December 2022

The Global Cryogenic Insulation Market Size accounted for USD 4.02 Billion in 2024 and is estimated to achieve a market size of USD 7.31 Billion by 2033 growing at a CAGR of 6.9% from 2025 to 2033.

The Global Cryogenic Insulation Market Size accounted for USD 4.02 Billion in 2024 and is estimated to achieve a market size of USD 7.31 Billion by 2033 growing at a CAGR of 6.9% from 2025 to 2033.

insulation market trend that fuels the industry demand

insulation market trend that fuels the industry demandThe cryogenic insulation is a high performing material used to protect and reduce the energy leaks and offers high level of thermal isolation for applications operating below -75 degree Celsius. This is mainly used for transportation and storage of cryogenic gases such as liquid petroleum gas (LPG), liquid natural gas (LNG), and ethylene. Growing LNG terminals, transportation and storage of LNG and other LNG related applications required cryogenic insulation which further expected to boosts the demand for cryogenic market.

|

Market |

Cryogenic Insulation Market |

|

Cryogenic Insulation Market Size 2024 |

USD 4.02 Billion |

|

Cryogenic Insulation Market Forecast 2033 |

USD 7.31 Billion |

|

Cryogenic Insulation Market CAGR During 2025 - 2033 |

6.9% |

|

Cryogenic Insulation Market Analysis Period |

2021 - 2033 |

|

Cryogenic Insulation Market Base Year |

2024 |

|

Cryogenic Insulation Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Type, By Form, By Cryogenic Equipment, By End-Use, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Flowserve Corporation, Fives, The Weir Group PLC, Nikkiso Co., Ltd, Phpk Technologies, Sulzer, Cryostar, SHI Cryogenics Group, Armacell LLC, Ebara Corporation, Lydall, Inc., INOXCVA, Vanzetti Engineering, and BASF SE. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The increasing demand for alternative fuel coupled with the rising environmental awareness across the globe is primarily driving the market growth. Rising demand for transportation and storage of liquefied natural gas (LNG) in North America and Europe region is further bolstering the market growth. Increasing disposable income in developing economies and increasing investment in the development of LNG pipeline infrastructure are further accelerating the market value. Growing applications of cryogenic insulation in energy & power, chemicals, metallurgical, and electronics sectors is expected to drive the demand in the market.

On the flip side, fluctuating raw material costs and decrease in steel production are likely to hamper market growth. High cost of development in insulation is additionally expected to hinder the market growth. Whereas, the increasing investment energy sector, growing demand for alternative fuels, growing infrastructure development, and rise in demand for cryogenic technologies from aerospace applications is anticipated to create potential opportunities over the cryogenic insulation market forecast period.

Cryogenic Insulation Market Segmentation

Cryogenic Insulation Market SegmentationThe worldwide market for cryogenic insulation is split based on type, form, cryogenic equipment, end-use, and geography.

According to cryogenic insulation industry analysis, in 2024, PU & PIR segment held the highest market share and the segment is also projected to maintain its dominance over the forecast period. The attributes which are supporting the growth of the segment is growing number of LNG terminals, growing transportation of liquefied gases, growing use of PU and PIR in various applications which includes tank and pipe insulation, refrigerators, and coolers.

The foam segment is the largest in the market, driven by its superior thermal resistance, durability, and widespread application across industries. Foam-based insulation, particularly polyurethane (PU), polyisocyanurate (PIR), and expanded polystyrene (EPS), is extensively used in LNG storage and transportation, industrial gas storage, and healthcare applications. Its lightweight nature, ease of installation, and cost-effectiveness make it the preferred choice for cryogenic environments requiring long-term thermal stability. Additionally, foam insulation provides excellent mechanical strength, reducing the risk of system failures in extreme cold conditions. With the rising demand for LNG infrastructure, hydrogen energy storage, and cryopreservation in healthcare, the foam segment continues to dominate, ensuring enhanced insulation efficiency and operational reliability.

Based on the cryogenic market analysis, in 2024, tank segment held the highest market share and the segment is also projected to maintain its dominance throughout the projection period from 2025 to 2033. The attributes which are supporting the growth of the segment is growing demand for storage and transportation of gases and liquids from energy and power industry.

According to cryogenic insulation market forecast period, in 2024, energy & power segment held the highest market share and the segment is also projected to maintain its dominance over the forecast period. The attributes which are supporting the growth of the segment is growing demand for energy and power in developing countries due to growing expansion of industrial and residential sector and growing demand for LNG across the globe.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

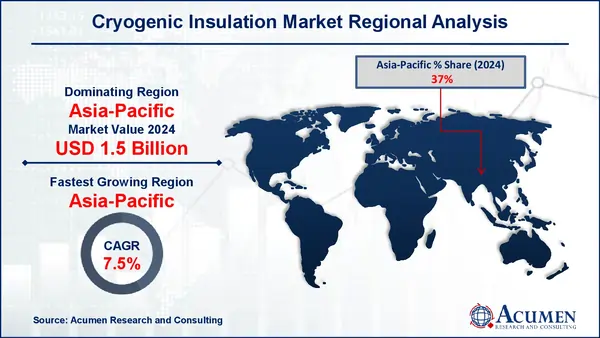

Cryogenic Insulation Market Regional Analysis

Cryogenic Insulation Market Regional AnalysisAsia-Pacific accounted for the largest market share and fastest growing region of the cryogenic insulation market and the region is also expected to maintain its dominance over the forecast period. The region is experiencing the maximum growth owing to growing foreign direct investment in manufacturing, energy and power sector, growing end use industries such as chemicals and energy and power, and rising infrastructure development, and growing demand for LNG. NA is followed by the Asia-Pacific region in the market.

Europe is expected to exhibit the noteworthy in the global market during the forecast period. The manufacturers are investing in Europe countries to meet the demand for end user industries. Growths of industries such as metallurgical, electronics, shipping are expected to enhance the market growth in the global market during the forecast.

North America is expected to hold the notable CAGR in the global market during the forecast period. The manufacturers are investing in North American countries to meet the demand for cryogenic insulation. The increased expenditure in innovation and growing investment in oil and gas sector are expected to enhance the market growth in the global market during the forecast. The US is expected to be the major contributor to the regional growth of market due to growing emergence of offshore exploration and is expected to see a significant demand for cryogenic insulation during the forecast period.

Some of the top cryogenic insulation companies offered in our report include Flowserve Corporation, Fives, The Weir Group PLC, Nikkiso Co., Ltd, Phpk Technologies, Sulzer, Cryostar, SHI Cryogenics Group, Armacell LLC, Ebara Corporation, Lydall, Inc., INOXCVA, Vanzetti Engineering, and BASF SE.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

December 2022

June 2023

June 2023

September 2024