December 2024

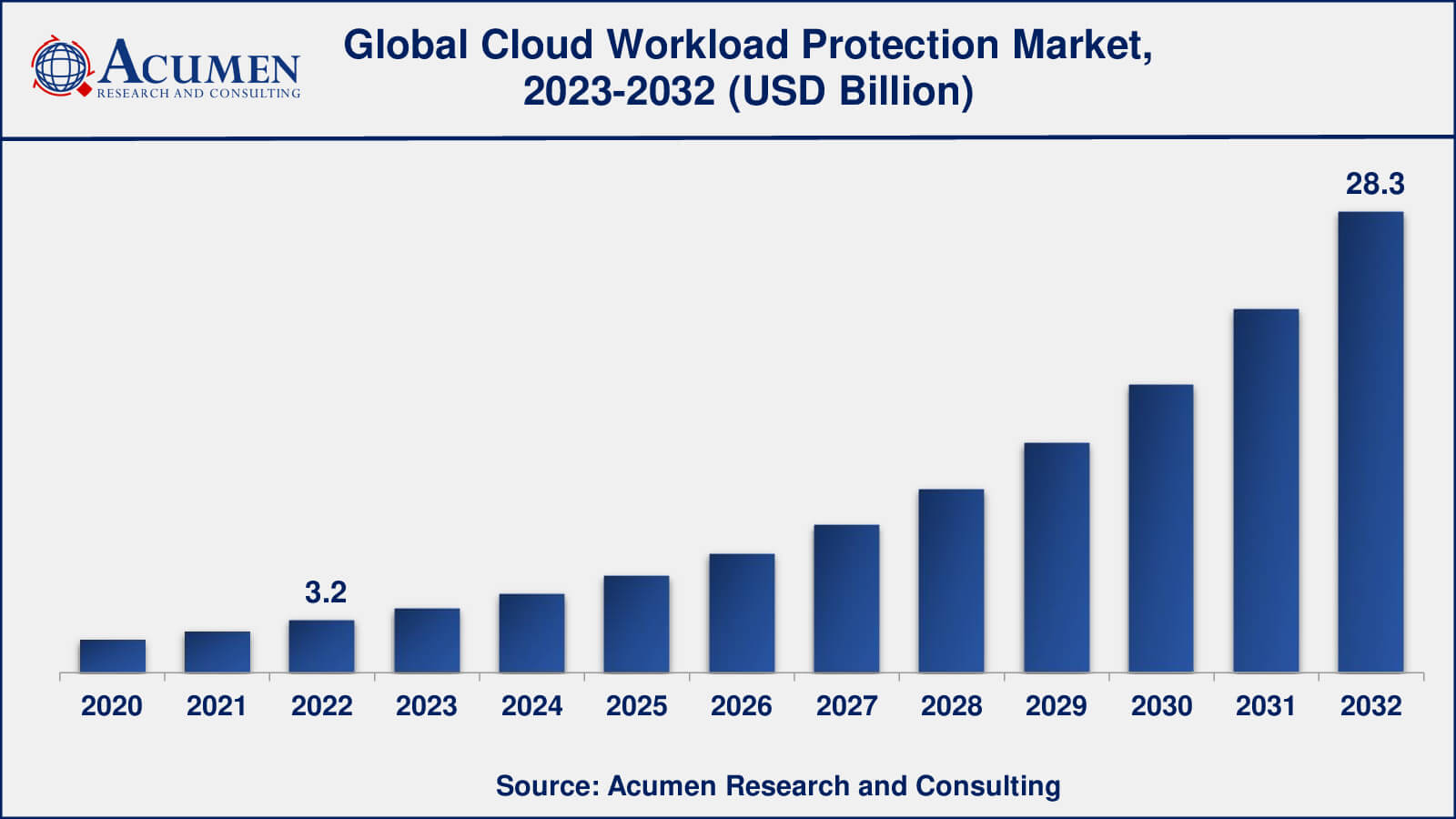

Cloud Workload Protection Market size was valued at USD 3.2 Billion in 2022 and is projected to reach USD 28.3 Billion by 2032 mounting at a CAGR of 24.5% from 2023 to 2032.

