February 2024

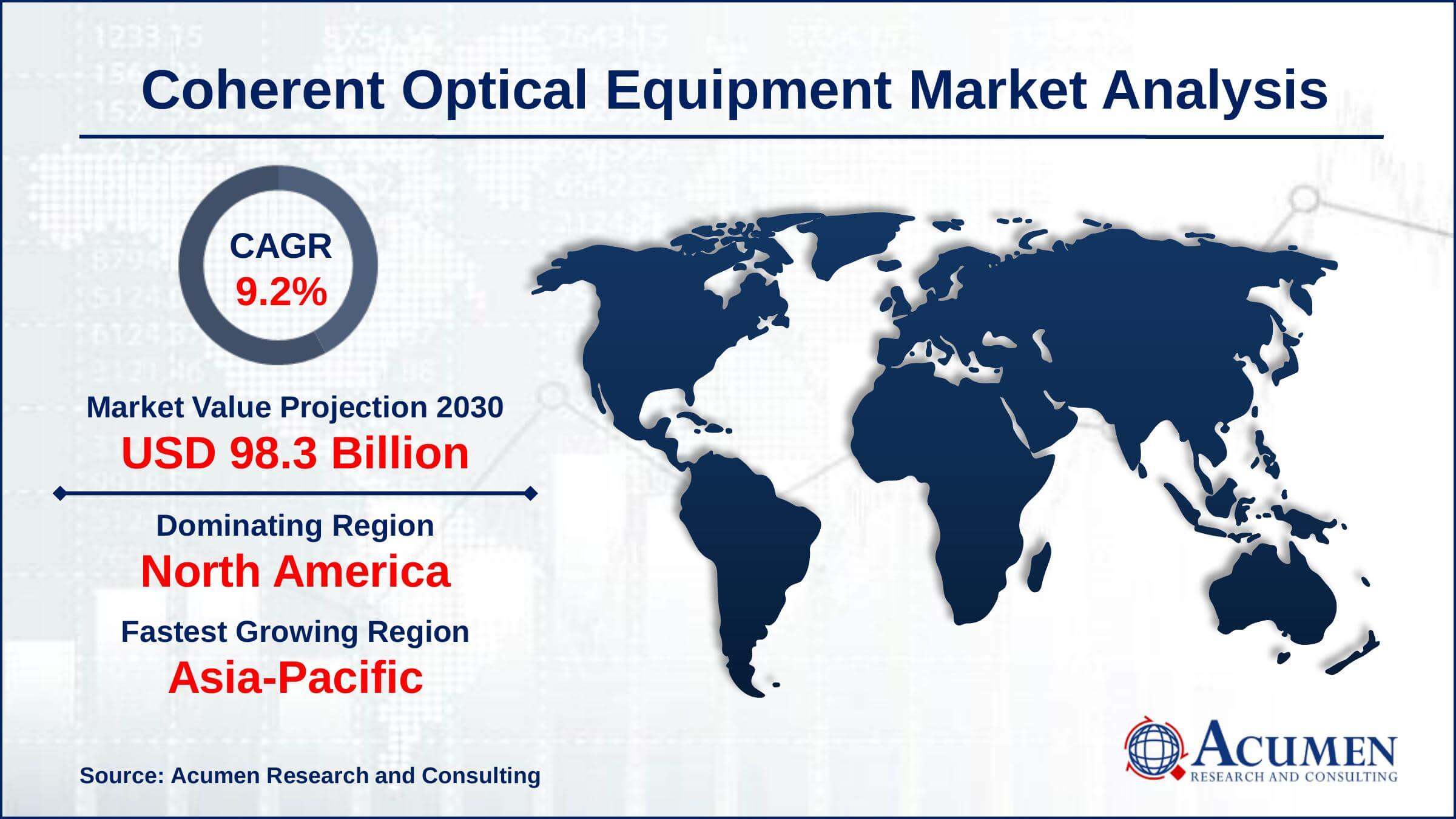

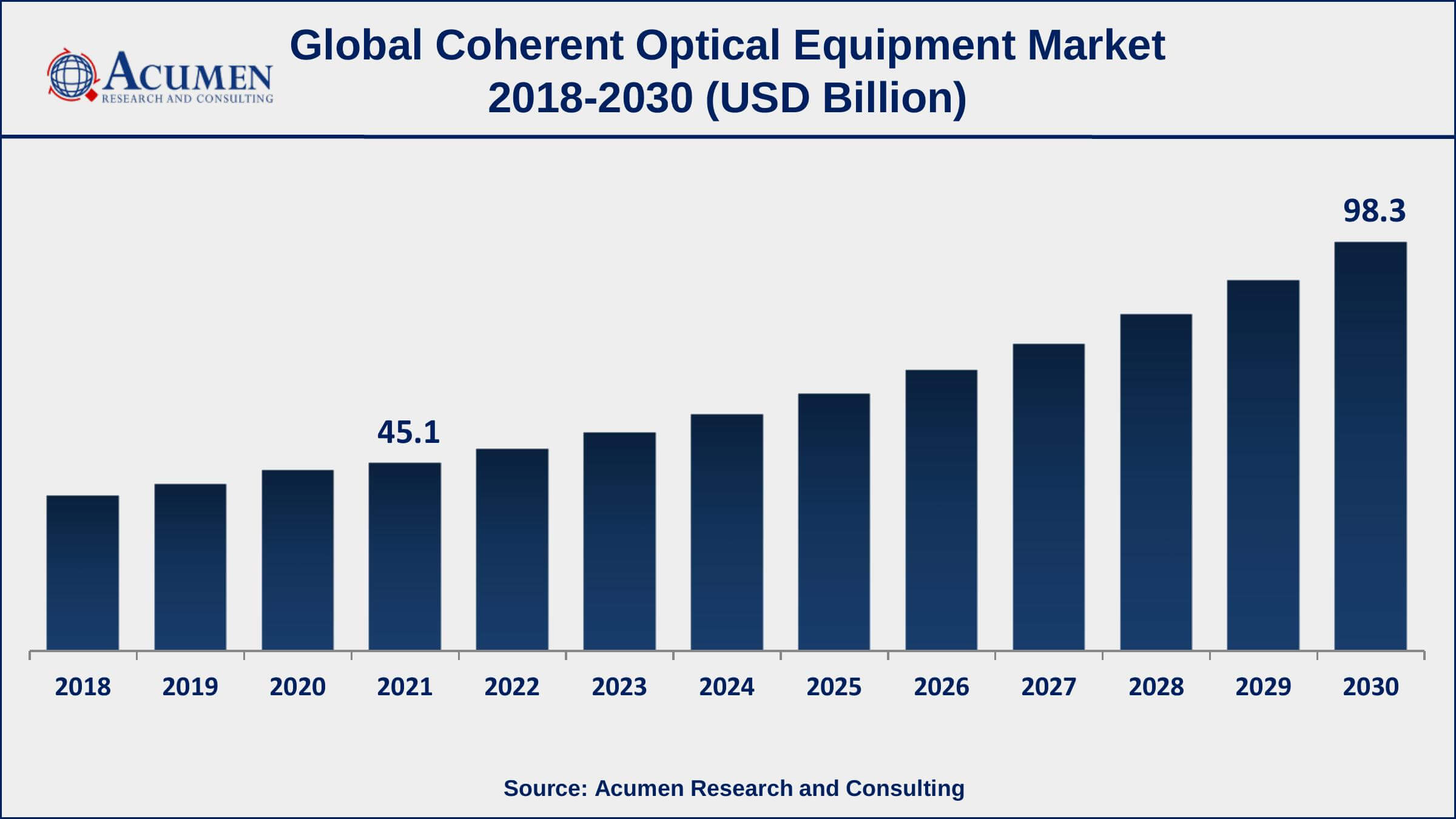

Coherent Optical Equipment Market Size accounted for USD 45.1 Billion in 2021 and is estimated to achieve a market size of USD 98.3 Billion by 2030 growing at a CAGR of 9.2% from 2022 to 2030.

The Global Coherent Optical Equipment Market Size accounted for USD 45.1 Billion in 2021 and is estimated to achieve a market size of USD 98.3 Billion by 2030 growing at a CAGR of 9.2% from 2022 to 2030. The growing demand for high-quality audio and video is projected to have an impact on the coherent optical equipment market growth. Furthermore, rising digitization and the widespread presence of optical equipment providers are projected to fuel demand for coherent optical equipment market value.

