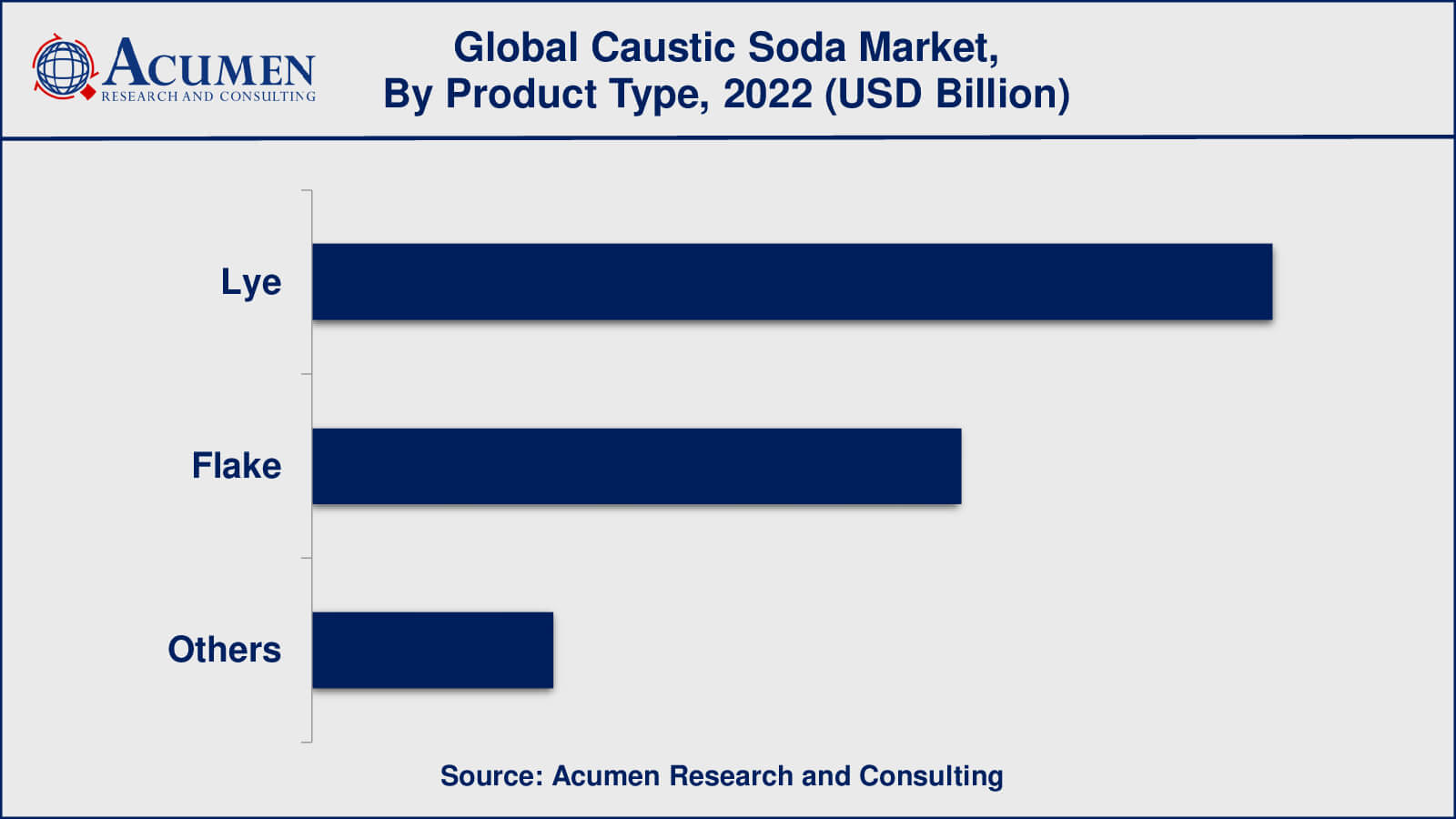

Caustic Soda Product Type

In terms of product types, the market is categorized into lye, flake, and others. Within the product type segment, the lye subsegment has held the largest market share in recent years, accounting for approximately 52% of the market. This subsegment primarily consists of inorganic sodium hydroxide. Lye is used in the manufacturing of soaps, biodiesel, glass, chemicals, candles, plastics, ceramics, and other materials. Notably, lye does not contain any harmful chemicals. The use of lye in soap manufacturing results in products that are free from irritation and possess non-allergenic properties. These numerous benefits of lye are expected to drive the growth of this segment in the near future.

Caustic Soda Grade

In terms of grade segmentation, the market is categorized into industrial grade, pharmaceutical grade, lab reagent grade, and other grades. According to the caustic soda market forecast, the industrial grade segment has consistently dominated the market share and is likely to maintain its dominance throughout the forecasted period from 2023 to 2032. This segment is employed in the preparation of chemicals for various industries, encompassing both organic and inorganic applications. In the past years, the industrial grade segment has commanded around 65% of the market share. It finds applications across diverse industries such as textiles, chemicals, automotive, petrochemicals, metallurgy, and food processing.

