September 2018

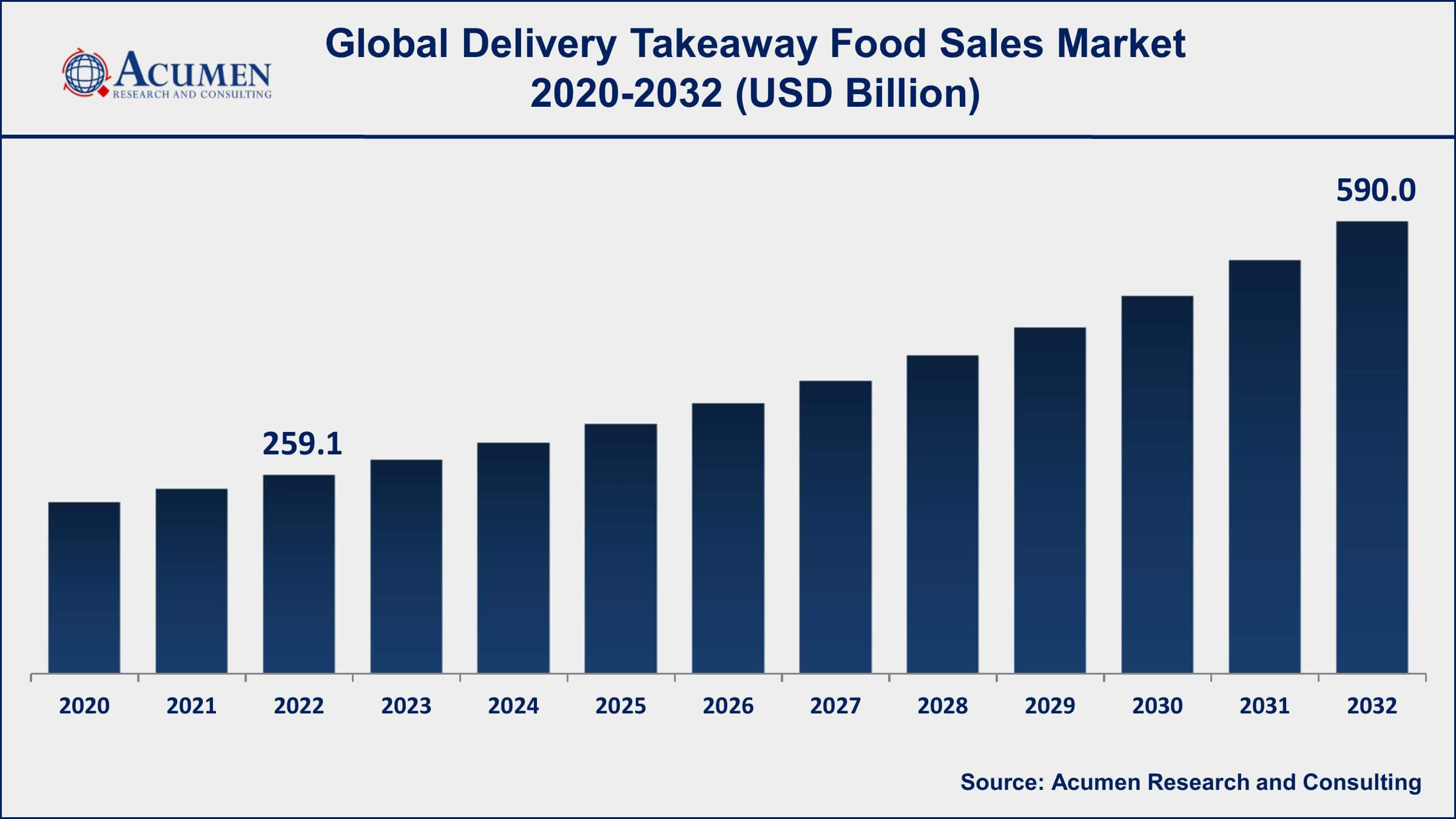

Delivery Takeaway Food Sales Market Size accounted for USD 259.1 Billion in 2022 and is projected to achieve a market size of USD 590.0 Billion by 2032 growing at a CAGR of 8.7% from 2023 to 2032.

The Global Delivery Takeaway Food Sales Market Size accounted for USD 259.1 Billion in 2022 and is projected to achieve a market size of USD 590.0 Billion by 2032 growing at a CAGR of 8.7% from 2023 to 2032.

Report Key Highlights

Delivery takeaway food sales refer to the practice of ordering food from restaurants or other food service providers through online platforms and having it delivered directly to the customer's location. This model has gained immense popularity in recent years due to the convenience it offers to consumers who want to enjoy restaurant-quality food from the comfort of their own homes. This market is dominated by a few major players who operate online platforms that connect customers with local restaurants and food providers. These platforms typically charge a commission on each order and provide a range of features and services to both customers and restaurants.