Coherent Optical Equipment Market Report Key Highlights

Coherent Optical Equipment is a group of equipment that can transmit data at high speeds. It is essentially a fiber optic cable with a frequency of 100G+ and increased information volume and transferrable capacity. To improve coherent optical transmission, approaches such as phase and amplitude manipulation of light by transmitting across two polarizations are introduced. It is widely used in data centers, networking, and many industries including aerospace, power, and others.

Global Coherent Optical Equipment Market Trends

Market Drivers

Market Restraints

Market Opportunities

Coherent Optical Equipment Market Report Coverage

| Market | Coherent Optical Equipment Market |

| Coherent Optical Equipment Market Size 2021 | USD 45.1 Billion |

| Coherent Optical Equipment Market Forecast 2030 | USD 98.3 Billion |

| Coherent Optical Equipment Market CAGR During 2022 - 2030 | 9.2% |

| Coherent Optical Equipment Market Analysis Period | 2018 - 2030 |

| Coherent Optical Equipment Market Base Year | 2021 |

| Coherent Optical Equipment Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Technology, By Equipment, By Application, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ADVA Optical Networking, Nokia, Cisco Systems, Ciena Corporation, Ericsson, ECI Telecom, Infinera, Fujitsu, NEC, Huawei Technologies, and ZTE Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Coherent optical equipment alludes to all the equipment in the optical network that promotes 100G+ speed for information transmission. Critical growth in transfer speed necessities to decrease inactivity issues and give smooth information transmission is evaluated to fuel the growth of the coherent optical equipment market. Various technical innovations have occurred in the optical system equipment market in the past years. Network access suppliers, telecom specialist organizations, open divisions, and distinctive ventures are broadly utilizing coherent optical equipment attributable to the huge growth of web infiltration among the populace, and expanding interest in high-quality visuals and audio. Accordingly, the coherent optical equipment market is required to grow at a fast pace in the coming years. The growing need to embrace new IT arrangements with present-day customer slants over the world is driving the interest in coherent optical equipment.

Coherent Optical Equipment Market Segmentation

The worldwide coherent optical equipment market segmentation is based on the technology, equipment, application, end use, and geography.

