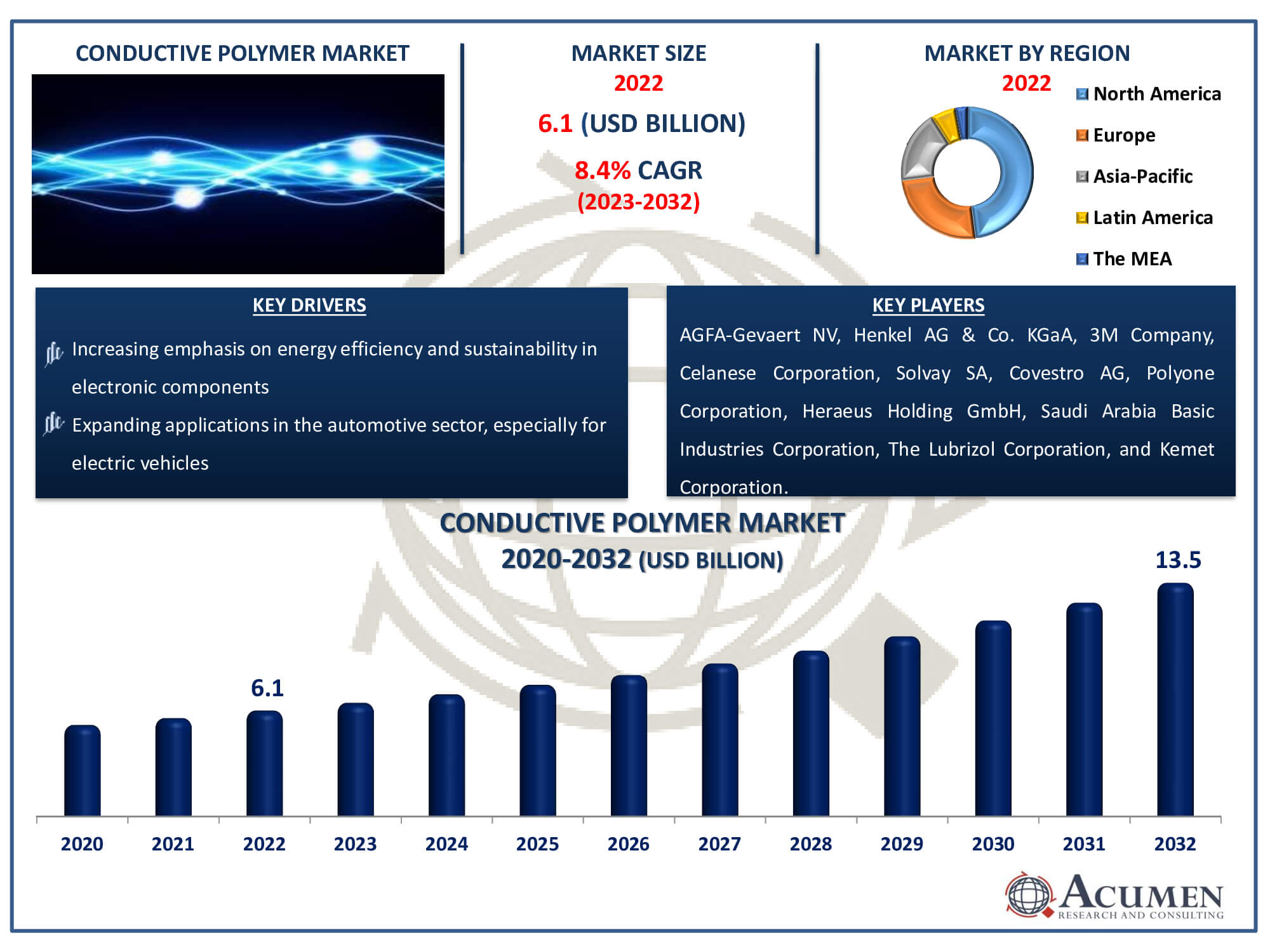

The Conductive Polymer Market Size accounted for USD 6.1 Billion in 2022 and is estimated to achieve a market size of USD 13.5 Billion by 2032 growing at a CAGR of 8.4% from 2023 to 2032.

