November 2020

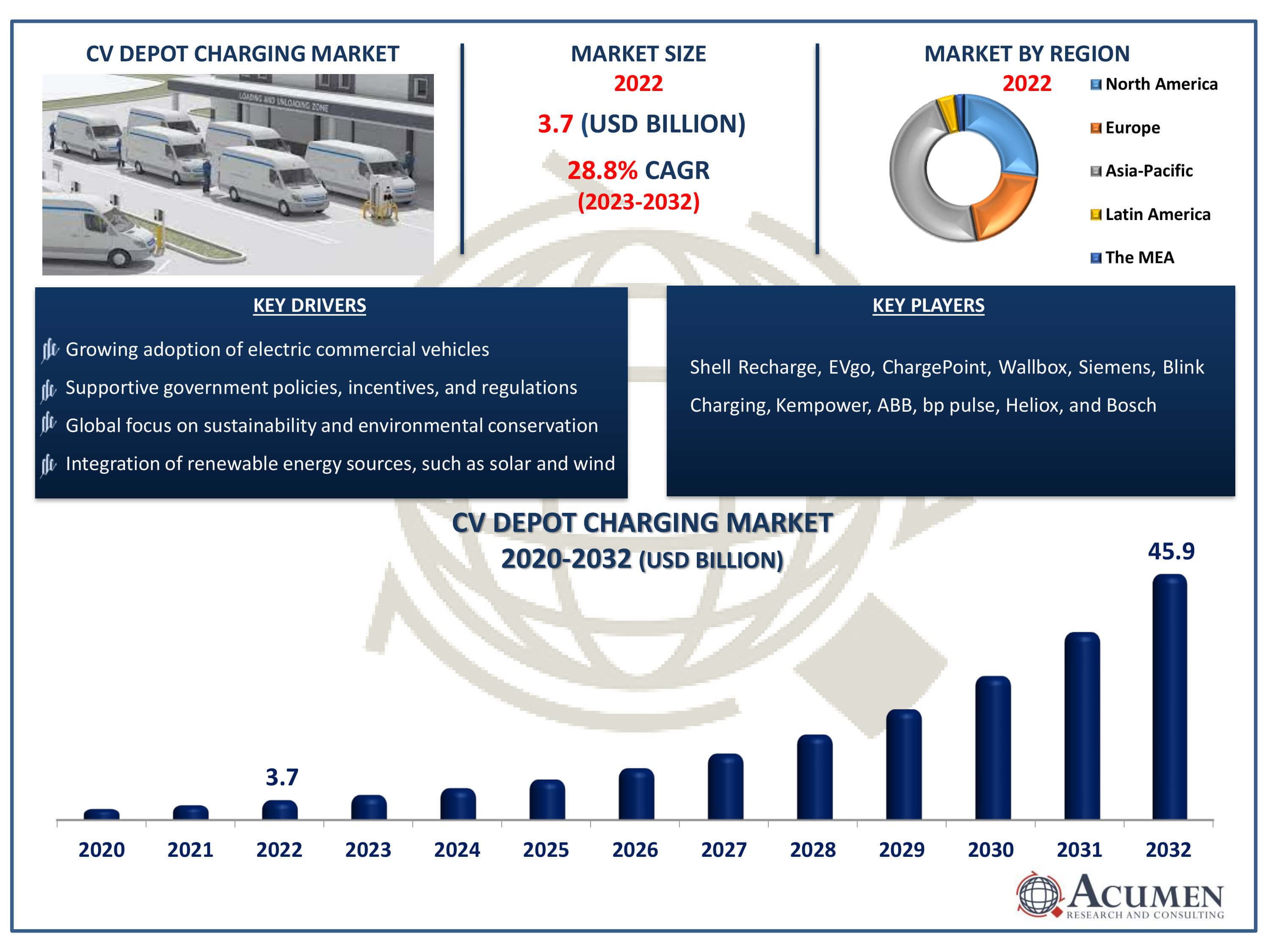

CV Depot Charging Market Size accounted for USD 3.7 Billion in 2022 and is estimated to achieve a market size of USD 45.9 Billion by 2032 growing at a CAGR of 28.8% from 2023 to 2032.

