August 2022

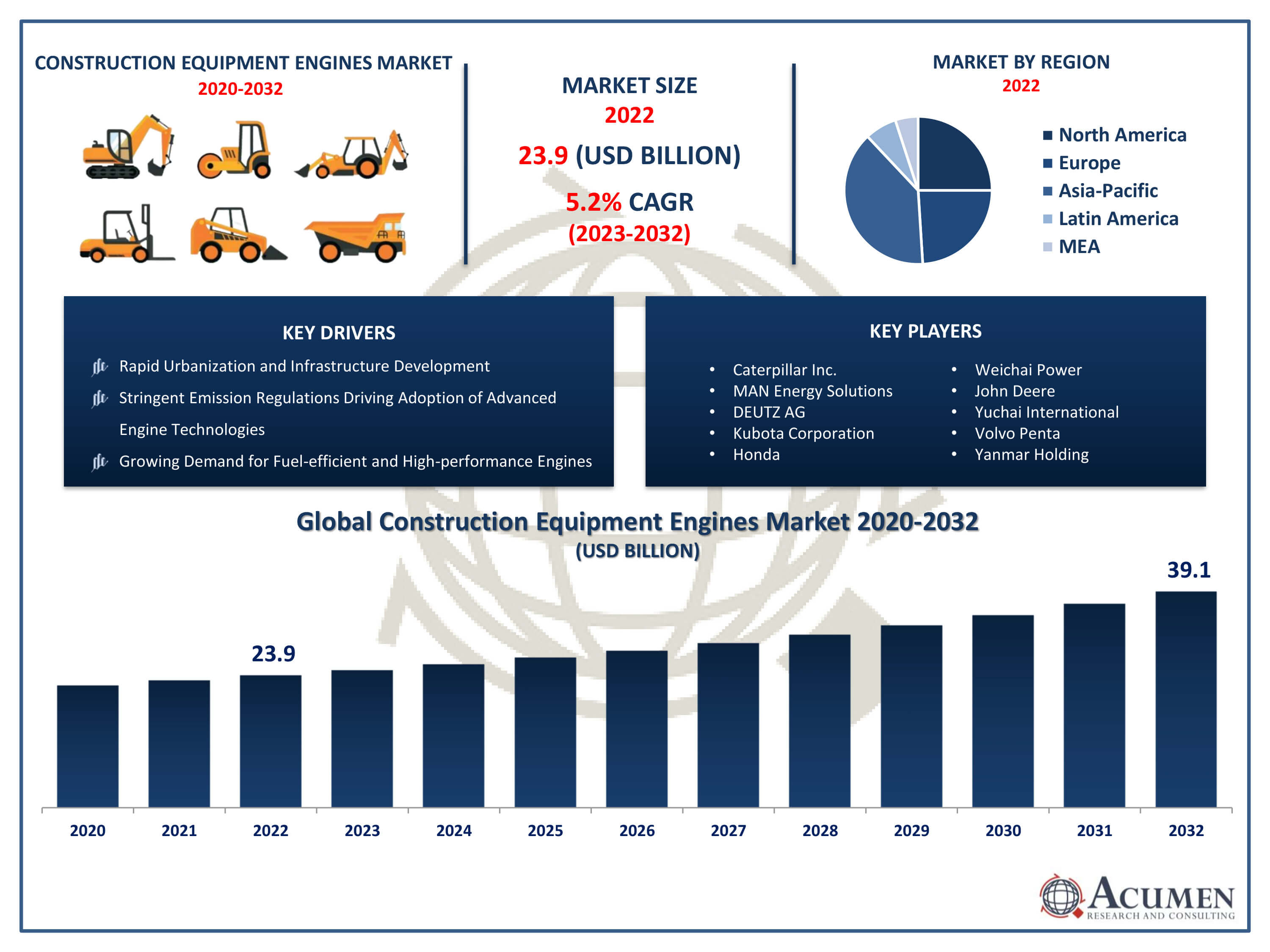

Construction Equipment Engines Market Size accounted for USD 23.9 Billion in 2022 and is projected to achieve a market size of USD 39.1 Billion by 2032 growing at a CAGR of 5.2% from 2023 to 2032.

The Construction Equipment Engines Market Size accounted for USD 23.9 Billion in 2022 and is projected to achieve a market size of USD 39.1 Billion by 2032 growing at a CAGR of 5.2% from 2023 to 2032.

Construction Equipment Engines Market Highlights

Construction equipment engines play a critical role in powering various heavy machinery used in the construction industry. These engines are designed to provide the necessary horsepower and torque to drive construction equipment such as excavators, bulldozers, loaders, and cranes. Typically, construction equipment engines are robust and durable, capable of withstanding the demanding conditions of construction sites. They are engineered to deliver high performance, fuel efficiency, and low emissions to meet environmental regulations.

