January 2021

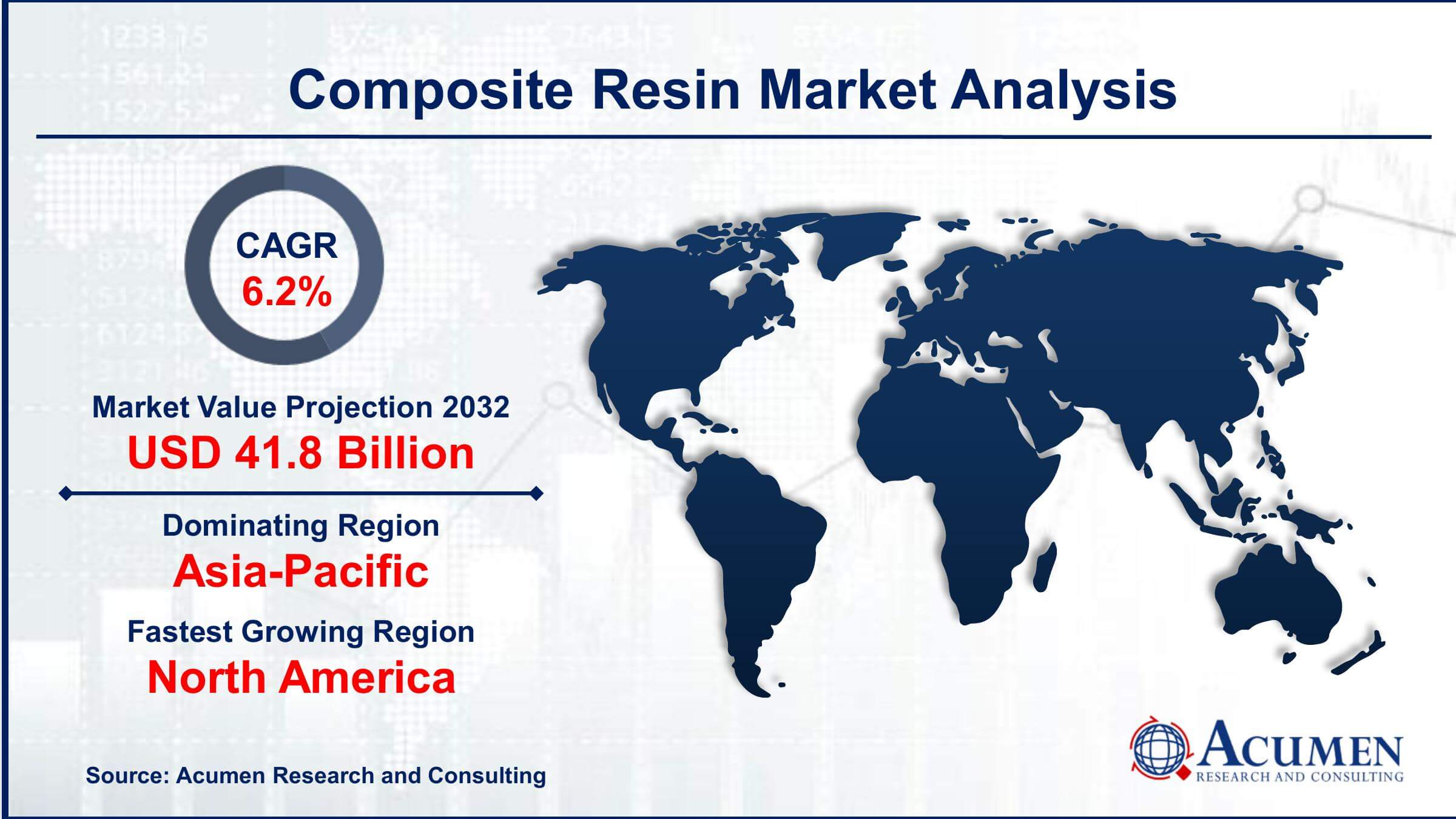

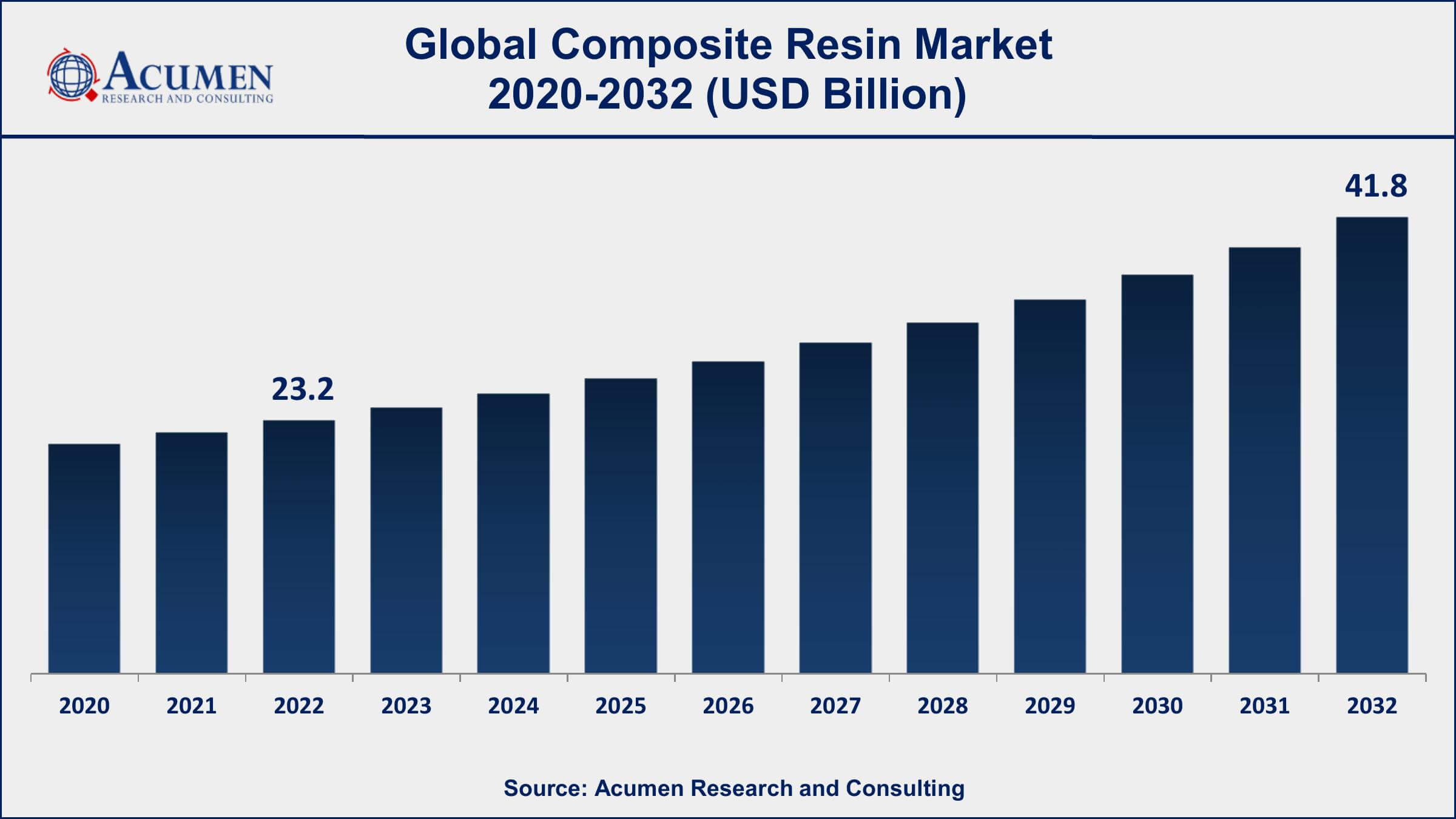

Composite Resin Market Size accounted for USD 23.2 Billion in 2022 and is projected to achieve a market size of USD 41.8 Billion by 2032 growing at a CAGR of 6.2% from 2023 to 2032.

