September 2018

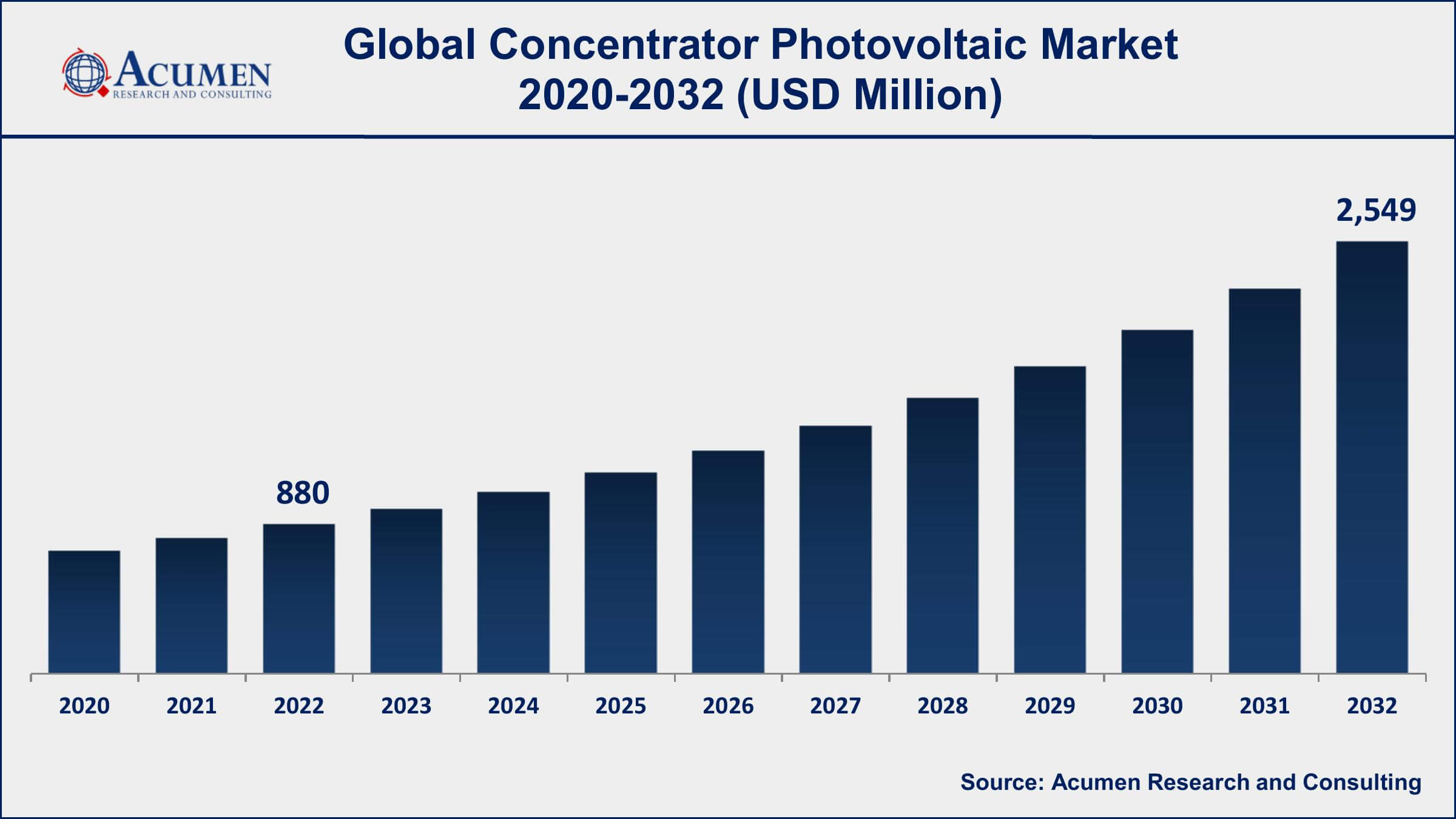

Concentrator Photovoltaic Market Size accounted for USD 880 Million in 2022 and is projected to achieve a market size of USD 2,549 Million by 2032 growing at a CAGR of 11.3% from 2023 to 2032.

The Global Concentrator Photovoltaic (CPV) Market Size accounted for USD 880 Million in 2022 and is projected to achieve a market size of USD 2,549 Million by 2032 growing at a CAGR of 11.3% from 2023 to 2032.

Report Key Highlights

Concentrator photovoltaic (CPV) is a type of photovoltaic technology that uses optics such as lenses and mirrors to concentrate sunlight onto small, high-efficiency solar cells. By concentrating sunlight, CPV systems can achieve much higher efficiencies than traditional flat-plate photovoltaic systems. CPV systems are typically used in areas with high direct normal irradiance, such as deserts and other sunny locations.