Conductive Polymer Market Highlights

- Global conductive polymer market revenue is poised to garner USD 13.5 billion by 2032 with a CAGR of 8.4% from 2023 to 2032

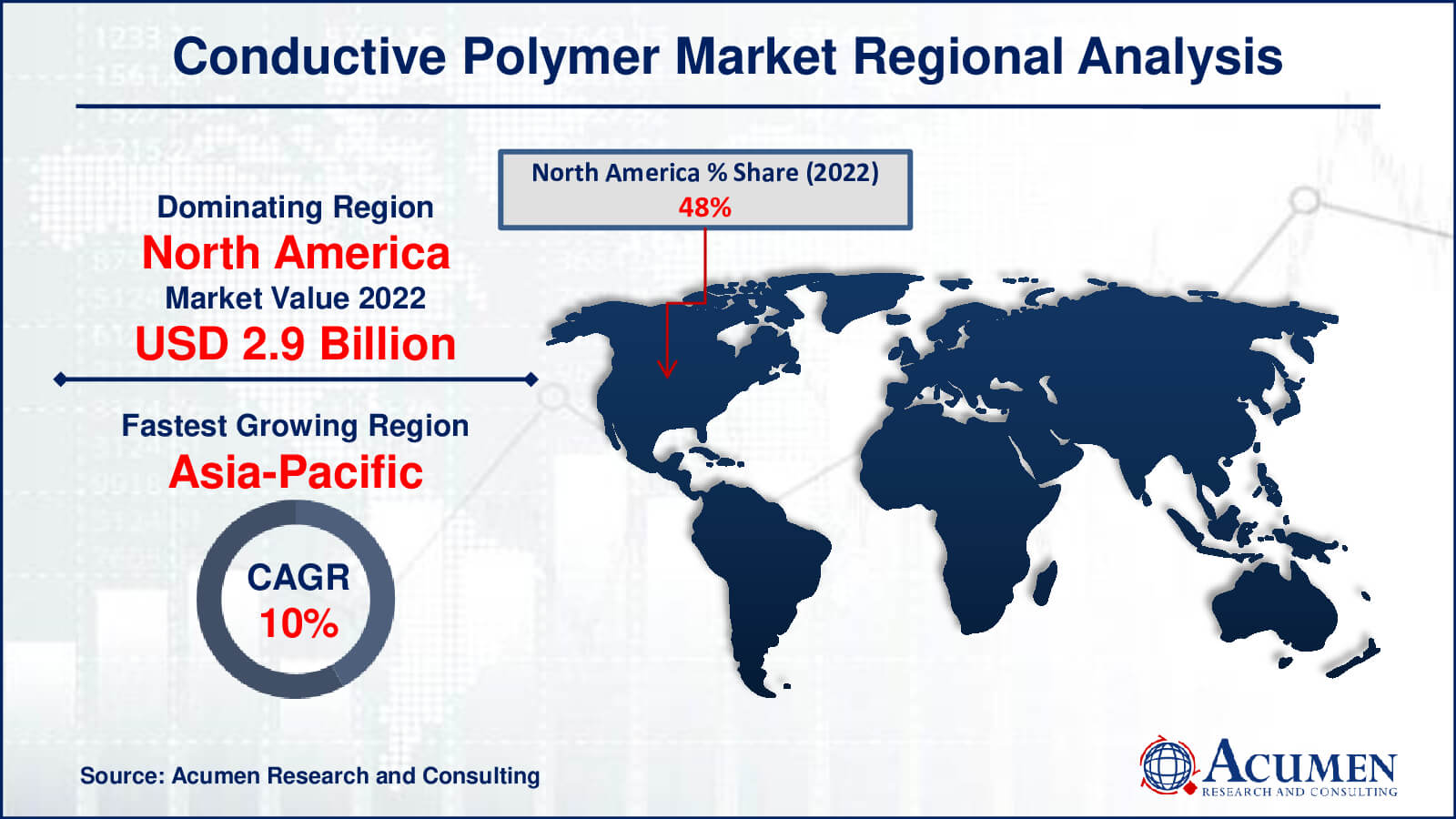

- North America conductive polymer market value occupied around USD 2.9 billion in 2022

- Asia-Pacific conductive polymer market growth will record a CAGR of more than 10% from 2023 to 2032

- Among type, the acrylonitrile-butadiene-styrene (ABS) sub-segment generated around USD 1.8 billion revenue in 2022

- Based on application, the ESD & EMI protection sub-segment generated significant share in 2022