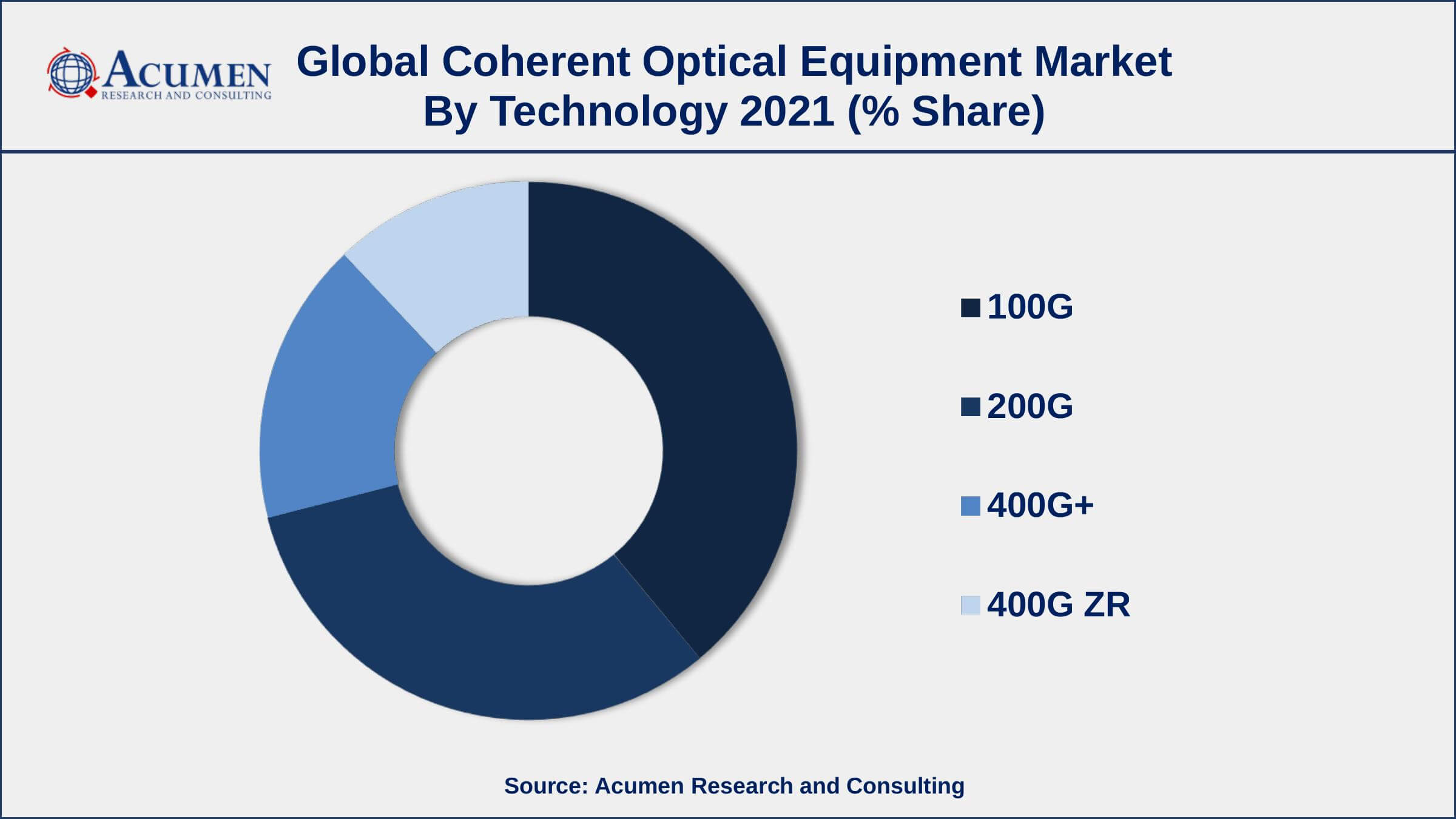

Coherent Optical Equipment Market By Technology

According to a coherent optical equipment industry analysis, the 100G segment represented a huge market share all-inclusive in 2021. This segment is anticipated to maintain its dominance of market share over the projected time frame. Both business and residential customers are supporting fast data transfer capacity. The 100G coherent technology adoption has flooded both whole deal systems and metro systems. Coherent optical fiber empowers more prominent system programmability and adaptability by supporting distinctive modulation formats and baud rates. These outcomes in more prominent adaptability in line rates, with versatility from 100G to 400G and past per single flag bearer, conveying expanded information transmission throughput at a lower cost for every piece. The 400G+ technology segment is assessed to extend at a quick pace during the projected time frame with growing interest from the industry end-use sector and the public sector.

Coherent Optical Equipment Market By Equipment

According to the coherent optical equipment market forecast, the WDM segment represented a significant market share in 2021 and is projected to hold its situation over the estimated time frame. The WDM segment is probably going to be driven by the interest in 100G+ coherent wavelengths. It is exceptionally well-known equipment that supports in multiplexing of many optical fiber bearer signals into a solitary fiber optic link by utilizing diverse wavelengths of light. The greatest preferred standpoint of WDM is that it can convey different wavelengths in a solitary fiber link. However, the optical switches segment is required to extend essentially over the estimated time frame. In addition, the test and estimation equipment segment is anticipated to pick up market share in the next few years as it pushes the limits of rapid optical communication with a scope of easy-to-use modular, innovative, and customized solutions.