The CPV market value has experienced steady growth over the past few years, with a compound annual growth rate (CAGR) of around 11.3%. The market is expected to continue growing at a similar pace over the next few years, driven by factors such as increasing demand for renewable energy, advancements in CPV technology, and the need for more efficient solar energy solutions. Despite its potential advantages, CPV faces some challenges, such as higher installation costs compared to traditional photovoltaic systems, and the need for sunny locations with high direct normal irradiance. However, with continued advancements in technology and decreasing costs, CPV is expected to become a more viable and competitive option for solar energy generation in the future.

Global Concentrator Photovoltaic Market Trends

Market Drivers

Market Restraints

Market Opportunities

Concentrator Photovoltaic Market Report Coverage

| Market | Concentrator Photovoltaic Market |

| Concentrator Photovoltaic Market Size 2022 | USD 880 Million |

| Concentrator Photovoltaic Market Forecast 2032 | USD 2,549 Million |

| Concentrator Photovoltaic Market CAGR During 2023 - 2032 | 11.3% |

| Concentrator Photovoltaic Market Analysis Period | 2020 - 2032 |

| Concentrator Photovoltaic Market Base Year | 2022 |

| Concentrator Photovoltaic Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Concentration Factor, By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Arzon Solar, CPV Ltd., Amonix, SunPower Corporation, SolFocus, Semprius, Morgan Solar Inc., Soitec, Prism Solar Technologies, Inc., Magpower, Oxford Photovoltaics, and MicroLink Devices. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Concentrator photovoltaic (CPV) generates electricity from the light of the sun. Unlike photovoltaic systems, CPV uses bent mirrors and lenses to focus light onto multi-junction (MJ) solar cells that are small, but extremely efficient. In the mid-2000s, the concentrator photovoltaic entered the global market as a utility-range solar power generation alternative. While the technology has seen extensive approval and a major number of installations all around the globe in the past few years, it is still at a promising stage of development. When compared to conventional flat-plate photovoltaics, which has been acclaimed for their easy application in rooftops and domestic settings of private and public buildings, the concentrator photovoltaic technology is comparatively a small player in the whole solar power generation market.

In recent times, the CPV industry has experienced unstable times with the number of new installations considerably declining in 2015 as compared to the earlier period. Several major CPV companies have exited the market due to rising pressures from declining costs of other PV technologies. Also, a number of players are facing significant difficulties in raising the capital required to grow and experiment in the market.

However, CPV modules continue to get better in terms of efficiency, realizing exchange rates far beyond what is possible from customary flat-panel PV modules. Constant research efforts in the field of the CPV market have led to the growth of modules that have efficiencies of up to 44%, the maximum of all existing PV technologies. Researchers consider the technology still has scope for improvement in the upcoming years, provided that a way for achieving an important decline in overall system costs. Concentrator photovoltaic systems are mostly of concern to power generation projects situated in sun-rich locations that accept direct normal irradiance (DNI) which values of more than 2000 kWh. These PV systems are not appropriate for installation on rooftops, thus restraining their scope of application to a level.

Concentrator Photovoltaic Market Segmentation

The global concentrator photovoltaic market segmentation is based on concentration factor, technology, application, and geography.

Concentrator Photovoltaic Market By Concentration Factor

According to the concentrator photovoltaic industry analysis, the concentration photovoltaic (HCPV) segment accounted for the largest market share in 2022. HCPV systems use multi-junction solar cells that are designed to operate at high concentrations, allowing for higher efficiency and lower system costs per watt compared to traditional flat-plate photovoltaic systems. The HCPV segment of the CPV market has experienced moderate growth over the past few years, driven by factors such as increasing demand for higher efficiency solar energy solutions and advancements in multi-junction solar cell technology. One of the main drivers of growth in the HCPV segment is the potential to achieve very high efficiencies, typically above 40%, which can result in lower overall system costs per watt. Additionally, HCPV systems can be used in a variety of applications, such as utility-scale solar power plants, off-grid energy systems, and remote telecommunications systems.