The market for construction equipment engines has witnessed significant growth in recent years, driven by several factors. The global construction industry's expansion, fueled by urbanization, infrastructure development, and increasing demand for residential and commercial spaces, has led to a rising need for construction equipment. Additionally, stringent emission standards and regulations have prompted manufacturers to invest in advanced engine technologies, including cleaner and more efficient power sources. As a result, the market has seen a shift toward the adoption of electric and hybrid construction equipment engines, contributing to sustainable practices in the construction sector. The integration of smart technologies and telematics into construction equipment engines also enhances productivity, maintenance efficiency, and overall equipment management, further boosting market growth.

Global Construction Equipment Engines Market Trends

Market Drivers

Market Restraints

Market Opportunities

Construction Equipment Engines Market Report Coverage

| Market | Construction Equipment Engines Market |

| Construction Equipment Engines Market Size 2022 | USD 23.9 Billion |

| Construction Equipment Engines Market Forecast 2032 | USD 39.1 Billion |

| Construction Equipment Engines Market CAGR During 2023 - 2032 | 5.2% |

| Construction Equipment Engines Market Analysis Period | 2020 - 2032 |

| Construction Equipment Engines Market Base Year |

2022 |

| Construction Equipment Engines Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Caterpillar Inc., MAN Energy Solutions, DEUTZ AG, Kubota Corporation, Honda, Weichai Power, John Deere, Yuchai International, Volvo Penta, and Yanmar Holding. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Construction equipment engines are specialized power units designed to provide the necessary energy for heavy machinery used in construction projects. These engines are integral components of various construction equipment, including excavators, bulldozers, loaders, cranes, and more. They are engineered to deliver the high torque and horsepower required to perform demanding tasks in construction, such as digging, lifting, grading, and transporting heavy materials. Construction equipment engines are characterized by their durability, efficiency, and adaptability to the rugged conditions of construction sites, ensuring reliable and consistent performance throughout the lifespan of the machinery. The applications of construction equipment engines are diverse and cover a wide range of construction activities. Excavators, equipped with powerful engines, are used for digging and earthmoving tasks, such as digging foundations or trenches.

The construction equipment engines market has experienced robust growth in recent years, driven by a confluence of factors. The global surge in construction and infrastructure projects, especially in developing economies, has substantially increased the demand for heavy machinery, thereby propelling the market for construction equipment engines. Moreover, a growing emphasis on sustainable and eco-friendly practices within the construction industry has accelerated the adoption of advanced engine technologies, such as electric and hybrid power sources. Stringent emission regulations and a heightened awareness of environmental concerns have incentivized manufacturers to invest in cleaner and more efficient engine solutions, fostering market growth. Additionally, the integration of smart technologies and telematics into construction equipment engines has played a pivotal role in shaping the market landscape. These innovations not only enhance the overall performance and productivity of construction machinery but also contribute to efficient maintenance practices. With the construction sector increasingly embracing digitalization, the demand for intelligent and connected engines is expected to continue driving market growth.

Construction Equipment Engines Market Segmentation

The global Construction Equipment Engines Market segmentation is based on type, application, and geography.

Construction Equipment Engines Market By Type

In terms of types, the diesel engines segment accounted for the largest market share in 2022. This growth is primarily due to its longstanding position as a reliable and powerful choice for heavy-duty applications. Diesel engines are renowned for their high torque output, durability, and fuel efficiency, making them well-suited for the demanding conditions of construction sites. The construction industry's reliance on heavy machinery, such as excavators, loaders, and bulldozers, has sustained the demand for diesel engines, as they provide the robust performance required for earthmoving and material handling tasks. Furthermore, technological advancements in diesel engine design have contributed to improved efficiency and compliance with stringent emission standards. Many manufacturers have invested in developing cleaner and more environmentally friendly diesel engines to align with global efforts to reduce carbon emissions. The versatility of diesel engines also plays a crucial role in their growth, as they are suitable for a wide range of construction equipment applications.

Construction Equipment Engines Market By Application

According to the construction equipment engines market forecast, the excavator segment is expected to witness significant growth in the coming years. Excavators are indispensable for tasks such as digging, trenching, and material handling, making them a cornerstone in various construction applications. The increasing need for urban development, infrastructure expansion, and mining activities has propelled the demand for excavators, consequently stimulating growth in the construction equipment market. In particular, advancements in excavator design and technology have played a pivotal role in driving this segment's growth. Manufacturers are incorporating more powerful and fuel-efficient engines into excavators, enhancing their overall performance and productivity. Additionally, there is a growing emphasis on environmental sustainability, prompting the integration of cleaner engine technologies in excavators to meet stringent emission standards.