The CV Depot Charging Market Size accounted for USD 3.7 Billion in 2022 and is estimated to achieve a market size of USD 45.9 Billion by 2032 growing at a CAGR of 28.8% from 2023 to 2032.

CV Depot Charging Market Highlights

Commercial vehicle (CV) depot charging is the installation of electric charging infrastructure particularly intended to suit the charging requirements of commercial vehicles at their operational depots or facilities. In this sense, commercial vehicles encompass a variety of electric possibilities, including electric light commercial vehicles (eLCVs), electric heavy commercial vehicles (eHCVs), electric medium commercial vehicles (eMCVs), and electric buses. The major goal of CV depot charging is to provide a dedicated and easy option for fleet operators, allowing them to charge their electric cars during downtime, usually overnight or between shifts.

This customized charging infrastructure is designed to meet the specific needs of commercial fleets, taking into account variables like as charging power levels, fleet management integration, scalability, and the operational patterns of various types of vehicles. CV depot charging supports the transition to electric commercial fleets by providing dependable and personalized charging solutions, therefore contributing to the overall sustainability and efficiency of commercial vehicle operations.

Global CV Depot Charging Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

CV Depot Charging Market Report Coverage

| Market | Commercial Vehicle Depot Charging Market |

| Commercial Vehicle Depot Charging Market Size 2022 | USD 3.7 Billion |

| Commercial Vehicle Depot Charging Market Forecast 2032 | USD 45.9 Billion |

| Commercial Vehicle Depot Charging Market CAGR During 2023 - 2032 | 28.8% |

| Commercial Vehicle Depot Charging Market Analysis Period | 2020 - 2032 |

| Commercial Vehicle Depot Charging Market Base Year |

2022 |

| Commercial Vehicle Depot Charging Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Vehicle Type, By Charging Infrastructure Type, By Operational Model, By Depot Size, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Shell Recharge, EVgo, ChargePoint, Wallbox, Siemens, Blink Charging, Kempower, ABB, bp pulse, Heliox, and Bosch. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

CV Depot Charging Market Insights

The Commercial Vehicle (CV) Depot Charging industry is undergoing rapid changes due to a number of important factors. One of the key drivers is the growing worldwide attention on sustainability and the shift to electric commercial fleets. Governments and corporations are aligning their policies with environmental aims, and the quest for greener mobility alternatives is driving up demand for CV depot charging stations. This trend is especially visible when regulatory agencies impose strict emission limits and offer incentives to encourage the use of electric commercial vehicles.

However, the market is not without obstacles. The introduction of CV depot charging infrastructure confronts challenges because to the initial investment costs and complications connected with modifying existing electricity grids. The demand for high-power charging stations capable of successfully servicing commercial vehicle fleets necessitates significant initial expenditures. Furthermore, regulatory and permitting delays impede the timely installation of charging stations. Standardization difficulties and interoperability hurdles between charging stations and commercial vehicle models also contribute to market constraints, demanding industry-wide collaboration and standardization initiatives.

On the potential front, the combination of smart charging solutions and fleet management systems represents a major prospect for industry development. The combination of intelligent charging technologies and comprehensive fleet management capabilities enables optimal charging schedules, real-time monitoring, and increased operational efficiency. Strategic alliances and cooperation between charging infrastructure providers, automakers, and energy firms provide complete solutions that handle charging infrastructure and fleet management requirements. Furthermore, the establishment of CV depot charging networks along important transportation routes presents a strategic opportunity to provide rapid charging solutions at rest breaks while also catering to long-haul electric commercial vehicles.

CV Depot Charging Market Segmentation

The worldwide market for CV depot charging is split based on vehicle type, charging infrastructure type, operational model, depot size, and geography.