The market growth of the delivery takeaway food sales has been staggering in recent years, and it shows no signs of slowing down. The COVID-19 pandemic has only accelerated this trend, as more people are choosing to order food delivery rather than dine in at restaurants. This growth is driven by factors such as increasing demand for convenience, rising disposable income, and technological advancements in the online food ordering and delivery industry. Overall, the delivery takeaway food sales market value is poised for continued growth and is expected to become an increasingly important part of the global food industry.

Global Delivery Takeaway Food Sales Market Trends

Market Drivers

Market Restraints

Market Opportunities

Delivery Takeaway Food Sales Market Report Coverage

| Market | Delivery Takeaway Food Sales Market |

| Delivery Takeaway Food Sales Market Size 2022 | USD 259.1 Billion |

| Delivery Takeaway Food Sales Market Forecast 2032 | USD 590.0 Billion |

| Delivery Takeaway Food Sales Market CAGR During 2023 - 2032 | 8.7% |

| Delivery Takeaway Food Sales Market Analysis Period | 2020 - 2032 |

| Delivery Takeaway Food Sales Market Base Year | 2022 |

| Delivery Takeaway Food Sales Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Distribution Channel, By Restaurant Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Uber Eats, Grubhub, DoorDash, Postmates, Just Eat, Deliveroo, Zomato, Swiggy, Seamless, Foodpanda, Caviar, and Eat24. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The delivery takeaway food sales market involves packaging and providing different variety of food options to consumers in their workplaces, homes, or at their locations at their convenience. Food is delivered to customers through delivery channels and a vast network. Online takeaway food option allows customers to order food from various locations and from varieties of items, and by using efficient methods of payment such as online transactions or cash on delivery (COD). The delivery takeaway food market is changing rapidly as online platforms are gaining more acceptance among people who wish to dine food at a comfortable location and desire quality food. Thus, increasing demand for home delivery and fast food items is expected to increase the growth of the delivery and takeaway food market during the forecast period.

The delivery and takeaway food market are witnessing drastic growth which is proportional to hectic schedule, a rise in a busy lifestyle and expanding urbanization, quick access to the digital world by using mobile phones via internet penetration, demand for hygienic fast foods, and access to online platforms to order food by the online transaction. The rising need for convenience is effectively driving the demand for food products. Online ordering can be expensive at times as restaurants charge extra for home distribution and pickups which is halting the growth of the market. Increasing consumer preference for the easy availability and convenience of a huge variety of food at home will rapidly accelerate business. Growing employment opportunities and easy availability of workforce will accelerate the demand for food products during the forecast period.

Delivery Takeaway Food Sales Market Segmentation

The global delivery takeaway food sales market segmentation is based on product type, distribution channel, restaurant type, and geography.

Delivery Takeaway Food Sales Market By Product type

According to the delivery takeaway food sales industry analysis, the non-vegetarian segment accounted for the largest market share in 2022. Non-vegetarian food items, including meat, poultry, and seafood, are widely popular among consumers and constitute a major portion of the food service industry. With the increasing demand for convenience and time-saving options, consumers are increasingly turning to online platforms to order non-vegetarian food for delivery. One of the key drivers of growth in the non-vegetarian segment is the increasing popularity of fast food and quick-service restaurants. These types of restaurants typically offer a range of non-vegetarian options, such as burgers, fried chicken, and sandwiches, which are often popular choices for delivery orders. In addition, many casual and fine dining restaurants also offer non-vegetarian dishes, which can be delivered through online platforms.