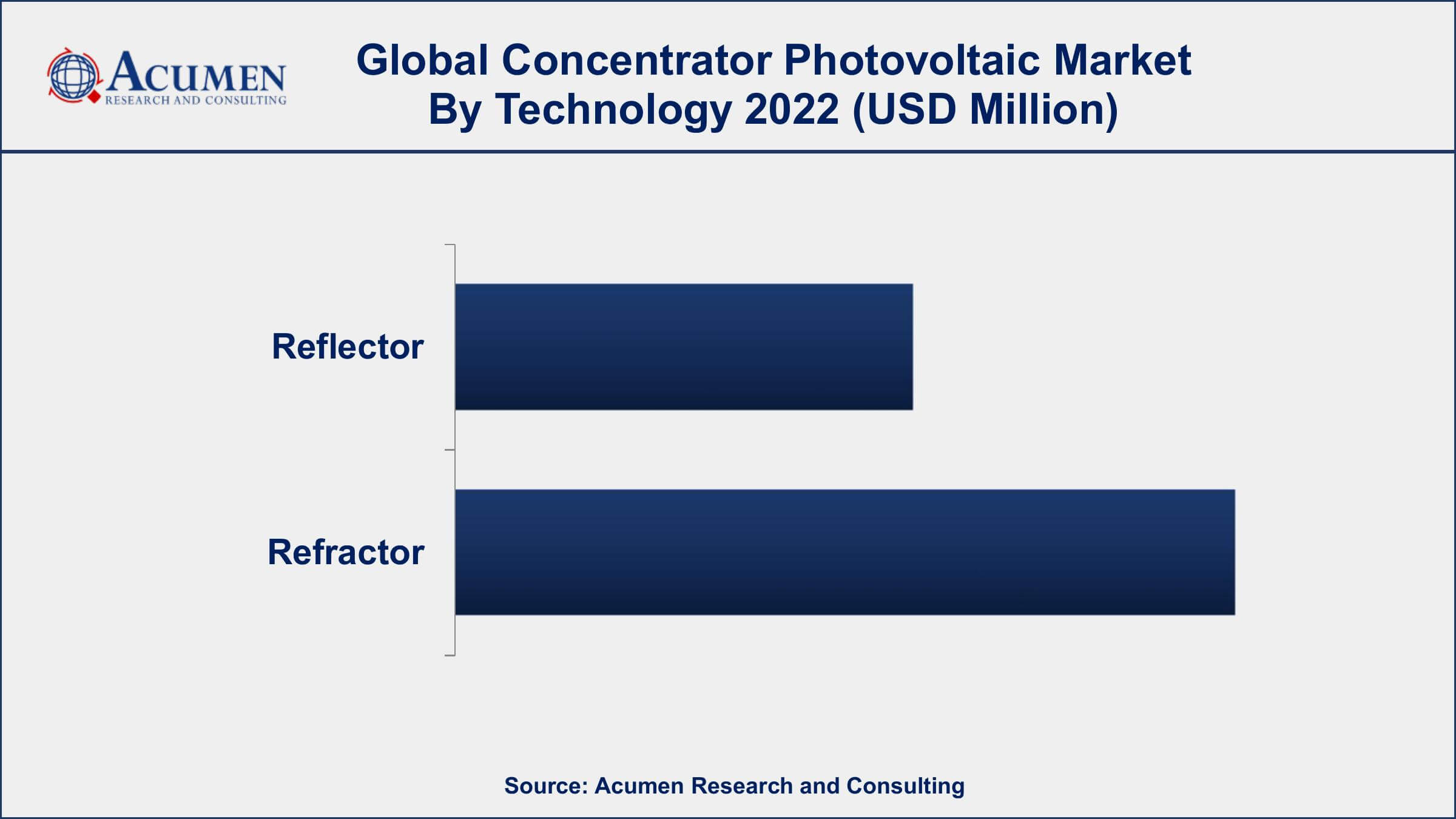

Concentrator Photovoltaic Market By Technology

In terms of technology, the refractor segment is expected to witness significant growth in the coming years. Refractor CPV systems concentrate sunlight onto small, high-efficiency solar cells using lenses made of refractive materials such as glass or plastic, which bend light to focus it onto the cells. The refractor segment of the CPV market has experienced slower growth compared to other CPV technologies such as high-concentration photovoltaic. However, the refractor segment has some advantages over other CPV technologies, such as lower system costs and higher reliability due to the use of fewer optical components. Additionally, refractor CPV systems can be used in a variety of applications, such as remote telecommunications systems, off-grid energy systems, and distributed energy generation.

Concentrator Photovoltaic Market By Application

According to the concentrator photovoltaic market forecast, the commercial segment is expected to witness significant growth in the coming years. This growth is driven by factors such as increasing demand for renewable energy and the potential for CPV technology to provide higher efficiency and lower system costs compared to traditional flat-plate photovoltaic systems. One of the main advantages of CPV technology in the commercial segment is the potential for higher efficiency compared to traditional photovoltaic systems, which can result in lower overall system costs per watt. Additionally, CPV systems can be designed to operate in a variety of climates and conditions, making them suitable for a wide range of commercial applications.