- Collaborations for research and development initiatives is a popular conductive polymer market trend that fuels the industry demand

Electrically conducting polymers that are inexpensive and lightweight are referred to as conductive polymers. When these plastics are exposed to an electric stimulus, they can shrink, bend, or take on new shapes. Their metallic conductivity qualities make them useful in semiconductor technology. Conductive polymers are widely used across multiple industries in the production of textiles, solar cells, capacitors, batteries, sensors, and non-static containers. The market for conductive polymers has expanded significantly due to the growing need for cutting-edge electronic components. Their adaptable qualities make them essential to contemporary technology, providing answers in a variety of domains like electronics and materials research. The constant research and development of new applications and opportunities in the field of conductive polymers is driving the market's growth.

Global Conductive Polymer Market Dynamics

Market Drivers

- Growing demand for lightweight and flexible electronic devices

- Increasing emphasis on energy efficiency and sustainability in electronic components

- Expanding applications in the automotive sector, especially for electric vehicles

- Technological advancements leading to improved conductivity and performance

Market Restraints

- Challenges related to scalability and mass production

- High initial costs of development and production

- Environmental concerns associated with the disposal of conductive polymer-based products

Market Opportunities

- Rising adoption of conductive polymers in emerging economies

- Exploration of new applications in the healthcare industry for bioelectronic devices

- Collaborations and partnerships for research and development initiatives

Conductive Polymer Market Report Coverage

| Market | Conductive Polymer Market |

| Conductive Polymer Market Size 2022 | USD 6.1 Billion |

| Conductive Polymer Market Forecast 2032 | USD 13.5 Billion |

| Conductive Polymer Market CAGR During 2023 - 2032 | 8.4% |

| Conductive Polymer Market Analysis Period | 2020 - 2032 |

| Conductive Polymer Market Base Year |

2022 |

| Conductive Polymer Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AGFA-Gevaert NV, Henkel AG & Co. KGaA, 3M Company, Celanese Corporation, Solvay SA, Covestro AG, Polyone Corporation, Heraeus Holding GmbH, Saudi Arabia Basic Industries Corporation, The Lubrizol Corporation, and Kemet Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Conductive Polymer Market Insights

The global conductive polymer market is experiencing increased demand, driven by the rising adoption of affordable, lightweight, and high-performance products. Additionally, the market's growth is fueled by the physical attributes of conductive polymers, including dimensional durability, versatility, chemical resistance, and strength. The prevalence of smart phones, featuring superior sensors, larger touch screens, and the integration of high-tech features like 3D facial recognition, has replaced many personal electronic and networking devices. Smart phones encompass various micro and electronic components, such as super capacitors, capacitors, printed circuit boards, batteries, and an array of sensors, including accelerometers, gyroscopes, proximity sensors, touch screen sensors, magnetometers, fingerprint sensors, and GPS.

The impact of emerging technologies such as virtual reality (VR), augmented reality (AR), Internet of Things (IoT), and artificial intelligence (AI) is anticipated to influence developments in the conductive polymer market. Conductive polymers find widespread use for antistatic purposes in smart phones, and the market is expected to witness growth with the increasing production of folding phones and flexible screens. Researchers and manufacturers are actively seeking ways to enhance the performance of solar cells in response to the growing use of solar energy. Polymer layering is employed to improve solar cell stability and performance, with organic conductive polymers playing a crucial role in absorbing light and converting it into electricity. These polymers, known for their lightweight, transparency, durability, and production capabilities, are extensively utilized in solar equipment.

Conductive Polymer Market Segmentation

The worldwide market for conductive polymer is split based on type, application, and geography.

Conductive Polymer Types

- Polyphenylene Based Resin

- Acrylonitrile-butadiene-styrene (ABS)

- Polyaniline

- Polycarbonates

- Nylon

- intrinsically conducting polymers (ICPs)

- Others

The market leader in conductive polymers, acrylonitrile-butadiene-styrene (ABS), has amassed the biggest share thanks to a special set of qualities that make it extremely desirable for a wide range of applications. Thermoplastic polymer ABS is renowned for its remarkable resilience, resistance to impact, and stability in dimensions. Because of these characteristics, it is a recommended option in sectors where structural integrity and longevity are crucial. Among conductive polymers, ABS is particularly useful since it is simple to work with and can be used to create a wide variety of goods quickly. It can support a variety of electrical and electronic applications since conductive additives are frequently added to increase its conductivity. Electronic housings, casings, and components for consumer electronics, vehicle parts, and industrial equipment are frequently made utilising conductive polymers based on ABS. ABS also exhibits outstanding chemical resistance, which guarantees the durability of items in demanding settings. The fact that it may be used with a variety of fabrication processes, including extrusion and injection moulding, is one of the reasons it is widely used in manufacturing operations. Because they are more economical, ABS-based conductive polymers are in higher demand and are favoured by sectors looking for dependable and reasonably priced solutions.