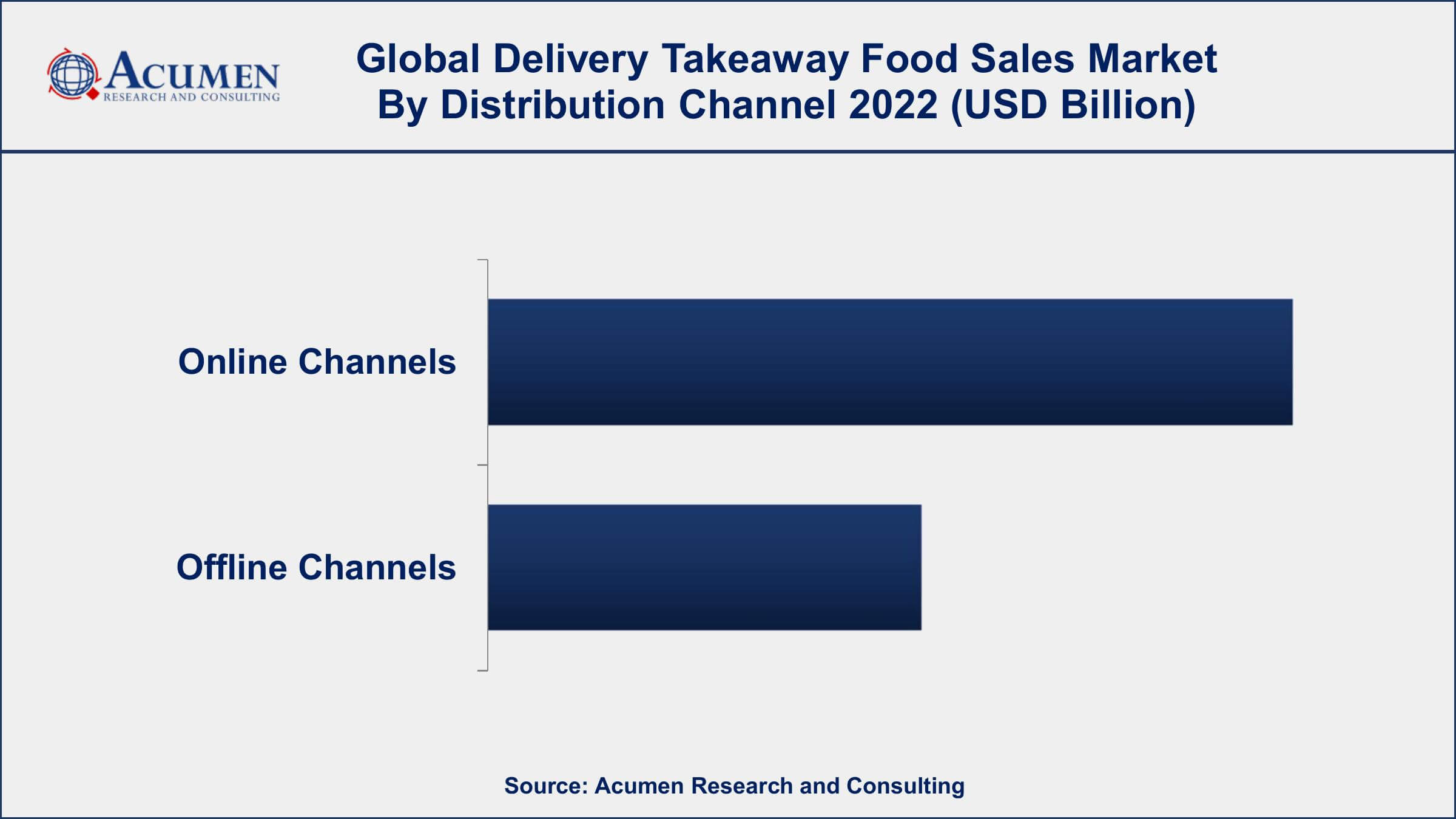

Delivery Takeaway Food Sales Market By Distribution Channel

In terms of distribution channels, the online channels segment is expected to witness significant growth in the coming years. Online ordering platforms and mobile apps have become increasingly popular among consumers as they offer convenience and a wide range of options. This has led to the emergence of several major online food delivery platforms that connect customers with local restaurants and food service providers. One of the key drivers of growth in the online channels segment is the increasing penetration of the internet and smartphones around the world. This has enabled more people to access online ordering platforms and has created a larger market for food delivery services. In addition, many online food delivery platforms have invested heavily in marketing and promotions to attract new customers and retain existing ones. The growth of the online channels segment is also being driven by the increasing adoption of technology in the food service industry.

Delivery Takeaway Food Sales Market By Restaurant Type

According to the delivery takeaway food sales market forecast, the cloud kitchens segment is expected to witness significant growth in the coming years. Cloud kitchens, also known as ghost kitchens or virtual kitchens, are commercial kitchens that operate without a traditional brick-and-mortar restaurant. These kitchens are designed solely for delivery and takeaway orders and are typically located in areas with high demand for food delivery services. One of the key drivers of growth in the cloud kitchen segment is the increasing demand for convenience and speed in food delivery services. Cloud kitchens are able to offer faster delivery times and a wider range of food options, as they are not limited by the physical space constraints of traditional restaurants. In addition, cloud kitchens can operate with lower overhead costs, as they do not need to invest in expensive dining areas or front-of-house staff.

Delivery Takeaway Food Sales Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Delivery Takeaway Food Sales Market Regional Analysis

Geographically, North America has been dominating the delivery takeaway food sales market due to several reasons. One of the primary factors is the fast-paced lifestyle and busy work schedules of people in North America. With a lack of time to cook meals at home, people tend to rely on the convenience of delivery and takeaway food options. Additionally, North America has a strong culture of eating out and ordering food, which has been further bolstered by the rise of online food delivery platforms such as Uber Eats, DoorDash, and Grubhub. These platforms have made it even easier for people to order food with just a few clicks on their smartphones. Another factor contributing to the dominance of North America in the delivery takeaway food sales market growth is the availability of a wide range of cuisines. The diverse population of North America has led to the development of a vast variety of food options, ranging from traditional American dishes to international cuisines. This has made it possible for delivery and takeaway food to cater to a wide range of tastes and preferences, making it a popular choice among consumers.

Delivery Takeaway Food Sales Market Player

Some of the top delivery takeaway food sales market companies offered in the professional report include Uber Eats, Grubhub, DoorDash, Postmates, Just Eat, Deliveroo, Zomato, Swiggy, Seamless, Foodpanda, Caviar, and Eat24.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

September 2018

July 2024

February 2025

December 2023