CV Depot Charging Market By Vehicle Types

According to the CV depot charging industry report, electric light commercial vehicles (eLCVs) dominated the market due to their widespread use in urban areas for last-mile deliveries and local transportation. The small size and mobility of eLCVs make them suitable for fleet operations located at depots, where charging infrastructure can easily support their daily routes and timetables. This dominance is consistent with the worldwide trend towards sustainable urban mobility solutions and the growing emphasis on decreasing emissions in densely populated regions.

Electric buses (eBuses) emerge as a strong candidate for the second-largest market. eBuses play an important part in public transportation, and their popularity is growing due to environmental legislation, government incentives, and a need for more sustainable transit choices. The need for charging infrastructure to service electric bus fleets at depots is increasing, making eBuses a key participant in the expanding CV depot charging market.

CV Depot Charging Market By Charging Infrastructure Types

AC Charging infrastructure is often employed in CV depot charging settings, making it a more cost-effective and practical alternative for overnight charging or lengthy vehicle downtime. It's ideal for smaller fleets with fewer time-sensitive charging requirements.

DC Charging infrastructure, particularly high-power DC rapid charging, is critical for fleets that operate bigger commercial vehicles or require quick turnaround times. DC charging is frequently used for heavy-duty applications and settings where reducing charging delay is crucial.

CV Depot Charging Market By Operational Models

Public charging infrastructure, in which CV depot charging stations are available to a larger spectrum of commercial vehicles, may prevail in circumstances where depots service numerous operators or when commercial vehicles from different fleets share a similar charging space. This concept may be common in urban areas or regions where centralized charging stations are created to cater to several operators.

Private charging infrastructure devoted to certain fleets or firms may take precedence in circumstances where bigger commercial operations or logistics organizations invest in their own charging infrastructure at depots. This strategy provides exclusivity and control over the charging stations, guaranteeing that the fleet's cars have preferential access to the charging infrastructure.

CV Depot Charging Market By Depot Size

Small depots may dominate in scenarios where local businesses or smaller fleets operate. These depots might serve localized delivery services or businesses with a limited number of commercial vehicles.

Medium-sized depots could be prevalent in regions or industries where there is a moderate scale of commercial vehicle operations. These depots might cater to regional logistics or service providers with a more extensive fleet.

Large depots may dominate in areas with significant industrial and commercial activity, serving as hubs for extensive commercial vehicle operations. Large depots could be common in densely populated urban areas or regions with robust logistics and transportation networks.