Conductive Polymer Applications

- ESD & EMI Protection

- Actuators

- Antistatic Packaging

- Capacitors

- Sensor

- Batteries

- Solar Cells

- Others

As per conductive polymers industry analysis, ESD & EMI protection emerges as the top application for the market. This dominance is explained by the vital role conductive polymers play in resolving issues with electromagnetic interference (EMI) and electrostatic discharge (ESD). Effective ESD and EMI protection is becoming more and more important as technology develops and electronic components grow more delicate. Because of their inherent electrical conductivity, conducting polymers offer a dependable way to disperse static charges and shield against electromagnetic interference. ESD and EMI protection are non-negotiable in electronic devices and systems, particularly in industries where interference can impair functioning, such as telecommunications, automotive, and aerospace. Because they are flexible and lightweight, conductive polymers can be easily integrated into a wide range of electronic housings and components to provide seamless protection without sacrificing performance or design. The market for consumer electronics, which includes wearables, tablets, and smartphones, is expanding, which increases the need for ESD and EMI protection. Because of their adaptability, conductive polymers can be used in a wide range of settings, such as connectors and integrated circuits, to offer a complete defence against electrical disruptions.

Conductive Polymer Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Conductive Polymer Market Regional Analysis

The major market for conductive polymers is North America, driven by the presence of existing end-use industries and the increasing utilization of conductive polymers in the healthcare, electronics, and energy sectors. Furthermore, the forecasted rise in the conductive polymer market is expected to attract involvement from the 'Big Three' automotive manufacturers in the region, including General Motors, Ford Motor Company, and Toyota Motor Corporation.

Asia-Pacific is expected to fuel the demand for the conductive polymer market, experiencing a significant Compound Annual Growth Rate (CAGR) during the conductive polymer market forecast period. The region's increasing GDP has contributed to the growth of the automotive sector in India, China, and Japan, leading to the use of conductive polymers in wires and engine boxes. Additionally, governments are promoting the use of lightweight products in the automotive industry, which, in turn, will encourage the use of ABS and PPP-based resins to decrease reliance on crude oil imports.

The rising electronic sector is also contributing to the development of the conductive polymer market in the region, particularly in Japan and China. Moreover, in India, the market for conductive polymers is growing, driven by government initiatives such as the Digital India Initiative and Make in India.

Conductive Polymer Market Players

Some of the top conductive polymer companies offered in our report include AGFA-Gevaert NV, Henkel AG & Co. KGaA, 3M Company, Celanese Corporation, Solvay SA, Covestro AG, Polyone Corporation, Heraeus Holding GmbH, Saudi Arabia Basic Industries Corporation, The Lubrizol Corporation, and Kemet Corporation.

Frequently Asked Questions

The conductive polymer market size was valued at USD 6.1 billion in 2022.

The CAGR of conductive polymer is 8.4% during the analysis period of 2023 to 2032.

The key players operating in the global market are including AGFA-Gevaert NV, Henkel AG & Co. KGaA, 3M Company, Celanese Corporation, Solvay SA, Covestro AG, Polyone Corporation, Heraeus Holding GmbH, Saudi Arabia Basic Industries Corporation, The Lubrizol Corporation, and Kemet Corporation.

North America held the dominating position in conductive polymer industry during the analysis period of 2023 to 2032.

Asia-Pacific region exhibited fastest growing CAGR for market of conductive polymer during the analysis period of 2023 to 2032.

The current trends and dynamics in the conductive polymer industry include growing demand for lightweight and flexible electronic devices, increasing emphasis on energy efficiency and sustainability in electronic components, expanding applications in the automotive sector, especially for electric vehicles, and technological advancements leading to improved conductivity and performance.

The acrylonitrile-butadiene-styrene (ABS) type expected to hold the maximum share of the conductive polymer industry.