The global Cloud Workload Protection Market size was valued at USD 3.2 Billion in 2022 and is projected to reach USD 28.3 Billion by 2032 mounting at a CAGR of 24.5% from 2023 to 2032.

Cloud Workload Protection Market Highlights

Cloud workload protection is a comprehensive strategy to safeguarding cloud workloads. It entails putting in place security procedures and technologies that are especially designed to protect applications, processes, and services running within the cloud architecture. Unlike traditional security solutions, which priorities infrastructure security, Cloud workload protection prioritizes safeguarding individual components and operations within the cloud. Workloads are at the heart of every cloud system, hence this strategy is critical. Organizations may prevent risks such as unauthorized access, data breaches, malware, and insider threats that represent a substantial threat to the security and integrity of their workloads by using cloud workload protection. Additionally, cloud workload protection assists in ensuring compliance with industry-specific standards and data privacy needs by offering a strong security architecture that enforces security controls, monitoring, and reporting capabilities. Organizations can maintain a safe and robust cloud environment by prioritizing workload protection.

Global Cloud Workload Protection Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Cloud Workload Protection Market Report Coverage

| Market | Cloud Workload Protection Market |

| Cloud Workload Protection Market Size 2022 | USD 3.2 Billion |

| Cloud Workload Protection Market Forecast 2032 | USD 28.3 Billion |

| Cloud Workload Protection Market CAGR During 2023 - 2032 | 24.5% |

| Cloud Workload Protection Market Analysis Period | 2020 - 2032 |

| Cloud Workload Protection Market Base Year | 2022 |

| Cloud Workload Protection Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Deployment Model, By Enterprise Size, By Industry Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Trend Micro, McAfee, Symantec (Broadcom), Palo Alto Networks, Check Point Software Technologies, Cisco Systems, Fortinet, CrowdStrike, Sophos, Microsoft, and CloudPassage. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cloud Workload Protection Market Insights

Several reasons are driving the market dynamics of cloud workload protection, emphasizing its rising relevance. To begin with, the fast acceptance of cloud computing and the shift of workloads to the cloud has raised the demand for effective security measures. As organizations use cloud infrastructure, they confront additional cloud-specific security problems, such as the dynamic nature of workloads and the shared responsibility paradigm. Cloud workload protection tackles these issues by providing specialized security solutions designed to safeguard cloud workloads.

In addition, the ever-changing threat landscape needs more stringent security measures. Cyberattacks are growing more sophisticated and targeted, posing considerable dangers to sensitive data and applications in organizations. To address these risks, cloud workload protection includes advanced security capabilities such as threat detection, real-time monitoring, and vulnerability management. These systems may proactively identify and respond to new threats by employing machine learning and artificial intelligence, therefore improving the overall security posture of cloud workloads.

Furthermore, organizations are being pushed to invest in comprehensive security solutions as they become more conscious of the financial and reputational consequences of security breaches. A data breach or outage can have serious effects, including financial losses, brand reputation harm, and legal ramifications. Cloud workload protection acts as a proactive defense mechanism against various threats, minimizing the likelihood and severity of security events.

Cloud Workload Protection Market Segmentation

The worldwide market for cloud workload protection is split based on component, deployment model, enterprise size, industry vertical, and geography.

Cloud Workload Protection Components

According to cloud workload protection industry analysis, solutions they tend to dominate the market because they are the principal products supplied by vendors in this field. Cloud workload protection solutions include a variety of security methods and tools that are particularly intended to safeguard cloud workloads. Workload monitoring, threat detection, vulnerability management, access restrictions, encryption, and compliance enforcement are common elements of these solutions. These solutions are developed and marketed by vendors to solve the rising security problems associated with cloud workloads.