CV Depot Charging Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

CV Depot Charging Market Regional Analysis

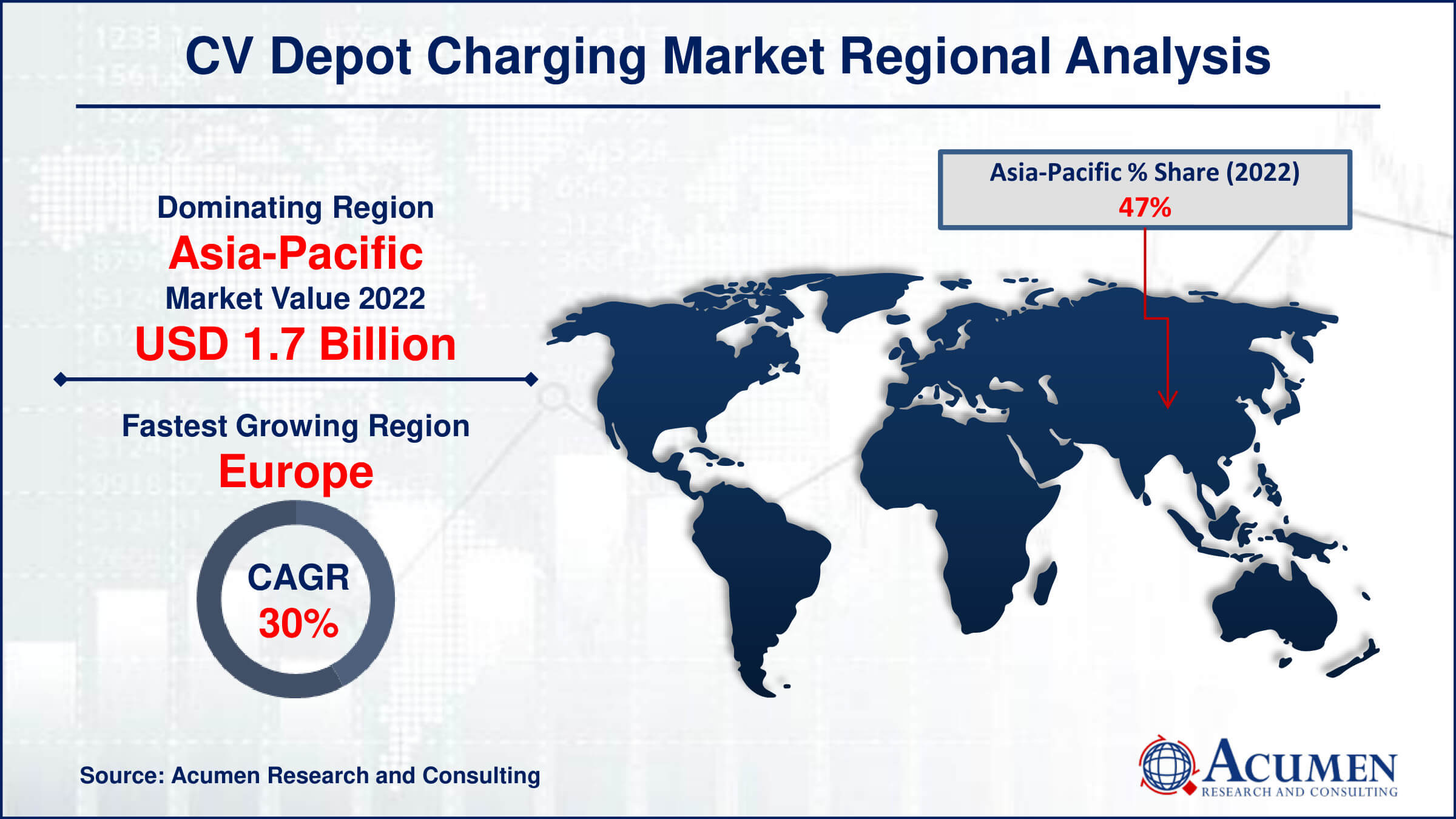

Asia-Pacific, notably China, is a significant participant in the electric car industry. The region has experienced a significant increase in the deployment of electric commercial vehicles, necessitating the development of appropriate charging infrastructure. Government backing, technical developments, and the existence of major commercial vehicle production centers all help to drive the spread of CV depot charging systems.

Europe has been a key location for electric car uptake and charging infrastructure development. Various European nations have stringent emission-reduction standards, which is driving up demand for CV depot charging options. Government incentives, tough pollution standards, and a strong push for sustainable transportation all help to drive the expansion of CV depot charging infrastructure in the region.

In North America, demand for CV depot charging infrastructure is being pushed by a variety of federal and state-level efforts intended at encouraging electric vehicle adoption. The existence of established logistics and transportation firms, together with a rising interest in sustainable practices, helps to drive the development of charging infrastructure for commercial cars.

Other regions, like as Latin America, the Middle East, and Africa, are seeing an increase in demand for electric commercial cars and charging infrastructure. Factors influencing growth include urbanization, environmental concerns, and worldwide attempts to minimize carbon emissions.

CV Depot Charging Market Players

Some of the top CV depot charging companies offered in our report includes Shell Recharge, EVgo, ChargePoint, Wallbox, Siemens, Blink Charging, Kempower, ABB, bp pulse, Heliox, and Bosch.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

November 2020

April 2020

December 2022

October 2024