Concentrator Photovoltaic Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Concentrator Photovoltaic Market Regional Analysis

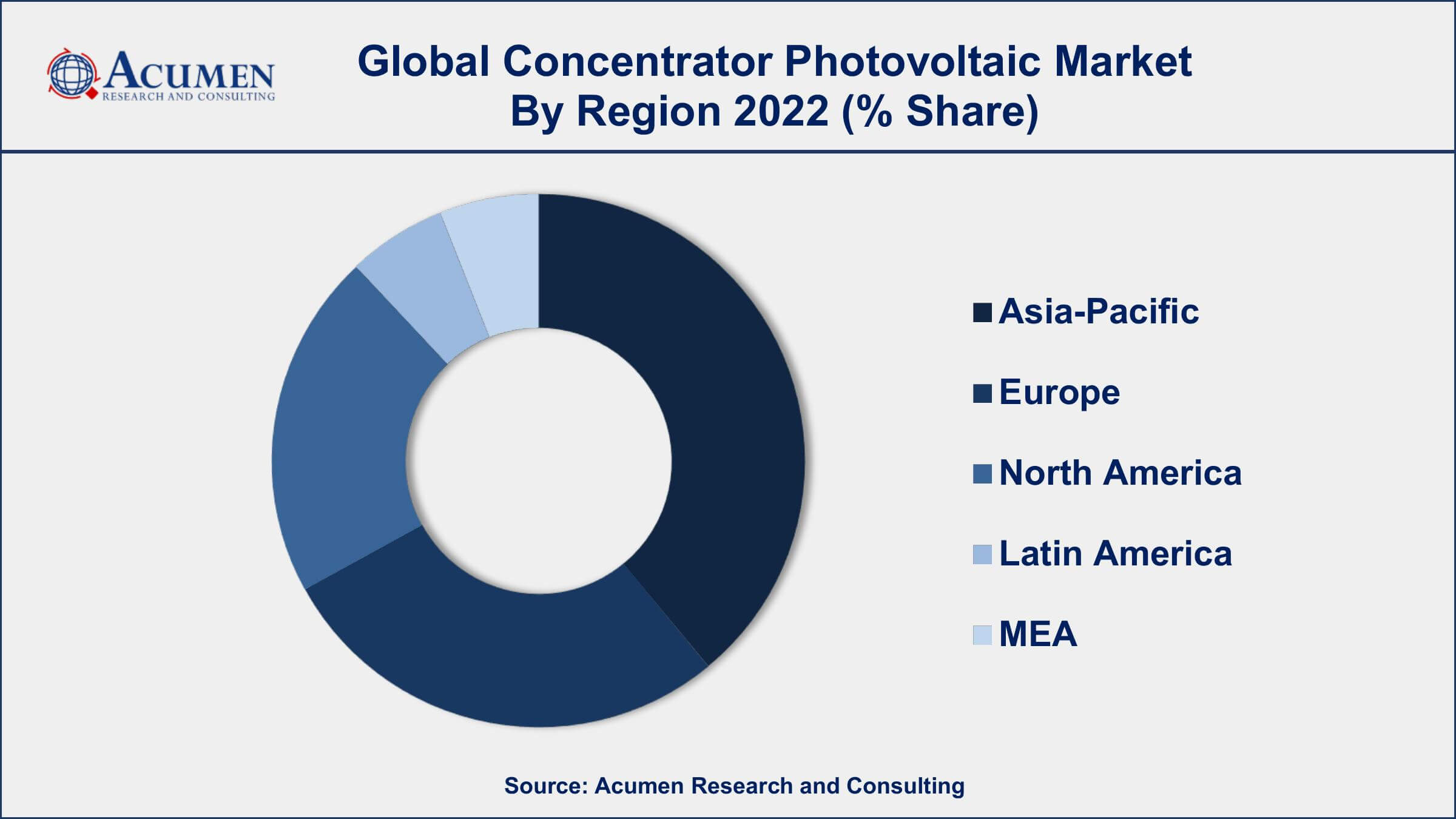

The Asia-Pacific region has emerged as the dominant market for concentrator photovoltaic (CPV) technology, accounting for the largest share of the global CPV market in recent years. The region's dominance can be attributed to several factors, such as the increasing demand for renewable energy sources, the availability of favorable government policies and incentives, and the presence of leading CPV manufacturers and suppliers in the region. One of the main drivers of the Asia-Pacific CPV market growth is the increasing demand for renewable energy sources, driven by factors such as rising energy demand, growing concerns over climate change, and the need to reduce dependence on fossil fuels. Many countries in the region, such as China, Japan, and India, have set ambitious renewable energy targets and are actively promoting the adoption of CPV technology through favorable policies and incentives.

Concentrator Photovoltaic Market Player

Some of the top concentrator photovoltaic market companies offered in the professional report include Arzon Solar, CPV Ltd., Amonix, SunPower Corporation, SolFocus, Semprius, Morgan Solar Inc., Soitec, Prism Solar Technologies, Inc., Magpower, Oxford Photovoltaics, and MicroLink Devices.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

September 2018

March 2024

June 2024

January 2018