The Global Composite Resin Market Size accounted for USD 23.2 Billion in 2022 and is projected to achieve a market size of USD 41.8 Billion by 2032 growing at a CAGR of 6.2% from 2023 to 2032.

Composite Resin Market Highlights

Composite resin, also known as composite material or simply composite, is a type of material composed of two or more distinct components combined to create a new material with enhanced properties. The two main components in composite resin are the matrix and the reinforcement. The matrix is a polymer-based material that binds and holds the reinforcement together, while the reinforcement provides the strength and stiffness to the composite. Common reinforcement materials include fiberglass, carbon fibers, and aramid fibers.

The market growth of composite resins has been impressive in recent years, driven by increased demand in multiple industries and advancements in material science. The expanding automotive sector's focus on lightweighting to improve fuel efficiency has led to a surge in composite resin usage. Additionally, the aerospace industry's push for more fuel-efficient aircraft and the construction industry's adoption of composite materials for infrastructure projects have further contributed to market growth. Moreover, the rising awareness about renewable energy sources has increased the demand for composite materials in wind energy applications. As technology advances, manufacturers are continually developing innovative composite resins to meet the ever-evolving needs of various sectors, leading to a positive growth outlook for the composite resin market in the coming years.

Global Composite Resin Market Trends

Market Drivers

Market Restraints

Market Opportunities

Composite Resin Market Report Coverage

| Market | Composite Resin Market |

| Composite Resin Market Size 2022 | USD 23.2 Billion |

| Composite Resin Market Forecast 2032 | USD 41.8 Billion |

| Composite Resin Market CAGR During 2023 - 2032 | 6.2% |

| Composite Resin Market Analysis Period | 2020 - 2032 |

| Composite Resin Market Base Year | 2022 |

| Composite Resin Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Reinforcement Type, By Manufacturing Process, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ashland Global Holdings Inc., BASF SE, Huntsman Corporation, Hexion Inc., Sika AG, DuPont de Nemours, Inc., 3M Company, Arkema SA, DIC Corporation, Sumitomo Bakelite Co., Ltd., Mitsubishi Chemical Corporation, and Evonik Industries AG |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Composite resin is a type of material made by combining two or more distinct components to create a new material with enhanced properties. The two main components in composite resin are the matrix and the reinforcement. The matrix is typically a polymer-based material, such as epoxy or polyester, that acts as a binder, holding the reinforcement materials together. The reinforcement provides strength and rigidity to the composite and is usually made of fibers, such as fiberglass, carbon fiber, or aramid, embedded in the matrix. The combination of these components results in a material that possesses superior mechanical properties compared to individual components alone.

Composite resin finds diverse applications across various industries due to its exceptional properties. In the automotive sector, it is used to manufacture lightweight components, which contribute to improved fuel efficiency and overall vehicle performance. In aerospace and defense, composites are extensively used in aircraft and spacecraft to reduce weight, increase payload capacity, and enhance aerodynamics. The construction industry employs composite resin in structural elements, such as bridges and columns, for their high strength and durability, leading to more sustainable and long-lasting infrastructure.

The composite resin market had been experiencing steady growth and was projected to continue expanding over the coming years. The market growth was primarily driven by the increasing demand for lightweight and high-performance materials across various industries, such as automotive, aerospace, and construction. Composite resins' unique properties, including high strength-to-weight ratio, corrosion resistance, and design flexibility, made them attractive options for manufacturers looking to improve the efficiency and durability of their products. The automotive industry's focus on fuel efficiency and emission reduction had led to a growing adoption of composite resins in vehicle manufacturing, especially for parts such as body panels, chassis components, and interior parts.

Composite Resin Market Segmentation

The global Composite Resin Market segmentation is based on type, reinforcement type, manufacturing process, end use, and geography.