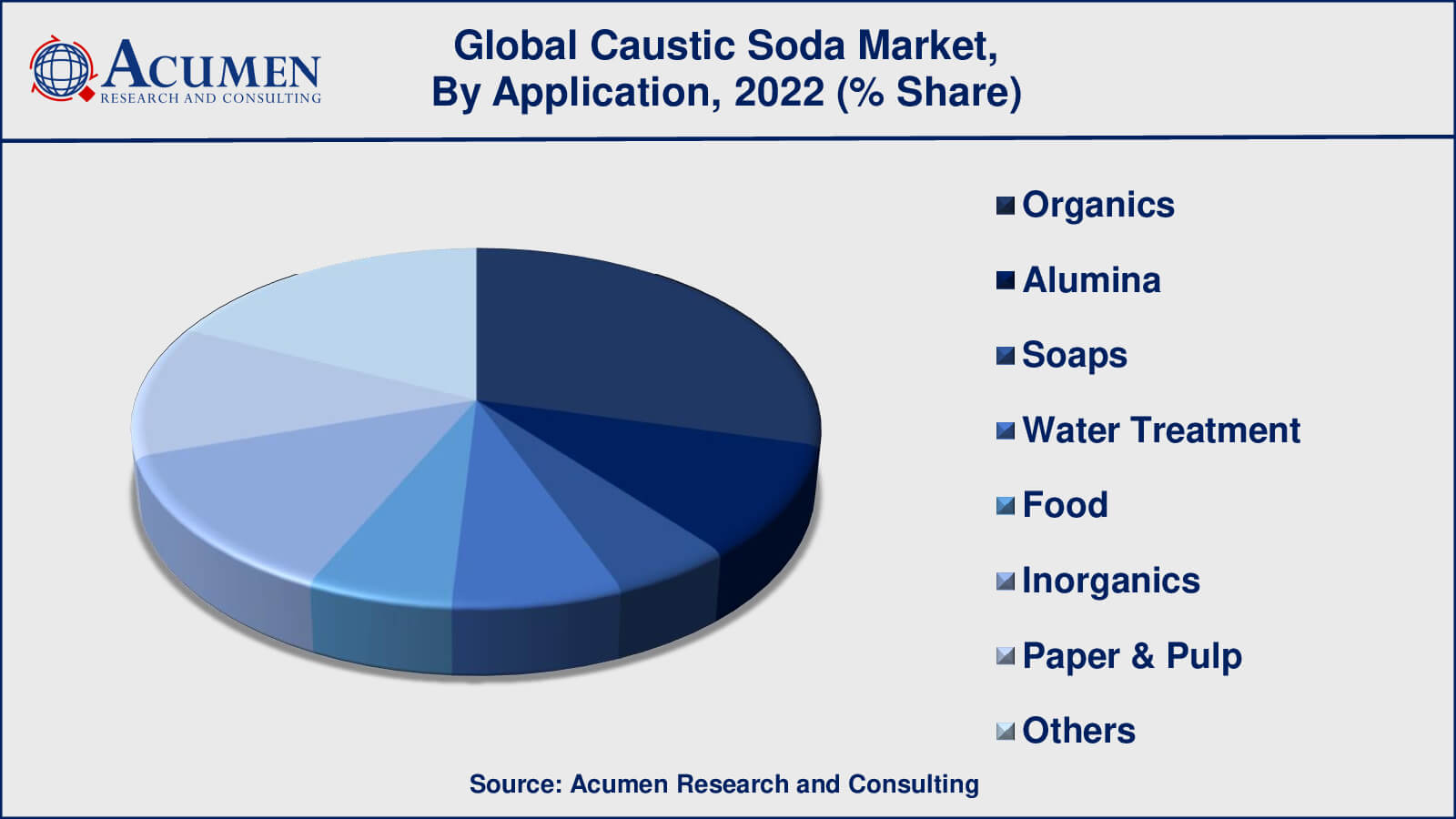

Caustic Soda Application

In terms of applications, the organics segment held the dominant position in the market with the largest share in 2020. Over 50% of chemical products produced, either directly or indirectly, utilize chlorine or caustic soda. Caustic soda plays a vital role in the manufacturing of a wide array of organic compounds. It is frequently utilized in the synthesis of numerous valuable organic chemicals, as well as in the processing of inorganic substances such as paints, glass, and ceramics. Meanwhile, the pulp and paper application is projected to experience significant growth (CAGR) throughout the forecast period from 2023 to 2032.

Caustic Soda Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Caustic Soda Market Regional Analysis

In terms of regional segments, the Asia-Pacific region is currently experiencing the largest share and fastest growth in the caustic soda market. Particularly, China is witnessing a surge in the adoption of robotic systems, coupled with a growing emphasis on artificial intelligence (AI) applications, especially in the security and defense sectors. The government's dedication to the development of defense caustic soda systems is anticipated to serve as a key driver for market growth in the Asia-Pacific region.

In North America, there has also been a consistent holding of a significant revenue share in the caustic soda market in recent years. This growth can be attributed to increased government investments in the military, defense, and security sectors. In the United States, the demand for Caustic Soda has risen due to concerns about terrorist operations, further bolstering market growth in the region.

Following closely behind, Europe secures the third-largest revenue share in the caustic soda market. Notably, Germany has exhibited a significant focus on advancing defense technologies, leading to an increase in the adoption of Caustic Soda systems. The escalating demand for defense technology in Europe is expected to propel further market growth in the upcoming years.

Caustic Soda Market Players

Some of the top caustic soda companies offered in our report includes AkzoNobel, Dow Chemical Company, FMC Corporation, Formosa Plastics Corporation, Hanwha Chemical Corporation, INEOS Group Limited, Occidental Petroleum Corporation, PPG Industries, Solvay SA, Tosoh Corporation, and others.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2023

November 2022

September 2023

September 2023