Services, on the other hand, supplement solutions by providing organisations with implementation, integration, customisation, and support. Consulting, professional services, managed security services, training, and continuous monitoring and support are examples of Cloud Workload Protection services. While services are necessary to assist organisations in properly deploying and managing Cloud Workload Protection systems, they often serve a supporting role in comparison to the market prominence of solutions.

Cloud Workload Protection Deployment Models

The public cloud deployment model has been the dominant force in the cloud workload protection market. The term "public cloud" refers to cloud services made available to different organisations through the internet by third-party suppliers. Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform are examples of public cloud companies that have seen substantial growth and popularity. Many organisations have transferred their workloads to public cloud environments because of the scalability, flexibility, and cost-effectiveness they provide.

The term "private cloud" refers to dedicated cloud environments owned and maintained by a single company. Private clouds, although providing greater control and customisation, are often used by bigger companies with strict security and regulatory needs.

Furthermore, hybrid cloud blends public and private cloud environments, allowing businesses to reap the benefits of both. Organisations can use hybrid cloud deployments to blend on-premises infrastructure, private cloud, and public cloud services. Hybrid cloud use has been slowly increasing as organisations attempt to optimise their infrastructure, balance workloads, and protect data sovereignty. Cloud Workload Protection solutions are also used in hybrid cloud setups to safeguard workloads.

Cloud Workload Protection Enterprise Sizes

In 2022, large enterprise size accounted for utmost shares and is likley to do so in the forthcoming years. Large enterprises have been at the forefront of using Cloud Workload Protection solutions due to their scale, complexity, and larger security expenditures. These organisations frequently have a large number of workloads on the cloud and face more severe security problems. Large organisations also have specialised IT security teams and resources to install and operate complex cloud workload protection systems. Their emphasis on complete security measures, regulatory compliance, and sensitive data protection complements the substantial capabilities provided by cloud workload protection solutions.

On the other hand, SMEs are increasingly adopting cloud technology, their adoption of cloud workload protection solutions may be lower when compared to large organisations. Smaller IT teams and minimal cybersecurity expenditures are common in SMEs. They may prioritise more basic security measures or rely on cloud service providers' security capabilities.