Composite Resin Market By Type

According to the composite resin industry analysis, the epoxy segment accounted for the largest market share in 2022. Epoxy resins are a type of thermosetting polymer that is widely used in composite materials due to their excellent adhesive properties, high strength, and chemical resistance. These characteristics have made epoxy resins a preferred choice for various applications across industries. The automotive sector had been one of the primary drivers of epoxy resin demand in the composite market. Epoxy composites were being utilized to manufacture lightweight automotive parts, leading to improved fuel efficiency and reduced carbon emissions. Additionally, the aerospace industry's increased adoption of epoxy-based composites for aircraft components, such as wings and fuselage sections, contributed to the growth of this segment.

Composite Resin Market By Reinforcement Type

In terms of reinforcement types, the glass fiber segment is expected to witness significant growth in the coming years. Glass fibers are widely used as reinforcement in composite resin matrices due to their high strength, stiffness, and relatively low cost. They play a vital role in enhancing the mechanical properties of composites, making them popular across various industries. The automotive industry had been a significant driver of the glass fiber segment's growth in the composite resin market. Glass fiber-reinforced composites were increasingly being utilized to manufacture lightweight yet durable automotive components, contributing to improved fuel efficiency and overall vehicle performance.

Composite Resin Market By Manufacturing Process

According to the composite resin market forecast, the hand lay-up segment is expected to witness significant growth in the coming years. Hand lay-up is a traditional and labor-intensive method of fabricating composite structures where layers of reinforcing fibers (such as fiberglass) are manually placed in a mold, and resin is applied by hand to impregnate and bind the fibers together. While hand lay-up has been widely used for various applications, especially in smaller-scale productions and custom designs, it has faced some challenges in the context of mass production and industrial applications. The process can be time-consuming and may require skilled labor, leading to higher production costs compared to more automated manufacturing methods like resin infusion or filament winding.

Composite Resin Market By End Use

Based on the end use, the automotive segment is expected to continue its growth trajectory in the coming years. The automotive industry's increasing focus on lightweighting to improve fuel efficiency and reduce emissions has been a key driver for the adoption of composite resins. Composite materials, including various types of resins reinforced with fibers like carbon or glass, offer an excellent strength-to-weight ratio, making them attractive for automotive applications. The demand for composite resin materials in the automotive sector has been driven by the need to design and manufacture lightweight vehicles without compromising on safety and performance. Components such as body panels, hoods, doors, and even structural elements have been manufactured using composite resins to achieve weight reduction and enhance overall vehicle performance. Additionally, composites' ability to dampen vibrations and noise has contributed to improved ride comfort in vehicles.

Composite Resin Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Composite Resin Market Regional Analysis

Geographically, the Asia-Pacific region had been dominating the composite resin market in 2022. The region's rapid industrialization, expanding manufacturing sector, and significant economic growth have been instrumental in driving the demand for composite materials, including composite resins. One of the primary factors contributing to Asia-Pacific's dominance is its robust manufacturing base. The region is home to some of the world's largest automotive, aerospace, and electronics industries, which are major consumers of composite resins. The automotive sector, in particular, has been growing steadily in countries like China, India, Japan, and South Korea, leading to an increased demand for lightweight and high-performance materials like composite resins. The aerospace industry's expansion, driven by the growth of budget airlines and increasing air travel, has also spurred the use of composite resins in aircraft manufacturing. Moreover, the construction industry in the Asia-Pacific region has been flourishing, with extensive infrastructure development and urbanization projects. Composite resins offer numerous advantages in construction applications, including their ability to reinforce concrete structures and provide durability, which has further fueled the demand for composite materials in the region.

Composite Resin Market Player

Some of the top composite resin market companies offered in the professional report include Ashland Global Holdings Inc., BASF SE, Huntsman Corporation, Hexion Inc., Sika AG, DuPont de Nemours, Inc., 3M Company, Arkema SA, DIC Corporation, Sumitomo Bakelite Co., Ltd., Mitsubishi Chemical Corporation, and Evonik Industries AG.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

January 2021

December 2023

April 2023

April 2020