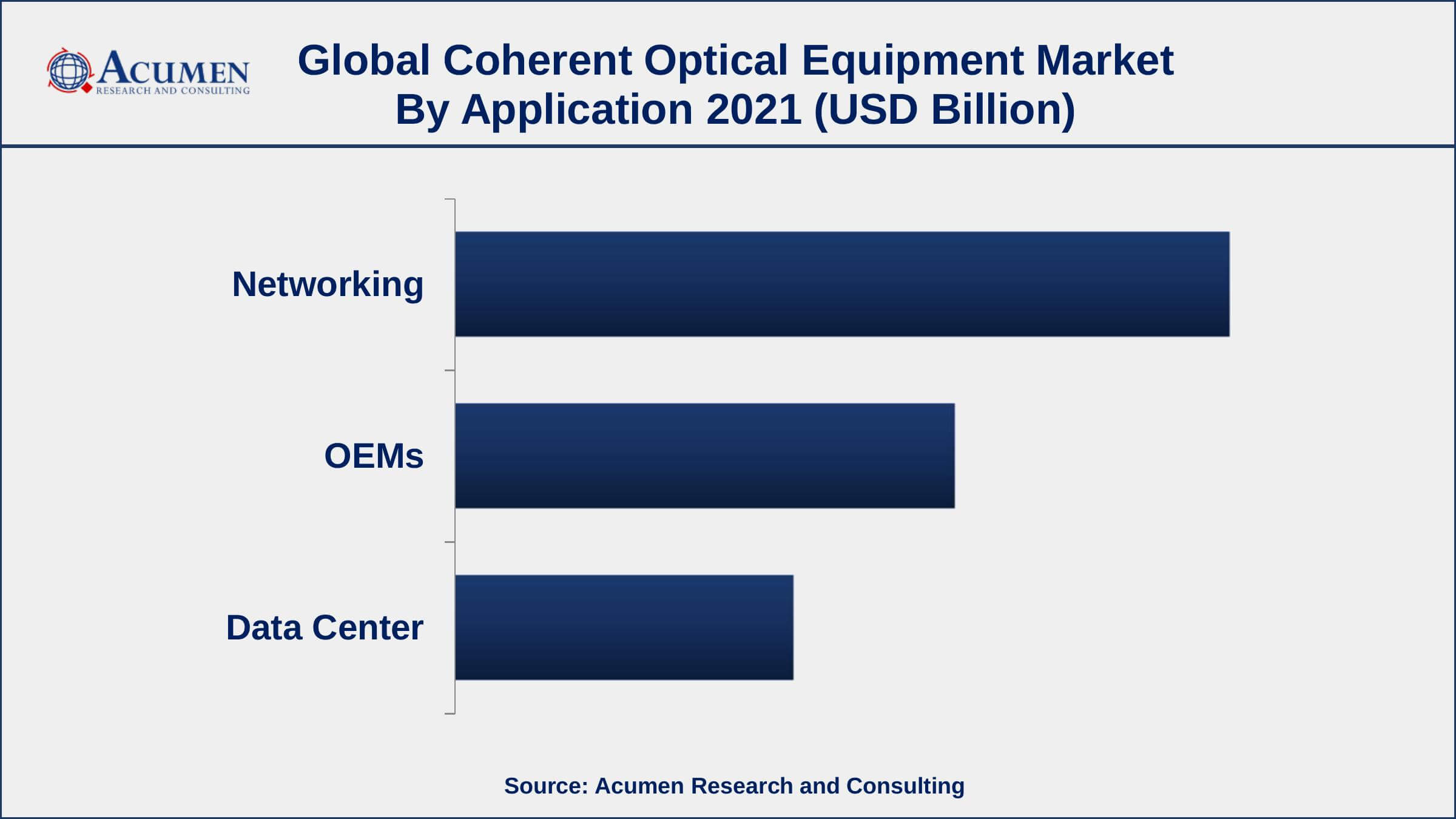

Coherent Optical Equipment Market By Application

In terms of application, the networking segment accounted for the largest market share in 2021. Networking is a sort of optical communication that uses optical amplifiers, lasers, LEDs, and WDM to transport data across an optical fiber channel. It can transport data with the highest possible bandwidth and the lowest possible losses.

Coherent Optical Equipment Market By End Use

Based on the end user, the service provider sector is the leading user of coherent optical equipment pursued by the public sector, owing to the expanding interest in fast transfer speed from network access suppliers and telecom service providers. The industry sector is anticipated to extend at a quick pace over the estimated time frame owing to increasing demand for rapid data transmission speed from various ventures, for instance, railways and aviation.

Coherent Optical Equipment Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

North America Holds Dominating Share Of Coherent Optical Equipment Market

Geographically, the North America market is foreseen to keep on being at the front line of worldwide demand, with the market in the region growing at a strong CAGR during the projected time frame. The presences of a large number of optical equipment providers, technical advancements, high internet penetration, increased digitization, etc., are foreseen to drive the coherent optical equipment market in North America. In 2021, the U.S. held a noteworthy revenue share of the coherent optical equipment market in North America, followed by Canada. However, the markets in the Asia-Pacific and The Middle East & Africa regions are projected to grow at a noteworthy CAGR in the upcoming years.

Coherent Optical Equipment Market Players

Some of the top coherent optical equipment market companies offered in the professional report include ADVA Optical Networking, Nokia, Cisco Systems, Ciena Corporation, Ericsson, ECI Telecom, Infinera, Fujitsu, NEC, Huawei Technologies, and ZTE Corporation.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

February 2024

December 2022

July 2021

October 2023