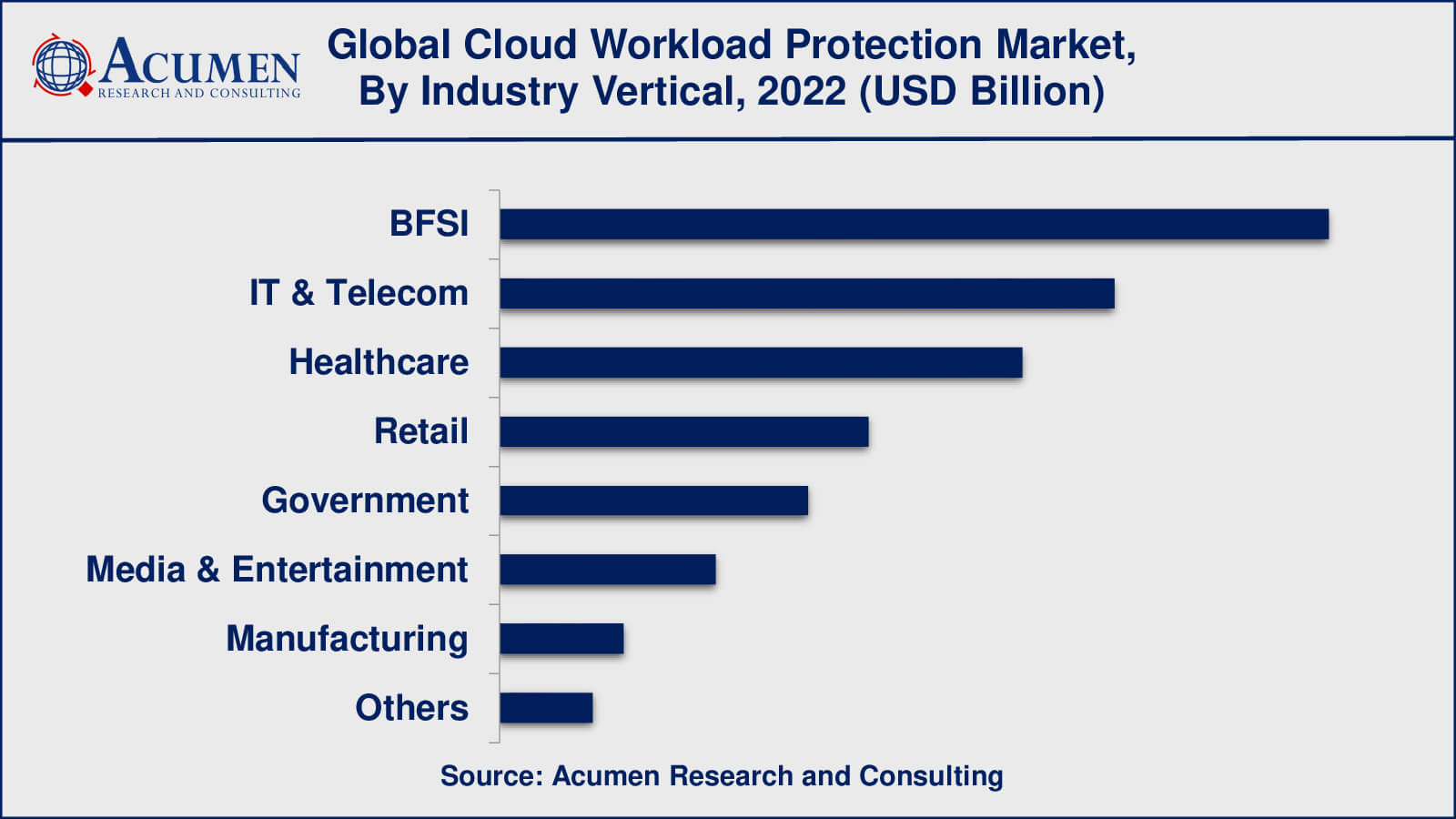

Cloud Workload Protection Market, By Industry Verticals

As per the cloud workload protection market forecast, the BFSI industry vertical has typically been one of the major industries pushing the adoption of cloud workload protection solutions. The BFSI industry is responsible for sensitive client data, financial transactions, and regulatory compliance. Because of the possible financial consequences of data breaches and regulatory fines, these organisations are subjected to intense cybersecurity inspection. Cloud workload protection solutions assist organisations in securing workloads and sensitive data within their cloud environments, guaranteeing compliance with industry laws such as PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation).

Cloud Workload Protection Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Cloud Workload Protection Market Regional Analysis