Construction Equipment Engines Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

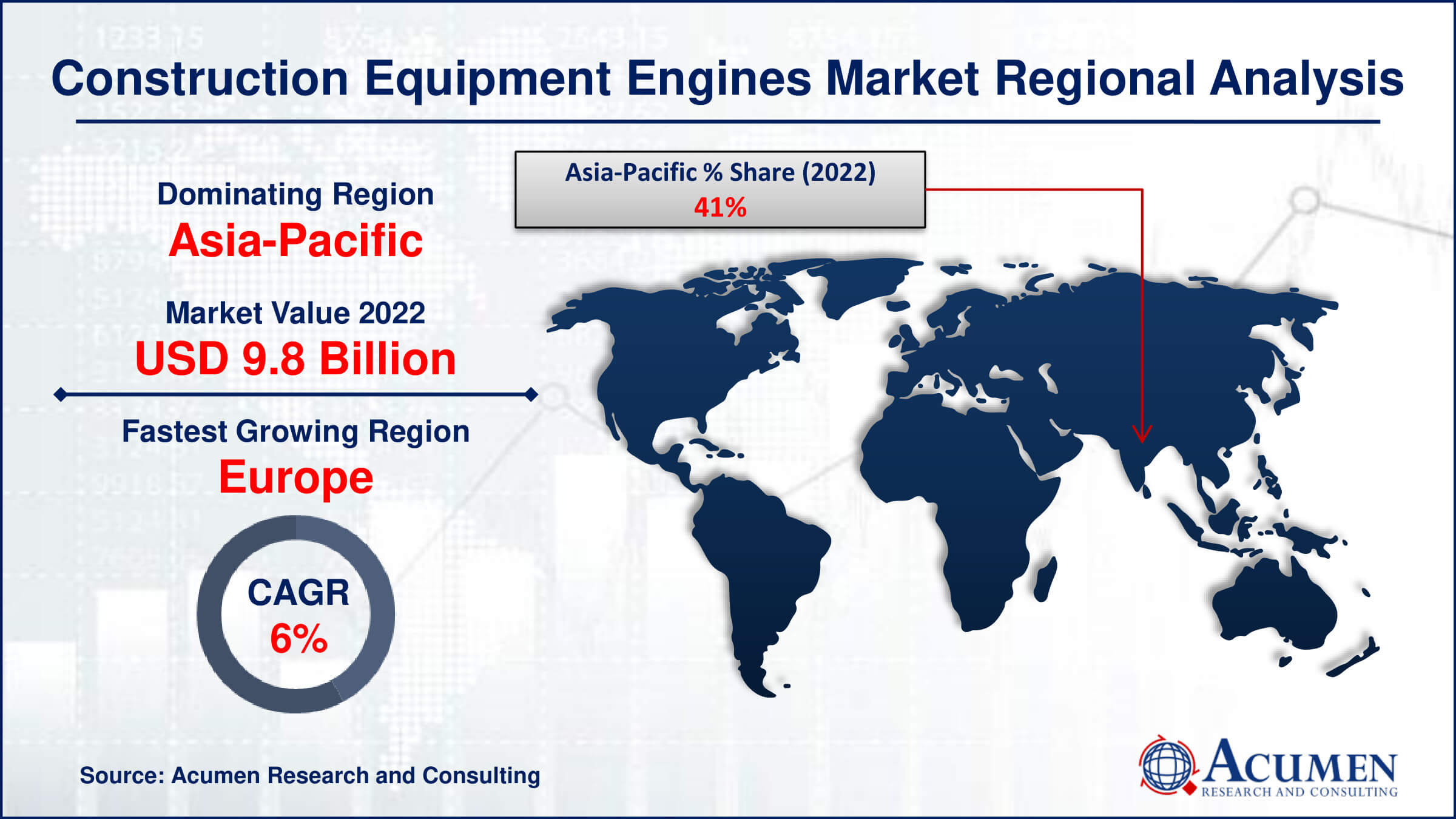

Construction Equipment Engines Market Regional Analysis

The Asia-Pacific region has emerged as a dominating force in the construction equipment engines market, fueled by rapid urbanization, industrialization, and a surge in infrastructure development projects. Countries like China and India are at the forefront of this growth, driven by massive investments in construction and the need for modernizing their urban landscapes. The expanding population in these regions has led to increased demand for residential and commercial spaces, driving the construction industry and, subsequently, the demand for construction equipment engines. Moreover, the Asia-Pacific region is a manufacturing hub for construction machinery and engines. Many global and regional players in the construction equipment engines industry have established production facilities in countries like China, India, and Japan to cater to the escalating demand locally and for exports. This localized production not only reduces manufacturing costs but also allows these companies to tailor their products to the specific requirements of the Asian market. Government initiatives and infrastructure development plans in the region further contribute to the robust growth of the construction sector, ensuring that the Asia-Pacific remains a dominant and dynamic force in the construction equipment engines market for the foreseeable future.

Construction Equipment Engines Market Player

Some of the top construction equipment engines market companies offered in the professional report include Caterpillar Inc., MAN Energy Solutions, DEUTZ AG, Kubota Corporation, Honda, Weichai Power, John Deere, Yuchai International, Volvo Penta, and Yanmar Holding.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

August 2022

April 2020

October 2024

November 2018