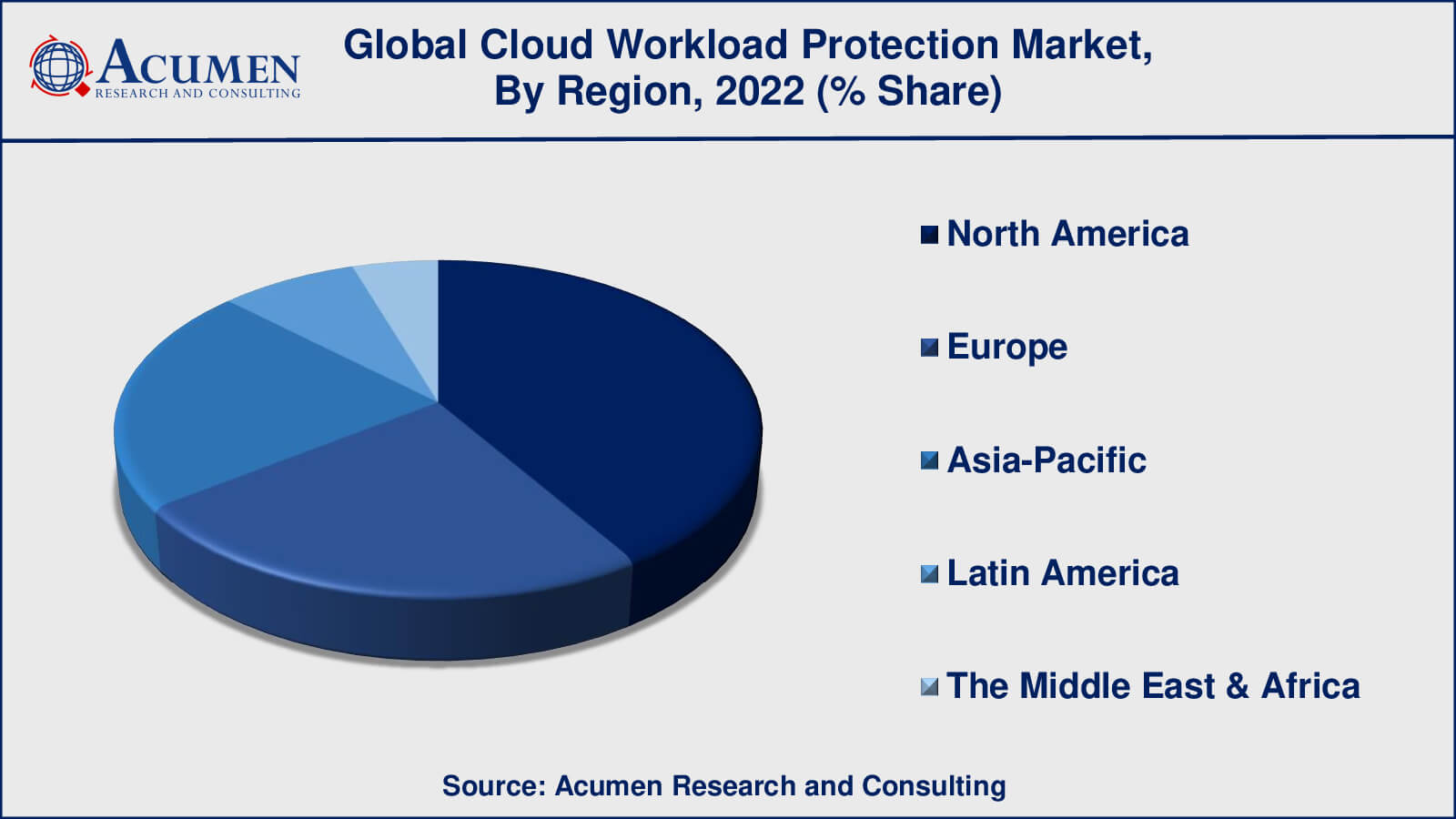

North America has long been a market leader in cloud workload protection. Its dominance is aided by the presence of large cloud service providers, strong cloud adoption rates, and a robust cybersecurity ecosystem. The United States, in particular, has a robust industry, with many businesses implementing cloud workload protection solutions to safeguard their workloads.

Europe is another important market for cloud workload protection. Cloud use and cybersecurity activities have grown significantly in countries such as the United Kingdom, Germany, France, and the Nordics. The General Data Protection Regulation (GDPR) of the European Union has also increased demand for cloud workload protection solutions to assure compliance and data protection.

The Asia-Pacific area is seeing significant cloud adoption, digital transformation, and a rapidly evolving cybersecurity landscape. Countries such as China, Japan, Australia, and India are propelling industry expansion. The dynamic economies of the area, rising IT infrastructure, and increased awareness of cybersecurity dangers all contribute to the demand for cloud workload protection solutions.

Cloud Workload Protection Market Players

Some of the top cloud workload protection companies offered in our report include Trend Micro, McAfee, Symantec (Broadcom), Palo Alto Networks, Check Point Software Technologies, Cisco Systems, Fortinet, CrowdStrike, Sophos, Microsoft, and CloudPassage.

Cloud Workload Protection Industry Recent Developments

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

December 2024

September 2023

April 2025

December 2023